michaelquirk

Main Thesis & Background

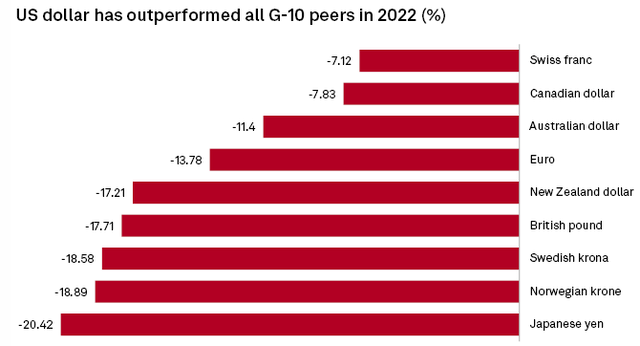

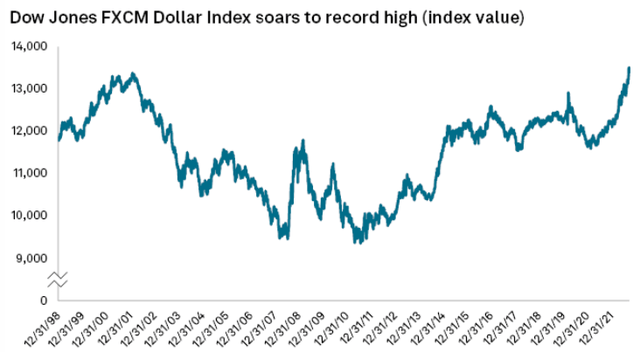

The purpose of this article is to discuss the U.S. dollar (USD), its consistent rise in 2022, and how investors can position themselves if the currency begins to see a reversal or a decelerating increase. Importantly, I will emphasize straight off that predicting currency movements is very difficult. While I see a path where the USD begins to ease a bit, there are also tailwinds on the horizon that could send it higher still. Readers need to evaluate this push-pull environment and decide what side of the fence they sit on. But the takeaway for me is that USD’s rise has been unusually large, so beginning to hedge a portfolio for an eventual reversal makes a lot of sense at this juncture. Over time, the USD rarely sits at this current valuation, so expecting a pullback is reasonable:

In particular, I see value in emerging market equities, commodities such as gold, silver, and oil, as well as fixed-income. But, again, this is under the assumption that the USD will not be able to sustain its current trajectory. If it does, then those assets are almost sure to suffer as they have been for the better part of this calendar year.

Let’s Look At How We Got Here

To begin, I want to take a moment to review how we arrived at this environment. The USD’s rise in 2022 is the result of a number of factors. For one, it is seen as a safe haven asset, along with other currencies like the Swiss Franc. It also benefits from being the global reserve currency, making it a relatively more stable currency that benefits the U.S. in ways that other countries can’t match. Finally, the Fed has embarked on an aggressive interest rate hiking cycle. While other central banks have also been increasing their benchmark rate, the Fed has been one of the most aggressive in its bid to contain inflation. As a result, rates have shot higher, bringing the USD up along with it. On a year-to-date basis, USD has thrived:

USD Index (YTD Rise) (TD Bank)

I bring this up because it is critical to understand the backdrop. While this review is going to focus on what assets may see a boost if the USD rally falters, readers must consider the risk of this thesis. The USD has been rallying for valid reasons, and those reasons could continue.

Investors are beginning to pivot with their rate hike expectations – notably expecting a more dovish Fed starting in mid-2023. That is why consideration of a (relatively) weaker USD is timely now. But investors have been wrong before. And the fact is the Fed is not giving much of a hint that they are going to reverse course in the short-term.

According to the most recent Fed minutes, Fed officials indicated rates would be maintained at a “restrictive level” for “some time”. The actual excerpt follows:

Many participants indicated that, once the policy rate had reached a sufficiently restrictive level, it likely would be appropriate to maintain that level for some time until there was compelling evidence that inflation was on course to return to the 2 percent objective”

What I am getting at here is readers need to approach an upcoming dovish move in the USD cautiously. The Fed has not backed off its stance on raising rates and keeping them there. While investors are not convinced at this likelihood 6-12 months out from now, that only means the backdrop is mixed. This presents opportunity, but plenty of risk, so weigh that carefully before acting.

Some Areas Of Opportunity

With the key risk discussed, let’s now shift to focusing on where the opportunity is. As noted, the USD has seen an unusual push higher, suggesting it could be ripe for a partial reversal. It won’t take much in terms of a shift in tone from the Fed to send it lower, since the market has baked in more hikes over the next few quarters. Any divergence from this path, and the USD will be ripe for a modest fall.

If that happens, where can we expect gains? One area is commodities and precious metals, all of which tend to perform well during a weakening USD cycle. The opposite, of course, is also true, which explains why metals such as gold and silver are having a difficult year. Silver is a bit more versatile (and therefore volatile) of an asset given its many commercial and industrial uses. Gold, on the other hand, tends to move in a very consistent pattern with the USD. The two assets are very negatively correlated, explaining gold’s downward trending path for most of 2022:

Gold and USD Index Movements (Yahoo Finance)

To me, this presents the perfect hedge against a falling dollar. With gold moving in a very negatively correlated fashion, any fall in the USD is predictably going to push gold up. While not a “perfect” hedge, it is as close to it as one can get.

A similar story can be used to justify positions in silver, oil, and many other “hard” assets like materials, metals, and commodities. This is a realm that often moves inversely against the dollar and thus sets up a potentially rewarding play if the dollar moves south (or at least stops rising).

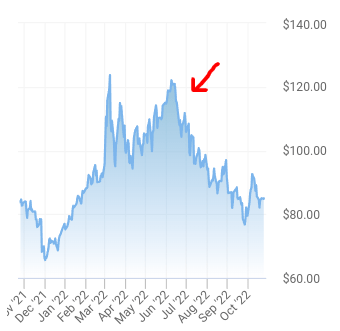

I have a very similar outlook for crude oil. This is an asset that has benefited tremendously in 2022 from supply challenges, rising demand, and geo-political headwinds. Yet, oil has been struggling in the second half of the year:

Crude Oil (1-Year Chart) (Bloomberg)

The key here is to remember oil is almost always sold in USD as both Brent and WTI Crude are traded in U.S. dollars. When the value of the dollar drops, the price of crude must rise to have the same worth on the market. Similarly, when the dollar value rises, the price of crude should correspondingly drop. While in the immediate term crude prices do not always move perfectly in-line with USD, significant moves in USD’s value often result in corresponding changes in the price of crude.

This is an opportunity similar to gold. If we see USD fall/stop rising, oil should benefit (all other things being equal). This tells me is it also a handy hedge to own moving in to 2023.

*My personal holdings include Sprott Physical Gold and Silver Trust (CEF), Vanguard Energy ETF (VDE), and ProShares Ultra Bloomberg Crude Oil (UCO). I also see merit to owning iShares Gold Trust ETF (IAU), or other straight metals plays for similar reasons.

Foreign Equities, Or U.S. Equities With Foreign Revenues

The next topic to focus on is the opportunity overseas. Similar to commodities, the pressures of a rising USD has taken its toll on companies located in emerging markets in particular. But the same is true for U.S. companies with a lot of foreign exposure. The logic is this: When a company converts what it makes in another country (foreign currency) into U.S. dollars, those dollars are worth less than they were before the dollar’s rise. This is true across the board. Whether the repatriated profits from abroad are in Euros, Pounds, or any other EM currency, they are going to be worth less in dollars. As a result, U.S. companies (and their foreign counterparts) are at a disadvantage compared to domestic U.S. companies that are generating the bulk (or all) of their revenue in USD.

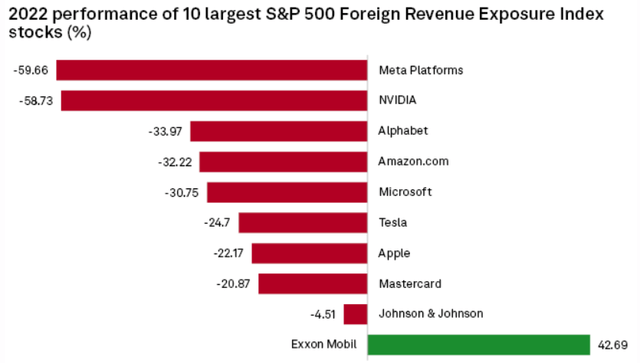

This backdrop has sent investors fleeing from both EM and large-cap U.S. stocks with substantial foreign revenues. For example, if we look at the YTD returns of the companies within the S&P 500 with the most foreign exposure (in terms of revenue) are getting punished with only one exception:

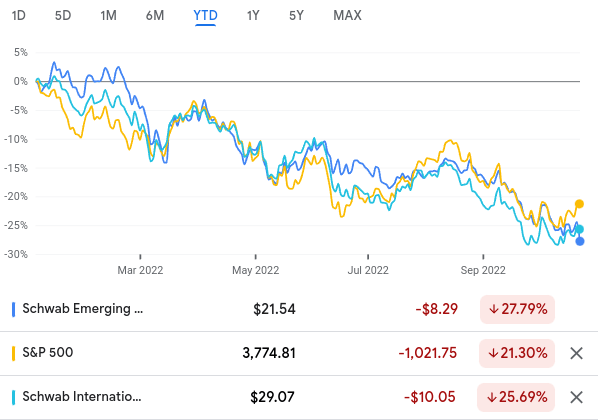

If we look at foreign stocks as well, a similar story pans out. If we look at the S&P 500 against both the Schwab Emerging Markets ETF (SCHE) and the Schwab International Equity ETF (SCHF) (which measures mostly developed markets) then we see the S&P 500 with a small lead:

YTD Performance (Google Finance)

So – what is the point of all this?

My point is that investors have punished areas that have non-USD exposure in a disproportionate way. The S&P 500 is obviously more USD-focused than SCHE and SCHF, but it still generates a sizable portion of its revenues overseas. So all of these strategies are down this year as the USD has risen. I, therefore, see all of these as valid ways to play a less hawkish UDS going forward. Emerging and developed markets look ripe for a sharp turnaround if upward pressure on the dollar eases. Even the S&P 500 should generate solid returns under this scenario. In particular, however, I would look to some of the holdings within that index that saw the biggest drops, as the initial graphic showed, since they have the most ground to recover.

*I would suggest investors consider SCHE and SCHF if they expect USD weakness. The top foreign-exposed stocks in the S&P 500 are also good alternatives (i.e. Meta Platforms (META), Alphabet (GOOG), Amazon.com (AMZN), Microsoft Corporation (MSFT), and more.

Bonds Will Be A Primary Beneficiary

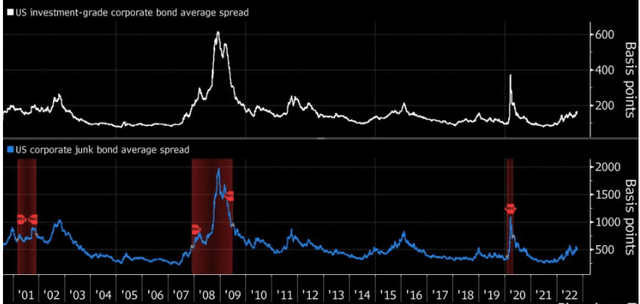

As readers are most likely aware, one of the biggest market pain points in 2022 has been fixed-income. As rates have risen and the USD has surged, bond prices have fallen off a cliff. This has included IG bonds, junk bonds, muni bonds, and the numerous leveraged CEFs and non-leveraged ETFs that investors have at their disposal. Suffice to say, fixed-income investors have taken it on the chin and we all know now the reasons why. The more important consideration at this juncture is – where do we go from here?

Similar to the other themes I laid out in this review, bond prices have plenty of room to fall further if the Fed stays aggressive and interest rates keep rising. We will not have seen a bottom yet, despite how far prices have dropped. But the good news is that such a sharp sell-off in fixed-income markets is unusual. This means that any reprieve from the Fed or USD’s rise should set up a nice tailwind for most of the credit market.

Aside from that potential, we may see investors creep back into this market anyway. While spreads in both IG and non-IG could absolutely widen further if economic data disappoints, we should also note spreads are wide on a two-year comparison:

Credit Spreads (St. Louis Fed)

This tells me there is plenty of upside if the dollar slows down. Bond prices will get a natural reprieve, and investors will most likely rotate back in to buy and tighten spreads. Plenty of downside risk remains here, but the opportunity is also very clear.

*I would suggest using non-leveraged ETFs to play the bond market right now. There is a lot of downside risk if the current trend continues and leveraged CEFs have been hit hard. While I own the Nuveen AMT-Free Quality Municipal Income Fund (NEA) and the BlackRock Taxable Municipal Bond Trust (BBN), I see more value/less risk in passive ETFs such as iShares National Muni Bond ETF (MUB), Invesco Build America Bond Portfolio ETF (BAB), Investment Grade Corporate Bond ETF (LQD), High Yield Bond ETF (JNK), as well as individual corporate issues from companies with strong balance sheets.

Bottom-line

One story that stands out in 2022 is the steady rise of the USD. With all the uncertainty in the globe right now, one point of stability has been the resilience of this currency, which has sharply out-performed its peers:

USD’s Relative Performance (World Bank)

Now, I am not suggesting this trend cannot continue. USD’s rise has been a justifiable story and if geo-political risks persist, the Fed stays the course, and inflation does not reverse, then USD could have plenty of room to rally further.

However, the USD’s trading history also suggests it may be nearing a top. If so, there are plenty of sectors that will rally on the news. Most of these are areas that have been disproportionately hammered year-to-date, suggesting to me there is plenty of upside to taking on positions now. While this may be for the more risk-taking investor, I still feel comfortable suggesting these ideas for consideration in the current environment.

Be the first to comment