ipopba

Swiss RE (OTCPK:SSREF) offers a high-dividend yield that is supported by its superior capitalization, but not by its earnings. For income investors with a higher risk-taking profile, it may be a good opportunity to get a yield of close to 8%.

Company Overview

Swiss Reinsurance Company, generally known as Swiss Re, is Swiss company and one of the world’s largest reinsurance providers across the globe. Its core business is the providing of reinsurance, insurance and other insurance-based form solutions to its customers. As usual within the reinsurance industry, Swiss Re operates globally and its main clients are other insurance companies, corporations the public sector clients.

The company has a long history, considering that it was founded in 1863, and is based in Zurich. It currently has a market value of about $23 billion, and trades in the U.S. on the over-the-counter market.

Measured by gross premiums written during 2021, the company is the second-largest reinsurance company worldwide, behind Munich RE (OTCPK:MURGY). Other important competitors include Hannover RE (OTCPK:HVRRY), SCOR (OTCPK:SCRYY), and Berkshire Hathaway (BRK.A) (BRK.B). Like most of its peers, Swiss Re has a defensive and conservative business profile, which is a strong support of its good credit rating of A by Standard & Poor’s.

Strategy & Targets

While Swiss Re’s core business is reinsurance, being its largest business in terms of income, the company has adopted a strategy of increasing its business diversification throughout the past few years. Nowadays, the group’s operating segments are divided across three units, with reinsurance being the core of its business, supplemented by corporate solutions and iptiQ, a digital unit focused on personal lines.

Business (Swiss Re)

According to the company, all segments enjoy positive market growth expectations during the next decade, as Swiss Re expects compounded annual growth rates to be between 4-6% from 2021-30. These aren’t impressive growth rates, but considering that insurance is a mature industry and growth expectations aren’t generally high, this represents a good support for Swiss Re to report positive earnings growth over the long term.

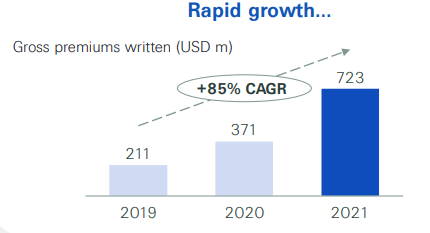

Where the company has better growth prospects is in its iptiQ unit, a digital business-to-business-to-consumer solution focused on personal lines. In this segment, Swiss Re offers tech-driven solutions across the insurance value chain to corporates and individuals through a digital platform, making long-term partnerships with insurers, banks, and leading consumer brands.

It provides life and non-life insurance products, plus data analytics services, enabling its partners to offer their customers better, simpler, and faster insurance solutions. This unit has experienced strong growth over the past three years, measured by gross premiums written, but still has a small weight within the group, and is still not profitable as Swiss Re only expects to reach breakeven in this unit by 2025.

iptiQ growth (Swiss Re)

Regarding its main financial targets, Swiss Re aims to achieve a return on equity (ROE) ratio of 14% by 2024, compared to just 5.9% in 2021, to be achieved by a combination of several factors, including not incurring in Covid-19 losses, higher profits and margins both in its life and non-life segments, plus good cost discipline during the next couple of years. If Swiss Re is able to achieve this profitability level in 2024, it would be its highest since 2015, which shows that it is an ambitious target and may not be easy to get there.

Financial Overview & Dividends

Regarding its financial performance, Swiss Re has reported relatively weak results over the past few years, as the company was affected by the low interest rate environment that penalized its investment income, while Covid-19 was another drag in more recent years.

Indeed, its life segment was affected by excess mortality levels in key markets, which led to overall group losses in 2020 of about $900 million. This trend has become less severe in 2021, both in Europe and the U.S., a trend that was reflected in the company’s accounts. Swiss Re’s net income recovered to a net profit of $1.4 billion, even though it still faced net losses of about $2 billion related to Covid-19 during the year. Its ROE of 5.7% was still quite weak, and much lower than its medium-term target.

Nevertheless, some operating metrics showed a good progress in the past year, with premium growth of 4.8% YoY, to $42.7 billion, being a good indicator of higher earnings in the near future.

During the first six months of 2022, while Covid-19 entered the endemic phase and losses in its life segment were lower, the insurance company got hit from volatility in the capital markets. It suffered losses from equity investments of more than $400 million in Q1 2022, impacting negatively its overall group figures.

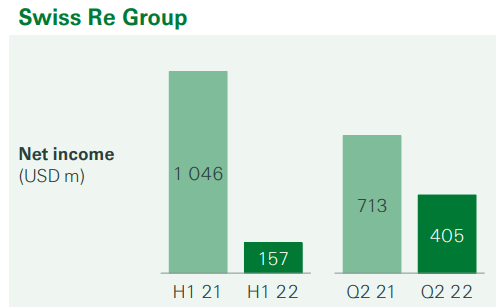

During the first semester, its net income was only $157 million, a considerable drop from the same period of 2021 as shown in the next graph. This is to some extent quite surprising, given that Swiss Re’s investment policy is quite conservative and has high exposure to low-risk government bonds, thus high losses from equity investments were not really expected as they only represent some 6% of its investment portfolio.

Earnings (Swiss Re)

Due to these weak earnings, the company’s ROE in the H1 2022 was only 1.6%, even though it has recovered to more than 9% in Q2. Despite this improvement, Swiss Re is still far away from its ROE target of 14% by 2024, showing that its earnings power has to improve considerably to achieve this target.

On the other hand, excess mortality recovered to much more normal levels during Q2, boding well for lower Covid-19 losses over the coming quarters, which will be key together with more stable investment returns, for Swiss Re to report a higher ROE in the near future.

Regarding its capitalization, Swiss Re has a conservative business culture and usually has an excess capital position, among the highest within the European insurance industry. Indeed, measured by the Swiss Solvency Test (‘SST’), its capital ratio at the end of last June was 252%, at the top of its target range of 200-250%.

This means that Swiss Re is very well capitalized and does not need to retain much earnings to improve its economic capital position, even considering the headwinds its business has faced from Covid-19 and higher capital market volatility.

I think this strong capital position is the main reason why Swiss Re’s dividend has been completely dislocated from its earnings over the past couple of years, given that is has been unchanged at CHF 5.90 ($5.85) per share related to 2019 earnings (paid in 2020), despite its earnings being quite volatile.

This shows me that its dividend policy is based on management’s commitment to provide a regular dividend stream, despite its earnings volatility. On the other hand, this policy is not sustainable over the long term if it isn’t supported by earnings. This was the case in the past couple of years, when Swiss Re reported losses and maintained its dividend (related to 2020 earnings), while last year its dividend payout ratio was 118%, which is not a sustainable payout over the long haul.

Therefore, dividend growth is not expected in the short term given that its earnings should remain weak this year, while some dividend growth may be possible if earnings improve in 2023.

Nevertheless, at its current share price, Swiss Re offers a dividend yield of close to 8%, which seems to be interesting and, according to analysts’ estimates, its dividend per share is expected to grow over the next few years.

Conclusion

Swiss Re has a good position within the reinsurance market, but its business has been affected by Covid-19 and capital market volatility in recent years, which together had a considerable negative impact on the company’s profitability.

Despite that, Swiss Re the company has maintained its dividend policy, showing that delivering a stable dividend is paramount to its investment case. While this is not supported by its earnings power, its superior capitalization enables it to distribute excess capital to shareholders, thus its dividend is not expected to be cut in the near term and Swiss Re’s high-dividend yield may be enough to attract income investors.

Be the first to comment