Joel Carillet/iStock Unreleased via Getty Images

During the recession of 2001, Leonard Lauder, the then Chairman of cosmetic giant Estee Lauder (EL) introduced the ‘Lipstick Index’ as a pulse for the economy. Lipstick sales were on the rise despite the slowdown, and it was believed that at such times customers spend on small luxuries in lieu of making big purchases. And that’s where the French cosmetics company L’Oreal (OTCPK:LRLCY) comes in. Its sales continue to grow even as the economic gloom gets bigger. But there’s much more to a company’s health than just its sales. This analysis explores its fundamentals and compares its market valuations with peers, concluding that on the whole, L’Oreal has a lot going for it.

Is the lipstick index still at play?

First things first. The company hasn’t in fact grown consistently in the face of recessions. During the big COVID-19 year of 2020, its revenue shrank. But that was an exceptional sort of recession, we might argue, in that it wasn’t a routine market cycle phenomenon but driven by an external occurrence. So I dug back further to the late-2000s recession, which followed the financial crisis of late 2008. Same finding. It did indeed see its revenue shrink in 2009. This means that much like in the case of luxury goods companies, there is indeed an impact from the recession, but the recovery can be fairly swift.

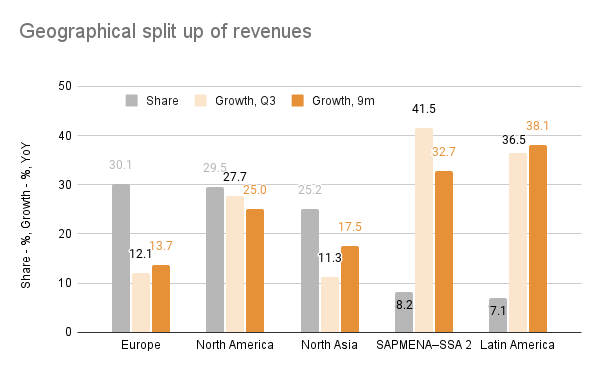

That said, for the past decade, L’Oreal’s growth was underwhelming with a CAGR of just 2.6%. It has accelerated to an average of 5.3% growth in the past five years, which is faster than that for the consumer staples sector. But even this is nothing compared to the huge 20.5% rise seen for the first nine months of 2022. So far, at least, it appears that the Lipstick Index is turning out to be on point. It’s also a reflection of the company’s own balanced geographical diversification, which has allowed it to grow even as North Asia, its biggest market until the first half of 2022 (H1 2022) slowed down in Q3 because of COVID-19 restrictions in China.

Source: L’Oreal financial update

Robust operating margin

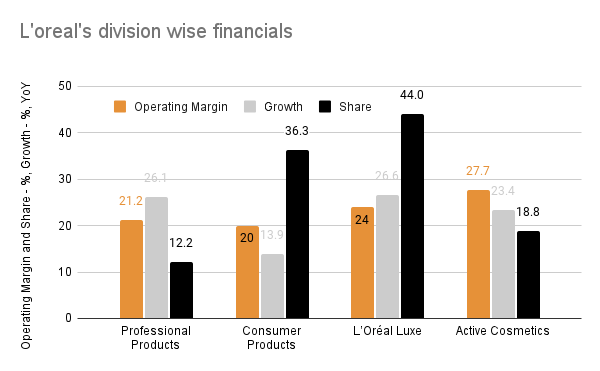

If its latest sales figures are impressive, the company’s margins (available up to H1 2022) are even more so. Despite rising inflation, its operating margin rose slightly to 20.4% at the end of June 2022, compared with 19.7% at the same time last year. Moreover, it’s consistently at 20%+ levels across its four segments (see chart). Its most encouraging division is L’Oreal Luxe, which includes brands like Lancome, Kiehl’s and Urban Decay. The division’s margins are also second only to the skincare-focused Active Cosmetics segment. In other words, the division driving growth is the biggest and a profit generator, which can impart stability to its margins than if growth stemmed from smaller or lower margin divisions.

Source: L’Oreal financial results

E-commerce and growth markets

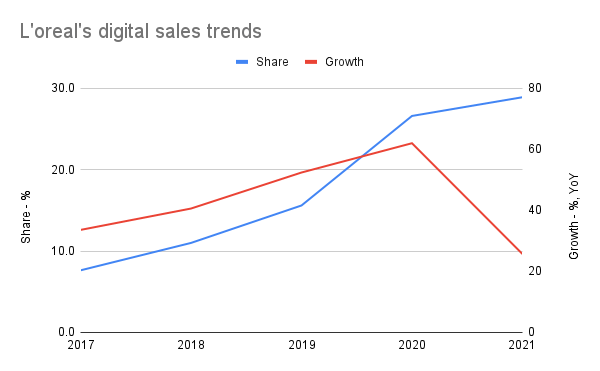

As encouraging as these developments are, they left me with a nagging question. Considering the company’s history of relatively muted growth and slightly lower operating margins, can it sustain this performance over time or will soon taper off? The answer probably lies in the growth of its e-commerce sales. A look at the past five years’ data reveals that in 2017, L’Oreal’s digital sales were already growing at a robust 33.6%, but they had a small share of total revenue at 7.6%. Still, by 2019 the share had more than doubled. And then came the pandemic, forcing even the most unwilling among us to adopt online shopping. By the end of 2020, the company’s online sales had risen by a huge 11 percentage points and showed even stronger growth than in the years before at 62%. Its pace of digital expansion slowed down in 2021 but still continues to grow.

Source: L’Oreal, various financial statements

The future of online sales as such is bright, especially as the internet’s penetration increases in emerging markets, which are big growth geographies for L’Oreal. According to Morgan Stanley research, global e-commerce sales can rise by 70% from current levels of USD 5.4 trillion by 2026. The company already has the advantage of being the biggest cosmetics company in the world, which has clearly pivoted well to online sales. This could continue to show in its growth. For the near future too, it appears positive on its outlook for this year saying “…we are confident in our ability to outperform the market in 2022 and achieve another year of growth in both sales and profits.”.

I am less sure about whether its high operating margins can sustain over time though. Typically, there’s an inverse correlation between retailers’ margins and e-commerce sales as there’s a lot of competition online and delivery and returns costs can pile up. L’Oreal’s products are available across a host of third-party retailers, so the market dynamics can play out differently for it. But if retailers’ costs rise, it’s conceivable that it could feel some impact too.

Highly valued or not?

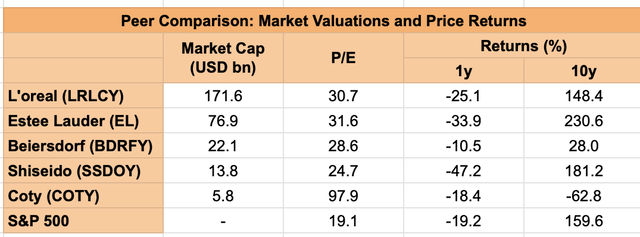

Then there’s the question of its market valuation. At a P/E ratio of almost 31x, it looks like a pricey stock compared to the S&P 500 (SP500) at 19x. This is especially so since both its one-year and 10-year returns underperform the index (see table). But here’s the twist. Compared to peers, it doesn’t look all that high priced. In fact, it has only the third highest P/E ratio, with Coty (COTY), at an eye-popping 97.9x. Even if we don’t consider this outlier stock, the average P/E for the remaining four stocks in consideration is at an elevated 29x.

With L’Oreal’s market leadership position and its continued strong growth, it’s not surprising then that it has a slightly higher valuation. In fact, right now, it’s trading at a slightly lower P/E compared to its five-year average of 39.8x. Here’s another fun fact. Over the same time period, its lowest P/E has been 27.7x, which isn’t much lower than its current levels. This along with its higher ratio than the broader markets, however, suggests that there could be a downside of 10% in the short term if the stock markets stay uncertain.

What next?

On the whole, though, as a consumer staple, it has defensive qualities which is a winner right now. Its robust financials encourage confidence as do its growing digital sales and emerging market opportunities. Its long-term returns aren’t bad either. Its P/E ratio might look high but when seen in the context of peers, it’s more reasonable. In any case, it doesn’t have a history of falling much, I guess, to paraphrase its famous tagline – Because it’s worth it.

Be the first to comment