Araya Doheny/Getty Images Entertainment

When we last covered Newtek (NASDAQ:NEWT) we gave it an upgrade to a neutral rating. The rationale back then was that we entering the upper atmosphere from outer space on the valuation front. Specifically, we said:

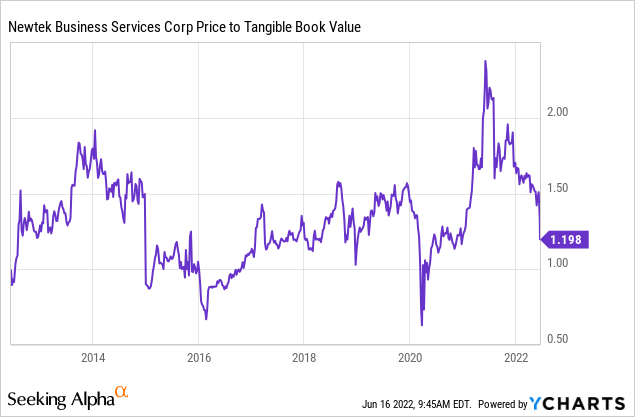

Nonetheless, we felt that the upper end of what any sane investor should pay, should be 1.5x tangible book value. We have got there again. At this point we can dial down the bearish rhetoric.

Source: ‘3 Reasons We Are Upgrading This Today’

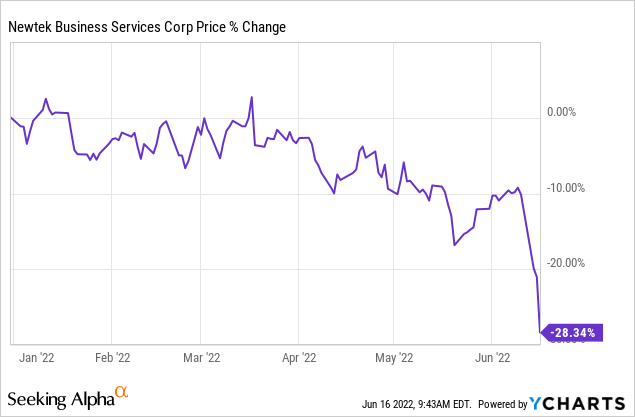

Valuation calls help maintain discipline but rarely are exact turning points. As it so happens in this case, NEWT dropped and dropped a lot.

Seeking Alpha

Do we make a bull case here? Let’s find out.

Q1-2022

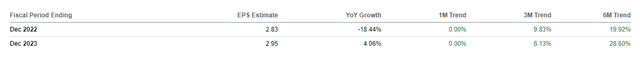

NEWT beat Q1-2022 estimates by delivering 72 cents a share of net adjusted income vs the 60 cents expected. There are very few analysts that cover the company and commentary from management has also been cryptic in terms of expectations. Hence, investors tend to fly blind into these earnings. NAV per share declined slightly as credit spreads widened. Overall it was a great performance and once again we saw analysts uplift their estimates for 2022 and 2023. This move in estimates shown below is extremely huge for a stock.

You are rarely going to get a stock with a 25% average increase in estimates for the current and the next year. In today’s market, outside of the energy sector, it would be the equivalent of a pink unicorn. A fascinating aspect here is that NEWT has declined more in percentage terms in the last 6 months than its earnings estimates have increased!

This is the classic valuation compression we expected when we first wrote the bearish thesis, as NEWT was moving to regional bank comparatives and you generally would not get another trading so far above tangible book value in there. Still, this looks overcooked just by those raw numbers. NEWT is now moving towards just 6.5X earnings.

Outlook

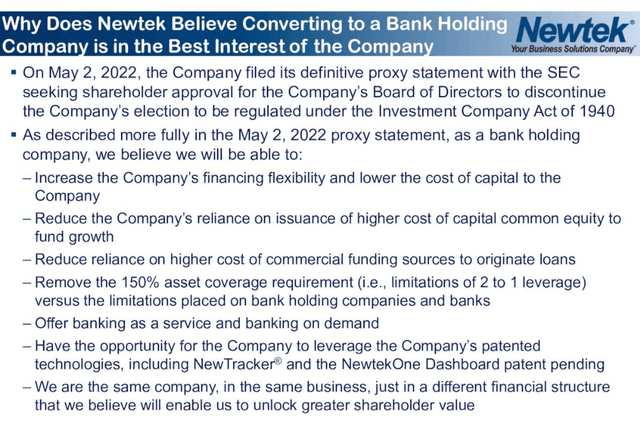

NEWT moved ahead with its plans to become a bank holding company.

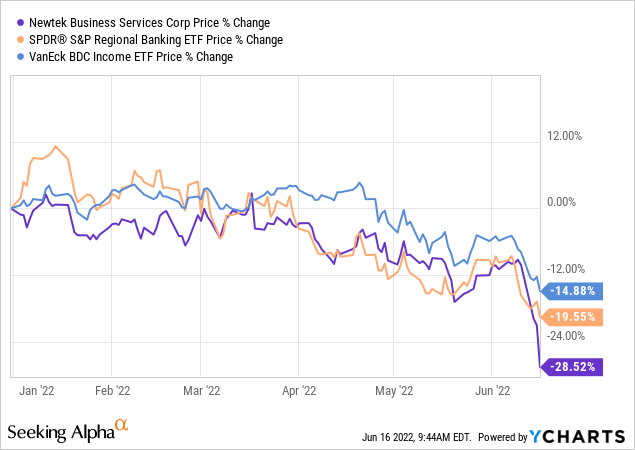

This was actually ratified by shareholders with an overwhelming majority giving this the go ahead. While we were worried about the idea from the point of view of changing the shareholder base, the timing could not have been worse. We are seeing a rather swift yield curve compression and the regional banks are just getting crushed. While NEWT has underperformed the SPDR S&P regional Banking ETF (KRE) and the VanEck Vectors BDC Income ETF (BIZD) so far, we think it could still underperform further.

A key reason behind our thinking is that the “low-cost funding” that NEWT was aiming for, is history. Banks will be fiercely competing for deposit cash as interest rates rise sharply. Even corporate bond yields are now much higher and investors will actively look to park cash rather than be indifferent to it lying in their bank account at a 0.01% interest rate. In this climate, we expect NEWT to trade close to tangible book value (1.0X-1.1X).

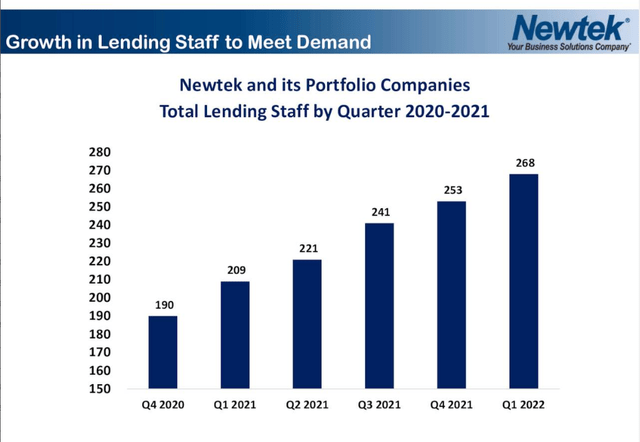

Earnings are of course important, but the longer-term sustainability remains in question. NEWT has continued to increase staff into what is likely to be a very slow period for GDP growth.

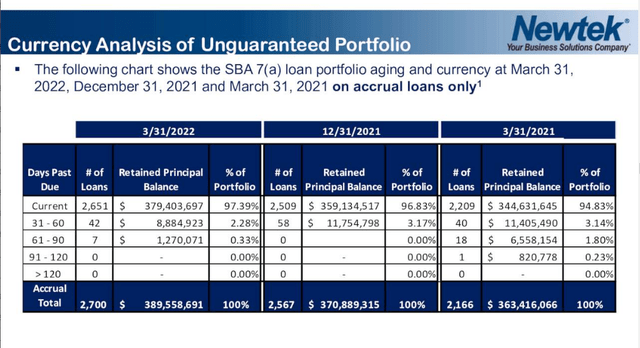

While analysts have actually upgraded their earnings estimates, we remain skeptical that this loan pipeline will continue to show strength beyond 2022. NEWT can also take more losses on the portion of loans it retains exposure to.

Offsetting this negativity is the increasing floating interest rates that they earn on their portfolio. Finally, one must keep in mind that neither the currently structured NEWT, nor the upcoming bank holding company, has really been tested in a recession setting. The BDC conversion took place in 2014 and the COVID-19 recession was met with exceptional government support. Market will want to see performance first before attaching a larger multiple.

Verdict

Existing shareholders will likely get 2 extra-large dividends before the smaller dividend makes an appearance in Q4.

The Company’s Board of Directors will not seek to discontinue the Company’s election as a BDC under the 1940 Act until after the Company receives the necessary regulatory approvals of the Transaction and after Transaction closing conditions are met. Any discontinuance of the Company’s BDC election will become effective upon receipt by the SEC of a Form N-54C. After the Form N-54C is filed with the SEC, the Company will no longer be subject to the regulatory provisions of the 1940 Act applicable to BDCs. The Company anticipates the Transaction to be completed during the third quarter of 2022.

Source: Global News Wire

So the large dividend stream will continue to soothe the price action wounds.

In an absolute sense, NEWT has become cheaper and if the market were at a standstill from the last time we wrote on it, we might give it a buy. Unfortunately, we are seeing way too many quality bargains here. Whether we look among regional banks or among BDCs, we are finding better deals than NEWT. None of them come with the current uncertainty of NEWT’s transition either. We are hence maintaining this at a neutral/hold rating. We anticipate giving this a buy rating in the $17 price range.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment