Roland Magnusson

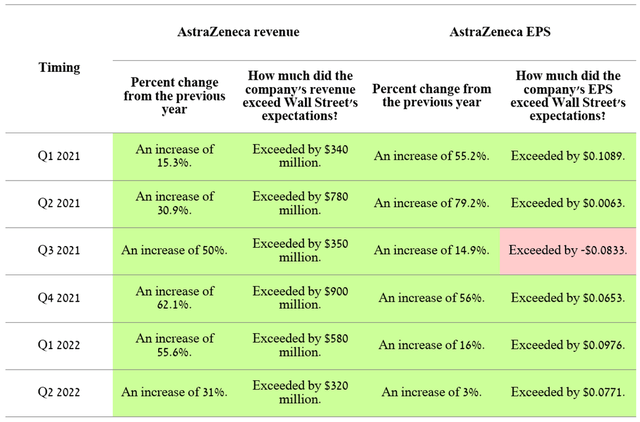

On November 10, 2022, AstraZeneca (NASDAQ:NASDAQ:AZN), one of the latest among major pharmaceutical companies, will publish its financial report for the third quarter of 2022. Announcing results in the second week of November is standard practice for a company and thus is the first indication that extraordinary revenue or net income data is not expected to be announced as companies with unusually good or poor results try to publish with a deviation of 5-7 days than usual. In recent quarters, sales of medicines and vaccines not only grew quarter by quarter, but beat analysts’ expectations, which is the first signal of an effective business model built under the leadership of Pascal Soriot.

Source: Author’s elaboration, based on Investing.com

Various factors, including sales of approved drugs, expansion of indications, development of new-generation product candidates capable of capturing a significant market share, and the percentage of successful clinical trials and drug approval without obtaining a CRL, had an essential impact on the development of the company’s financial position not only in the third quarter of 2022, but will continue to affect growth prospects for AstraZeneca’s key financials in the long term. This article will provide an analysis of the most important things from AstraZeneca’s business that stock market participants should consider.

AstraZeneca Approved Medicines Portfolio

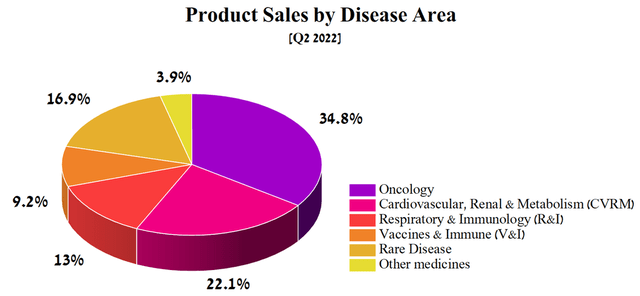

AstraZeneca’s focus is on five key therapeutic areas, namely oncology, cardiovascular, renal and metabolic (CVRM) diseases, respiratory & immunology (R&I), vaccines & immune therapies (V&I), and rare diseases, which together generated $10,771 million in the second quarter of 2022 and thus showing a 31% increase compared to the previous year.

Source: Author’s elaboration, based on quarterly securities report

Of these, the largest contribution to AstraZeneca’s revenue is made by drugs aimed at combating cancer and CVRM diseases. Thus, I believe that they have priority status for analysis before the publication of the quarterly report.

Successes of AstraZeneca’s division focused on cancer treatment

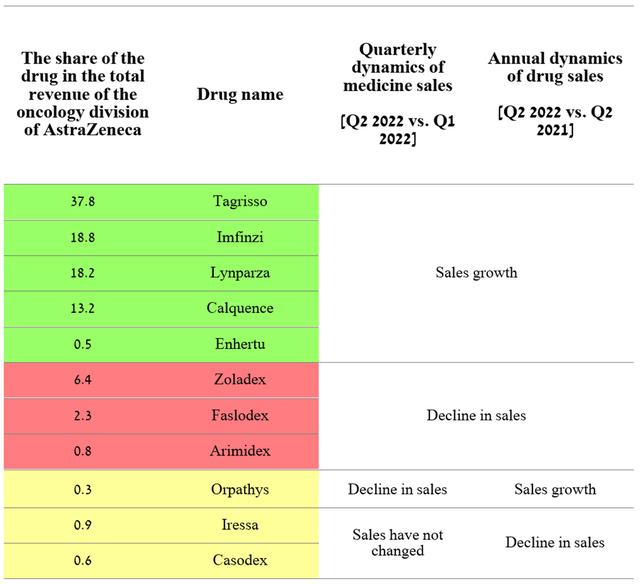

AstraZeneca’s industry-leading oncology portfolio brought in $3,701 million in Q2 2022, representing 34.8% of the company’s total revenue, while their combined sales posted a 20% year-over-year increase.

Source: Author’s elaboration, based on quarterly securities reports

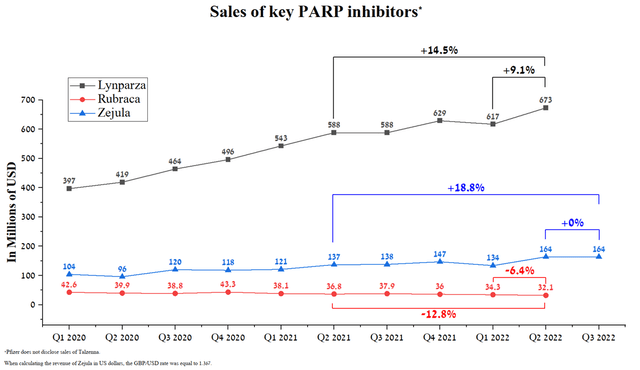

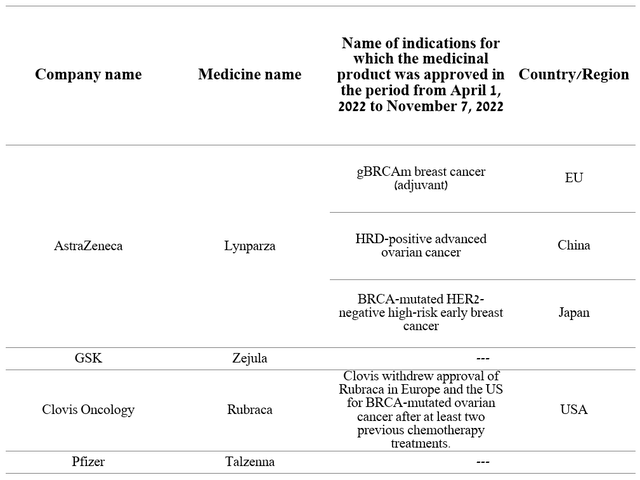

Although three medicines showed sales decline both quarter-on-year and year-on-year, five other drugs with a combined share of 88.5% of the oncology division’s total revenue continue to increase their market share strongly quarter-on-quarter. Lynparza is one such medicine approved for various types of cancer and brought in $673 million in Q2 2022, up 14.5% year-over-year. The main reason that contributes to the rapid increase in sales volumes is the status of the first PARP inhibitor to enter the market. Thus, AstraZeneca’s management is still gaining an advantage in capturing a larger market share compared to other pharmaceutical companies. Moreover, Lynparza remained the only PARP inhibitor for two years until 2017, and thus became the standard of care for many types of cancer at an accelerated pace. In the end, these advantages translate into stronger sales dynamics relative to competitors, which are GSK’s Zejula (NYSE:GSK), Clovis Oncology’s Rubraca (NASDAQ:CLVS), and Pfizer’s Talzenna (NYSE:PFE). For example, Zejula sales were £120 million in Q3 2022, showing no increase quarter-on-quarter, thus increasing the likelihood that Lynparza sales will maintain positive momentum not only in the short term but also until the loss of exclusivity in 2026. Another factor that indirectly indicates continued high demand for Lynparza is Merck’s Q3 2022 quarterly report (NYSE:MRK), in which the company reported that the alliance’s revenue from this drug was $284 million, up 15.4% year-on-year.

Source: Author’s elaboration, based on quarterly securities reports

Over the past seven months, Lynparza has continued to expand its indications more actively than its competitors. From the end of Q1 2022 to today, AstraZeneca has received three drug approvals in major markets. As a consequence, this increases the potential number of patients who may consider Lynparza as a treatment option and end up generating hundreds of millions of additional dollars relative to current values. At the time, GSK’s medicine had not received any approval in the same period of time, and Clovis Oncology withdrew its approval of Rubraca altogether in Europe and the US for BRCA-mutated ovarian cancer.

Source: Author’s elaboration, based on quarterly securities reports

AstraZeneca medicines targeting CVRM diseases

The company has an extensive portfolio of medicines targeted at cardiovascular, renal, and metabolic diseases that collectively affect hundreds of millions of people around the world. AstraZeneca’s already approved drugs and product candidates can not only halt the progression of the disease but also cure it, thereby reducing the global burden of CVRM diseases on the healthcare system and people.

Source: AstraZeneca

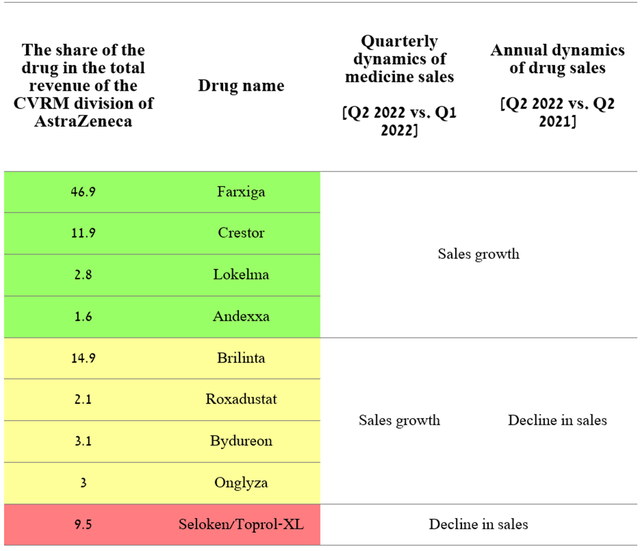

This segment generated $2,352 million for AstraZeneca in Q2 2022, accounting for 22.1% of the company’s total revenue, while their combined sales were up 16.3% year-on-year.

Source: Author’s elaboration, based on quarterly securities reports

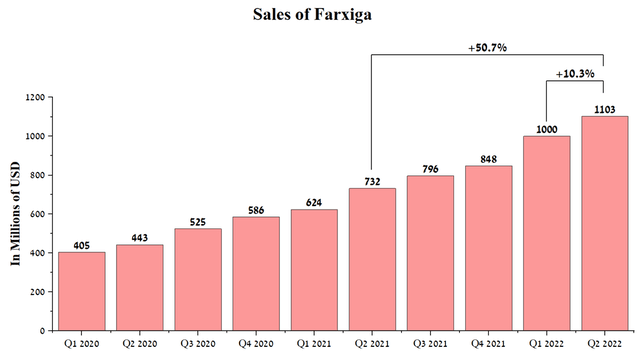

The dynamics of sales of the segment dealing with the commercialization of drugs for the treatment of CVRM diseases showed similar dynamics relative to the oncology segment. On a positive note, only Seloken posted sales declines both quarterly and year-on-year, while four other medicines with a combined share of 63.2% of the division’s total revenue were able to achieve tangible positive results. As the sector’s top-selling drug, Farxiga generated $1,103 million in sales for AstraZeneca in Q2 2022, up 50.7% year-over-year.

Source: Author’s elaboration, based on quarterly securities reports

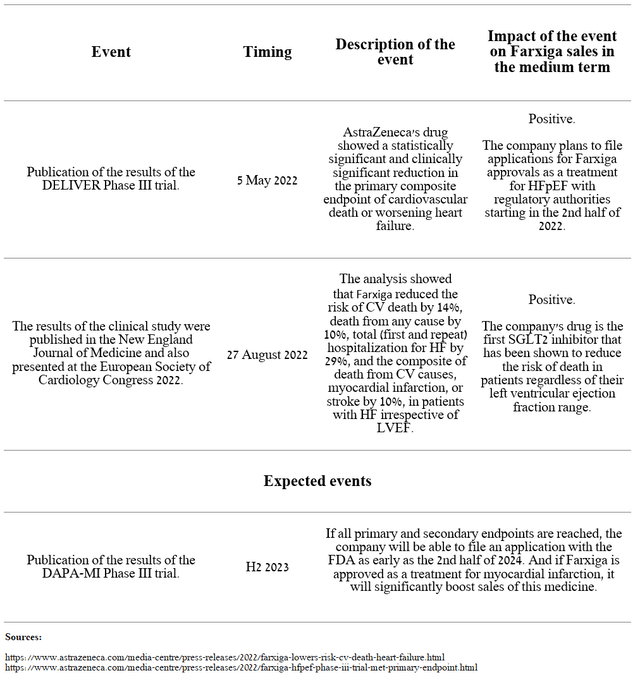

A significant increase in sales was due not only to the high performance of this drug relative to competitors but also to the rapid increase in brand share among SGLT2 inhibitors and the ability of the company’s sales department to promote Farxiga to millions of patients who suffer from diseases such as type 2 diabetes, heart failure, and kidney disease. I believe in maintaining the current sales pace of this drug in the medium term due to the expansion of its use in therapeutic areas with unmet medical needs and the publication of new data from clinical trials over the past year.

Source: Author’s elaboration, based on AstraZeneca press releases

I estimate Farxiga’s peak sales will be $8.4 billion by 2026, up $5.4 billion from 2021. As a result, this medicine will remain a cash cow for a very long time and will allow the company’s management to reinvest hundreds of millions of dollars to rejuvenate the AstraZeneca product portfolio and pursue a more aggressive M&A policy.

Conclusion

In the first three quarters of 2022, AstraZeneca achieved impressive results in terms of successful clinical trials and medicine approvals that could dramatically improve the quality of life for millions of patients. Moreover, over the past six quarterly reports, the company’s management has confirmed the effectiveness of its innovative business model through revenue and net profit growth year on year. In the second half of 2022, regulatory authorities in the US and Europe approved Enhertu for patients with metastatic breast cancer based on phase III clinical trials, which demonstrated a significant clinical advantage of this drug compared to competitors. In my estimation, Enhertu’s mechanism of action and the extensive clinical development program developed in partnership with Daiichi Sankyo will increase the number of indications in a relatively short period of time and also exceed EBITDA margin relative to pharmaceutical industry giants such as Bristol-Myers Squibb (NYSE:BMY), Novartis (NYSE:NVS), and Eli Lilly (NYSE:LLY). I believe that AstraZeneca will continue its trend of beating Wall Street analysts’ expectations and retain high investment interest from funds looking to find promising assets that can outperform the S&P 500 (NYSEARCA:SPY) in a time of deteriorating macroeconomic conditions.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment