robbin0919

Strong Core Performance Despite Business Mix Disadvantage

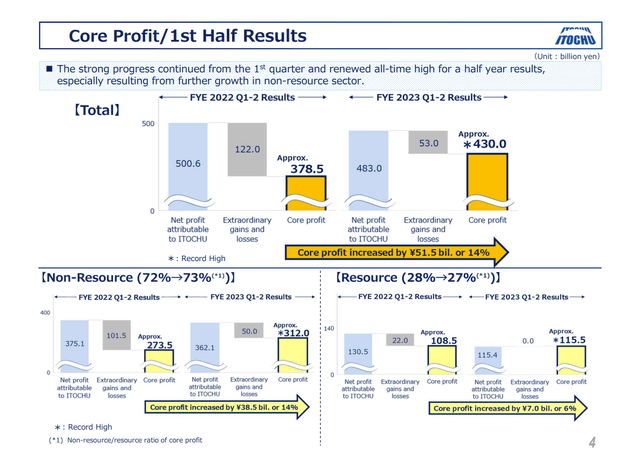

ITOCHU Corp. (OTCPK:ITOCY) (OTCPK:ITOCF) had a strong first half of Fiscal 2023 with a profit of ¥483 billion. This is just ¥17.6 billion below 1H 2022 despite having ¥49 billion less in extraordinary gains this year. Like the other trading companies, Itochu benefitted this year from higher oil and gas prices in the Energy business and strong coal prices offsetting weaker iron ore prices in Metals & Minerals. Itochu has a mix of businesses that are less resource-focused than its peers, however. The company also performed better than expected in its steel business, shipping and automotive-related businesses within Machinery, and construction materials within General Products & Realty. The result was record core profits for a half year. The company also raised its full year profit forecast from ¥700 billion to ¥800 billion and its dividend forecast from ¥130 to ¥140 per share.

Itochu 2Q 2023 Earnings Slides

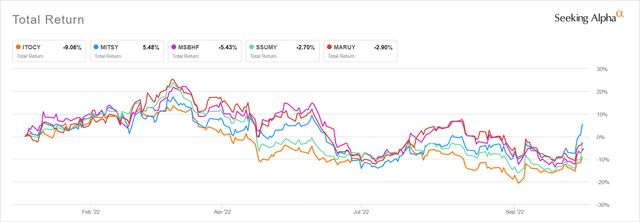

With its lower concentration in resource-related businesses, Itochu does not get as much tailwind from a weak yen as its peers, who sell more commodities priced in dollars. Itochu’s guidance raise was the lowest of the trading companies that have reported. The stock has been out of favor YTD, coming in last of the five trading companies on total return.

Seeking Alpha

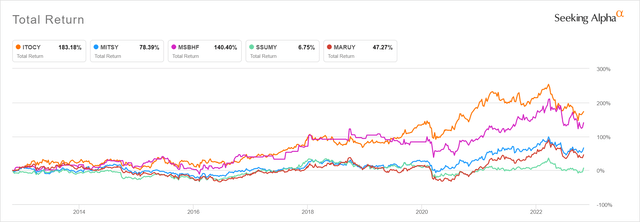

Although the commodity pricing and forex issues have been negatives for Itochu recently, the lower cyclicality has been an advantage in the longer-term, where we see Itochu stock performing the best of its peers over the last 10 years. It also still trades at a higher valuation based on P/E and P/B.

Seeking Alpha

Itochu’s greater mix of non-resource businesses could become a relative advantage if the yen starts to strengthen again. Itochu has the lowest debt ratio among its peers, and it would also have an advantage if interest rates increase. While the Bank of Japan has given no indication it is ready to start tightening as other countries have done, there is some speculation this could change in 2023, especially if wage levels increase. The relative pullback in Itochu stock this year provides a good entry point for investors who believe the low interest rate environment can’t go on forever.

Remaining Upside For FY 2023

I went through a detailed sensitivity analysis last quarter based on changes in commodity prices from the original planning assumptions for FY 2023. At that time, I estimated that Itochu had room to increase its profit forecast by ¥100 billion, which is exactly what they did one quarter later. The key sensitivities I reviewed then haven’t changed much on average. Iron ore continued to weaken, coal has remained strong, and the yen has weakened further. All three charts have shown signs of flattening or reversing trend in the past month, however.

Although the company’s profit forecast increase matched my estimate, there are a few more positive developments that were not reflected in my estimate last quarter. These could provide additional upside in the second half. First, the company has generated ¥50 billion of extraordinary gains in the first half. ¥30.5 billion of these came in 2Q. Also, the company still has a ¥20 billion “loss buffer” built into the forecast, compared to the ¥30 billion buffer to start the year. Therefore, the current ¥800 billion profit forecast still has some conservatism built in. If things go smoothly the rest of the year without unexpected gains or losses, Itochu could report around ¥850 billion profit, which would be a new record.

Valuation

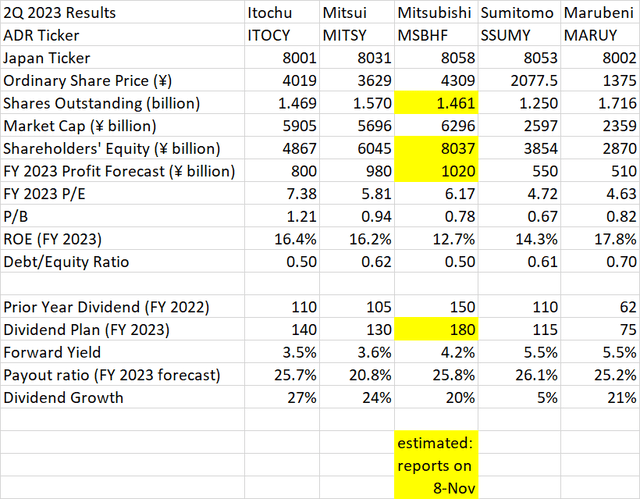

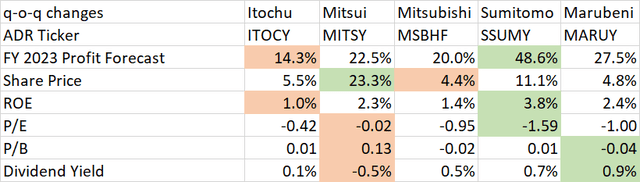

Comparing Itochu to the other major trading companies, it has the highest P/E at 7.4 times the FY 2023 earnings estimate. It also has the highest price/book ratio at 1.21. Itochu’s Japanese trading company peers are all in the 4-6 P/E range and trade below book value. Itochu’s long-term performance, low debt, and return on equity near the high end of the range justify the premium multiples in my opinion.

Author Spreadsheet

Itochu stock may have suffered this year and last quarter in particular because its greater non-resource focus caused it to improve less than its peers. Looking at the changes on the above chart compared to the similar chart I published last quarter; we see that Itochu ranked last of the five on the increases in profit forecast and return on equity.

Author Spreadsheet

It’s uncertain if the recent reversal in commodity price trends will continue, or when the yen will strengthen, but Itochu would be more likely to outperform the pack in that environment.

Capital Management

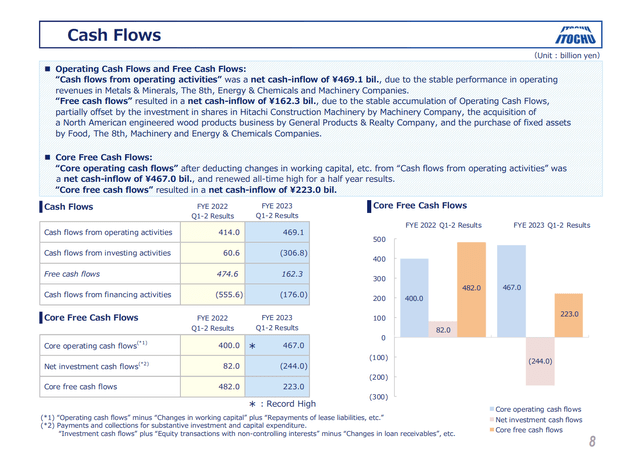

Itochu continued its trend of record core operating cash flows in the first half. Free cash flow was not a record because the company made several investments this year, while they were a net seller of assets last year. Some key new investments are a stake in Hitachi Construction Machinery and a North American engineered wood products business.

The ¥223 billion core free cash flow left over after these investments is nearly enough to cover the new full year dividend of ¥140 per share or ¥206 billion total, plus the recently announced ¥35 billion of buybacks authorized. Nearly all the cash generated in the second half of the year will be available for further productive investment.

Itochu 1H 2023 Earnings Slides

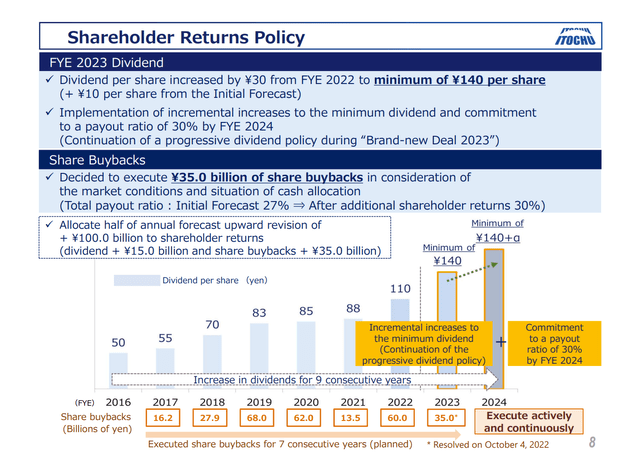

The dividend forecast for FY 2023 was raised to ¥140 per share. The interim dividend paid in December remains at ¥65, but the final dividend paid in June 2023 is now projected to be ¥75. At 3.5%, this is still the lowest yield of the five trading companies. Year-over-year dividend growth remains the highest of the five, even though others announced bigger raises this quarter. The company’s “Brand New Deal” medium-term plan commits to a payout ratio of 30% by FY 2024. The ¥140 planned for FY 2023 is a payout ratio of only 25.7%. This suggests there is room to raise the dividend to ¥160 based on the current profit forecast. Alternatively, the dividend would be safe from a cut if profits fell by as much as 15%.

Itochu 1H 2023 Earnings Slides

Conclusion

Itochu delivered record core profit in 1H 2023, but the stock has underperformed peers so far this year. The company’s greater focus on non-resource businesses has been a drag this year as it benefits less from high commodity prices and a weaker yen. As these conditions reverse, Itochu should resume outperforming its peers. The company’s lower debt will also be an advantage if interest rates begin rising in Japan. Over the long term, Itochu’s business mix is an advantage to return on equity and stock performance. If the economic environment is about to turn, now is the time to buy to generate relative outperformance in the future.

Be the first to comment