bjdlzx

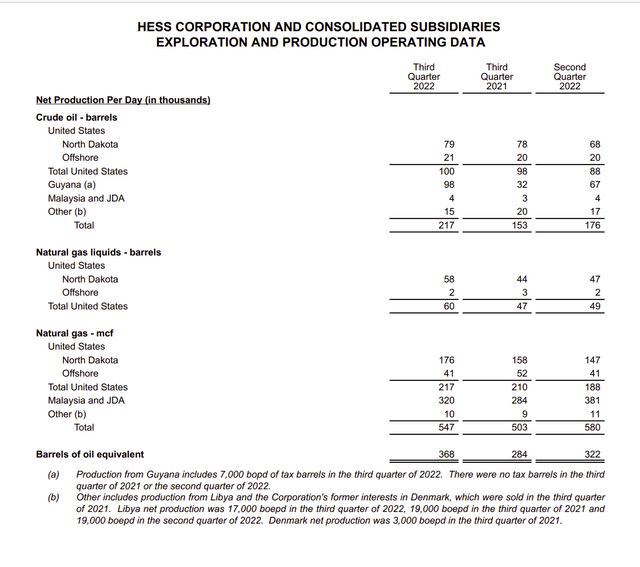

Hess Corporation (NYSE:HES) has fantastic growth prospects as the smallest partner of the Guyana partnership with Exxon Mobil (XOM). But those growth prospects promise a lot of cash flow in the future. At least some of that cash flow will be returned to shareholders. Management mentioned that growth was already 32% above the previous year in the latest quarterly report. That production is going higher still in the fourth quarter. This is one of the fastest growing companies in the industry.

It does not take a rocket scientist to realize that fast growth like that is going to lead to fast dividend growth. Therefore, an original investment now could lead to a lot of dividends in the future when you retire due to the success of the Guyana partnership.

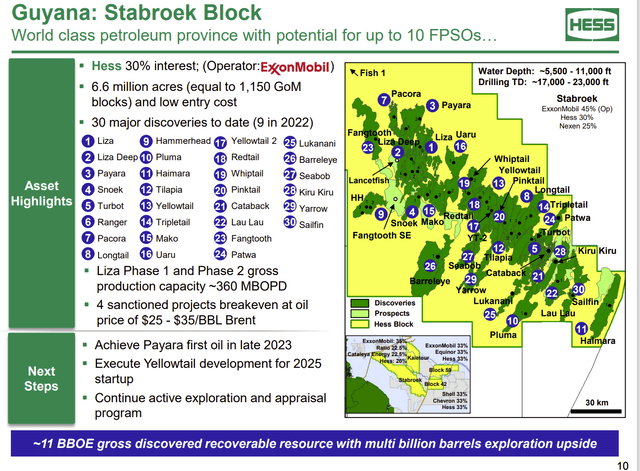

Hess Presentation Of Map Of Guyana Discoveries And Other Leasehold Interests (Hess Presentation At Bank Of America Global Energy Conference November 2022)

There is already likely more discoveries to add to the list above. Management has many times estimated that the current discoveries will need about 10 FPSO’s to properly produce all of them. That means that if the partnership only drills dry holes from now on, there is enough growth to last into the next decade just from what is on the slide above.

Exxon Mobil, the operator, has estimated that the partnership will produce 1 million barrels of oil per day by the end of the decade. The Hess share of that is nearly the total current production.

Hess has already begun to return money to shareholders in the form of a dividend and share repurchases. But clearly there is going to be a lot more activity in the future on both the dividend and share repurchases with all those discoveries shown above.

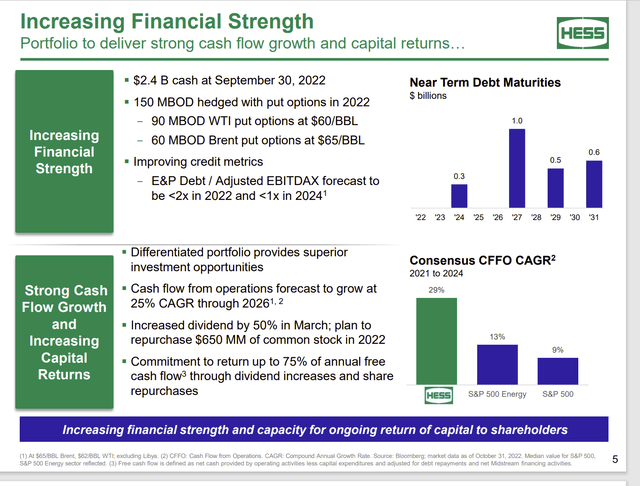

Hess Corporation Financial Guidance (Hess Corporation Presentation At Bank Of America Global Energy Conference November 2022)

That cash flow growth rate, if maintained through a five-year period, would triple cash flow from the present rate. (Note that the rate assumed is a compound rate, not a flat rate.) That is a lot more money to pay dividends and repurchase stock. Even if that rate slows after 2026 or because oil prices end up lower than expected, there is still going to be a lot of room for dividend growth.

Hess is currently growing faster than a lot of high-tech companies that are valued much higher. Yet Hess has the ability to pay more dividends along the way that the high-tech crowd frequently does not. This is a fast-growing company that has the cash from that growth now. The story line about a lot of profits is that those profits are here now. Investors do not have to wait as is often the case.

Hess Production Third Quarter 2022 (Hess Earnings Press Release Third Quarter 2022)

Hess is using the current cash flow to grow just about every part of the operations as shown above. Should oil prices unexpectedly crash, the company intends to have a larger amount of cash flow available from the Bakken should cash be needed to keep the Guyana partnership interests going.

One thing about the Guyana partnership is that the partners often commit to large projects that happen over a period of years. Those FPSO’s are quite a commitment for any company let alone the supporting infrastructure and necessary wells that accompany the decision to build and then run an FPSO. So, cash or credit lines need to be available should cash flow unexpectedly decline to levels below what the partnership needs.

I have often figured that either the next FPSO or the one after that would allow the partnership to generate enough cash throughout the business cycle so that the partners could develop other things. Now Exxon Mobil has begun to drill on other leases. So, cash needs of those partnerships may be a factor. This is a giant project that frankly dwarfs just about anything else the partners are doing. Guyana and probably Suriname are going to become major oil exporters.

Investors always want to know about cash flow growth. Each FPSO adds roughly 70,000 BOD of production capacity to Hess production. At current production levels that is a nearly 20% jump in production every time an FPSO reaches its capacity. That is a lot of growth for a company the size of Hess. No companies I follow are growing at that rate (let alone growth prospects with up to 10 FPSO’s from all the discoveries made). This stock has only begun to increase in the face of all that cash flow growth.

I have always been amazed at how a good “story stock” gets bid to sky high levels on the promise of “a pot of gold at the end of a long future”. Here, that pot of gold is well delineated with only the cost of development and the risk of getting it on production. The high-risk discoveries are already shown on the map above. Getting the oil on production in the future is far less risky than a lot of stories from those “story stocks” at sky high price-earnings ratios. Even more competition is hardly a risk for a development with some of the lowest breakeven costs in the industry.

Finances

Hess still intends to keep a sizable cash balance based upon the latest report. That is probably wise given the relatively large cash requirements of the partnership. Also given the size of the project, the last thing I am worried about is them repaying debt. There is simply too much very profitable growth to worry about debt repayments at this time.

If anything, another discovery on another block in which Hess has interests could demand more cash in the future. Frankly, this is one of the few projects that is probably worth some financial leverage. The breakeven points for the project are extremely low.

There is clearly a need to keep some cash on hand to keep the project going when commodity prices are weak.

The Future

The ability to be able to place 10 FPSO’s from the current discoveries made ensures a lot of growth even if no more oil is discovered “forever”. It is going to take more than a decade to bring the current discoveries online. What is likely to happen is that as more FPSO’s come online, the process will begin to speed up.

Guyana has expressed an interest in faster development. However, they also need to approve the FPSO’s faster (and Exxon Mobil needs to make the proposals faster) for that to happen. It is likely to happen as production grows and more discoveries are made.

Currently robust commodity prices have sped up the exploration and development process because partnership cash flow is unexpectedly high. Offshore has long been left out of the industry recovery. That appears to be rapidly changing now. But the low costs from expenditures made during the downturn offshore will be a competitive advantage for a very long time well into the future.

Cost increases can now be offset by efficiency gains as more is learned about the area. That puts this partnership years ahead of just about anyone else in the basin.

Be the first to comment