Wolterk

Investment Thesis: Walmart could see further long-term upside as a result of continued growth across revenues, particularly across e-commerce. Additionally, the continued reduction in long-term debt is highly encouraging.

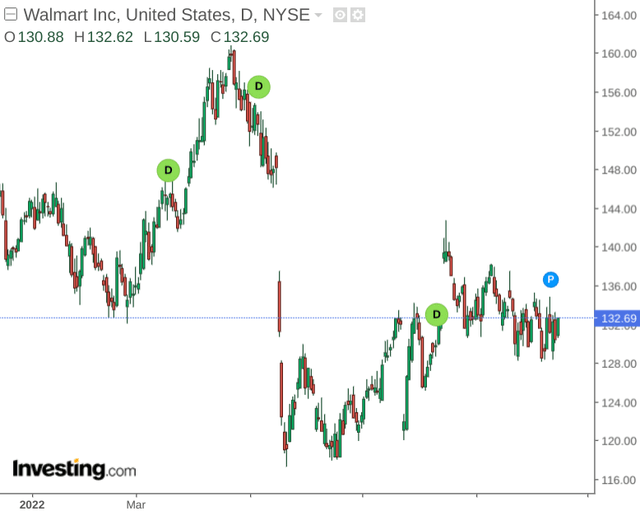

After a sharp fall in price earlier this year as a result of lower profit guidance, Walmart (NYSE:WMT) has continued to deliver revenue growth during an inflationary period and the stock has been making a recovery:

The purpose of this article is to assess whether the stock could have the capacity to see a longer-term rebound from here.

Performance

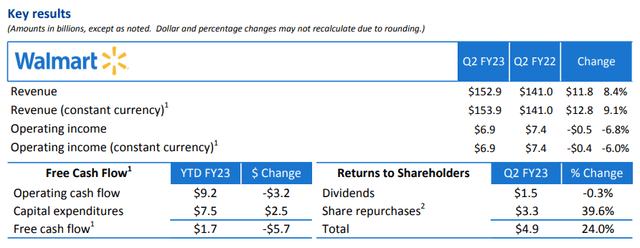

While partially driven by inflation, top-line revenue growth in the most recent quarter was quite respectable – up by 9.1% in constant currency as compared to the previous quarter:

Walmart Earnings Release: August 16, 2022

Particularly, e-commerce revenues showed growth of 12% in the most recent quarter – with growth of 18% on a two-year timeline.

When looking at the company’s quick ratio from July 2019 to the present (calculated as current assets less inventory all over current liabilities) – we can see that the ratio has improved slightly from 0.21 to 0.24.

| July 2019 | July 2022 | |

| Current Assets | 61371 | 84164 |

| Inventories | 44134 | 59921 |

| Current Liabilities | 80283 | 99899 |

| Quick Ratio | 0.21 | 0.24 |

Source: Figures sourced from Walmart Earnings Releases – Q2 2020 and Q2 2023. Amounts provided in millions of USD. Quick ratio calculated by author.

While the ratio has improved slightly – investors would likely prefer to see a significantly higher ratio – as a quick ratio above 1 indicates that the company has more than sufficient liquid assets to meet its current liabilities.

With that being said, we can also see that the company’s long-term debt has decreased from over $44 billion in July 2019 to just under $30 billion in July 2022, and the company’s long-term debt to revenues ratio has fallen from 0.34 to 0.19 over this period.

| July 2019 | July 2022 | |

| Long-term debt | 44404 | 29801 |

| Revenues | 130377 | 152859 |

| Long-term debt to revenues ratio | 0.34 | 0.19 |

Source: Figures sourced from Walmart Earnings Releases – Q2 2020 and Q2 2023. Amounts provided in millions of USD. Long-term debt to revenues ratio calculated by author.

From this standpoint, the reduction in long-term debt is encouraging and a continuation of this trend, i.e. growth in revenues and a reduction in long-term debt – could be a catalyst for further long-term upside.

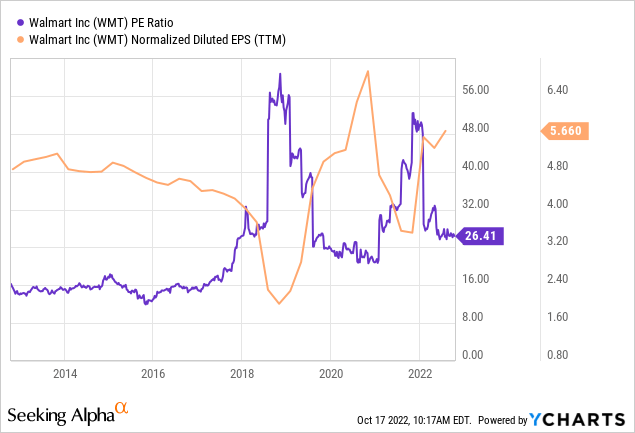

In terms of potential value from an earnings perspective, we can see that on a 10-year basis – earnings per share is up significantly from the lows seen during 2018-2019. However, the P/E ratio is also at a higher level as compared to pre-2018 levels.

ycharts.com

I take the view that while the stock may be more expensive as compared to this period – the stock still has significant room for upside provided earnings growth continues.

Looking Forward

Going forward, I take the view that Walmart should still see significant consumer demand in spite of inflation. In particular, there is also the possibility of inflation allowing the company to attract more mid and high-income consumers who are looking to save costs on groceries – and such growth in food and consumables demand could also lead to market share gains.

In my view, the main risk to the stock at this time is in the event that earnings growth slows significantly – or the anticipated growth in interest from higher-income consumers does not materialise.

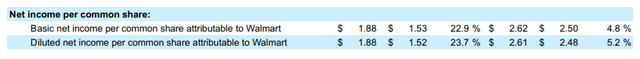

For instance, net income per share on a diluted basis was up by over 23% in July 2022 when compared to July 2021.

Walmart Earnings Release: August 16, 2022

Should we see a slowdown in earnings growth over the winter quarters – then this could place downward pressure on the stock. Additionally – depending on how bearish the broader markets become with respect to inflationary or recessionary fears – we could see a scenario where the stock sees a short-term decline in spite of Walmart’s earnings and other business fundamentals remaining strong.

Conclusion

To conclude, Walmart has seen growth in revenues and earnings in the most recent quarter – and previous fears regarding lower profit guidance appear to have been overblown.

While the stock might see short to medium-term downside in line with the broader market, the reduction in long-term debt since 2019 is quite encouraging. Should we see resilient earnings growth over the winter months – then I take the view that the stock could have further long-term upside from here.

Be the first to comment