f11photo

(This article was originally posted in the marketplace newsletter on October 17, 2022.)

SL Green Realty Corp. (NYSE:SLG) is the largest New York City owner of office real estate. Being the largest means, a lot more considering this company possesses or controls interests in some key locations in the city.

New York City can certainly suffer from any downturn that happens to appear. Right now, the Federal Reserve is fixing some earlier leniency that led to inflation before that inflation becomes damaging. That leads to worries about rental rates and then the fears pile on.

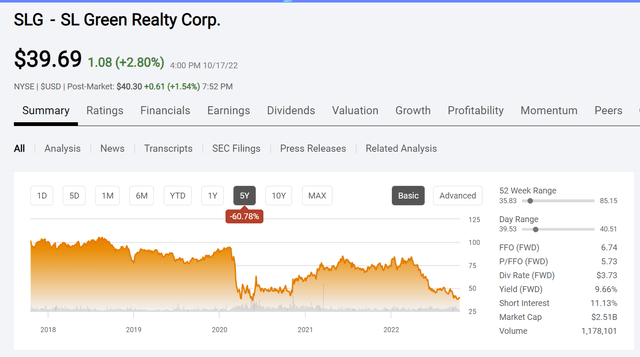

SL Green Realty Corp Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 17, 2022.)

If enough fears circulate, before you know it you have an institutional panic where “everyone” heads to the exits to provide the stock price action shown above. But this company made it through fiscal year 2020 as shown above well enough for the stock price to rally.

So, there is no reason in the world that this company cannot handle a recession. For sure, management has reported some soft spots. But not every single lease is going to come due the minute the Federal Reserve decides to raise interest rates (causing those recession fears).

There will be some tenants that may at least try to renegotiate leases and of course there are likely to be some vacancies. But short of a depression, New York City is a great place to own real estate and it is likely to remain that way for some time to come.

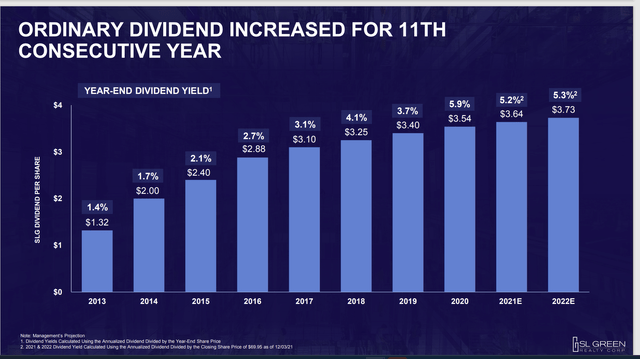

SL Green Realty Corp Monthly Dividend History (SL Green Realty Investor Day Presentation)

This company has a monthly dividend that has resulted in a steady climb of monthly dividends paid to equal the annual amounts shown above. Unlike many REITs, this company does not pay out its earnings in cash necessarily. So, the cash used for dividends shown above is considerably less than the funds available for dividends.

Management found an IRS regulation that allows much of the earnings to be paid out as stock. Management then follows that with a reverse split to keep the number of shares constant. The effect of this maneuver is to have cash available to reinvest in the business as needed.

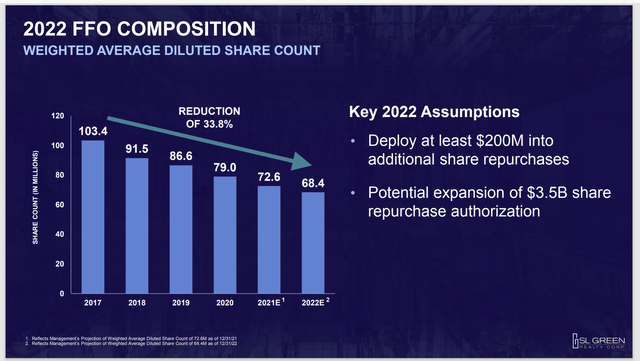

SL Green Realty Share Repurchase Program (SL Green Realty Investor Day Presentation)

Shareholders get a boost from the reinvested cash as at least some of that cash is diverted to repurchase shares outstanding. As shown above, the company is heading towards having repurchased about half the outstanding shares as shown for 2017 at the current time.

Interestingly, during the market downturn of fiscal year 2020 when the stock price was again the victim of market worries, this management was repurchasing stock as shown above. Investors can just about bet what will happen in the future with the current stock price as low as it is.

Currently, investors get a great deal in the form of a nearly 10% dividend. The share repurchase program assures long-term appreciation potential to add to that dividend. The current stock price is so low that the appreciation potential from any future stock repurchases will be significant.

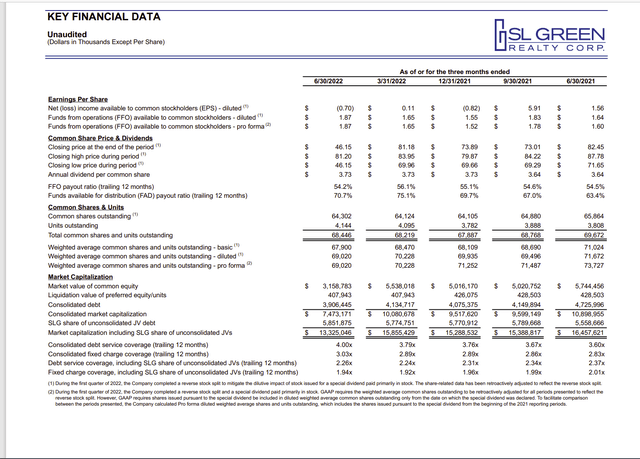

SL Green Realty Financials

This management has a revolving credit line that will not be maturing anytime soon. It also appears to have access to the debt markets at decent rates as needed. Fears of a recession are very different from fears of lots of tenants not being able to pay their bills. That latter fear of not being able to pay is absent.

SL Green Realty Key Second Quarter 2022, Results (SL Green Realty Corp Second Quarter 2022, Earnings Report)

The earnings report for the second quarter is really showing expected progress that just not justify the fears sending the stock price lower. The debt coverage shown above is explained in far more detail later in the report. Basically there is coverage of just operating properties and then a lack of coverage for properties under development. That should be expected. The coverage for debt of operating properties is just fine.

Given the company history, the debt of properties under development is likely to also be in decent shape once development is complete.

Notice that FFO pretty much has covered the monthly dividend (annual amount shown above) at the six-month interval. As noted, before, when possible, this company will have a special dividend for the rest of what has to be distributed, in stock. This allows for a considerable amount of discretion on the part of management to raise that monthly dividend for the foreseeable future.

Interestingly the stock repurchase program has the effect of lowering cash requirements for the monthly dividend. The net effect is to “guarantee” a monthly increase just to keep the same amount of cash spent for dividends. Management already repurchased enough shares to be able to increase the monthly dividend roughly a penny each month.

SLG’s Future

This management is clever enough to provide shareholders with a future appreciation potential that exceeds the appreciation of the real estate. One would have thought Mr. Market would value that more than the fear of any potential effects of the recession. The fact that Mr. Market has not caught on to management’s long-term plan of repurchasing shares while slowly increasing the dividend on the remaining shares gives investors an interesting long-term opportunity not usually associated with (what is normally) an income producing entity.

This company owns prime real estate in New York City. New York City itself is a great location to own real estate. The city will always attract business. So real estate within the city in good locations is likely to continue to appreciate. This management adds to that appreciation with the share repurchase program.

Should there at any time be a sharp decrease in FFO to match the market fears, then the year-end dividend would be correspondingly decreased or eliminated. But for a company like this, it would take a depression that lasts years for such a scenario to actually occur. That scenario is so unlikely.

More likely risks would be a bad acquisition that did not work out. But this management owns so many properties and is now engaging in an “asset lite” strategy, that such a damaging outcome is unlikely to occur.

The stock price decline has taken the risk out of the stock. Investors are paid more than the average total return (over the long-term) to wait for a coming recovery. As the stock chart shows, the last recovery came very fast. This one is likely to also be “just around the corner” and this time the recovery should be sustained.

Be the first to comment