Spencer Platt

Thesis

Philip Morris International Inc. (NYSE:PM) stock has been under significant pressure given the Fed’s hawkish posture. As a result, the market has astutely used buying spikes in PM to digest its gains further. As such, buying the dips has not worked out for investors in 2022, as the market took out its lows going all the way back to February 2021 at its recent September 2022 lows.

We had postulated in our previous article (Hold rating) in August that PM’s July 2022 lows could hold. However, the market action over the past three weeks suggests that PM has been de-rated further. Therefore, we believe it’s more appropriate to be cautious at the current levels, even though PM is likely at a near-term bottom.

With a global recession approaching (and Europe already arguably in one), PM’s premium valuation could come under further pressure, given significant earnings exposure to Europe.

As such, we reiterate our Hold rating and discuss the critical levels for investors to monitor as they watch from the sidelines.

Philip Morris’ Estimates Revised Downwards

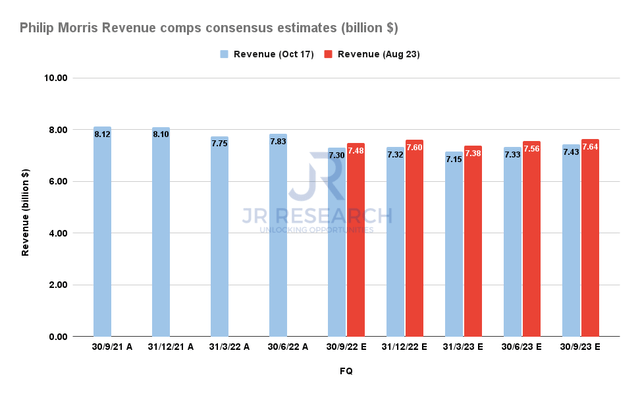

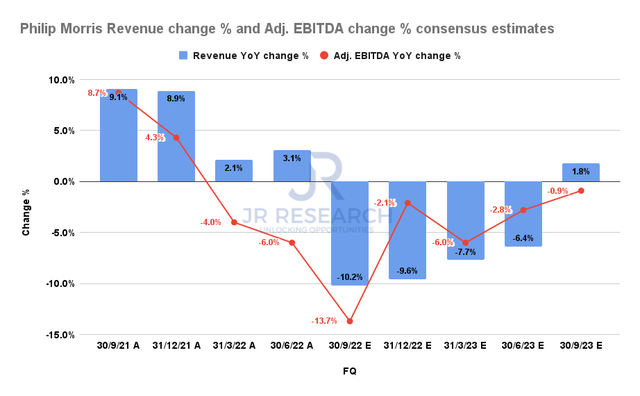

Philip Morris Revenue comps consensus estimates (S&P Cap IQ)

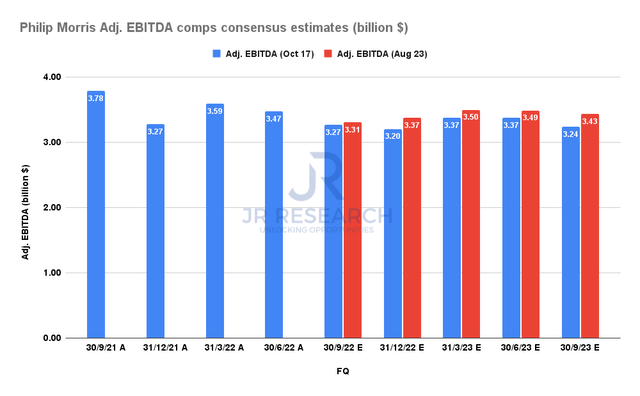

Philip Morris Adjusted EBITDA comps consensus estimates (S&P Cap IQ)

The Street analysts (bullish) revised PM’s estimates downward from August, as macro and forex headwinds continue to hinder the company’s forward prospects.

As seen above, the revisions impact projections through FY23, suggesting that the challenges to the company’s recovery could be worse than anticipated.

Notably, the market had already de-rated PM even before the recent revisions. Therefore, we postulate that the market’s positioning on PM has turned negative, leveraging momentum spikes from the buyers to sell and digest their gains.

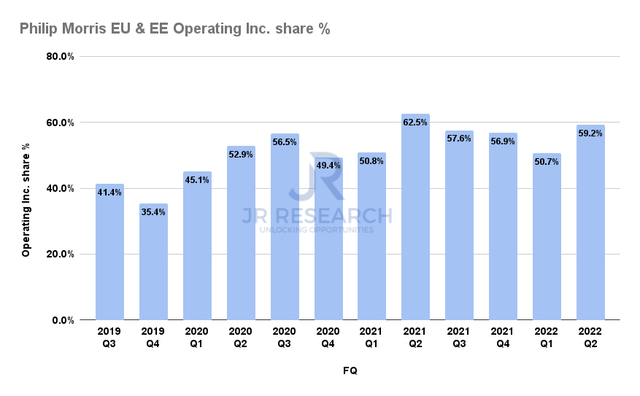

Philip Morris EU and EE share of Operating Income % (Company filings)

We believe the market’s posture is prudent. As seen above, Philip Morris derived nearly 60% of its operating income from Europe in Q2. Therefore, Europe is a critical region to watch closely for PM investors. Don’t assume that Philip Morris would not be immune to a worse-than-expected recession in Europe. However, the market has likely reflected downside risks in PM’s valuations. Notwithstanding, our analysis (to be discussed subsequently) indicates that PM’s valuations have not been pummeled to reflect a significant downturn.

Furthermore, the worsening macro headwinds are expected to spread globally, with a global recession looking increasingly likely. Edward Yardeni also highlighted in a recent commentary (October 13):

It’s not often that the whole world’s economy faces a synchronized economic slowdown, but that’s what appears to be occurring. In Europe, high natural gas and electricity prices are crushing consumer demand and boosting corporations’ expenses. And missteps by the UK government’s new leaders have spooked that country’s financial markets, sending interest rates and inflation spiraling higher. – Yardeni Research

Hence, we postulate that the market is positioning for significant headwinds that could cause PM’s earnings estimates to fall further, behooving value compression.

Philip Morris Revenue change % and Adjusted EBITDA change % consensus estimates (S&P Cap IQ)

However, the bullish consensus estimates suggest that PM’s revenue and adjusted EBITDA growth could bottom in its upcoming Q3 release (October 20) before recovering through FY23.

Hence, Wall Street still expects PM to pull through the global recession relatively firmly and that view could be overly optimistic. At PM’s current valuations, we believe the macro challenges have not been fully reflected.

PM Stock’s Valuations Need To Go Down Further

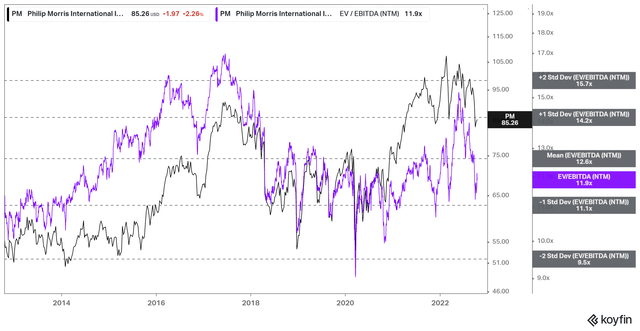

PM NTM EBITDA multiples valuation trend (koyfin)

As seen above, the market has already de-rated PM, with its NTM EBITDA multiples close to the one standard deviation zone under its 10Y mean.

However, a recessionary scenario could see the market force its valuation down further to the two standard deviation zone under its 10Y mean. Therefore, we believe that posture is appropriate in the event of a severe recession.

Is PM Stock A Buy, Sell, Or Hold?

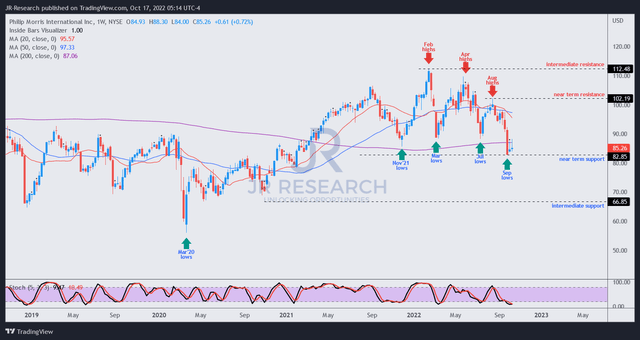

PM price chart (weekly) (TradingView)

We gleaned that PM’s price action is not constructive for a medium-term recovery of its bullish bias.

Accordingly, the bull trap (indicating the marker denied further buying upside decisively) in February 2022 was significant. It had prevented buyers from retaking its intermediate resistance, forcing lower highs in April and August.

Therefore, we observed that the market had astutely used buying surges from bullish PM investors to force decisive bearish reversals, significantly weakening PM’s bullish momentum.

Notwithstanding, we postulate the recent capitulation move has likely shaken out weak hands, as it forced significant lows in PM through February 2021. As such, we deduce a near-term consolidation to draw in dip buyers is likely.

However, we urge investors not to buy the dips as PM’s valuation has not been battered adequately to reflect significant global headwinds. Furthermore, PM’s unconstructive price action has corroborated our perspective that the market has de-rated PM decisively, seeing more headwinds moving ahead.

As such, we urge investors to wait on the sidelines for now and reiterate our Hold rating on PM.

Be the first to comment