Martin Dimitrov/E+ via Getty Images

We are surprised that Macerich shares (NYSE:MAC) continue to trade at an incredibly low valuation despite clear signs of recovery. There is some worry about increasing interest rates making it harder to refinance mortgages, and that the US economy might enter a recession soon. It seems, however, that the existential threat that the Covid crisis represented for this REIT has passed, and yet shares do not trade that much higher. In our opinion, that makes them even more attractive, given that the current risks are easier to understand and manage for, compared to those of the Covid crisis.

After reading the second quarter results it is clear that the majority of their operating metrics are trending very positively, that the retail environment is much healthier today, and that the company is confident that given the strong leasing pipeline that occupancy will continue to increase throughout 2022 and into 2023

Second Quarter 2022 Results

For the second quarter 2022, same center NOI grew 5.4% compared to the second quarter of 2021. FFO per share came in for the quarter at $0.46, and occupancy level was 91.8% at the end of the quarter.

Traffic in the malls was about 95% of pre-COVID traffic, but tenant sales exceeded 2021 levels and also pre-pandemic levels. 2022 FFO is now estimated in a range of $1.92 to $2.04 per share. This FFO range includes an increased expectation for same center NOI growth in the range of 5.5% to 6.75%

Trailing 12-month leasing spreads remained positive at 0.6% as of June 30, 2022. One interesting comment the company made is that now that it is getting close to where it was pre-COVID in terms of occupancy, it gives it a lot more ability to push rate, and therefore leasing spreads should start increasing. Especially given that occupancy cost, which is now at 11.7%, is significantly lower as a result of increasing sales than it was pre-pandemic. The company therefore expects that it should be able to get more traction as it relates to re-leasing spreads.

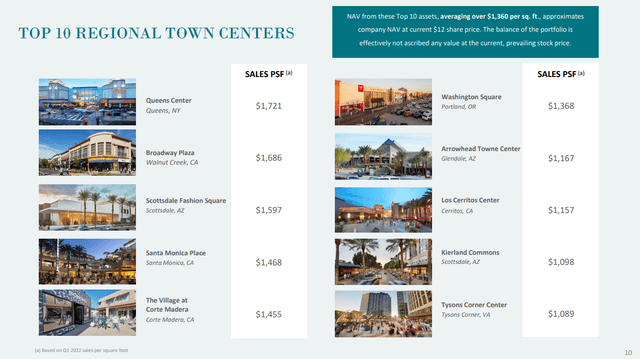

Top 10 Regional Town Centers

Macerich made an interesting observation in a recent investor presentation, noting that NAV from their top ten assets approximates company NAV at around the current share price, close to $12. It is as if the balance of the portfolio was not assigned any value at prevailing stock prices. In total the company has 44 malls / town centers primarily in California, Arizona, and the Northeast.

Macerich Investor Presentation

Occupancy

The company ended the quarter with occupancy at 91.8%, which is a 240 basis point improvement from the second quarter of 2021, and a 50 basis point improvement on a sequential basis compared to the first quarter of 2022. This is still significantly below the 2010-2019 average occupancy for the company of 94.6%.

In the years following the Global Financial Crisis, occupancy rebounded 450bps without the breadth and depth of leasing demand the company is currently experiencing. The company is on track for a much quicker occupancy recovery post pandemic. Already, occupancy rebounded 300bps from a low of 88.5% on March 31, 2021, to 91.5% at December 31, 2021.

Macerich already has commitments on 71% of its 2022 expiring square footage, with another 22% in the letter of intent stage.

Balance Sheet

So far, the company has been successful securing extensions for its maturing mortgages. So far it has secured nine such extensions for over $1.6 billion dating back to September of 2020. The company is preparing to execute on longer term refinancing transactions once the markets reopen and become more liquid.

Including undrawn capacity of $459 million on its line of credit, Macerich has over $630 million of liquidity today. Debt service coverage is at 2.7x. Net debt to forward EBITDA at the end of the quarter was 9.0x. The company expects roughly $235 million of free cash flow after the dividend and recurring capital expenditures this year.

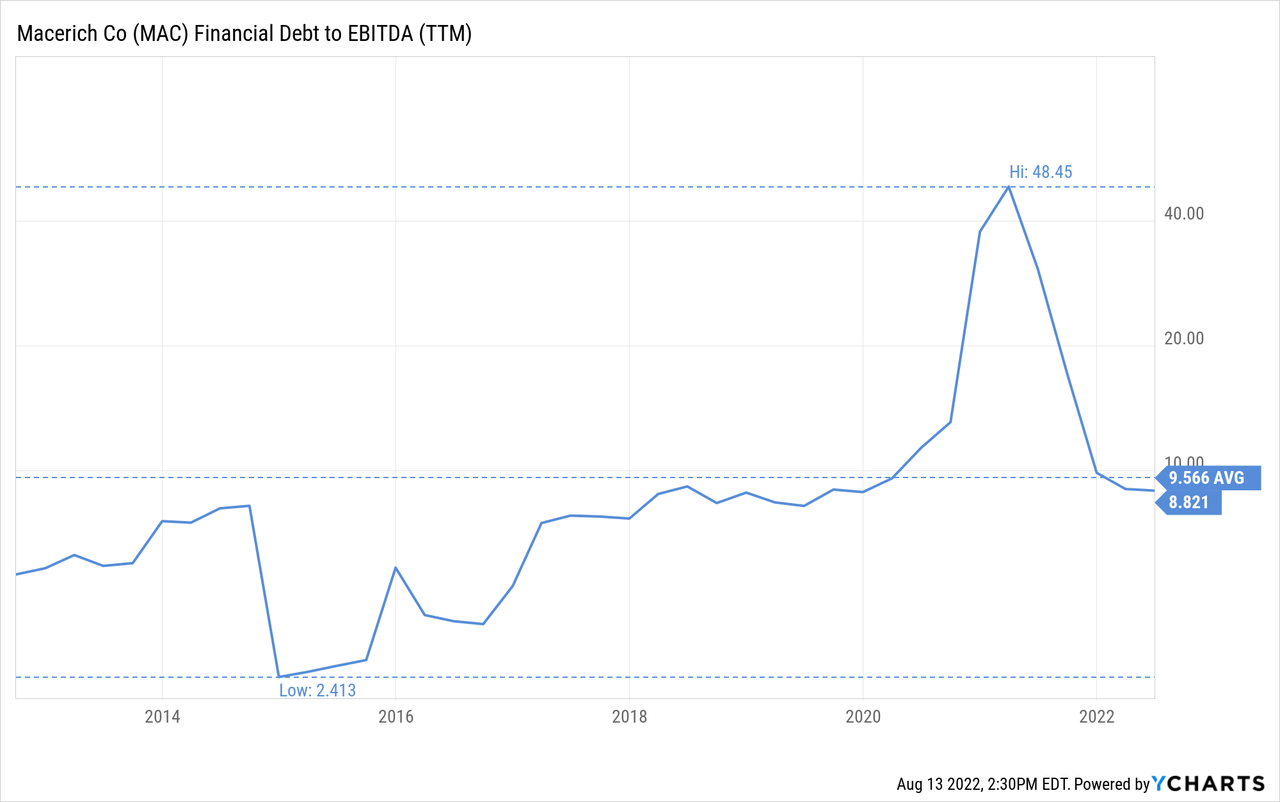

While the company’s leverage reached dangerous levels during the Covid crisis, it is now at a much more reasonable level thanks to debt reduction and profitability improvements.

Valuation

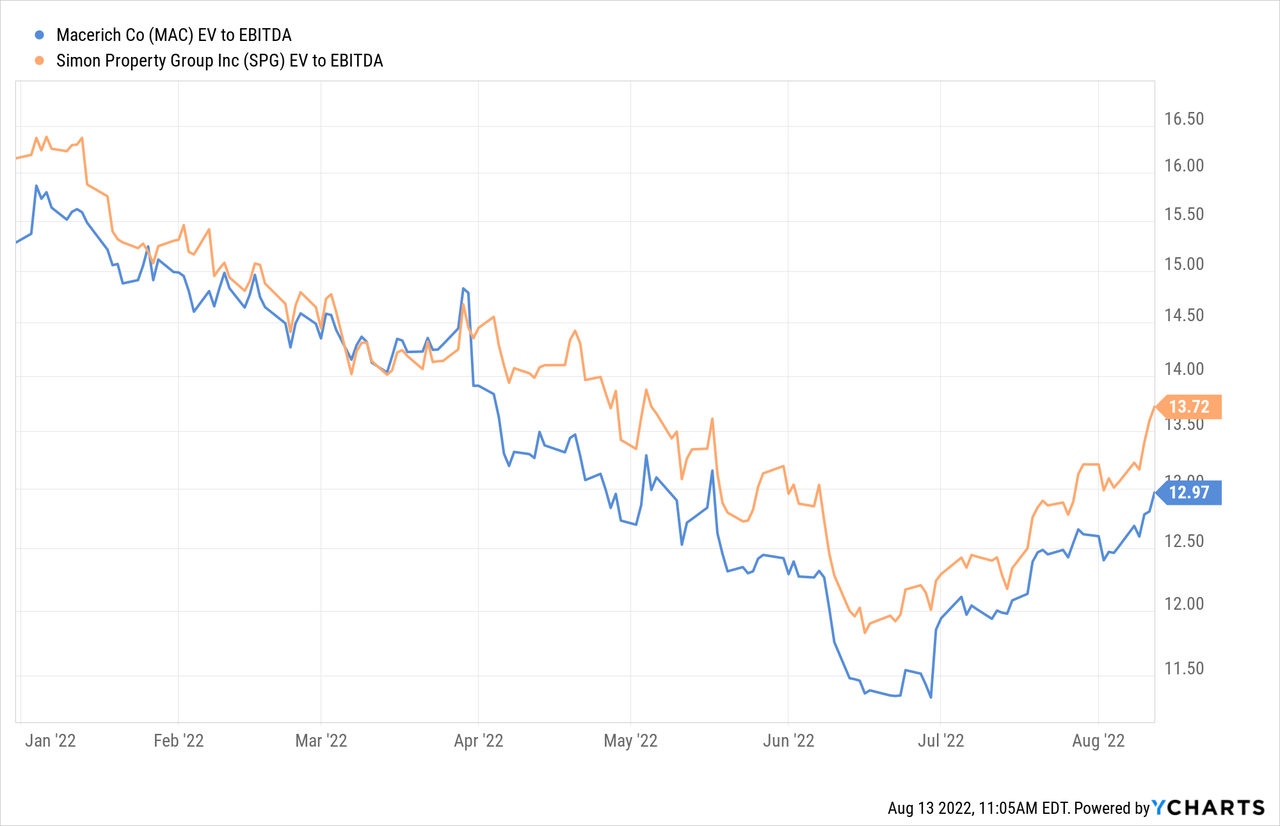

In general, shares of shopping malls are currently very cheap, but Macerich is particularly cheap. For example, it is trading at a discount to its closest peer Simon Property Group (SPG), despite Simon also trading at a very low valuation.

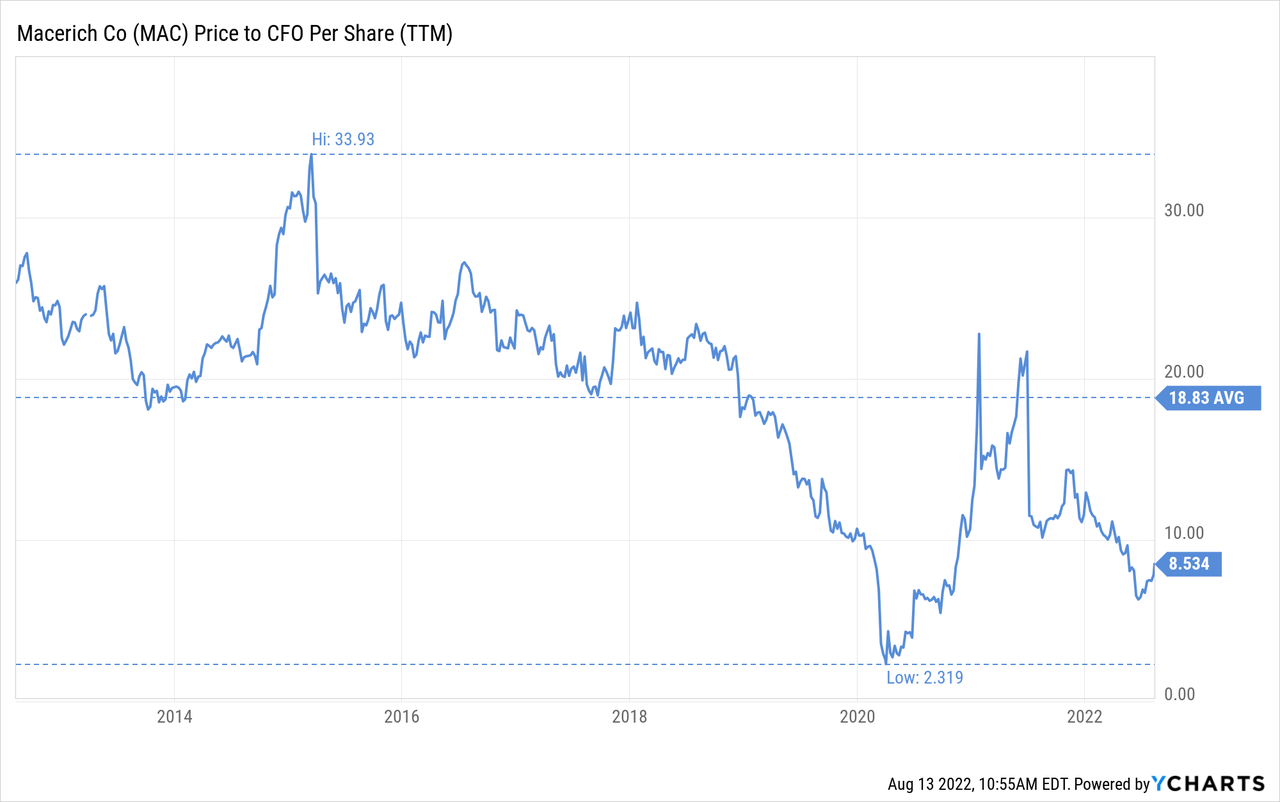

Compared to its own history, Macerich has rarely traded at a lower valuation than the 8.5x price to cash flow it currently is at. The ten-year average price/cash flow for Macerich is 18.8x, therefore it is trading at more than a 50% discount.

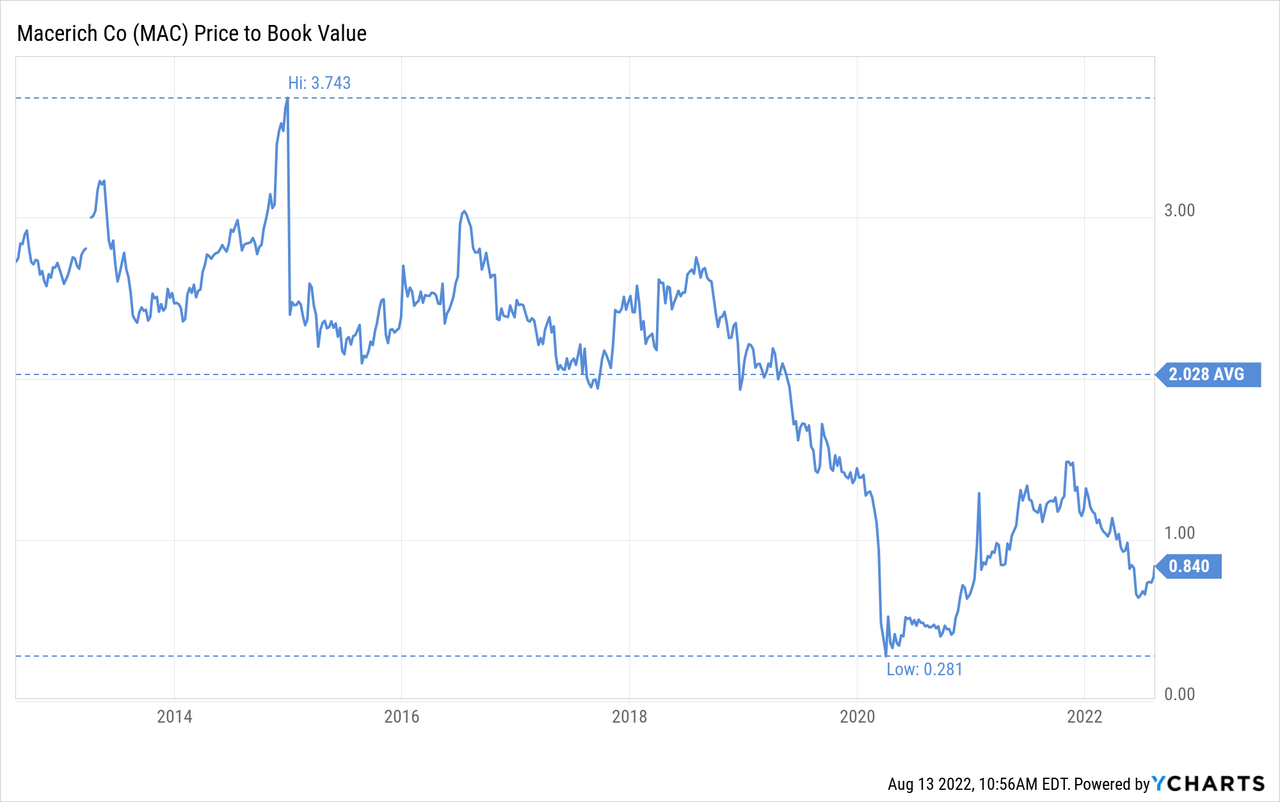

The price/book value tells the same story, with a ten-year average of 2x, and currently below 1x, at ~0.84x. Therefore, more than a 50% discount to its historical valuation. If the company’s fundamental were deteriorating, we could understand this valuation levels, but what we are seeing so far are improving fundamentals with a still bargain level valuation.

Risks

While we see a lot of value in Macerich shares, we do believe it is an above average risk investment. While the company has significantly reduced debt, it still has high leverage. Also, while its fundamentals such as occupancy levels are improving, they still have some way before they completely recover. Another significant financial impact, such as new lock-downs or a severe recession, could put the company in financial risk again.

Conclusion

For investors willing to take the risk, we believe there are few opportunities as attractive as Macerich right now. The valuation is incredibly low, while the fundamentals are improving. Second quarter results showed that the recovery continues to be on track, and the company sounds optimistic that occupancy and leasing spreads will continue to improve going forward. Leverage, while still high, has come down significantly, and the valuation leaves a lot of room for shares to move higher.

Be the first to comment