LPETTET

VICI Properties (NYSE:VICI) is currently one of our largest holdings at High Yield Landlord, representing 9% of our Core Portfolio.

We invested so heavily in the company because it has a superior business model that creates far more value than your average REIT.

Most REITs buy traditional properties like office buildings or apartment communities through the brokerage market and compete with a vast world of high-net-worth individuals and other institutional investors. There is a lot of capital chasing a limited number of deals and as a result, the bargaining power of these REITs is limited.

VICI, on the other hand, targets specialty assets such as casinos and originates its own deals through relationships with casino operators that it has built over the years. Since there is a lack of buyers for these specialty assets, it is getting much better deals with higher cap rates and landlord-friendly lease terms.

To give you an example, below you can see how VICI’s net lease casinos compare to traditional net lease properties like Walgreen pharmacies:

|

Casino Net Lease |

Average Net Lease |

|

|

Cap rate |

7-9% |

5-7% |

|

Rent escalations |

1.5-2% (or CPI) |

1-1.5% |

|

Lease Length |

15 + 5 |

10-15 + 5 |

|

Normalized Rent Coverage |

3-4x |

2-3x |

|

Occupancy Rate |

100% |

98-99% |

|

NOI Margin |

95-100% |

90-95% |

|

Capex Need |

Very low |

Low |

|

Barrier-to-Entry |

High |

Low |

|

Lease Renewal Likelihood |

Very high |

High |

|

Technology Risk |

Below average |

Depends |

|

Master Lease Protection |

Yes |

Occasional |

|

Mission Critical Real Estate |

Yes |

Yes, but to a lesser extent |

|

Lease expiration in next 5 years |

0% for VICI |

3-5% per year on average |

|

Competition for Investments |

Low |

High |

|

Investment Spreads |

Above average |

Average |

|

Iconic Assets |

Some |

No |

Picture of the Caesars Palace – One of VICI’s Most Prized Possessions:

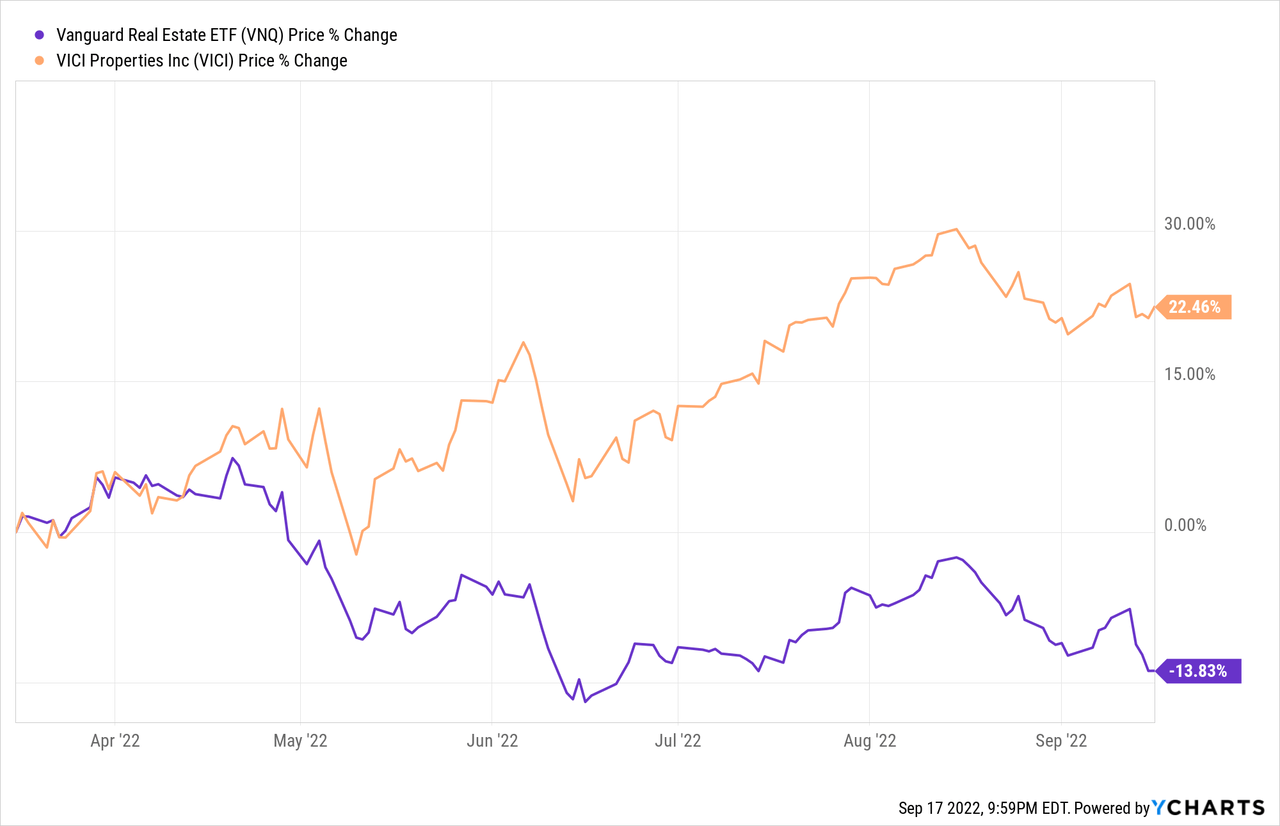

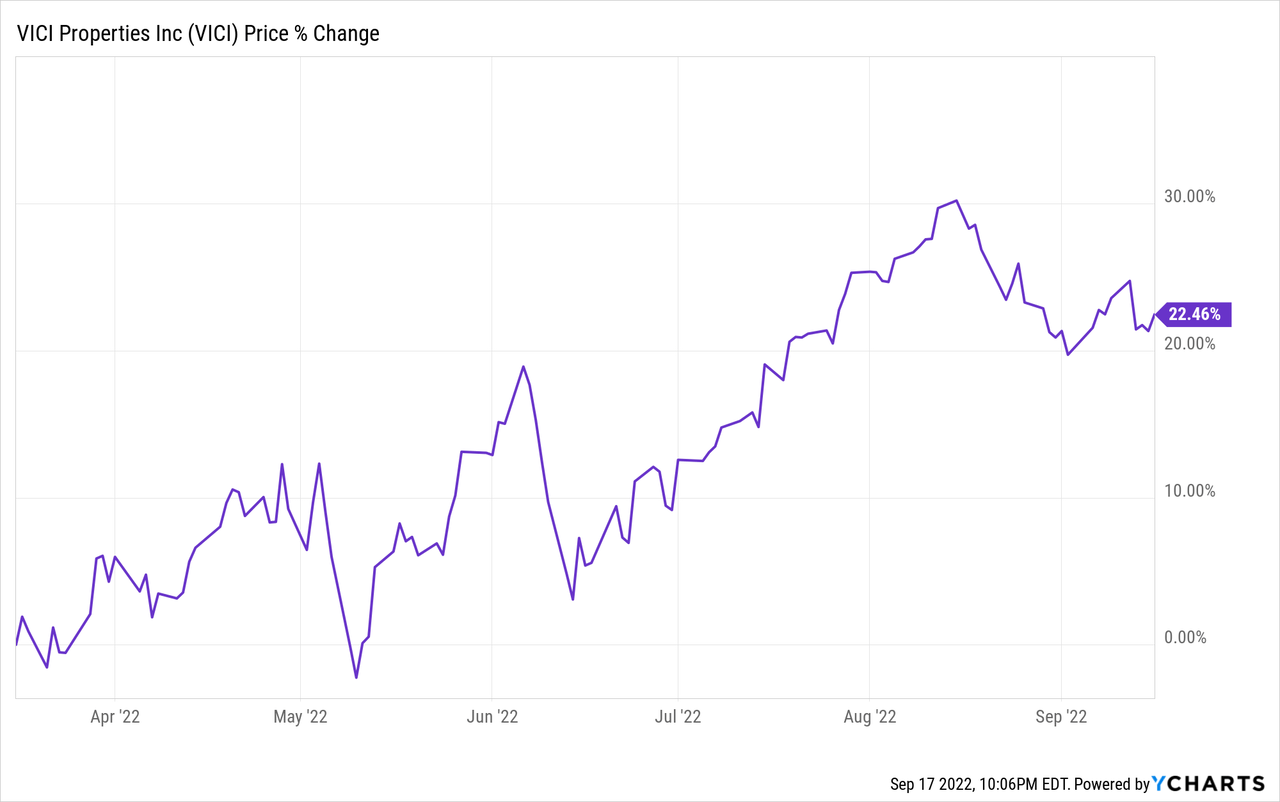

This unique strategy has resulted in significant market outperformance since its inception, but for a long time, we didn’t own it as we were waiting for the right time to initiate a position at an opportunistic price.

We got this opportunity in early 2020 and we kept buying more shares until late 2021 as the company kept persistently trading at a discounted valuation.

In late 2021, we explained in an article that VICI was in a “class of its own” and that it was arguably the best opportunity in the REIT sector.

You can read the article by clicking here.

Shortly after, it started surging even as the rest of the REIT market suffered a dip. The large size of our position helped stabilize the value of our portfolio even as other positions lost in value:

That’s great, but what’s next?

Can VICI keep on rising?

Or is now a good time to take profits?

To answer these questions, we reached out to VICI’s CEO, Edward Pitoniak to have a conversation about their current fundamentals, their future prospects, and their current valuation. The conversation wasn’t recorded so I cannot share a transcript, but it helped me reassess our investment thesis, and below I share my latest thoughts on the company.

The first thing that most investors like to point out about VICI is that its share price is up significantly in the recent past and that its valuation multiple has also expanded.

But what many appear to ignore is that this is the result of significant improvements that have enhanced VICI’s fundamentals. These improvements have been so significant that the company has described them as “transformational” for the company.

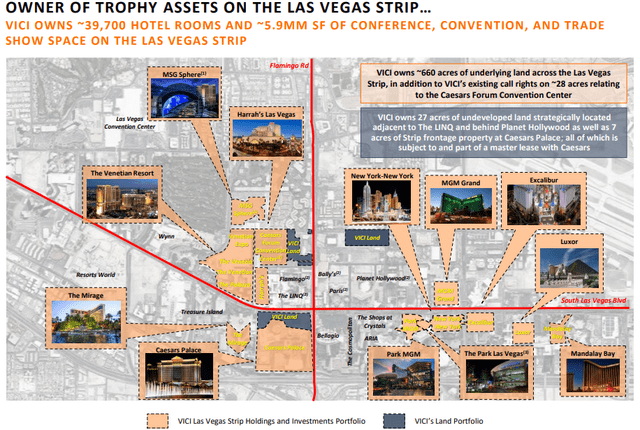

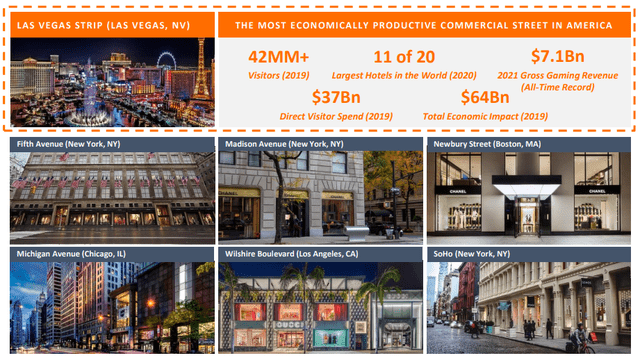

Firstly, it closed its merger with MGM Growth Properties, which added 15 trophy assets to its portfolio, greatly improved its diversification, boosted its exposure to the Las Vegas strip, enhanced its scale, and provided another avenue of growth via its new partnership with MGM.

Some of the properties that were added to the portfolio include:

The MGM Grand:

The Mirage:

Park MGM:

These are all irreplaceable trophy assets in Class A locations, exactly what you would expect one of the highest-quality REITs to own.

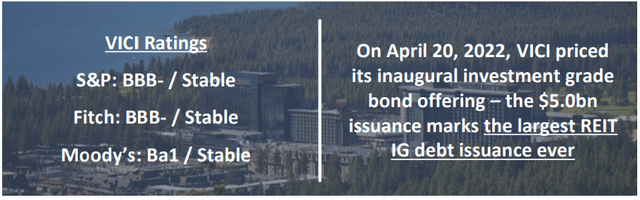

Then VICI finally also gained an investment grade rating from both, Fitch and the S&P. It also closed a $5 billion raise, which was the single largest IG debt raise by any REIT in history.

Then VICI was also added to the S&P 500 (SPY). It is the first REIT in history to go from IPO to S&P 500 inclusion in less than 5 years and for context, there are only 30 REITs in the S&P 500. Quite impressive!

And that’s not all.

Another catalyst that benefits VICI is the high inflation. Unlike most other REITs, VICI is not responsible for any property expenses, not even maintenance. It has true triple net leases and its leases even stipulate that the tenants need to reinvest 1-2% of their revenue annually into the property.

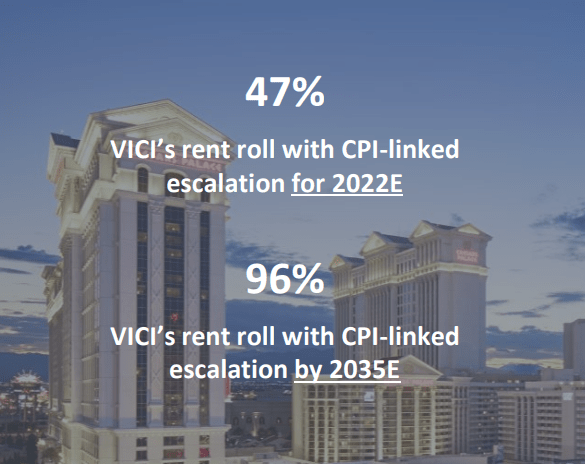

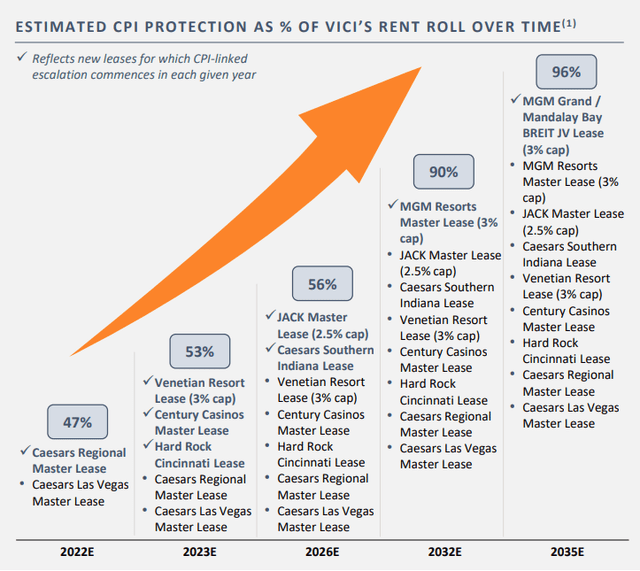

At the same time, its rental revenue is rising rapidly because it enjoys CPI adjustments in its leases. Approximately half of its revenue will rise by the greater of 2% or CPI each year with no cap. The other half of its leases typically also have 2% annual rent escalations, and after a certain number of years, they will also include capped CPI adjustments.

So VICI is protected on the cost side, but its organic rent growth is now accelerating as a result of the high inflation.

VICI Properties

And there’s still more.

The casino sector has continued to institutionalize over the past year as increasingly many investors have taken notice of its spectacular resilience.

As a reminder, VICI did not miss a single rent payment even when its properties were forced to shut down in 2020. Casinos are so durable because their real estate is mission-critical to their tenants. If you are the tenant of the Caesars Palace, you cannot just stop paying rent and move elsewhere because there is no other alternative. Elsewhere simply doesn’t exist. These are irreplaceable properties that enjoy enormous barrier-to-entry. The property itself is a brand and so you cannot replace it with another.

Because the property is so valuable, the landlord is in a position of strength and the tenants cannot play games. If it doesn’t pay, the landlord will simply find another tenant to take over the operations and there goes the tenant’s business.

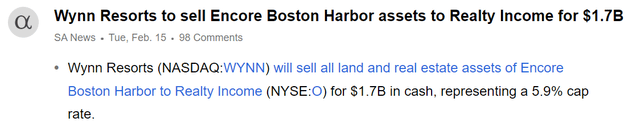

Until fairly recently, the casino property sector was quite obscure with few willing buyers and many misconceptions about the risk profile of these assets. But this is quickly changing and investors are now more confident than ever before in the casino property sector after witnessing its resilience during the pandemic. It also helps that Blackstone acquired the Bellagio and more recently, Realty Income (O) also closed a major casino investment.

On one hand, this could hurt VICI by increasing the competition for new acquisitions, but on the other hand, it also leads to cap rate compression, which increases the net asset value of its shares.

And then one final point: Las Vegas gained great momentum during the pandemic as a lot of Californians moved there to lower their cost of living and taxes. There is no state income tax in Las Vegas, a lot of great entertainment, a major airport, a lot of jobs, and it is in close proximity to California – explaining why many prefer moving there instead of Texas as an example. Now that many have learned to work remotely, Las Vegas makes a lot more sense as it makes it easier to travel cost-efficiently (major airport with relatively cheap ticket prices), and it also allows you to save money on other expenses and taxes.

As a result, Las Vegas was one of the fastest growing cities in recent years and the University of Nevada predicts that Las Vegas and Southern Nevada will be home to 3.3+ million people by 2060 – a 42% increase. That’s huge for VICI since 40%+ of its rents come from Las Vegas.

So to recap, here are all the improvements that have affected VICI in the recent past:

- MGP Deal Closure: It closed the biggest transaction in its history, merging with MGP, which added 15 trophy assets to its portfolio, diversified its income stream, increased its quality, and added another avenue for future accretive growth.

- Investment Grade Rating: With larger scale and diversification, it has now finally convinced the rating agencies to grant it an investment grade rating and has already made good use of it.

- S&P 500 Inclusion: It was included in the S&P 500 which should diversify its investor base and sustainably improve its cost of capital and improve its credibility among investors, property sellers, and tenants.

- Accelerating Organic Growth: VICI’s CPI adjustments in almost half its leases are proving to be highly beneficial in today’s environment. Besides, VICI also has higher fixed rent hikes in its other leases and since it has true triple net lease leases, it is perfectly protected from rising property expenses.

- Further Institutionalization of the Sector: The casino property is not in its infancy anymore. The pandemic was a great test and it passed it with flying colors. Major other players like Realty Income are now taking notice of it.

- Las Vegas is a Winner of the Pandemic: Las Vegas could grow by up to 40% by 2060 as increasingly many people move there to increase their quality of life. This is a great catalyst for the long-term growth of VICI’s top assets.

The point here is that today’s VICI is very different from yesterday’s VICI. Its share price has risen, but this is well-deserved given all the improvements that it has enjoyed. Next, we review its future prospects.

VICI Properties: The Future

Today, VICI Properties is a much larger and better company than it was just a year ago. This has pros and cons for the future of the company.

On one hand, the company is more defensive than ever. It is better diversified, has even stronger assets, an investment grade rating, and better access to capital, and it has proven its resilience to even the worst possible crisis that could affect experiential assets. So its risk profile has improved considerably, which warrants a higher valuation multiple as investors should require lower risk premiums/returns from a safer investment.

But on the other hand, since VICI is now a lot bigger and therefore, its future growth via acquisitions may slow down going forward. The impact of a new acquisition simply isn’t as large when you have a $30 billion market as when you have a $10 billion market cap. All else held equal, slower external growth should lead to lower returns going forward.

That’s the dilemma that most investors are today facing. They recognize that VICI is safer than ever, but they also realize that its future growth may not keep up with that of the past.

I have had some concerns about how VICI’s size could impact its future growth prospects and so we spent a lot of time discussing this on my call with the CEO of the company.

My takeaway is that yes, growth may slow down a bit as VICI’s recent growth has been exceptional, but its future growth is still likely to remain more than enough to support its current valuation, and perhaps even justify some more upside (more on this later).

Let’s break it down component by component to better understand VICI’s future growth prospects.

Firstly, let’s quickly revisit the internal growth prospects, which we already discussed briefly earlier.

VICI has the best organic rent growth prospects of all net lease REITs, and some of the best of the entire REIT sector, because it has no capex or property expenses, and a large portion of its leases enjoys annual CPI adjustments.

I don’t have a crystal ball and so I can’t tell you what the inflation rate will be in the coming months and year, but assuming it remains high, VICI could deliver ~4-5% FFO per share growth from the rent increases alone.

This will come back down to ~3% once inflation pressures cool off, but still, that’s above average for a net lease REIT and importantly, it is extremely consistent, through economic expansions and recessions, so there is a real compounding effect, and it is real organic growth since VICI does not have to reinvest in its properties to grow its rents.

So before even discussing VICI’s future external growth prospects, it is good to take a step back and recognize that a large part of VICI’s growth is already secured as it comes from contractual rent increases which are not dependent on its size. This organic growth is above average.

Now that this is clear, we can discuss the more complex topic of external growth. REITs like VICI seek to grow externally by growing their portfolio of investments when their cost of capital is inferior to their expected returns on newly acquired assets. If there is a spread, then you can raise capital, invest it, and it grows FFO on a per share basis.

All else held equal, size hurts external growth because the larger you are, the more assets you need to acquire to keep the ball rolling.

VICI’s market cap has now exceeded $30 billion and it is causing many to worry about its future external growth prospects.

Is VICI getting big?

Yes, it is.

But the more important question is whether it is getting too big?

Before my talk with the CEO, I had my concerns, but following it, I am less worried, and here are six reasons why:

Reason #1: VICI is buying very high-ticket properties that truly move the needle

Comparatively, VICI is still in a much better place than most other large REITs to keep pushing for attractive external growth rates.

Below, we look at 3 other REITs that are much larger than VICI:

- Realty Income has a $45 billion market cap and it owns 11,400 properties.

- Public Storage (PSA) has a $60 billion market cap and it owns 2,600 properties.

- Prologis (PLD) has a $100 billion market cap and it owns 4,732 properties.

VICI has a $33 billion market cap, so about 1/3 the size of Prologis, and nearly 30% smaller than even Realty Income.

But the interesting thing to note here is that VICI achieved this market cap by owning just 43 properties! That’s nearly $1 billion of market cap per property on average, which is massive.

Prologis must acquire 40x more properties on average to keep the ball rolling and it is still able to generate attractive external growth rates.

The point here is that VICI’s size actually isn’t that big when you consider that it is buying high-ticket properties that truly move the needle. To give you an example, the Venetian in Las Vegas, a single property cost VICI $4 billion. Realty Income would need to buy ~3,000 properties to allocate an equivalent amount of capital, which is of course far more challenging, and yet, it is doing it quite successfully.

So simply looking at the market cap of the company can be quite misleading. VICI is growing externally by acquiring properties that are far more valuable than what other large REITs are acquiring.

If you look at VICI’s size based on the number of properties that it owns, which is 43, VICI actually isn’t such a big REIT.

Reason #2: Unlike other REITs, VICI has significant reinvestment opportunities in its existing properties

VICI owns extremely valuable real estate. It owns quite literally some of the most economically-productive real estate in the world and with that, comes significant reinvestment opportunities.

At times, its tenants may decide to redevelop portions of their properties to maximize profits, and VICI will then provide capital to them in exchange for growing rents. VICI calls this its “Property Growth Fund” and it serves to fund “same-store” capital for its tenants.

In addition to that, VICI also owns some 27 acres of undeveloped land that’s very well located. It is adjacent to the LINQ and behind Planet Hollywood as well as 7 acres of Strip frontage at the Caesars Palace:

VICI Properties

Someday, this will be developed and it will require a lot of capital, providing a predictable pipeline of reinvestment opportunities for VICI.

Reason #3: Unlike other REITs, VICI also has valuable ROFRs & Put/Call Agreements to buy additional properties at high cap rates

VICI has entered into several rights of first refusal and put / call agreements that provide an embedded growth pipeline of “low hanging fruits” for VICI and they are quite significant in size and accretion potential:

Harrah’s Hoosier Park and Horseshoe Indianapolis: VICI has the right to call Harrah’s Hoosier Park and Horseshoe Indianapolis from Caesars at a 13.0x multiple (7.7% cap rate) of the initial annual rent of each facility in a sale-leaseback transaction before December 31, 2024.

Caesars Forum Convention Center: VICI has the right to call the Caesars Forum Convention Center from Caesars at a 13.0x multiple (7.7% cap rate) of the initial annual rent in a sale-leaseback transaction between September 18, 2025, and December 31, 2026.

Then it has rights of first refusal agreements on a bunch of properties, subject to some conditions. This includes two properties of the following: Flamingo Las Vegas, Bally’s Las Vegas, Paris Las Vegas, Planet Hollywood Resort & Casino, and the LINQ Hotel & Casino. In addition to that, it also has ROFRs on the Horseshoe Casino Baltimore and the Caesars Virginia development projects.

These are large potential deals down the line for VICI and now that it has access to relatively cheap capital, some of these deals would also be very accretive.

Reason #4: The international casino market is large and completely untapped

VICI has already exhausted a lot of casino investment opportunities in the US, and the whole sector is slowly also becoming more competitive with other buyers taking notice of these opportunities.

That does not mean that VICI’s casino acquisitions in the US are coming to an end. In fact, VICI just announced another casino investment at an attractive 7.6% cap rate. But it is fair to say that the opportunity set is not the same as it was just 5 years ago.

At the same time, it is important to remember that there are also major casinos elsewhere in the world and this sector is still completely untapped outside of the US.

There are REITs in over 30 countries but there is not a single casino REIT outside of the US. VICI is the only one that’s now getting to a size that will open doors for foreign casino investments and those are expected to take place already in the near term.

Consider some of these popular casino destinations outside of the US:

- Niagara Falls, Canada

- Salzburg, Austria

- Nassau, Bahamas

- Aruba in the Caribbean

- Macau, China

- Klerksdorp, South Africa

- Lisbon, Portugal

- Singapore

- Sydney, Australia

- Monte Carlo, Monaco

Obviously, VICI won’t be able to target all these properties, but the point is that the world is vast, and there are lots of major opportunities for VICI to consider abroad.

VICI is the largest player in this sector and its size also affords some competitive advantages, especially as you move abroad. VICI has pioneered casino sale and leaseback solutions and it can now go abroad and show casino operators how they could efficiently unlock long-term capital to reinvest in their growth.

It also helps that VICI has valuable partnerships with some of the world’s biggest casino operators like MGM. This should help it make the transition to foreign markets.

As REITs grow to a certain size, they naturally start to look for opportunities elsewhere in the world. Realty Income did it. Prologis did it. But somehow, investors aren’t giving VICI much credit for making its move abroad and fear that it has exhausted its opportunities, which makes little sense when you consider VICI’s phenomenal track record and the lack of competition in foreign markets.

Reason #5: VICI is barely starting to look for opportunities outside of its casino niche

While casinos will remain a major contributor to VICI’s future growth, it should also be noted that VICI has ample growth opportunities outside of this niche.

VICI is not just a casino REIT, it is an experiential REIT, and there are other casino-type niche assets that can benefit from VICI’s sale and leaseback solutions.

With investments in Chelsea Piers, Great Wolf, BigShots Golf, and Cabot, VICI has made its first allocations of capital outside of gaming, and VICI will continue to pioneer other experiential assets that enjoy similar characteristics as casinos.

Reason #6: VICI’s cost of capital is coming down, increasing the accretion of future deals

For the first time in its history, VICI now has an investment grade rating, which gives it access to cheaper debt. At the same time, its equity multiple is now getting back to a level that will allow it to issue new shares at a cost that’s inferior to its expected returns on new acquisitions.

Trophy casinos in the US may have experienced some cap rate compression over the years, which limits VICI’s spreads on this segment, but remember that VICI has some call options with cap rates near 8%, it is starting to invest in other experiential assets also at around 8% cap rates, and finally, it is also now looking to expand abroad, where cap rates will likely be higher than in the US since the foreign casino property sector is still very much untapped.

The bottom line is this: VICI’s future growth is likely to remain very attractive, consistent, and predictable. Will it be as high as it has been in the past few years? Probably not, but that’s never been expected. VICI cannot close huge M&A deals like that of MGP every year. In some years, the growth will be somewhat lower, and in others, it will be higher due to one-time M&A deals, but on average, VICI will likely keep delivering growth that surpasses that of other net lease REITs, and also that of the broader REIT market.

VICI is getting larger, but it still only owns 43 properties and its universe of opportunities is massive and investment spreads in this sector are above average.

Prologis, Public Storage, Welltower, Realty Income, Equinix, etc. are all much larger than VICI, compete in more competitive sectors, and need to buy a lot more properties to grow, and yet, it has not prevented them from achieving attractive growth rates and delivering strong total returns to their shareholders over time as they grew larger.

VICI Properties: Its Valuation

Historically, there have been times when VICI traded at a discount relative to other net lease REITs. The discount existed because the market perceived casinos to be riskier than other net lease properties.

This never made sense to us.

The perception comes from the fact that gambling is discretionary spending and that therefore, casinos would take a bigger hit during a recession. In reality, casinos are surprisingly resilient to recessions, just like other sin businesses, and besides, this does not really matter since VICI is a triple net lease landlord, not a casino operator.

The discount led us to invest heavily in VICI, expecting its valuation multiple to expand, and presented 10 reasons why VICI deserves to trade at a premium to other net lease REITs:

|

Casino Net Lease |

Traditional Net Lease |

|

|

High construction quality |

Yes |

No |

|

Contractual minimum capex spend |

Yes |

No |

|

High barrier to entry |

Yes |

No |

|

Tenants Have No Other Options |

Yes |

No |

|

Great inflation protection |

Yes |

No |

|

Properties have reinvestment opportunities |

Yes |

No |

|

Big-Ticket Investments That Move the Needle |

Yes |

No |

|

Class A locations |

Yes |

No |

|

High cap rates / discount to repl. cost |

Yes |

No |

|

Put/Call/ROFR options |

Yes |

No |

In short, we thought that VICI was not only safer but also set for faster growth – both of which would justify a higher multiple.

The pandemic proved both points as VICI was much more resilient and grew a lot faster than other net lease REITs. VICI did not miss a single rent payment and managed to grow its dividend by 11% in 2020 and another 9% in 2021. In comparison, most other net lease REITs missed a lot of rent payments early on, struggled to sustain their dividend payments, and are still collecting deferred payments to this day.

This superior track record, combined with the inclusion in the S&P 500, the obtention of an investment grade rating, and other improvements, led the market to rerate VICI’s valuation:

Its FFO multiple expanded from ~14x in early 2022 to ~17x today.

This has led many to conclude that VICI must be now fully valued or even overvalued, but is it really?

The only net lease REIT that’s comparable to VICI’s size is Realty Income and it trades at 18x FFO, despite having materially worse prospects, especially in today’s inflationary world, and I don’t think that it is overpriced either. If O can trade at 18x, VICI should trade at a premium to it.

But I want to take this a step further and argue that VICI actually shouldn’t be compared to Realty Income or any other net lease REIT.

Yes, VICI used triple net structures to lease its properties, but ignoring that, its properties have nothing in common with those of other net lease REITs.

We wouldn’t compare the Caesars Palace to a Dollar General property and therefore, we also shouldn’t compare VICI to Realty Income or any other net lease REIT.

The Caesars Palace is an irreplaceable property, built with the finest materials and it is located on one of the most economically-productive pieces of land, right in the middle of the Las Vegas Strip. This is a real trophy asset that will be there forever:

In comparison, the average Dollar General is built very cheaply, with the idea that you will probably tear it down after a few decades and start off fresh. These properties are also typically in more rural areas with limited land value appreciation potential:

Net Lease Advisors

You get my point: the property type is not the same. It is day and night.

One has huge barriers to entry and attractive growth prospects.

The other doesn’t.

NAREIT doesn’t classify VICI as a net lease REIT and we shouldn’t either. We don’t compare Alexandria (ARE) to other net lease REITs, despite it using net lease structures, and therefore, we shouldn’t compare VICI either.

VICI, just like ARE, does not really belong in any peer group and this is why it is complicated to compare their valuations to that of other REITs.

But if we were going to build a peer group, it should include other S&P 500 REITs that own trophy Class A properties. Good examples would be Federal Realty (FRT), Regency Centers (REG), Public Storage, Ventas (VTR), Prologis, and Alexandria.

And all of them trade at materially higher valuations than VICI:

|

AFFO Multiple |

|

|

VICI Properties |

17x |

|

Regency Centers |

19x |

|

Ventas |

19x |

|

Federal Realty |

22x |

|

Public Storage |

23x |

|

Alexandria |

23x |

|

Prologis |

26x |

I would put VICI’s properties against any of those other REITs.

When you picture a trophy property, you literally picture what VICI owns.

Its resilience during the pandemic was superior to any of those REITs.

So is VICI overpriced trading at 17x AFFO?

No, it isn’t. If FRT can trade at 22x AFFO owning mainly retail, then I don’t see why VICI couldn’t trade at 20x AFFO.

With a 4.2% dividend yield, a path to 5-7% annual growth, and ~15% upside potential, VICI is likely to keep delivering double-digit annual total returns for a long time to come.

Bottom Line

VICI is not in the bargain bin anymore, but it remains a strong portfolio anchor that’s likely to deliver above-average total returns with below-average risk, and for this reason, we expect to maintain a large position in the long run.

Be the first to comment