Dwi Yulianto

Introduction

Topicus.com (OTCPK:TOITF) recently reported Q3 earnings. They were very good at first sight but the lower-than-expected organic growth left some doubts among investors after seeing Constellation Software’s (OTCPK:CNSWF) earnings.

If you want to read our Q2 earnings digest, you can do that here.

Let’s start by looking at the market’s reaction.

The market’s reaction to earnings

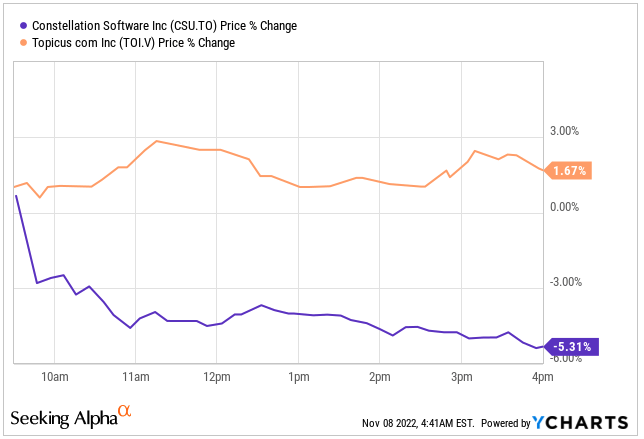

The market had a positive reaction to Topicus’ earnings. However, we were honestly surprised to see how this reaction differed from Constellation’s performance that day:

YCharts

Constellation was substantially down on Friday despite the absence of its earnings. One way to interpret this is that some Constellation shareholders sold Constellation and bought Topicus on fears that the former’s runway might be getting to a halt.

Constellation proved this fear to be unfounded after reporting its earnings, but that’s another topic. You can read our Constellation’s earnings digest here if you want.

Without further ado, let’s get on with the numbers!

The numbers

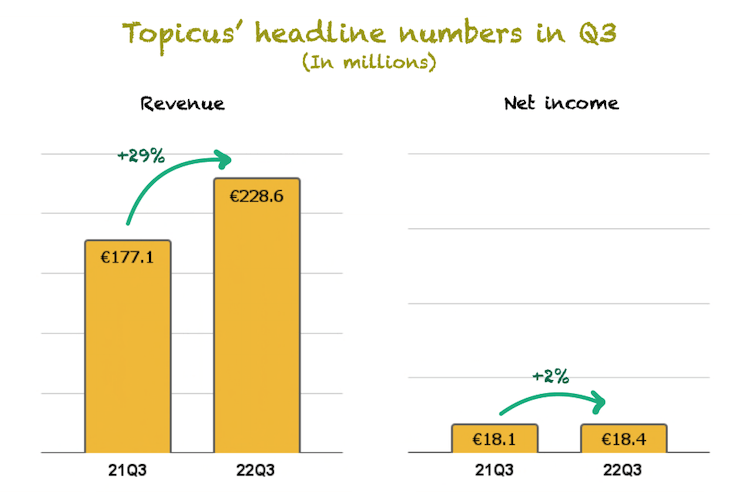

Headline numbers for Topicus were pretty good, especially on the top line. Bottom line growth was not great, but we’ll give all the necessary context later in the article so you can interpret the low growth there.

Revenue growth accelerated to 29% year-over-year and came in at €228.6 million. However, net income only grew by 2% to €18.4 million:

Made by Best Anchor Stocks

Seeing the top line grow faster than the bottom line is not unusual for serial acquirers that typically purchase troubled businesses. There are synergies to be realized from these acquisitions, but these synergies (which come from both revenue and cutting costs) usually take some time to flow through to the bottom line.

Recall that last quarter was a record in capital deployment for Topicus, which is undoubtedly the cause of the rapid surge in expenses. We’ll go over these expenses in more detail later.

Digging deeper into the top line

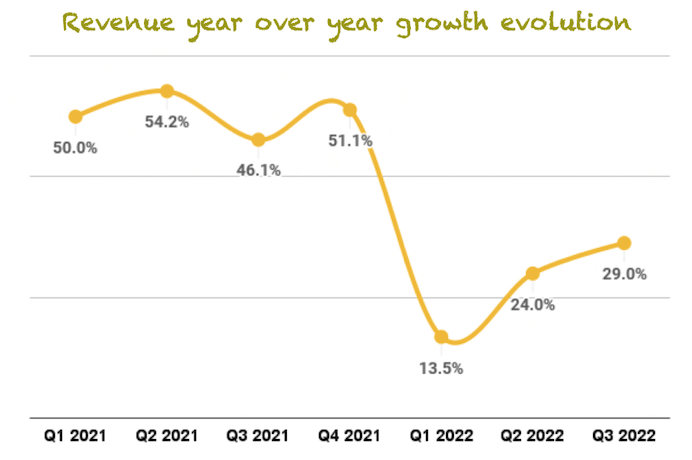

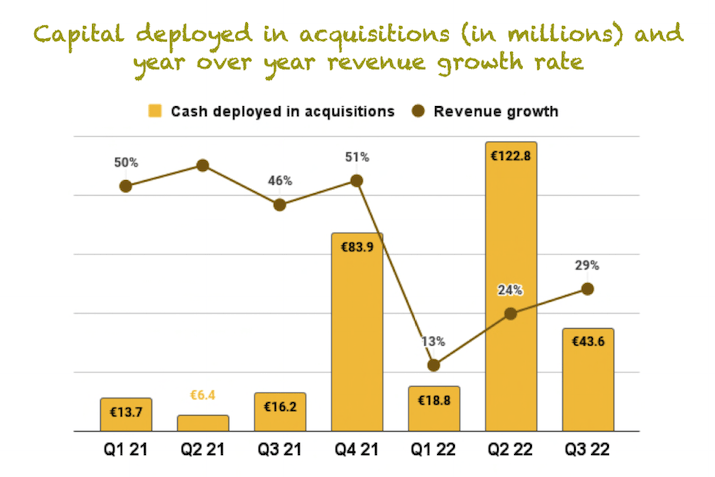

Revenue for a serial acquirer can turn out to be quite volatile, especially during the early stages. Topicus has two revenue growth sources (organic and inorganic), but current growth is primarily fueled by acquisitions, which are difficult to time. We already “warned” about this in one of our articles when revenue decelerated significantly:

This abrupt decrease would certainly be a warning sign if it were any other type of company. However, when it comes to Topicus or Constellation, this is something that I am comfortable with because the timing of acquisitions matters quite a bit.

We think it’s not different when revenue accelerates. Revenue growth dropped significantly in Q1 2022 but has accelerated since, driven by higher capital deployment.

Note that Q3 also faced tough comps, as the company grew revenue by 46% in the comparable quarter last year:

Made by Best Anchor Stocks

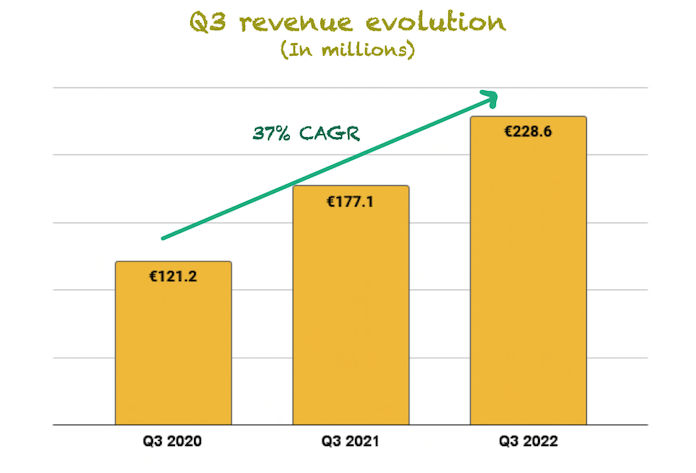

When revenue is so volatile, our best shot at analyzing the trend’s health is to zoom out. If we look at Q3 revenue for the last 3 years, we can see it has grown at a healthy clip:

Made by Best Anchor Stocks

Despite a slow start to the year, Topicus’ 9-month revenue growth stands at 22% year-over-year.

Organic revenue growth was, for many, a disappointment. We understand this disappointment, but we must also contextualize the numbers a bit.

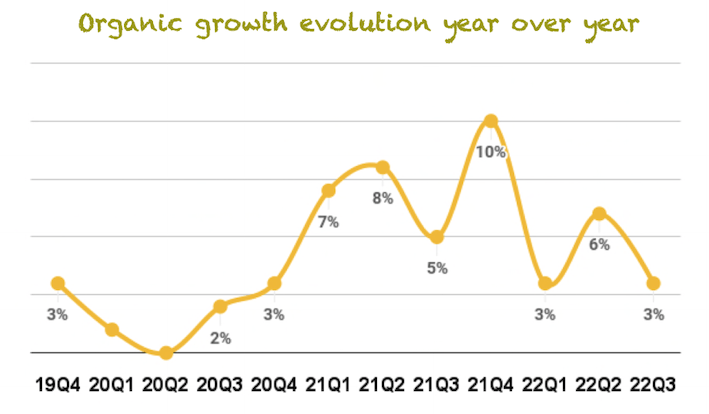

Organic revenue growth was 3% this quarter, decelerating significantly from last quarter despite facing easier comps:

Made by Best Anchor Stocks

If we zoom out and do an average of the above growth rates, we can see that it was a below-average quarter regarding organic growth. This is worrying considering that Topicus’ bread and butter, and the main reason it was spun out of Constellation, was its outperformance in this metric.

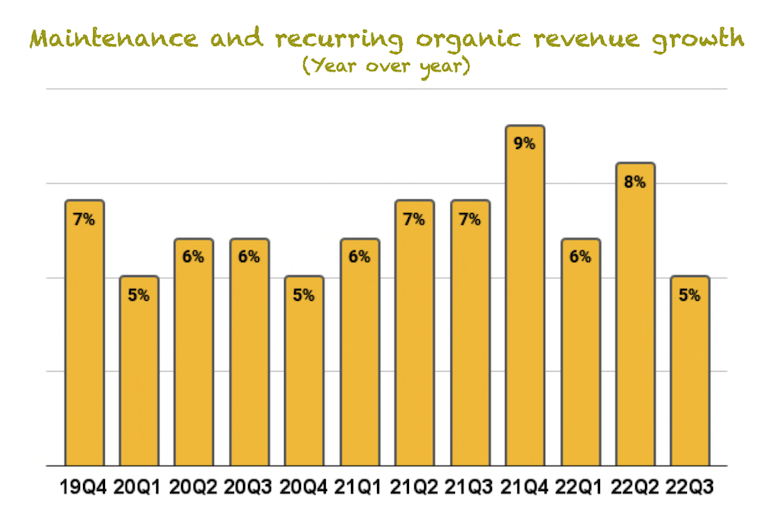

As usual, maintenance and recurring (management’s preferred revenue source) organic growth was higher than overall organic growth at 5%. However, it was still disappointing compared to other quarters:

Made by Best Anchor Stocks

It’s true, though, that maintenance and recurring did not enjoy such easy comps as overall organic growth, so we could consider it a highlight in the grand scheme of things.

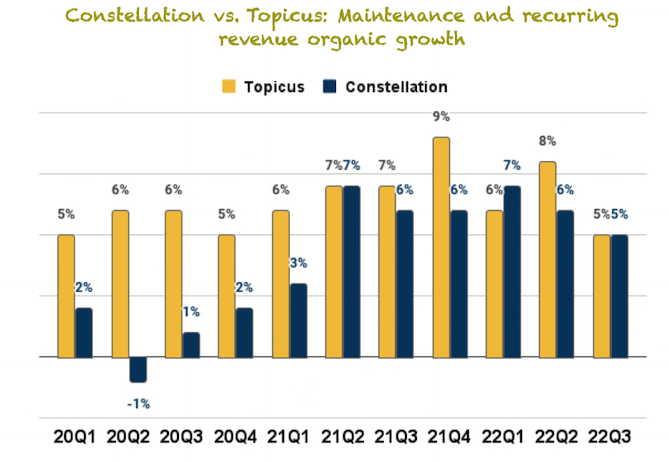

Organic growth performance was seen more as a lowlight when compared to Constellation’s performance, which managed to grow maintenance and recurring revenue at the same rate as Topicus despite being much larger. Constellation’s management has indeed mentioned that the focus will be on organic growth going forward, but this was also the reason for the Topicus spinoff. Constellation was supposedly going to learn some organic growth best practices from Topicus to deploy them into other operating groups. Unfortunately, it seems that the student (Constellation) is currently outpacing the teacher (Topicus).

We understand many investors are worried about this, but we also believe we need some context. First and foremost, this is just one quarter, and while it might look worrying, we should not rush into conclusions. Topicus’ organic growth in maintenance and recurring has outpaced Constellation’s in most other quarters:

Made by Best Anchor Stocks

Secondly, it’s essential to understand that even though Constellation and Topicus have a similar operating model, they operate in very different environments. Constellation has more exposure toward North America, while Topicus is almost entirely focused on Europe. When things are going well the distinction might not be that apparent, but in the current macro environment, we must consider it. The economic landscape in Europe seems to be much worse than in North America, which can negatively weigh on organic growth.

Investors will always look for something to compare against, and even though sometimes comparisons might look obvious, we must consider all the context to understand how seriously we can take this comparison. We believe Topicus will solve its organic growth hiccups, and one slower quarter will not change our perception.

Expenses and profitability

As we saw before, growth in the top line was not matched by growth in the bottom line. This evidently came from the fact that expenses grew faster than revenue.

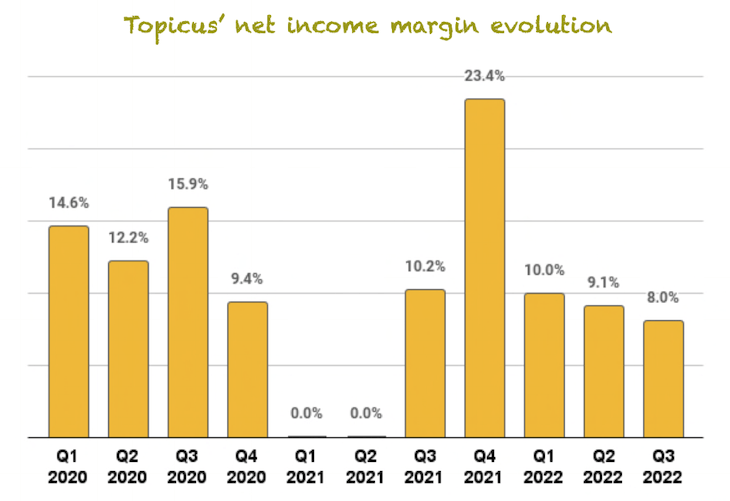

Topicus’ net income margin decreased again sequentially for this reason:

Made by Best Anchor Stocks

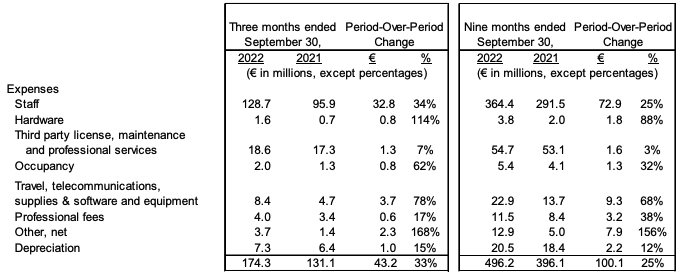

So, where did increased expenses come from? If we look at the expense table, we see massive increases in some expense lines, such as Hardware, Occupancy, Travel, and Other:

Topicus Q3 MD&A

However, the most significant expense increase by a wide margin was Staff. Even though it grew much slower than the other expense lines, it comes from a much bigger base and added almost €33 million in expenses. This is 4 times as much expense addition as all of the aforementioned expense lines combined.

When Topicus acquires other companies, it evidently acquires its staff too. Rarely are these companies well optimized (or else they would not be cheap), so acquisitions naturally add more to the bottom line than the top line initially. This is something that we must live with, knowing that Topicus can make these companies more efficient and realize some synergies from the acquisition as time goes by. This negative impact on margins is felt even more when there has been a significant quarter of capital deployment, as in Q2.

Regarding the other expenses, we would like to talk about two briefly. The first is travel, which added €3.7 million of additional expenses. This increase was simply caused by a return to normal after COVID. Employees are now traveling more after not traveling at all during the pandemic due to restrictions. This creates an uplift in these expenses.

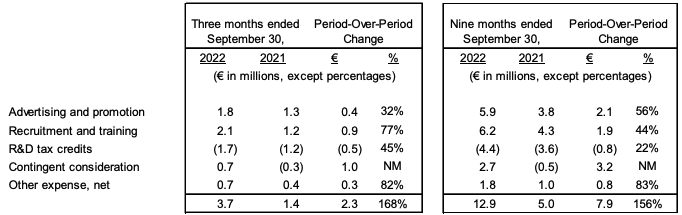

The other one we want to talk about is “Other, net,” which added €2.3 million of additional expenses. If we look at the breakdown of this expense, we see the following:

Topicus Q3 MD&A

Half of the increase was created by an increase in contingent consideration expense. This expense measures the anticipated earn-outs on acquisitions that have gone better than expected. Simply put, Topicus has to pay a bit more for some acquisitions that outperform.

As it was the case with Constellation, it sounds contradictory to treat an expense as a good thing, but in this case, it is. The contingent consideration expense has been positive throughout this year and has grown significantly in the first 9 months when compared to 2021. This is great to see because it means that some of Topicus’ acquisitions are going better than management expected.

Another expense that weighed into margins was amortization, which is a natural consequence of acquiring companies that hold significant intangibles. If a company has intellectual property, like software that it has created, this has to be amortized by the acquirer.

Topicus Q3 MD&A

Another positive highlight was that Topicus has not recorded any impairments this year. Contrary to contingent considerations, the company records impairments when acquisitions don’t meet the criteria outlined in the investment thesis. This is an expense you don’t want to see increasing.

If we combine both expenses (contingent consideration and impairments), we could conclude that acquisitions are going pretty well. Although I don’t doubt this, we must be careful rushing to conclusions. Impairments do impact all of the company’s acquisitions, but contingent considerations only impact those acquisitions where the company specifically stated these clauses.

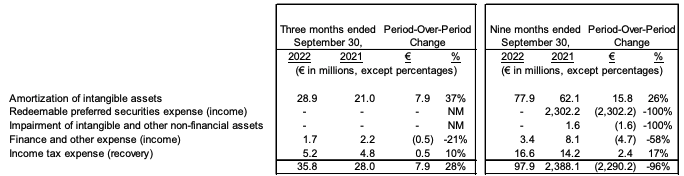

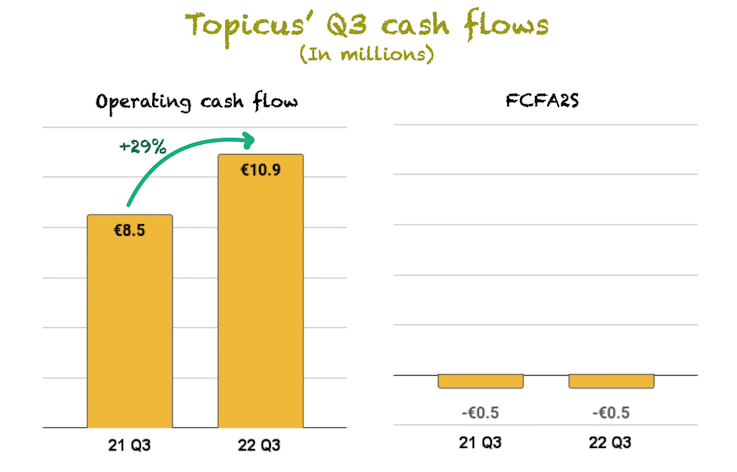

Looking at cash flows, the key metric

Cash flow is the key metric for any serial acquirer because it’s the company’s fuel to continue to acquire businesses. There has been a lot of noise regarding cash flow in the last quarters, especially in FCFA2S, Free Cash Flow Available to Shareholders, due to the preferred dividend. However, things are starting to normalize on this front.

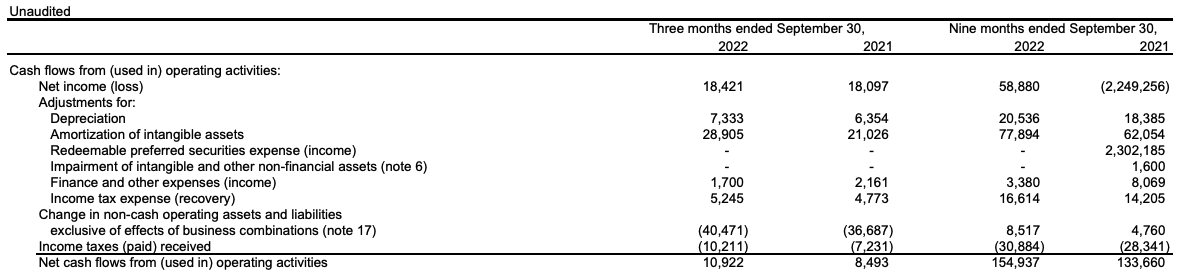

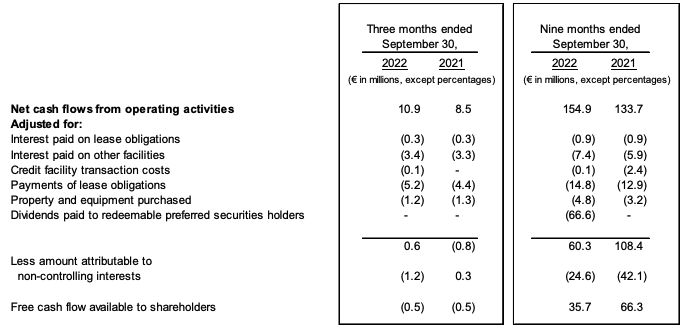

Topicus’ Operating cash flow increased 29% year-over-year, while FCFA2S remained flat at negative €0.5 million:

Made by Best Anchor Stocks

The divergence between net income growth and operating cash flow growth came from significantly higher amortization and depreciation expenses. These are non-cash expenses, so cash flow is not impacted directly. This positive effect was slightly offset by higher taxes paid during the quarter:

Topicus Q3 Financial Statements

If we zoom out and look at the first 9 months, Operating Cash Flow growth remained healthy at 16%. Topicus has generated €155 million in operating cash flow during the first 9 months, a 24% OCF margin. However, we will most likely see this margin come down in the fourth quarter, as there’s seasonality in cash flows.

Regarding FCFA2S it was mainly impacted by non-controlling interests. The company generated positive Free Cash Flow, but a portion of these cash flows belong to other parties such as Constellation or Sygnity’s remaining shareholders:

Topicus Q3 MD&A

If we look at the 9-month performance of FCFA2S, we can see it decreased from €66.3 million to €35.7 million. This decrease was caused by the preferred dividend the company paid this year, so we shouldn’t worry there as it’s non-recurring.

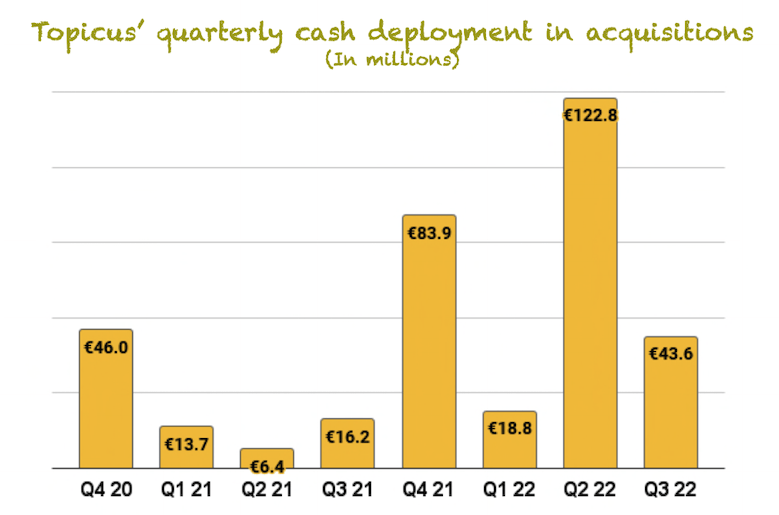

Acquisitions – Volatile but that’s normal

Acquisitions again showed volatility. After a very strong Q2, Topicus deployed €43.6 million in acquisitions. This is not at all the highest capital deployment the company has achieved in the last two years, but it isn’t bad either:

Made by Best Anchor Stocks

Acquisitions are very hard to time, which obviously impacts capital deployment and revenue. Note how revenue decelerates after some quarters of “weak” capital deployment and how it accelerates after quarters of strong capital deployment:

Made by Best Anchor Stocks

Revenue typically lags capital deployment, creating volatile results. We must focus on the long-term trend rather than any particular quarter to mute this volatility. We don’t aim to predict capital deployment but rather understand if the M&A “machine” is still operating as it should.

Strangely enough, we didn’t get any update on how the current quarter is going regarding capital deployment (unless we missed it). Topicus typically shares how much cash it has deployed into acquisitions quarter-to-date, but it was different this time.

Financial position – Leveraging the balance sheet

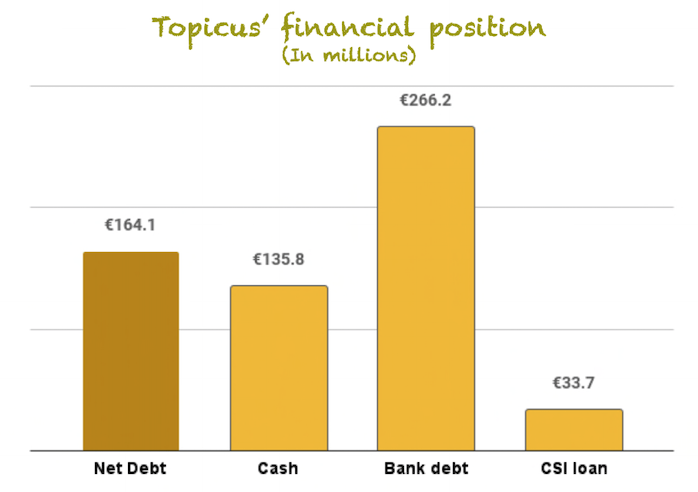

Topicus’ financial position worsened a bit sequentially. The company now has a net debt position of €164.1 million, made up of €135.8 million in cash, €266.2 million of bank indebtedness and a €33.7 million loan from Constellation:

Made by Best Anchor Stocks

In our Constellation’s earnings digest, we saw how Constellation is now leveraging the balance sheet a bit to pursue acquisitions, and Topicus seems to be following suit. Of course, seeing the financial position deteriorate may seem troubling, but it still remains at very healthy levels. Think about it this way: the Operating Cash Flow generated during the first 9 months is makes up the entire net debt position. We don’t think Topicus will have financial problems in the foreseeable future.

Conclusion

It was a decent quarter for Topicus once again. We understand that, when compared to Constellation, organic growth might seem disappointing. However, we must consider all the context before making such comparisons. Revenue growth and acquisitions remain volatile, but we must learn to live with this.

In the meantime, keep growing!

Be the first to comment