JulieanneBirch/E+ via Getty Images

Investment Thesis

Packaging Corporation of America’s (NYSE: NYSE:PKG) price may hit the $108.61 38.2% Fibonacci retracement level offering a good technical entry point if the overall market pulls back in the next few weeks. There was a pandemic slowdown, but the trend in EPS, P/E Ratio, Net Profit Margins, Targets, Meal Kits, and USA Production provides reasonable indications for stock price appreciation. Even if PKG’s stock price moves from $108.61 to $120 by April 20th, a 35.8% potential annualized return is possible, including covered call premiums and dividends.

Packaging Corporation of America

Packaging Corporation of America is the third largest producer of containerboard and corrugated packaging in North America and one of the largest producers of uncoated freesheet in North America, based on production capacity. It differentiates itself from larger competitors by focusing on smaller customers and operating with high flexibility. Its three reportable segments: Packaging, Paper, and Corporate, and Other.

PCA’s Packaging segment includes six containerboard mills, one containerboard machine at our Jackson, Alabama, white paper mill, and 89 converting operations. In 2021, PCA produced about 4.9 million tons of containerboard and shipped about 65.7 billion square feet of corrugated products.

PCA’s Paper segment operates under the trade name Boise Paper, a Division of Packaging Corporation of America. They manufacture and sell white papers, including commodity and specialty papers, at two white paper mills in the United States.

Its corrugated products manufacturing plants produce various corrugated packaging products, including conventional shipping containers used to protect and transport manufactured goods, multi-color boxes and displays with visual appeal, and honeycomb protective packaging. In addition, it is also a packaging producer for meat, fruit and vegetables, and other consumer products.

They are 96.2% owned by institutions. I consider institutional investors such as hedge funds, pension funds, mutual funds, and endowments are smart money because they have more resources available for research than retail traders. They control much more buying and selling than retail investors, which determines the stock price. According to Reuters, retail investors currently account for roughly 10% of the daily trading volume on the Russell 3000. I prefer to invest in companies with at least 70% institutional ownership.

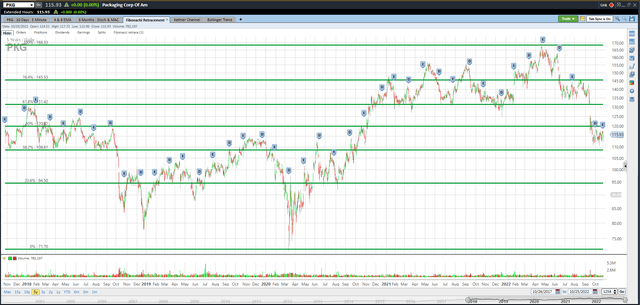

Good Technical Entry Point

I’ve added the green Fibonacci lines using the high and low of the past five years for PKG. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where PKG may be going. PKG may touch the $108.61 38.2% Fibonacci retracement level again or even go lower if the overall market pulls back in the next few weeks. However, I believe that PKG will trade above $120.00 by April for the reasons in this article. The 50% Fibonacci retracement level is $120.02.

The five most accurate analysts have an average one-year price target of $139.40, indicating a 20.2% potential upside from the October 25th closing price of $115.93 if they are correct. Their ratings are mixed with two buys, two holds, and one sell. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

Trend in Earnings per Share, P/E Ratio, Net Profit Margin, Targets, Meal Kits, and USA Production

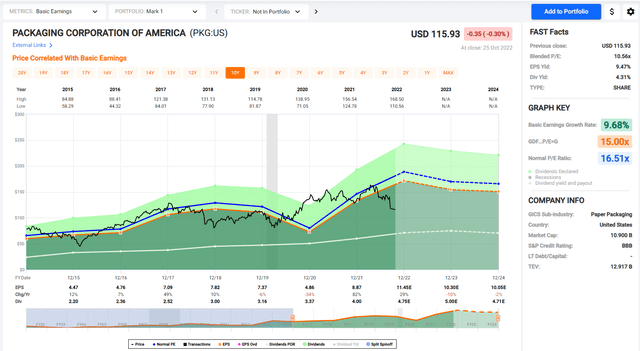

The black line shows PKG’s stock price for the past two decades. Look at the chart of numbers below the graph to see that PKG had trough earnings in 2020 during the pandemic. They bounced from $4.86 in 2020 to $8.87 in 2021, projected to earn $11.45 in 2022 and $10.34 in 2023.

The P/E ratio for PKG is currently 10.56. The average ratio for PKG over the past ten years is 16.51. I don’t think the P/E will rally back to 16.51 anytime soon. If PKG earns $10.30 in 2023, the stock could trade at $123.60 if the market assigns only a 12 P/E ratio.

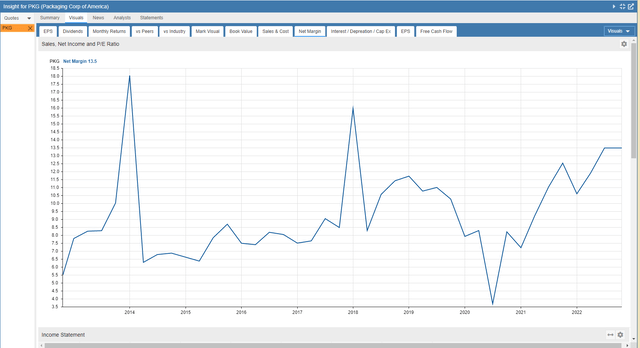

The trend in net profit margin shows improvement starting in the latter half of 2020. This metric is not at all-time highs but shows rapid progress.

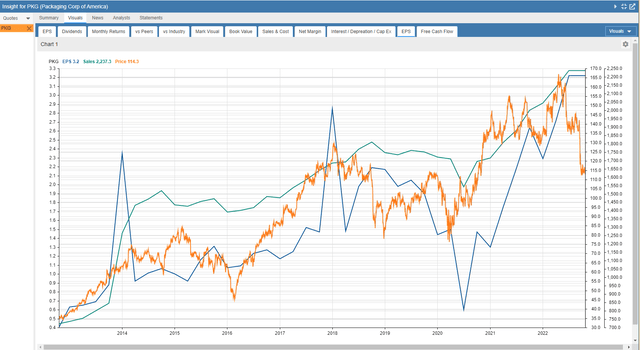

Sales (green line) and EPS (blue line) have grown nicely. Investors must patiently wait for the stock price (orange line) to catch up. I think the market may need one or two more post-pandemic earnings calls to value PKG higher.

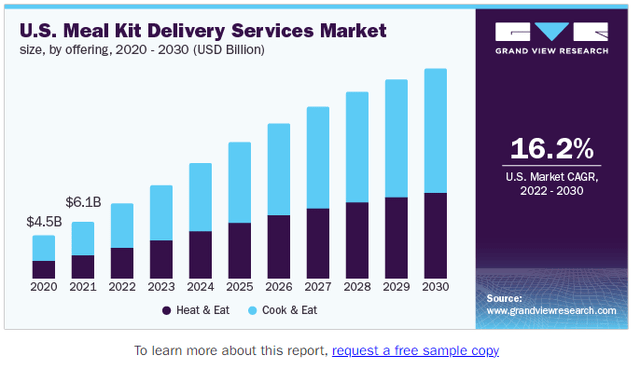

“The global meal kit delivery services market size was valued at USD 15.21 billion in 2021 and is expected to witness a compound annual growth rate of 17.4% from 2022 to 2030. Increasing preference for home-cooked and chef-cooked food among millennials is a major factor contributing to the market’s growth. The delivery service has been gaining popularity and adoption among generation Y and Z. The increasing preference for the product is driven by the benefits of homemade meals as they are more economical in comparison to takeout and home delivery services.” I expect this trend identified by Grand View Research will help drive enhanced sales and profits for PKG.

The pandemic is also increasing USA production as companies increasingly do not want to rely on China and long inconsistent lead times. This means more output for PKG.

PKG’s October 24th Press Release

PKG’s October 24th press release offered decent third quarter results but a muted fourth quarter outlook. Their $2.83 EPS was slightly ahead of the $2.80 guidance. Third-quarter revenue at $2.13B was somewhat behind the $2.2B consensus. Here is what I gathered from listening to their third-quarter webcast.

The third quarter upside versus the $2.69 from last year was primarily driven by higher prices and mix in both the Packaging and Paper segments. They had lower interest expenses and reduced share count. A lower tax rate helped further. These gains were somewhat offset by increased energy, repairs, materials and supplies, chemicals, and labor costs. Freight and logistics expenses were also higher. They had higher operating and converting costs as well as scheduled outage expenses. The company witnessed a 6% lower corrugated product volume. Higher than-average inventory volumes in the market still need time to correct.

I believe customers are moving from just in case back to just in time as supply chain problems dissipate. Analysts on the conference call seemed to be most interested in the channel’s inventory level. PKG has never seen inventory levels so high and does not believe they will return to normal for several quarters.

Mark W. Kowlzan, Chairman and CEO, guided fourth quarter EPS lower to $2.22. “At our Jackson, Alabama mill, we will complete the scheduled annual maintenance outage and the first phase of the containerboard conversion work on the No. 3 machine. Our box plants will have four fewer shipping days in the fourth quarter. We also expect a seasonally less rich mix in corrugated products and lower average export containerboard prices.

In our Paper segment, we will continue to implement our price increase that took effect in September; however, the volume will be lower compared to the seasonally stronger third quarter. Scheduled outage expenses will be higher, and we expect slightly higher operating costs, primarily labor and benefit expenses, along with anticipated colder weather resulting in higher energy costs. Considering these items, we expect fourth-quarter earnings of $2.22 per share.” Investors can read the entire press release for more details.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on PKG six months out. If PKG trades at $108.61 in the next few weeks, April’s $120.00 covered calls could be at or near $5.00. One covered call requires 100 shares of stock to be purchased. Selling April covered calls will allow the investor to collect dividends in January and April at $1.25 each. The stock will be called away if it trades above $120 on April 21st. It may even be called away sooner if the price is above $120, but that’s fine with me since I will have my capital returned sooner.

The investor can earn $500 from call premium, $250 from dividends, and $1,139 from stock price appreciation. This totals $1,889 in estimated profit on a $10,861 investment which is a 35.8% annualized return since the period is 177 days.

If the stock is below $120 on April 21st, investors will still make a profit on this trade down to the net stock price of $101.11. Selling covered calls and collecting dividends reduces your risk.

Takeaway

There was a pandemic slowdown, but the trend in EPS, P/E Ratio, Net Profit Margins, Targets, Meal Kits, and USA Production provides reasonable indications for stock price appreciation. Even if PKG’s stock price moves from $108.61 to $120 by April 20th, a 35.8% potential annualized return is possible, including covered call premiums and dividends.

Be the first to comment