bunhill

Introduction

Thanks to the booming operating conditions within the refining industry during 2022, PBF Energy (NYSE:PBF) enjoyed a massive cash windfall but as my previous article discussed, there was nothing for shareholders in the form of cash returns following the second quarter. Thankfully, the good times continued into the third quarter and pushed management to reinstate their dividends. Despite being a positive development, it now appears time to lock in profits with the top of the cycle likely here or not far away given the gloomy economic outlook, as discussed within this follow-up analysis.

Coverage Summary & Ratings

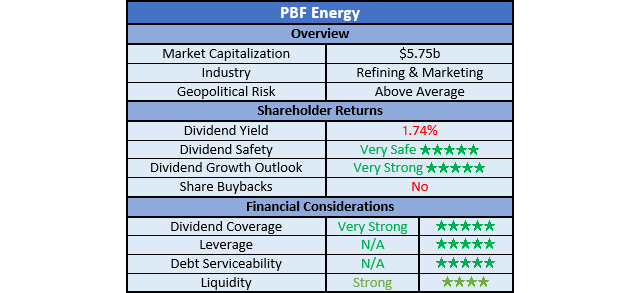

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

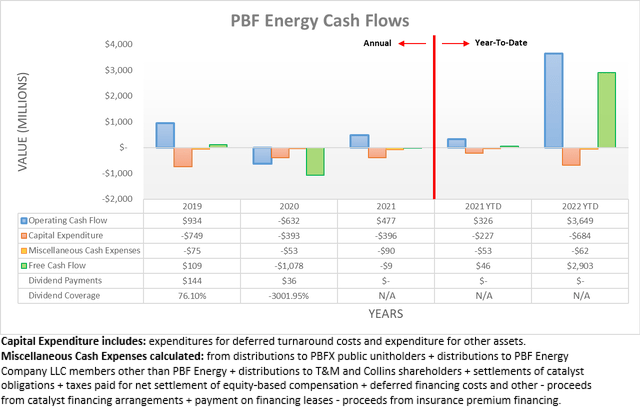

The booming operating conditions during the first half of 2022 created a massive cash windfall that seemingly continued into the third quarter with their operating cash flow climbing to a massive $3.649b during the first nine months, thereby up from $2.269b during the first half. Obviously, this far eclipses their previous result of $326m during the first nine months of 2021 and thus even with their capital expenditure increasing nearly three-fold year-on-year to $684m, their free cash flow still landed at a massive $2.903b during the first nine months of 2022. To make this more impressive, once again their massive cash windfall was not reliant upon working capital movements.

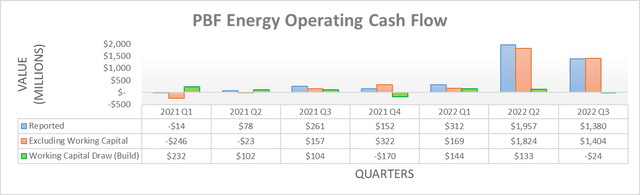

When viewing their reported operating cash flow alongside their underlying results that exclude working capital movements, it becomes easily visible that their massive cash windfall during the third quarter of 2022 was entirely fundamentally driven with both results very similar at $1.38b and $1.404b respectively. Even though these are both down versus their results of circa $1.9b during the second quarter, generating circa $1.4b of operating cash flow during a single quarter still provides a massive cash windfall that I suspect no one ever thought possible when the calendar rolled around to 2022.

Due to the inherent volatility of their industry, it remains impossible to accurately estimate their future cash flow performance. Although, the gloomy economic outlook makes their operating cash flow far more likely to soften going forwards, instead of continuing at these record-setting levels. Whilst the limited global refinery capacity and accompanying energy shortage could avert a return to the dark days of 2020 and 2021, the prospects of a recession on the horizon as central banks rapidly tighten monetary policy still creates a strong headwind. Plus as always, it should be remembered that the refining industry is cyclical and thus it is only a matter of time before these record-setting results soften. Nevertheless, at least shareholders can now look forward to receiving cash returns with their quarterly dividends being reinstated but despite this exciting development, it seems that shareholders will have to wait for clarity on what comes next, as per the commentary from management included below.

“Ultimately, share buyback is yet another tool that can be employed. We’ve seen it amongst our peer group and amongst other folks that are out there. And so it absolutely can be something that we could put in place at some point in the future.”

-PBF Energy Q3 2022 Conference Call.

Thankfully higher shareholder returns appear quite likely to be forthcoming, firstly because their dividends were reinstated at a modest base. To this point, their new quarterly dividends of $0.20 per share only cost $98m per annum given their latest outstanding share count of 122,519,827 and thus barring a severe downturn, this pales in comparison to their free cash flow. Secondarily, their financial position is now rock solid and thus as a result, they have few other uses for their free cash flow than shareholder returns.

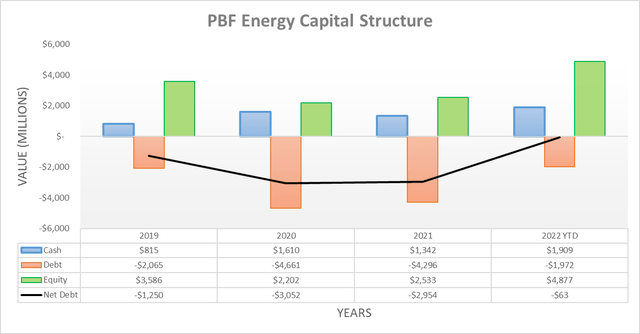

After seeing their net debt fall dramatically lower during the first half of 2022, their continued cash windfall during the third quarter saw it effectively eliminated and left barely visible at a mere $63m that was likely eliminated during the first days of the fourth quarter. When looking ahead, it should be no problem to keep their net debt under wraps because they reinstated their dividends at a modest and thus affordable base, especially as they will likely scale any further shareholder returns accordingly with their prevailing free cash flow. Obviously, this makes assessing their leverage and debt serviceability pointless as they have no leverage nor any issues servicing debt when their cash balance exceeds their total debt.

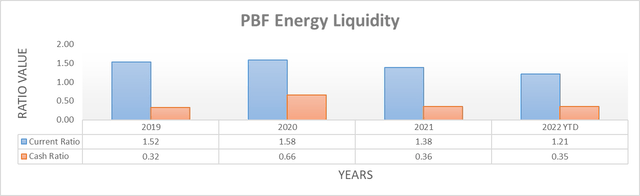

Quite unsurprisingly, their liquidity also benefitted from their cash windfall during the third quarter of 2022 with their respective current and cash ratios climbing to 1.21 and 0.35 versus their previous respective results of 1.08 and 0.32 following the second quarter. Needless to explain, this leaves their liquidity strong and when looking ahead, the same variables keeping their net debt under wraps should also steady their liquidity. Thanks to their net debt now being eliminated, there is obviously no longer any need to consider their debt maturities and thus as they head forwards, they have a perfect base to reward shareholders.

Conclusion

Notwithstanding their very strong outlook for dividend growth and possible share buybacks, investors should remember this is a cyclical company and thus one day, the tide will turn and almost certainly drag their share price lower, which makes it a question of when, not if. It is difficult to imagine a better combination of news than record-setting financial performance, the elimination of net debt and the accompanying reinstatement of dividends. Whilst positive news is obviously good, their share price is already over 200% higher year-to-date and leaves their dividend yield at a mere very low 1.74%. I suspect this marks the top of the cycle or not, it does not seem far away and thus as a result, I believe that downgrading to a sell rating is now appropriate as it appears time to lock in profits.

Notes: Unless specified otherwise, all figures in this article were taken from PBF Energy’s SEC Filings, all calculated figures were performed by the author.

Be the first to comment