Bradley Caslin

Dear readers,

As I said in my first article on the company, Deutsche Lufthansa (OTCQX:DLAKF) (OTCQX:DLAKY) isn’t a bad business. Airlines don’t need to be poor businesses – but unfortunately, recent decisions and pandemic trends have turned them into what I see as an uninvestable and uninteresting sort of prospect.

It’s now around half a year after the fact. And we’ll see what sort of overall upside we can work on here.

Updating on Lufthansa

There are many positives for Lufthansa that have crystallized over the past few months, that weren’t as visible around half a year ago. Despite some of these positives, the company hasn’t materially improved in terms of share price – which is good news for us.

Because if there is substance to this trajectory, that means we can “BUY” it cheaper, and if not, that means we’ve avoided some downside and can keep waiting.

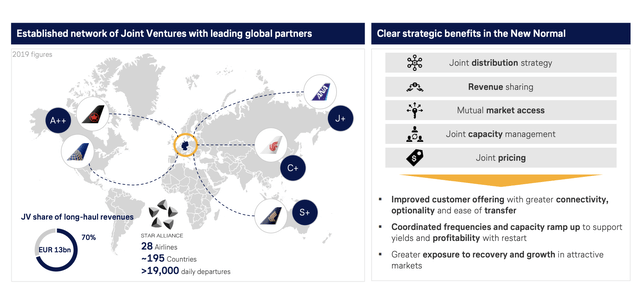

Lufthansa’s business includes the fully-controlled Swiss, Austrian, and Brussels airlines. It has the Star Alliance brand, and through it offers its travelers one of the most extensive networks of destinations on the planet. What could make exposure to German and Swiss economies of all things, unattractive? After all, we’re talking about International travel hubs such as Frankfurt, Munich, Zurich, Vienna, and Brussels.

These are some high-intensive travel routes, similar to some of the most-traveled routes in Asia or the USA. Any company that “owns” part of the cash flows from these should be on your radar as a company you may want to be looking at. If nothing else, then as a matter of interest.

Lufthansa does Network passengers, budget flights (Eurowings), Logistics/Freight, Engineering, and catering. An interesting and perhaps somewhat odd mix, with a heavy weighting towards network passengers and barely single-digit revenues from freight and R&D. Companies like Deutsche Post (OTCPK:DPSGY) are far larger than Lufthansa in these segments. It’s also very Europe-heavy, with over 55% of revenues around Europe and 25% from Germany alone.

The company has seen improvements over the past few months. The most crucial is that Lufthansa is private once again. The economic stabilization fund of Germany sold all remaining shares of Lufthansa back in mid-September. The WSF held around 6.2% of the company, down from an original 20% to save the company back in 2020. This marks an early divestment of the shares, about 1 year early compared to the overall plans for the company.

This opens the pathway for the company to return to a shareholder-friendly return approach. The company has now returned to growth.

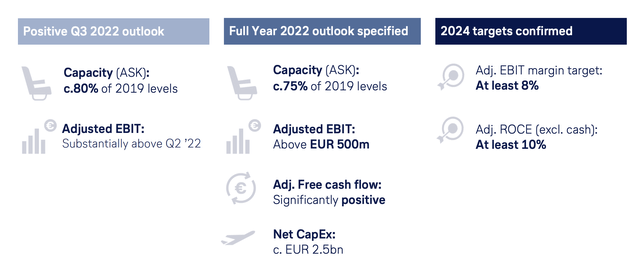

The company has delivered positive operating cash flow and adjusted FCF for the 2Q22 period. Lufthansa also reduced its net pension liabilities by close to €7B since late 2020. Cost reductions are another major part of the company’s current targets, and these are going forward as well, with billions in savings realized, and hundreds of millions more targeted going forward.

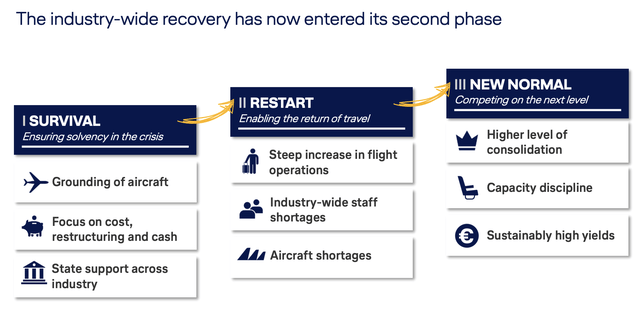

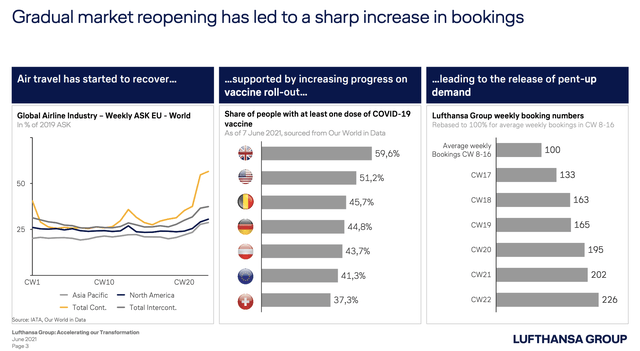

The overall trends is in line with the more positive post-COVID expectations for the industry.

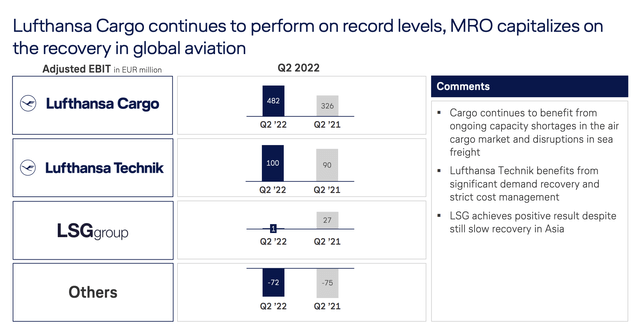

Freight and logistics are set to play a larger role for Lufthansa, despite its only 10% historical revenue split. The company’s cargo position is very appealing, in that it offers one of the best positions in Air Freight. Lufthansa has a very modern fleet that’s already among the leading in sustainability and ESG.

The company is moving forward in divestments and portfolio management, concluding the sale of Airplus/LSG Group, and IPO’ing the Technik segment, with a targeted date in 2023.

Lufthansa currently expects to return to profits and generate cash in FY22, which is ahead of schedule.

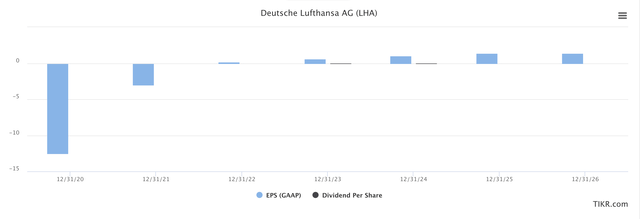

Dividends for Lufthansa still do not exist, and investors should not expect a change all that soon. Lufthansa was cut to junk (BB-) by S&P Global, and a Ba2 by Moody’s. Lufthansa did have an appealing capital payout up until 2018 but there are still significant reasons why investors shouldn’t expect anything from Lufthansa for some time, even with the company’s status in terms of economic relief now more positive than a few months back.

Airlines make money, on a high level, by utilizing their capacity/load factors and yields. Traditionally, increases for Lufthansa in utilization up to the low 80% in 2015 have come only at the cost of margins in the shape of price reduction. The actual yield on its services has been low for years, and in terms of yield on seat-kilometer, this turned negative in 2019, and revenue per sold seat was furthermore under pressure in 2019. That development is now slowly turning around.

There isn’t really any sort of fundamental danger for Lufthansa going bankrupt, specifically due to the company’s potential growth sectors, like Logistics/Freight. As prospective investors, we could only wish that this segment was larger because it remains one of the more unimpacted Lufthansa segments.

While passenger transport has been down, but is now rising, Cargo/Freight has delivered record-high adjusted pre-tax earnings on a quarterly basis, and as long as SCM issues persist, cargo/freight is likely to report very strong. It’s a seller’s market out there, and Lufthansa owns a large fleet of cargo planes. Furthermore, Lufthansa is a net beneficiary of increased German export. The outlook for this segment is positive, and it’s a rare positive in an otherwise pressured Lufthansa.

The targets for asset monetizations and the engineering IPO remain solid – paying down of debt, removing state influence from Lufthansa, and eventually turning cash-flow positive in a way that ensures its restoration of BBB- or above, as well as the possibility to once again start rewarding shareholders. The company still retains one of the largest JV hubs on earth, with availability across the planet.

Seeing Eurowings go profitable and better is also a possibility, with further cost cuts and restructurings in the sub-segment. Eurowings has plenty of yield premium to cut from in order to drive things here, compared to businesses like Ryanair (RYAAY), Wizz (OTCPK:WZZAF), easyJet (OTCQX:EJTTF), and others.

Lufthansa remains a transformation story. Here are the company’s goals.

I want to reiterate that “rewarding shareholders” is at the very bottom rung of the company’s priority ladder. This remains one of the core problems with this investment – because the fact is that there are many companies without this issue, that pay out quite excellent dividends and generate good returns without needing to wait for this normalization.

In order to justify an investment here, Lufthansa needs to provide an upside that goes well into triple digits in order for me to even consider taking the risk. Also, I want better visibility for the turnaround in terms of timing – which in the last article, we did not have.

Now, an argument can be made that this might exist here. Let’s look at valuation.

Lufthansa’s Valuation

Looking at the company’s valuation, we can see that the company is now at a far better risk/reward ratio than last we spoke of it. The company’s overall valuation multiples in terms of revenues, sales, EBITDA, and EBIT remain at extremely pressured levels. For instance, Lufthansa trades at below a 0.5x revenue multiple, and below 0.25x to sales. Until the company gets profit margins and EBIT under control, going by P/E is a bit of an issue, given that multiples easily go into the negative realm here.

So, what can we “say” about the business?

Lufthansa is showing tendencies toward profitability. For this fiscal, expectations are for the company to turn a GAAP Profit again, even if it’s a small one, but expectations for normalization here are extremely slow.

There are expectations for token dividends reinstatement as early as next year – I would call that optimistic, and even if it does happen, it’s really only a token yield.

Lufthansa GAAP EPS/Dividends (TIKR.com/S&P Global)

I recently wrote about another company on a similar path – Rolls-Royce (OTCPK:RYCEF). These two companies are fairly alike, even in similar segments in some ways. Both are storied giants with plenty of history and notches on their belt – both of them fallen on hard times. The main difference between RYCEF and Lufthansa is that Rolls-Royce’s recovery is further, and I believe the visibility for profitability for the company is actually very good here, even as early as 2022. We may even get a dividend – and not just a token one – as early as next year.

I’m not opposed to investing in turnarounds. Not at all. But if I do it, I do want good visibility and a solid expectation for when I might see returns. The absence of a yield makes this a must. And for Lufthansa, this visibility is low.

Current FactSet forecasts do not expect the company to earn substantial positive EPS in this fiscal, but for the ramp-up in earnings to start happening in 2023, with triple-digit positive EPS increases, followed by high double digits in 2024, that, in case we see a double-digit P/E multiple upside, could result in RoR of double digits on an annual basis.

The problem is, we’re talking about a BB- rated company with no yield and substantial challenges still to face. One of the perhaps best ways to value an in-distress company is by valuing its assets in a NAV/SOTP valuation. Assuming an EV/Sales or EV/EBIT multiple for the various segments, and valuing the parts at a range of 1-6.5X depending on the multiple and segment, we reach total gross assets of between €19.5-€20 billion. This assumes a relatively high 6.5X multiple for the Engineering/MRO segment. Based on a net cash/debt deduction of €13.6B, we land at around €7B, or €5.56/share.

The company is still above €6.5/share. This just doesn’t work for me.

Not only is there little upside on a SOTP valuation but this company is actually overvalued. I would welcome arguments as to why you believe the company deserves a premium here.

Bulls for the company can point to recover – I’m no stranger to this either. But the fact is, there is too little visibility, in this case, to make it worth considering here.

There are far better companies with substantially safer, better, and more profitable upside to investing in.

That being said, the absence of the economic relief money and the substantial improvements warrants a change from “SELL” to “HOLD”. If you own Lufthansa, I do believe the time might come in the next few years when this company turns around. It’s no longer as “out there” as it once was – and it is nearly 20% cheaper than last.

Because of this, a thesis change

Thesis

My thesis on Lufthansa is as follows:

- This incumbent airline has been on a rollercoaster ride since early 2002. 20-year returns for Lufthansa are negative 30%+, making it a terrible investment.

- There is the remote potential of a turnaround somewhere in 2023-2024, and this warrants a change in my rating on the company.

- Because of this, I am continuing my coverage on SA on Lufthansa with a “HOLD” rating. I still believe that Lufthansa should not be part of any conservative portfolio, even at the risk of some sort of upside here.

Remember, I’m all about :

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment