stock_colors/E+ via Getty Images

By Daniel Prince, CFA

Key Takeaways

- Waiting for the “right time to invest” may mean missing key market moments.

- iShares Core Allocation ETFs make it possible to invest in a diversified portfolio with as little as one share.

- These ETFs may be worth considering when you have cash ready to invest.

“Perfect is the enemy of good.” This time-tested saying applies to many walks of life – but does it also apply to your investment decisions?

Many individuals have cash ready to invest, but with so many different investment options, it can be hard to narrow down your choices to select a product that meets your financial needs.

This “analysis paralysis” could leave investors on the sidelines during important market moments, potentially missing out on future growth.

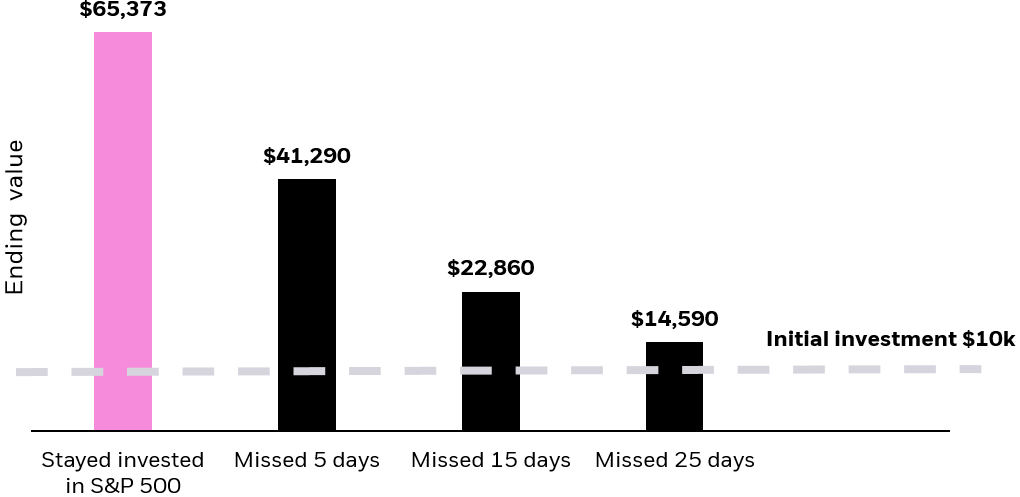

Missing Top-Performing Days Can Hurt Your Return

Diligent investors naturally spend a lot of time researching different ideas and choosing the vehicle that may be best for their financial goals. While considering different investments is important, you may also want to focus your energy on ensuring you’re positioned to invest your excess capital to capture market growth over time.

There may be a downside to waiting.

If your equity investments missed the 5 best-performing days over the last 20 years, your portfolio could have lost nearly a third of its potential value. As shown in this illustration, if you were unfortunate enough to miss the 25 best days, that portfolio loss increases to three-quarters of potential value. Here, you can think of the market like a well-known arena rock band: it’s the “big hits” that make the crowd go home happy.

Hypothetical investment of $10,000 in the S&P 500 Index over the last 20 years (09/30/2002 to 09/30/2022)

Source: Morningstar and BlackRock as of 09/30/2022. The S&P 500 Index is an unmanaged index that is generally considered representative of the US stock market. Chart data references the top five, 15 and 25 days over the period. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Chart description: Bar chart comparing the terminal values of investing a hypothetical $10,000 in the S&P 500 index over the last 20 years, after staying invested, and missing the top 5, 15, and 25 days over the period.

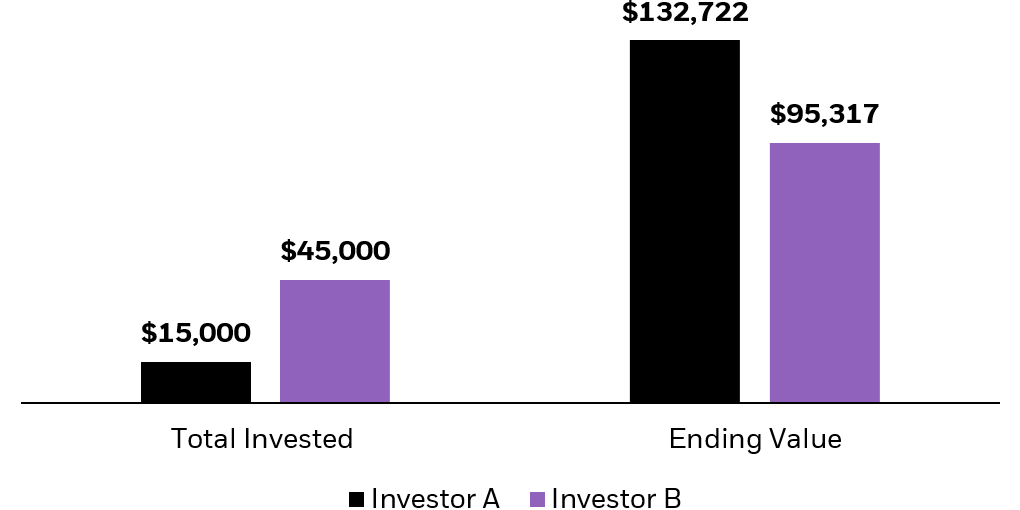

Time Is A Valuable Asset

Taking decisive action may provide long-term benefits as well. Consider two hypothetical investors with 30 years until retirement. For the first 15 years, Investor A contributes $1,000 every year, then watches it grow. Investor B does not start investing until 15 years later but contributes a larger sum of $3,000 each year until year 30. Assuming both investors earn 10% each year, investor B contributes 3 times as much but ends up with almost $40,000 less. Both investors build themselves a better financial future, but being decisive and starting sooner gives investor A an edge.

Hypothetical growth assuming a 10% annual return

Source: BlackRock as of 9/30/2022. The average annual return of the total U.S. stock market over the period July 1926 to April 2021 was 10.25%. 10% is used as an approximation of the actual average return realized over the last 95 years. Source: Fama and French. For illustrative purposes only and is not indicative of the performance of any actual fund or investment portfolio. Does not include commissions or sales charges or fees. Past performance does not guarantee or indicate future results. Chart description: Bar chart comparing return experiences of Investor A and Investor B. Investor A’s portfolio grows from $15,000 to $132,722. Investor B’s portfolio grows from $45,000 to $95,317.

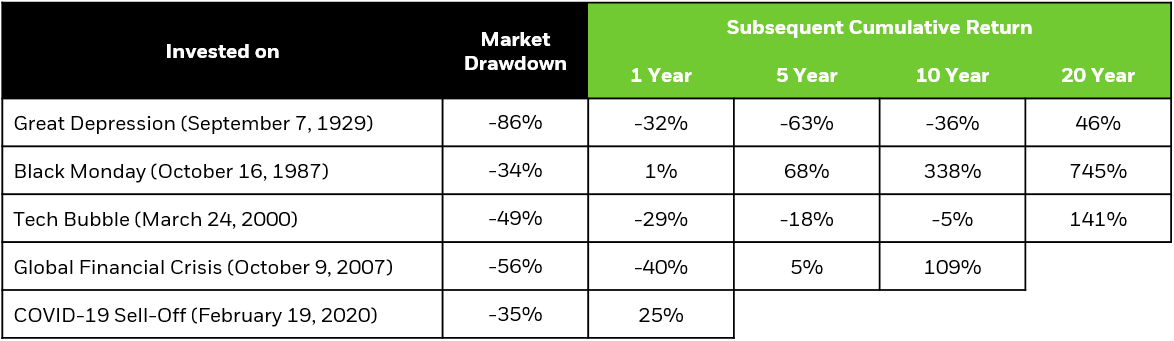

Time In The Market Is More Important Than Timing The Market

For most individual investors, the thought of losing money is scary. So, it is natural to worry whether now is the best time to invest. Nobody wants to invest right before the next downturn, but even if a hypothetical investor had the misfortune of investing in U.S. stocks at their peak before past market crises, they would likely have realized growth if they stayed invested for the long term.

What if you invested right before a market crash?

Source: Fama and French using daily total returns for the U.S. stock market. The dataset covers the period July 1, 1926 to April 30, 2021. Returns are calculated for the 1-year, 5-year, 10-year, and 20-year periods (where available) after the stated investment date. Market drawdown measured as the subsequent loss from the listed peak date. Past performance does not guarantee or indicate future results. For illustrative purposes only and not indicative of the performance of any actual fund or investment portfolio. Does not include commissions or sales charges or fees. Chart description: Table showing the performance of investing during several market drawdowns and the subsequent 1-year, 5-year, 10-year, and 20-year returns.

Summing It Up

Investing earlier and staying invested over the long term can put the power of time on your side. ETFs make it fast and easy to invest across a diversified portfolio of stocks and bonds, which may make it easier to make investment decisions. For example, the iShares Core Growth Allocation ETF (AOR) holds roughly 6,000 stocks and 14,000 bonds. These “all in one” ETFs also exist for investors with conservative, moderate, or aggressive risk targets, which differ by how much of the fund is invested in stocks vs. bonds. These low-cost vehicles may be easy ways for investors to maximize their “time in the market” while continuing to research additional solutions that work for them.

© 2022 BlackRock, Inc. All rights reserved.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

Non-investment-grade debt securities (high-yield/junk bonds) may be subject to greater market fluctuations, risk of default or loss of income and principal than higher-rated securities.

Investment in a fund of funds is subject to the risks and expenses of the underlying funds.

Buying and selling shares of ETFs may result in brokerage commissions.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

iCRMH1022U/S-2467768

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment