Iuliia Korniievych /iStock via Getty Images

Four months ago, I advised investors to consider a trade in junior dry bulk shipper OceanPal (NASDAQ:OP) after a heavily dilutive equity offering caused a steep sell-off in the company’s common shares.

The stock indeed managed to recover in the following weeks and peaked at $1.76 on March 7. With momentum fading, shares quickly retreated back below the $1 mark and continued their decent for most of the past three months.

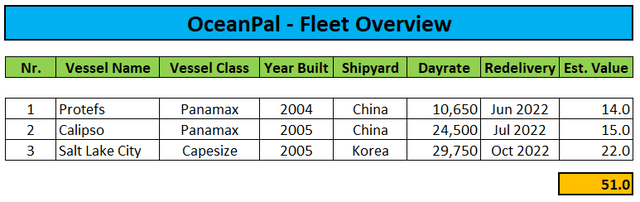

Two weeks ago, OceanPal reported uninspiring first quarter results as earnings were impacted by unfavorable legacy charter contracts for the company’s small fleet of three, fairly old dry bulk carriers. In recent weeks, two vessels have been chartered out at substantially improved rates:

Company SEC-Filings, Compass Maritime

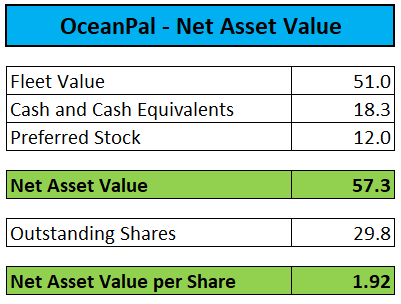

The fact that the company has been willing to dilute common shareholders at a fraction of net asset value to pursue its stated fleet expansion plans has resulted in shares trading at a steep discount to net asset value (“NAV”) as investors remain wary of additional offerings like recently exercised by fellow Greek junior shipper Imperial Petroleum (IMPP, IMPPP).

Company SEC-Filings, Compass Maritime

Unfortunately, these fears appears to be well-founded as the company already filed for a new offering in April. On Monday, OceanPal amended the F-1 after the company agreed to acquire a Capesize vessel from controlling shareholder Diana Shipping (DSX) for $22.0 million in a fairly unusual transaction (emphasis added by author):

OceanPal Inc., a global shipping company specializing in the ownership of vessels, today announced that it has signed, through a separate wholly-owned subsidiary, a Memorandum of Agreement dated June 13, 2022, to acquire the m/v Baltimore from Diana Shipping Inc., a related party of the Company, for an aggregate purchase price of $22.0 million. Of the purchase price, 20% was paid in cash upon the signing of the Memorandum of Agreement and the remaining 80% is expected to be paid upon delivery of the vessel to OceanPal in the form of shares of a new series of the Company’s preferred stock, the terms of which will be mutually agreed upon between the Company and Diana Shipping Inc., and are expected to include, among other terms, a preferred dividend and the right to convert the newly issued preferred shares into OceanPal common shares at any time after the issue date. The aggregate purchase price of the vessel was based on the average of two independent broker valuations, after adjusting for expected drydock expenses and taking into account the share-based component of the consideration.

Remember that Diana Shipping already holds $12.0 million of the company’s 8.0% Series C Cumulative Convertible Perpetual Preferred Shares (“Series C Preferred Shares”) which will be convertible into common shares approximately six months from now at a price equal to the lesser of $6.50 and the 10-trading day trailing VWAP of the common shares.

The transaction will provide Diana Shipping with another $17.6 million in preferred stock which in contrast to the above-discussed Series C Preferred Shares will be convertible into common shares at any time.

That said, I would not expect Diana Shipping to exercise its conversion rights anytime soon as the preferred shares remain protected from additional dilution caused by potential follow-on offerings of common stock.

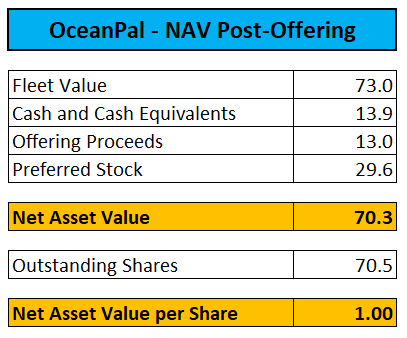

Assuming the proposed offering of 40.7 million common shares and warrant sweeteners to be priced at $0.35, net asset value per share would be almost cut in half to approximately $1.00:

Compass Maritime, Company SEC-Filings

Further assuming the current 70%+ discount to net asset value to persist, I would expect shares to trade down to the $0.25-$0.30 range following the offering.

Please note that the F-1 has not yet been declared effective by the SEC but this could happen at any time now.

Bottom Line

OceanPal remains a mess which long-term investors should not touch with a ten foot pole. While more favorable charter contracts are likely to improve cash generation quite meaningfully in the second half of the year, upcoming further dilution is likely to result in ongoing pressure on the company’s common shares.

In addition, the recent acquisition of the Capesize carrier “Baltimore” will increase controlling shareholder Diana Shipping’s holdings of the company’s convertible preferred shares to almost $30 million.

Assuming a conversion price of $0.50 per share, OceanPal would be required to issue almost 60 million new common shares to Diana Shipping.

Investors should also keep in mind that the company will likely be required to conduct a reverse stock split until September 5 to regain compliance with the Nasdaq’s minimum bid price requirement.

Given the issues discussed above, investors should consider selling existing positions and moving on. Even a short sale could yield decent results.

That said, while shares are currently available for borrowing at Interactive Brokers, the borrowing rate of approximately 44% might keep even the most speculative investors and traders at the sidelines for now.

As always, don’t bet the farm on short positions and adequately manage your risk.

Be the first to comment