SimonSkafar

Entergy Corporation (NYSE:ETR) is a regulated electric utility serving customers in four Gulf Coast states. The utility sector in general has been widely followed and invested in by conservative risk-averse investors for many years. There are many reasons for this including the general revenue and cash flow stability possessed by these companies. Entergy goes a step further as it also offers fairly respectable growth potential and a very high 3.76% dividend yield. When we combine this with a reasonable valuation, the company apparently has a lot to offer its investors. This is the same general thesis that was presented in my last article on the company but we certainly saw it play out in the company’s third quarter. In addition, the company’s valuation has improved quite a bit over the past few months, which increases its attractiveness as an investment today.

About Entergy Corporation

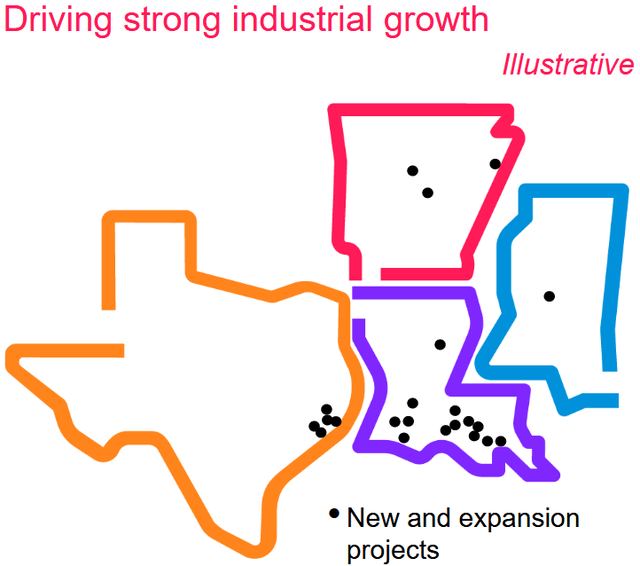

As stated in the introduction, Entergy Corporation is a regulated electric utility that serves customers in the states of Louisiana, Mississippi, Arkansas, and Texas:

This is a fairly good region for the company to be operating in as the Gulf Coast is currently experiencing fairly strong economic growth. There are quite a few reasons for this including low taxes, easy access to water-based transportation infrastructure, low energy costs, and good workforce demographics. In addition, the oil and gas boom that was been going on in Texas over the past decade has been attracting a great deal of money to the region, which naturally results in gentrification and investment. This has resulted in Entergy’s customer base growing at a 0.7% compound annual growth rate since 2011. This is something that is fairly nice to see as a growing customer base is one way that a utility can grow its operations. It is also something that is completely out of the utility’s control since they are generally confined to a single geographic area. The fact that Entergy’s customer base has been growing thus results in revenue growth even if Entergy keeps its rates static.

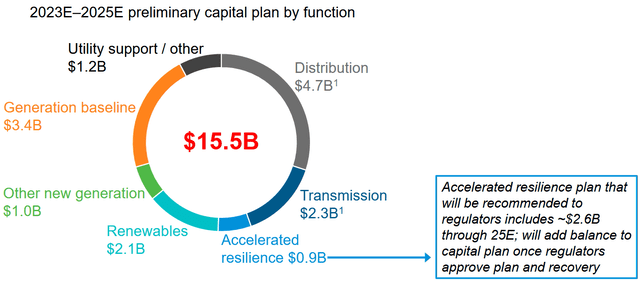

Of course, a 0.7% growth rate is hardly enough to entice investors. Entergy does have other methods to generate growth, however. The primary way is by increasing its rate base. The rate base is the value of the company’s assets upon which regulators allow it to earn a specified rate of return. As this rate of return is a percentage, any increase in the rate base allows the company to increase the prices that it charges its customers in order to earn this specified rate of return. The usual way for a utility to increase its rate base is to invest money into upgrading, modernizing, or even expanding its utility-grade infrastructure. This is exactly what Entergy Corporation is planning to do. The company recently laid out a plan to spend $15.5 billion over the 2023 to 2025 period toward growing its rate base:

This is a very different outlook than we had the last time that we looked at the company, which is nice to see as it provides increased visibility. Entergy previously planned to invest $11.7 billion over the 2022 to 2024 period so we can see that the company has increased the size of its program significantly as well as given us an additional year for our projections. This is still a shorter time period than we get from many of the company’s peers though as they tend to largely provide five-year capital plans as opposed to three years. It is still nice to have the increased visibility, though. This spending program should have the effect of growing the company’s rate base at a 7% to 8% compound annual growth rate over the period, which will increase it from $33 billion today to $41 billion at the end of 2025. This is admittedly much less than the amount that the company is spending, but this is typical. One reason for this is depreciation, which is constantly reducing the value of the assets that the company places into service. The second reason is that Entergy will be retiring some of its older assets during the period, which removes their value completely from the company’s rate base. Entergy should still be able to grow its earnings per share at a 6% to 8% compound annual growth rate over this period, however. This gives the company a total annual return of 10% to 12% on average when we combine this growth with its dividend, which is certainly enough to appeal to any investor interested in a utility.

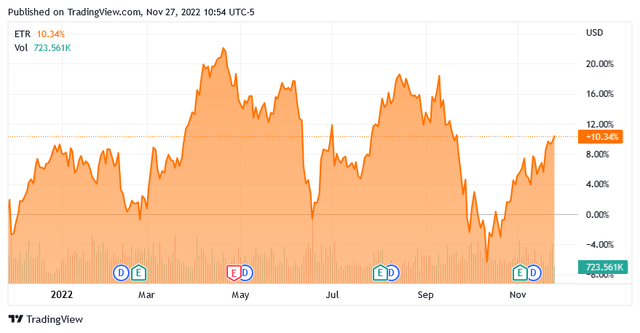

We saw this growth play out in Entergy’s third-quarter 2022 earnings results. The company reported a net income of $561 million compared to $531 million in the prior-year quarter. This works out to an $0.11 year-over-year increase in its earnings per share, which corresponds to a 4.18% improvement. This is admittedly less than the company expects over the 2023 to 2025 period but it is still a reasonable figure. Entergy’s stock price has not ignored these increased earnings as it is also up 10.34% over the past twelve months:

This is certainly more financial stability than we have seen from many other utilities and most other sectors. One major reason for this is the nature of Entergy’s business. The company provides a product that is generally considered to be a necessity for our modern way of life. After all, very few people today do not have electric service in their homes or businesses. As this service is generally considered a necessity, most people will prioritize paying their electric bill over making discretionary purchases during times when money gets tight. This is something that is a critical advantage today as the pervasive inflation that has been permeating our economy has generally resulted in money being tight for a great many people. This stability is what allows Entergy to pay out a significant proportion of its earnings as dividends, so income-focused investors should especially appreciate this characteristic of the company.

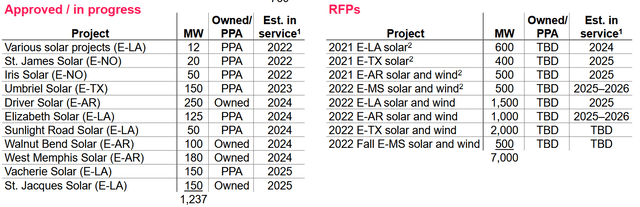

One thing that we notice above is that Entergy is devoting a great deal of money toward developing and deploying renewable sources of energy. This is something that may come as a surprise considering that the region that the company services is not generally considered to be a particularly progressive area. However, Texas currently has more wind power in its energy mix than any other state in America. In total, wind accounts for 20% to 30% of all electric generation in Texas. Texas also has more solar generation capacity than any state except for California. This is largely because the state’s climate is ideal for both types of renewables given its large amount of sunshine and generally flat terrain. Entergy is planning to spend $2.1 billion over the next three years to increase the proportion of renewable generation in its network:

As we can clearly see, the company will have another 1.237 gigawatts of solar capacity supplying its network by the end of 2025. It has also requested bids to add another 7 gigawatts of solar and wind capacity over the 2024 to 2026 period. This is all a part of the company’s ambition to achieve net-zero carbon emissions by 2050. Admittedly, this is not a particularly ambitious goal as most utilities share this ambition or intend to hit their target well before 2050. There may be some reason to believe that Entergy will also achieve it well before 2050 as the company is currently on track to achieve its 2030 carbon reduction emissions prior to 2030. Entergy appears to simply be conservative here and that is appreciated, particularly since we do not know how quickly renewable technology will advance and as of right now it cannot support the grid on its own.

The company’s heavy emphasis on renewables has not been noticed by investors, at least not when compared to peers like NextEra Energy (NEE). This is something that could prove advantageous to investors today since it allows us to get in before the big money in the various environmental, social, and governance funds begins to notice Entergy. As I have mentioned in the past, these funds contained approximately $357 billion as of December 31, 2021 (more recent data has not been released). This is more than enough to have an impact on the stock price of Entergy, which only has a market capitalization of $23.15 billion. We can clearly see that if the management of these funds begins to notice Entergy’s renewable credentials, their money could very easily begin to drive up the stock price. There may be some reason to believe that these funds are about to get much more money. Last week, the United States Department of Labor finalized rules that allow 401k plans to use environmental, social, and governance funds as their default investment option. This could very easily position sponsors of corporations touting these investment principles to transfer the retirement savings of their employees into these funds. While that may not be the best deal for unaware retirement savers, it could give the funds a lot more money to invest and they will need to buy companies like Entergy. We may have the potential to get in ahead of these funds and benefit from a potential rise in the stock price.

Financial Considerations

It is always important to look at the way that a company finances itself before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. This is usually accomplished by issuing new debt to repay the maturing debt. This could therefore cause the company’s interest expenses to increase following the rollover depending on the conditions in the market. In addition, a company must make regular payments on its debt if it is to remain solvent. Thus, an event that causes the company’s cash flow to decline could push it into insolvency if it has too much debt. Although utilities like Entergy tend to have very stable cash flows, bankruptcies have occurred in the sector so this is still a risk that we should always consider.

One metric that we can use to evaluate a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. In addition, the ratio tells us how well the company’s equity can cover its debt obligations in the event of a bankruptcy or liquidation event, which is arguably more important. As of September 30, 2022, Entergy had a net debt of $26.6031 billion compared to $12.4137 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 2.14. Here is how that compares to some of the company’s peers:

|

Company |

Net Debt-to-Equity |

|

Entergy Corporation |

2.14 |

|

DTE Energy (DTE) |

2.22 |

|

Eversource Energy (ES) |

1.41 |

|

Exelon Corporation (EXC) |

1.55 |

|

FirstEnergy Corporation (FE) |

1.87 |

We can see quite clearly here that Entergy Corporation appears to be a bit highly levered compared to its peers. This has been a long-running theme with this company and it is something that I have criticized it for numerous times in the past. With that said, we do see some improvement here compared to the end of the second quarter. At that time, Entergy had a net debt-to-equity ratio of 2.18 so the company has brought it down a bit. This is something that we will want to watch going forward to ensure that this trend continues. As Entergy reduces its debt, it reduces the risk associated with this debt, and most investors in a company like this try to avoid taking on too much risk.

Dividend Analysis

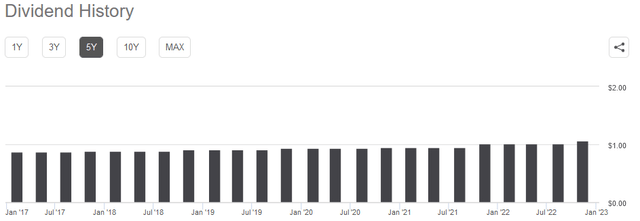

As stated earlier in the article, one of the defining characteristics of utility companies is that they usually have a higher dividend yield than other things in the market. Entergy is certainly not an exception to this as the firm currently boasts a 3.76% yield, which is substantially higher than the 1.53% yield of the S&P 500 index (SPY). Entergy also has a long history of increasing its dividend annually, which it continued along with the release of its third-quarter earnings report:

A dividend that grows with time is something that is very nice to see, particularly during inflationary times such as today. This is because inflation is constantly reducing the number of goods and services that we can purchase with the dividend that the company pays out. This can make it feel as though we are getting poorer and poorer with time. The fact that the company gives us more money each year helps to offset this effect and helps maintain the purchasing power of the dividend. As is always the case though, we want to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to be forced to reverse course and cut the dividend since that would reduce our incomes and most likely cause the company’s stock price to decline.

The usual way that we judge a company’s ability to pay its dividend is by looking at its free cash flow. The free cash flow is the amount of money that was generated by the company’s ordinary operations and is left over after the company pays all its bills and makes all necessary capital expenses. In the third quarter of 2022, Entergy reported a negative levered free cash flow of $596.0 million. This is not nearly enough to pay for any dividend, let alone the $205.5 million that the company paid out. At first glance, this certainly looks concerning.

It is, however, not unusual for utilities to finance their capital expenditures through the issuance of debt and equity while funding the dividend out of operating cash flow. This is due to the extremely high costs of constructing and maintaining utility-grade infrastructure over a wide geographic area along with the general stability of their cash flow. In the third quarter, Entergy had an operating cash flow of $993.5 million. This was easily enough to cover the $205.5 million in dividends that Entergy paid out with a great deal of money left over for other purposes. Overall, this dividend is likely to be pretty sustainable and we shouldn’t have to worry very much about a cut.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to generate a suboptimal return on that asset. In the case of a utility like Entergy Corporation, we can value it by looking at the company’s price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s forward earnings per share growth and vice versa. However, there are very few companies that have a price-to-earnings growth ratio of less than 1.0 today so the best way to use it is to compare the company’s ratio to that of its peers in order to determine which firm offers the most attractive valuation.

According to Zacks Investment Research, Entergy will grow its earnings per share at a 6.76% rate over the next three to five years. This is very similar to the growth rate that we projected earlier based on the company’s rate base growth so it seems pretty solid. This gives the stock a price-to-earnings growth rate of 2.63 at the current price. Here is how that compares to Entergy’s peers:

|

Company |

PEG Ratio |

|

Entergy Corporation |

2.63 |

|

DTE Energy |

3.18 |

|

Eversource Energy |

3.23 |

|

Exelon Corporation |

2.48 |

|

FirstEnergy Corporation |

2.44 |

Entergy Corporation appears to fall midrange here as it is significantly cheaper than a few of its peers but does appear expensive relative to the group as a whole. With that said, Entergy is quite a bit cheaper today than it was a few months ago. The company had a price-to-earnings growth ratio of 2.80 when we last looked at it back in September. When we combine this with the higher dividend today, the company could certainly be worth an investment, although it is possible that a more attractive entry price will present itself in the near future.

Conclusion

In conclusion, there is a lot to like about Entergy today. The company continues to display the growth that we have come to expect from it, yet its yield and valuation are both improving. As are the company’s finances as it continues to make progress in reducing its debt. We could begin seeing pressure from environmental, social, and governance funds over the coming months and years as they may begin hunting for more assets due to an influx of money. That part of the thesis is by no means certain, but overall Entergy continues to look like a very reasonable utility play today.

Be the first to comment