travelview/iStock Editorial via Getty Images

Thesis

Leading casino and experiential REIT VICI Properties Inc. (NYSE:VICI) has demonstrated tremendous resilience as it attempts to recover from its selloff from its August highs, as we urged investors to be cautious at those levels.

Accordingly, the market sent VICI down nearly 18% to its recent mid-October lows before VICI headed into its Q3 earnings release. Hence, the market had already anticipated a strong report from CEO Ed Pitoniak & team, as VICI improved the midpoint of its FY22 AFFO per share guidance.

With VICI up more than 12% from its October lows, we discuss why we encourage investors to continue to be patient, as VICI is not undervalued.

Maintain Hold.

VICI’s Valuation Is Not Cheap

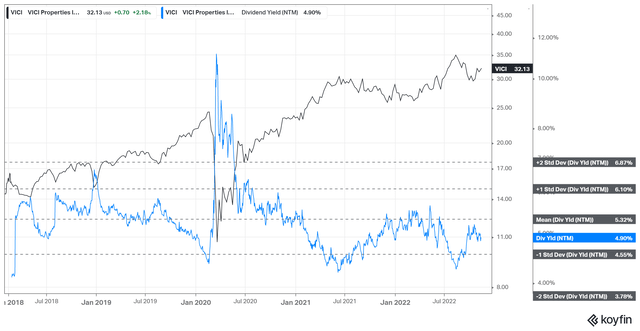

VICI NTM Dividend yields % valuation trend (koyfin)

VICI last traded at an NTM dividend yield of 4.9%, below its all-time average of 5.3%. Notwithstanding, it’s a reflection of VICI’s strength throughout 2022 as it outperformed the broad market and its peers significantly.

As seen above, buyers continued to support VICI’s valuation when its NTM dividend yield increased toward its average over the past year. Furthermore, analysts’ estimates do not suggest a significant deterioration in its operating performance, given the robust performance of its tenant base. Pitoniak articulated:

These are experiences that tend to attract within that experiential category, the most valuable and loyal clientele, able and willing through all cycles to pay a premium for the purest realization of the experience to which they are devoted. Of note as well the Las Vegas Strip is also a pilgrimage destination for people seeking apex experiences of all kinds. I was just there this week. It is the busiest place on Earth. (VICI FQ3’22 earnings call)

Despite that, we believe investors jumping on board for the 4.9% yield now may not have a considerable margin of safety if VICI’s growth slows through FY24.

Even Very Bullish Analysts Suggest A Marked Slowdown

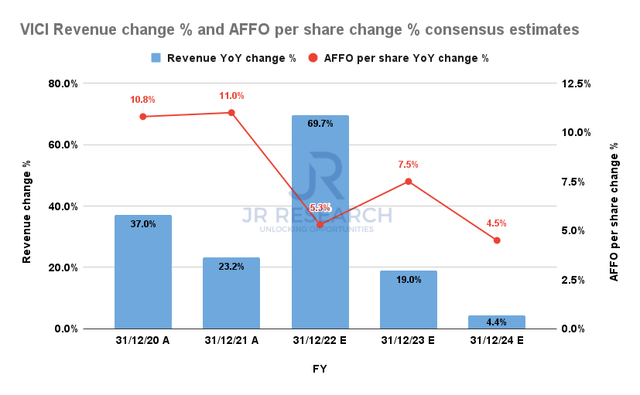

VICI Revenue change % and AFFO per share change % consensus estimates (S&P Cap IQ)

VICI reported revenue growth of 100% for FQ3, reflecting the accretion from its acquisitions of MGM Growth Properties and Venetian. Also, management lifted investors’ confidence by increasing the midpoint of its FY22 AFFO per share outlook.

Accordingly, VICI’s revised guidance suggests an AFFO per share of $1.915 (midpoint) for FY22, relative to its previous outlook of $1.905 (midpoint). The slight increase amid worsening macroeconomic conditions accentuates the robustness and resilience of its execution.

Notwithstanding, even the very bullish Street analysts don’t expect VICI’s growth to continue at its FY21 pace through FY24.

As seen above, VICI’s AFFO per share estimates is still expected to increase by 7.5% in FY23. However, it’s much slower than the pace seen in FY21.

We also urge investors to be cautious about the current investment climate, given the volatility in debt capital markets. In addition, while VICI continues to maintain discipline in its capital allocation, an increased cost of financing could continue to tighten its opportunities, given the bifurcation between the expectations of buyers and sellers over their cap rates.

Notwithstanding, the Fed could be near the end of its rate hikes with a welcome pause in early 2023. Still, we expect rates to remain elevated for some time as the Fed moves into data dependency mode to assess the effects of its record hiking cadence.

With a potentially slower investment cadence moving ahead, it could place more pressure on VICI to rely on its rent escalators to drive AFFO per share accretion further. Hence, we urge investors to pay close attention to management’s commentary at its Q4 earnings call on its outlook for FY23.

Is VICI Stock A Buy, Sell, Or Hold?

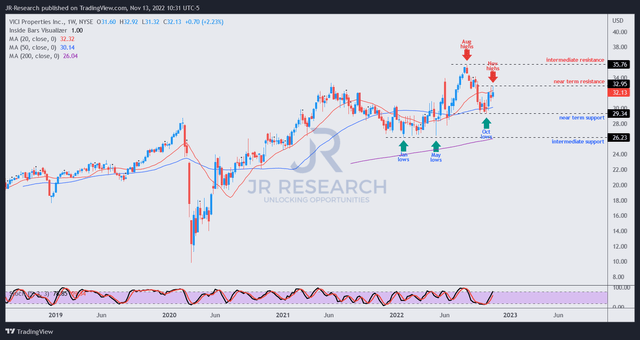

VICI price chart (weekly) (TradingView)

VICI has been a significant diversifier for investors’ portfolios in 2022, as it posted a YTD total return of 10.8%. Therefore, VICI has outperformed the broad market, helping investors to mitigate the losses in other stocks.

We noted in August that VICI investors who bought at its highs could be drawn into a trap. Accordingly, the market sent VICI down nearly 18% toward its October lows before buyers returned to stanch further selling downside.

However, we gleaned sellers appeared to have stalled further buying momentum from its recent recovery at its November highs, seen above.

Hence, we postulate it’s critical for VICI to regain its August highs to demonstrate the sustainability of its bullish bias. However, with a normalized AFFO per share growth cadence through FY24, the market could be unwilling to re-rate VICI much higher from the current levels.

While there are no clear sell signals yet, we urge investors to be cautious, as the directional bias from here remains tentative.

Maintain Hold.

Be the first to comment