Different_Brian/iStock Editorial via Getty Images

Over the past five years, shares of CSX Corporation (NASDAQ:CSX) outperformed the S&P 500 by about 15%. CSX is one of the two largest Class 1 railroads in the US, and the industry has been far more profitable over the last decade due to the implementation of Precision Scheduled Railroading (PSR).

Unfortunately, PSR comes with a price. Employees and some customers are disgruntled due to the changes the system has wrought. As a result, every major rail line is grappling with acute employee recruitment and retention issues. In fact, last week the railroads were on the cusp of an industry wide strike.

While it is likely CSX dodged that bullet, macroeconomic issues are weighing on results, while at the same time, the company is unable to meet customer demand. Like most investments, there are a number of pros and cons to weigh for those considering CSX as a potential investment.

CSX Corporation: Chugging Along

Operating east of the Mississippi, CSX has more than 26,000 miles of track and provides service to 23 states, Washington D.C., two Canadian provinces, and 70 ports. The railroad’s primary markets are New York City, Philadelphia, Atlanta, Miami, New Orleans, St. Louis, Memphis, and Chicago.

Two-thirds of the nation’s population resides within the geographic footprint of CSX. The only comparable competitor among rail lines in the region is Norfolk Southern Corporation (NSC).

In 2021, CSX generated 33% of revenue from industrial products, 19% from chemicals, and 15% from agricultural products. Intermodal, defined as highway and ocean containers moved by rail, constituted 16% of revenue; however, intermodal accounted for 48% of total railcar volume.

The company garners around 7% of revenue from automotive freight, consisting of both parts and vehicles.

It is important to note that 17% of the firm’s revenue was derived from coal.

During the pandemic, CSX took advantage of the lull in shipping activity to address needed infrastructure improvements. Those advances, combined with strong logistics demand in the US, led to the company posting solid results last quarter.

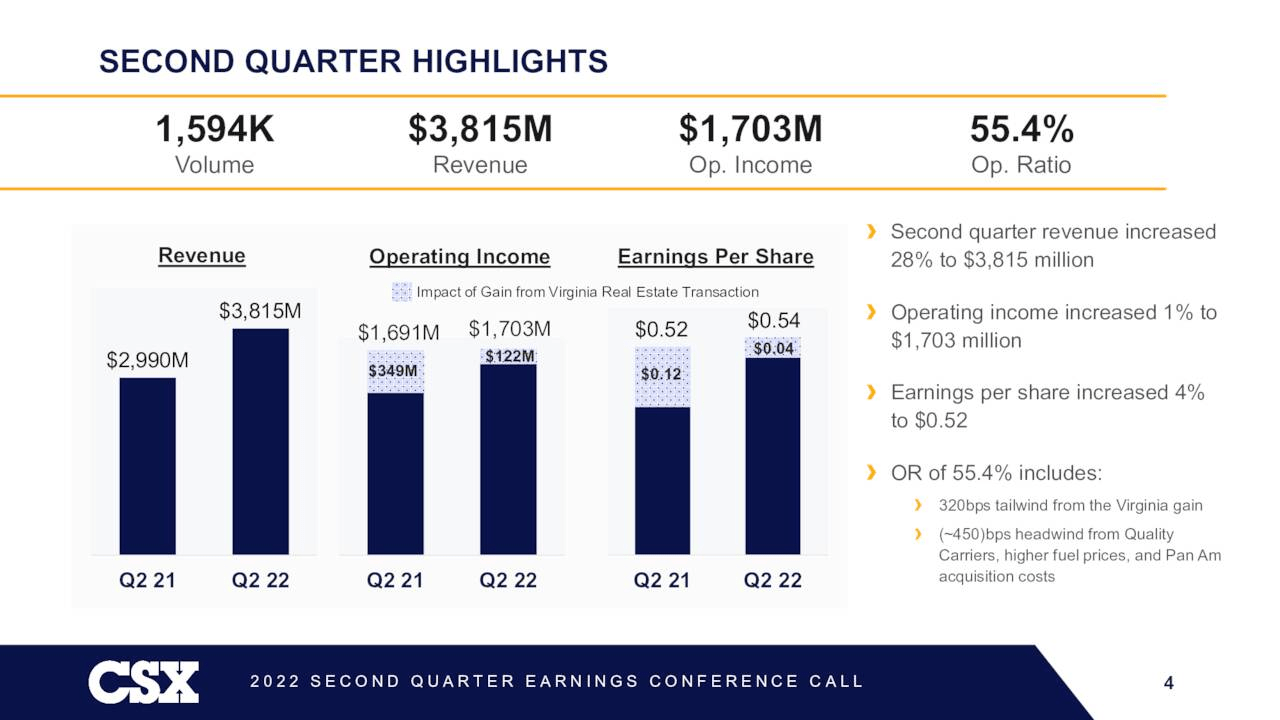

Year-over-year, Q2 EPS rose 25% on a pro forma basis, while revenue of $3.8 billion increased 28%. Although volume was flat, pricing surged 27% per unit. The operating ratio (OR) of 56.7% fell by 450 basis points, but that was largely due to increased fuel costs and the acquisition of Quality Carriers.

CSX Presentation

Management guides for full-year double-digit revenue and operating income growth in FY 22.

Along with all of the nation’s Class I railroads, CSX benefits from an enormous and durable moat. As previously stated, CSX only has one major rail line to compete with along the east coast.

The only form of freight transportation that can compete on a cost basis with railroads is water borne; however, those rivals are obviously confined to the oceans, major lakes and rivers.

Due to higher labor and fuel costs (railroads fuel costs per mile are a quarter of truckers), rail maintains a distinct cost advantage over all other carriers. Morningstar estimates that railroads’ cost advantage is in a range of 30% to 10% when compared to trucking.

Moreover, the prospect of additional railroad carriers coming into being is literally nil: the costs to replicate CSX’s infrastructure are massive.

The Pros And Cons Of Precision Scheduled Railroading

CSX was behind the curve in terms of implementing Precision Scheduled Railroading (PSR). The company headed down that path in 2017 when Hunter Harrison took the reins of the company.

During Harrison’s tenure at Canadian Pacific (CP), that railroad improved its operating ratio (OR) from 81.3% to 58.6% over a five year span. (A railroad’s OR is calculated by dividing the operating expenses by revenue; therefore, a lower number indicates increased profits.)

PSR takes trains’ speeds, the time cars remain in a terminal, and the length of trains into account to drive profitability. In other words, the railroads move the same volumes with fewer assets.

Trains using PSR principles also run on fixed schedules versus the former hub-and-spoke models that were once in use.

From the time CSX initiated PSR until 2021, revenue increased from $12.3 billion to $12.5 billion, a CAGR of just 1%; however, due to the lower costs associated with PSR, adjusted EPS grew at a CAGR of 7%, and the pretax margin surged from 33.7% in 2018 to 45.35% in 2021.

While the adoption of PSR has driven profits, it has resulted in very high employee turnover, and in some cases, customers complaining of a deterioration in services. In turn, this has resulted in railroaders scrambling for new employees. Furthermore, disgruntled union members were on the verge of initiating a strike as late as last week.

When I perused the last quarterly report, I was taken aback by the number of times analysts and management spoke of employee issues. Here is but one example of a comment made by the CEO during the earnings call:

I’ll take the first part of your question about the hiring. And yes. I don’t know if we’re struggling more than everybody else or not, I think everybody is struggling. We’ve hired over the last two years since we started talking about this issue, which we saw coming again a couple of years ago, 2,000 employees and our numbers haven’t gone backwards. So the question has been not really as much as our ability to — with employees into the pipeline and get them through the process, but a much, much higher attrition rate than we had expected from our current workforce. And a significantly higher attrition rate from the new people that we brought on.

The two largest of the twelve railroad unions were holding out until a tentative deal was reached last Friday. President Biden had appointed a Presidential Emergency Board (PEB) which in turn issued a nonbinding proposal.

The agreement provides workers with time off for certain medical events, an immediate 14% raise with retroactive pay increases dating to 2020, raises totaling 24% during the five-year life of the contract, which runs from 2020 through 2024, and cash bonuses of $1,000 a year for five-year life of the contract. The prospective contract awaits approval by the union members.

…it’s purely labors what’s — people is what’s holding us back. Our network is — as if anything, our network has improved over the past three years. As you heard Jim, we put just as much tie rail and ballast and as we have. We’ve done siding extensions in areas we’ve invested.

And we’ve got more locomotives than we need. We’re really in a great spot if we had the folks that we need to move the business.

Jamie Boychuk, Jamie Boychuk – Executive VP, Operations

Events Of Note

A bit over a year ago, CSX acquired Quality Carriers, a trucking company specializing in bulk liquid chemicals transportation. With the addition of Quality, trucking generates around 7% of CSX’s revenue while at the same time accounting for 10% of expenses. As a consequence, the OR for CSX is a bit less favorable than prior to the acquisition.

The trucking division gives CSX the ability to provide comprehensive transportation services to customers. If there is a threat to railroads on the horizon it is the eventual advent of autonomous/EV trucking which would result in markedly lower fuel and labor costs. While this evolution is in the distant future, it is one that younger investors should consider.

Last June, CSX completed the acquisition of Pan Am Railways. That deal expanded CSX’s presence into the Northeast.

Effective September 26 of this year, former Ford president of global automotive operations Joseph Hinrichs will take over as president and CEO of CSX. Hinrichs left Ford in February of 2020.

Prior to his tenure with Ford, at the age of 29, he had worked as a plant manager for General Motors (GM). His exemplary management of a powertrain plant in Virginia led to Harvard Business School engaging in a case study of the facility.

Shares of CSX jumped 5% pre-market with the announcement of Hinrichs appointment to the position.

Additional Considerations

Coal represents 13% of CSX’s revenue. Although coal volumes have increased of late, the industry forecasts continued declines in coal over the long term. However, it should be acknowledged that CSX lost half of its coal volume over the last eight years and still managed to increase revenue and profits. Furthermore, 75% of the company’s export coal revenue stems from metallurgical coal, which is expected to maintain some demand.

Due to a dearth of semiconductors, shipments related to the automotive industry have lagged for several quarters. However, automotive freight revenues rose 24% on a 10% increase in volume last quarter and are expected to remain strong.

Dividend, And Valuation

The current yield is 1.36%, the payout ratio is just above 22%, and the 5 year dividend growth rate is 9.20%.

CSX currently trades for $29.88 per share. The average one year price target of 23 analysts is $36.33. The average price target of the 8 analysts that rated the stock since the last earnings report is $36.50.

The forward P/E of 15.30x is well below the 5 year average P/E ratio for the stock of 19.60x. The 5 year PEG of 1.38x also compares favorably to the average PEG ratio over the last 5 years of 1.72x.

Is CSX Stock A Buy, Sell, Or Hold?

Since the advent of PSR, CSX has outperformed the S&P 500 by a wide margin.

Unfortunately for investors, it appears as if a time of reckoning has arrived. Employees, disgruntled by deteriorating working conditions brought on by PSR, are bargaining for better pay while the company scrambles to attract new hires. As a consequence, CSX also struggles to meet customer’s needs.

But what remains constant is that right now, as we have seen this entire year, there is more demand for rail service than what we are able to satisfy. The efforts we are making now to grow our workforce and add capacity to our network are not just a status by current demand. We are investing because we see plentiful long-term opportunities for rail, driven by customer demand for more fuel-efficient, environmentally friendly transportation options, and growth in domestic manufacturing.

Jim Foote – President & CEO

The company also has a headwind related to the loss of coal volumes.

Even so, CSX has a cost advantage that truckers cannot surmount. Railroad operators on the east coast charge 10% to 20% less than truckers. Add to that a deep, wide moat, and you have an investment with a high degree of safety.

CSX is currently trading near 52 week lows. In fact, the stock is roughly $3 above the peak share prices of 2019 and 2020. Additionally, the current P/E and PEG ratios are well below the 5 year averages for those metrics.

Consequently, I rate CSX as a BUY.

However, I do so with a caveat. Railroads are acutely sensitive to macroeconomic factors. Like most investors, I am very wary of the current state of the economy. As a result, I only devoted a small tranche to my CSX investment while conducting research on the stock.

Be the first to comment