Enes Evren

This has certainly been an interesting year in the market considering that the economy has been suffering all year from the highest inflation rate that has been seen in more than forty years. This has forced the Federal Reserve to begin tightening monetary policy and pushing down the value of most assets. One concern that many investors may have is how to preserve their wealth and purchasing power in such an environment. One possibility is by investing in real estate because real estate acts as a store of wealth. In addition, real estate can be rented out to other people and thus used to generate income, which can be useful to help us afford more expensive food and energy costs. There are plenty of ways to invest in real estate but one of the easiest and best ways is to purchase shares of a closed-end fund that specializes in investing in the sector. This is because these funds provide easy access to a portfolio of assets that is run by professionals and can in most cases deliver a higher yield than any of the underlying assets possesses. In this article, we will discuss the Cohen & Steers REIT and Preferred and Income Fund (NYSE:RNP), which is one fund that falls into this category. I have discussed this fund before but that was nearly two years ago, so obviously a great many things have changed. This article will therefore focus specifically on these changes as well as provide an updated analysis of the fund’s results. Let us proceed onward and see if this 7.38%-yielding closed-end fund could be a worthy addition to your portfolio today.

About The Fund

According to the fund’s webpage, the Cohen & Steers REIT and Preferred and Income Fund has the stated objective of providing its investors with a high amount of current income. This is not exactly surprising since this is the common objective of many closed-end funds that contain the word “income” in their names. The fund’s strategy to achieve this is a little different than might be expected, however. In short, the fund invests in the common equity of real estate investment trusts as well as preferred stock issued by any company, not just real estate companies. The unique aspect comes from the fact that the fund includes preferred securities from many different sectors, not only real estate.

Real estate investment trusts are a common investment among those looking for income. There are numerous reasons for this but one of the most important is that these companies are required by law to pay out nearly all of their income to investors in the form of dividends. This tends to result in relatively high yields because it limits their growth potential compared to a company that can keep all of its profits to invest internally, resulting in the market not bidding shares up as high. With that said, these companies are certainly still able to grow by acquiring new properties. The real estate income trust will usually fund the acquisition of new properties by issuing new equity and debt. The earnings come from the fact that it rents its properties out to tenants. These trusts thus provide a way for everyone to enjoy the benefits of being a landlord with none of the expense or hassle. This is how the fund basically serves as a way to invest in real estate with all of its protection against inflation, which we will discuss in a bit.

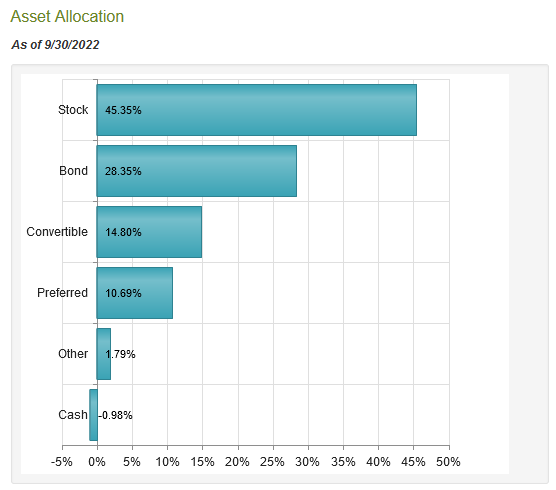

The fund is very well-balanced between common equity and fixed income, as we can see here:

CEF Connect

This is something that could prove to be to the shareholders’ benefit over time. One reason for this is that the presence of fixed-income securities helps to reduce risk because fixed-income securities such as bonds and preferred stock are safer than common equity. After all, the bondholders or preferred stockholders must be repaid in full during a bankruptcy or liquidation event before the common stockholders are eligible to receive anything. A second advantage that these securities provide to the portfolio is higher income because fixed-income securities usually have higher yields than common stock. Unfortunately, though, fixed-income securities do not have the same potential for capital gains because they have no link to the growth and prosperity of the issuing companies. A company does not pay its bondholders more money just because its profits increase, after all. In the case of real estate investment trusts, the common stock is also the only security that will benefit from rising real estate valuations, which is one thing that we are trying to achieve in our quest for protection against inflation. Thus, the fund probably will not be quite as good as an all-common stock fund at protecting the purchasing power of our assets but it should have a higher yield and less volatility. These things can all be important, particularly for someone that wants to live off of the money generated by their assets.

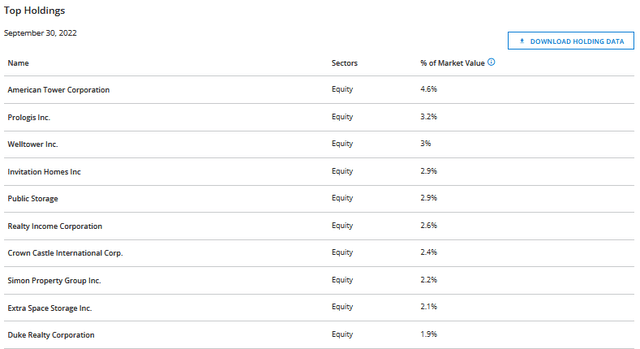

Many of the fund’s largest positions will be familiar to anyone that closely follows the real estate industry. Here they are:

Many of these companies are quite similar to what we have seen in other closed-end funds focusing on real estate investing. In fact, American Tower Corporation (AMT) and Crown Castle (CCI) are found among the top ten holdings of nearly every real estate fund. These two companies have also proven quite popular among investors due to the growing importance of wireless communication services. American Tower Corporation and Crown Castle both own cellular towers across the United States and abroad that they lease out to telecommunications companies. As a growing number of cellular companies have begun rolling out fifth-generation technology, the number of cellular towers needed will increase due to limitations with this technology. This is generally believed to be a growth engine for these companies and has resulted in them generally having higher valuations than many other real estate investment trusts.

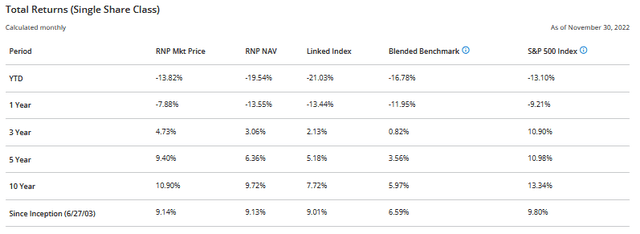

There have been surprisingly few changes to the fund’s largest positions list over the twenty months that have passed since we last looked at the fund. We have seen the removal of Ventas (VTR), Equinix (EQIX), Healthpeak Properties (PEAK), and Weyerhaeuser (WY) in favor of Invitation Homes (INVH), Realty Income (O), Extra Space Storage (EXR), and Duke Realty. Duke Realty, as some of you may know, was acquired by Prologis (PLD) back in October so it is no longer a separate company. Unfortunately, Cohen & Steers only provides updates to its portfolio on a quarterly basis so we do not know exactly what the tenth company on this list is today. Regardless, the fact that there have been relatively few changes over such a long time period would likely lead one to think that the fund has a fairly low turnover rate. This is certainly true as the fund’s 40.00% annual turnover is not especially high for an equity closed-end fund. It is generally nice to see low turnover rates because trading stocks or other assets costs money, which is billed to the fund’s shareholders. This creates a drag on the portfolio performance as management must generate sufficient returns to cover these costs as well as leave enough left over to satisfy the shareholders. This is a difficult task that many management teams fail at. The Cohen & Steers REIT and Preferred and Income Fund is an exception to this rule as it has consistently beaten its benchmark index even after accounting for trading costs:

We can unfortunately still see that the fund declined this year. This is fairly common for real estate funds though and, indeed, the US Real Estate Index (IYR) is down 24.00% over the past year. This is due to the impact that the Federal Reserve’s monetary tightening has had on mortgage rates. As it has made mortgages much less affordable, buyers of real estate have been reducing their offers of properties in order for the mortgage to have the monthly cost that they are comfortable with. This does not change the general thesis that real estate should hold its value over the long term, however. We will see this shortly. The fact that this fund is generally holding up better than the indices acts as a source of comfort for risk-averse investors that might be interested in it.

Real Estate As Protection Against Inflation

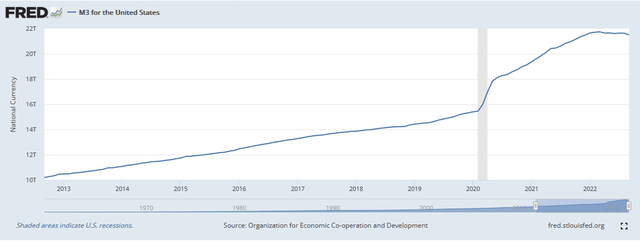

As mentioned in the introduction, real estate should act as protection against inflation over extended periods of time. In order to understand why this would be the case, it is critical to understand the root cause of inflation. Economists generally consider inflation to be a natural occurrence but this is not exactly correct. In fact, inflation is caused by the money supply increasing faster than the production of goods and services in an economy. This has certainly been the case in the United States over the past decade. We can see this by comparing the M3 money supply, which is the most comprehensive measure of the supply of money in an economy, to the gross domestic product over the same period. This chart shows the M3 money supply for the United States over the past ten years:

Federal Reserve Bank of St. Louis

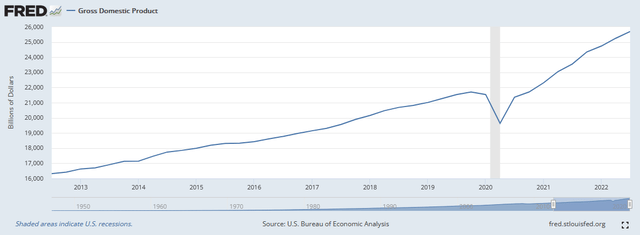

As we can see here, the M3 money supply has increased from $10.2008 trillion ten years ago to $21.5034 trillion today. This is a 110.80% increase over the period. Here is how the gross domestic product has evolved over the same period:

Federal Reserve Bank of St. Louis

As we can see here, the gross domestic product, which represents the production of goods and services by the economy, has increased from $16.31954 trillion a decade ago to $25.69896 trillion today. This is only a 57.47% increase. Thus, the money supply has increased roughly twice as quickly as the production of goods and services in the economy. The reason that this results in inflation is that there is more money attempting to purchase each unit of economic output. The law of supply and demand would dictate that the price of that unit of output would then increase. That is the very definition of inflation.

Real estate shares many of the same characteristics as other things that increase in price during inflationary times. In particular, real estate is in limited supply as there is only so much land on the planet. It also requires real human or mechanical effort to improve. Unlike the money supply, a wizard cannot simply press a button on a computer and cause a house or a shopping mall to appear out of thin air. These characteristics should result in real estate generally increasing in value along with the money supply because there is more money available to purchase a given piece of real estate. This is how real estate can act as a store of and protection of wealth over time.

Leverage

As stated in the introduction, closed-end funds have the ability to use certain strategies to boost their yields above that of any of the underlying assets. One of these strategies is the use of leverage, which is utilized by the Cohen & Steers REIT and Preferred and Income Fund. In short, the fund borrows money and uses that borrowed money to purchase shares of real estate investment trusts and other income-producing securities. As long as the yields on the purchased assets are higher than the interest rate that it has to pay on the borrowed money, the strategy works pretty well to boost the overall yield of the portfolio. As the fund can borrow at institutional rates, which are lower than retail rates, this will usually be the case.

Unfortunately, the use of leverage is a double-edged sword because debt boosts both gains and losses. Thus, we want to ensure that the fund is not using too much leverage because this would expose us to too much debt. I do not usually like to see a fund’s leverage above a third as a percentage of assets for this reason. The Cohen & Steers REIT and Preferred and Income Fund meets this requirement, however, as its levered assets currently comprise 31.85% of the portfolio. It, therefore, appears that the fund is striking a reasonable balance between risk and reward.

Distribution Analysis

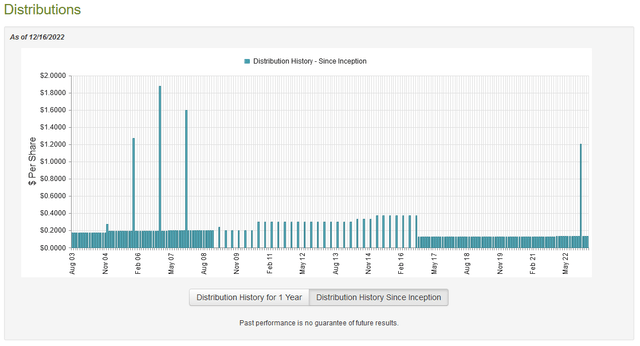

As stated earlier, the primary objective of the Cohen & Steers REIT and Preferred and Income Fund is to provide its investors with a high level of current income. In order to do this, it invests in real estate investment trusts and other things that generally have high yields. The fund also uses leverage to boost the effective yield of the portfolio. As such, we can assume that it has a fairly high yield itself. This is indeed the case as the Cohen & Steers REIT and Preferred and Income Fund pays out a monthly distribution of $0.1360 per share ($1.632 per share annually), which gives it a 7.38% yield at the current price. The fund has generally been reliable about this payout since 2017, but its history prior to that date is somewhat less encouraging:

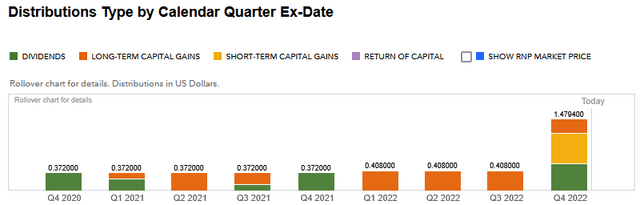

We see the biggest disappointment here during the last financial crisis that resulted in the fund cutting its distribution fairly substantially but that is hardly surprising for those that can remember this event. The fund has been remarkably consistent about its payout in recent years and even increased it earlier this year. This should overall be fairly comforting for those that are looking for a source of income with which to pay their bills or finance their lifestyles. Another thing that may be comforting is that the distributions are entirely free of return of capital:

The reason why this may be comforting is that a return of capital distribution can be a sign that the fund is returning the investors’ own money back to them. This is obviously not sustainable over any kind of extended period. However, there is no guarantee that the fund can consistently generate the capital gains needed to fund its distributions either. This is especially true given the weakness that we have been seeing in the market over the past twelve months. Thus, we want to investigate exactly how the fund is financing its distributions so that we can determine exactly how sustainable they are likely to be.

Fortunately, we have a fairly recent report that we can consult for this task. The fund’s most recent financial report corresponds to the six-month period ending June 30, 2022. As such, it will not include information from the past few months but it will still give us some idea of how the fund performed in the early stages of the Federal Reserve’s monetary tightening crusade, which was a difficult time for many real estate-related securities. This is also a considerably more recent report than what we had available the last time that we looked at this fund. During the six-month period, the Cohen & Steers REIT and Preferred and Income Fund received a total of $15,860,132 in interest and $13,999,523 in dividends from the investments in its portfolio. When we combine this with a small amount of income from other sources, it had a total income of $30,091,897 during the period. The fund paid its expenses out of this amount, leaving it with $19,319,467 available for investors. This was, however, not nearly enough to cover the $38,837,730 that the fund actually paid out during the period. This is admittedly somewhat concerning at first glance.

However, the fund does have other methods that it can use in order to get the money that it needs to cover its distributions. One of these is by generating capital gains. As might be expected given the poor performance in the market, the fund generally failed at this task. It achieved net realized gains of $18,913,874 during the period but this was more than offset by net unrealized losses of $296,920,811. Overall, the fund’s assets declined by $297,551,016 after accounting for all inflows and outflows. Clearly, the fund failed to cover its distributions during the period. It did, fortunately, manage to get very close when we combine net realized gains with net investment income but overall this is still very worrying. Unless the fund manages to have a much better financial performance over the next few reporting periods than it had during the most recent one, it may be forced to cut the distribution.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a closed-end fund like the Cohen & Steers REIT and Preferred and Income Fund, the usual way to value it is by looking at the fund’s net asset value. A fund’s net asset value is the total current market value of all of the fund’s assets minus any outstanding debt. It is therefore the amount that the shareholders would receive if the fund were immediately shut down and liquidated.

Ideally, we want to purchase shares of a fund when we can acquire them at a price that is less than the net asset value. This is because such a scenario implies that we are purchasing the fund’s assets for less than they are actually worth. This is unfortunately not the case with this fund today. As of December 15, 2022 (the most recent date for which data is currently available), the fund had a net asset value of $20.69 per share but the shares currently trade for $22.11 per share. This gives the shares a 6.86% premium to net asset value at the current price. While this appears to be a very good and well-managed fund, that is still an incredibly high price to pay. This is doubly true because it is above the 4.85% premium that the fund has had on average over the past month. It would appear to make the most sense to wait until the price comes down a bit before purchasing shares of the fund.

Conclusion

In conclusion, including real estate in a portfolio can be a good way to protect yourself against the ravages of inflation. This fund is a pretty good way to do that considering that it has historically outperformed the benchmark index and is pretty consistent with its distribution. The only real concern here is that the fund might struggle to maintain its distribution unless the market turns in its favor fairly soon. The price is also very expensive today, so anyone that is interested in purchasing shares would be best served by waiting until the price becomes much more reasonable.

Be the first to comment