Vedad Ceric/iStock via Getty Images

Introduction

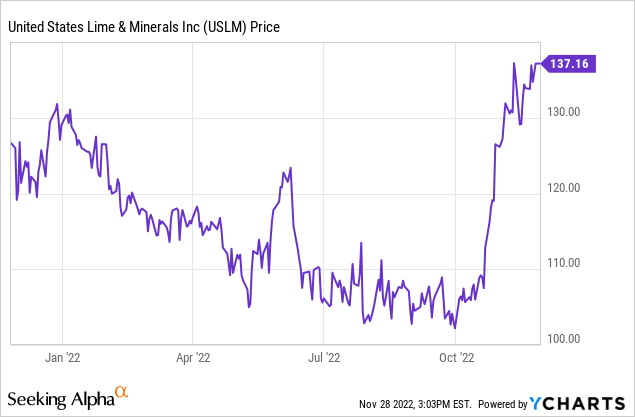

In an article published in April last year, I was becoming interested in US Lime & Minerals (NASDAQ:USLM) as I had expected the company to perform well on the back of the reopening of the economy as well as its strong cash position. Unfortunately its share price almost immediately started sliding, losing about 30% in the subsequent 15 months before sharply moving up again from the end of October on. The net result is relatively neutral: USLM is currently trading at almost exactly the same level it was trading at in my April article.

USLM is nicely plugging along

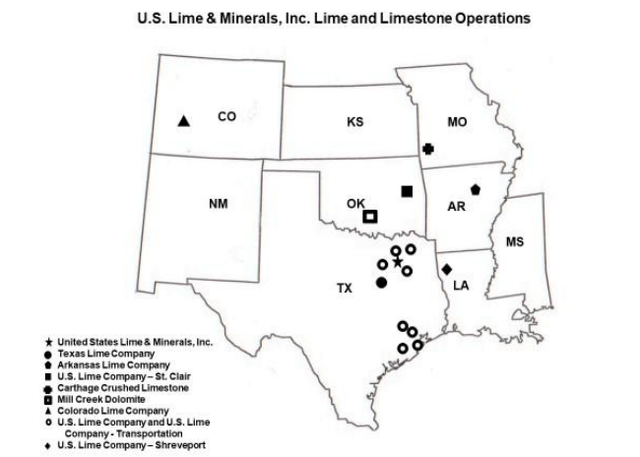

As a reminder, USLM is a producer of lime and limestone products used in the construction sector (aggregate) and by companies active in the oil and gas industry. USLM operates quarries and processes the limestone into the desired end product with some of the limestone being sold to paper and glass manufacturers as an input in the production process. Keep in mind the company’s activities are quite seasonal: The summer months are obviously the best months for USLM while the first and fourth quarters are pretty weak.

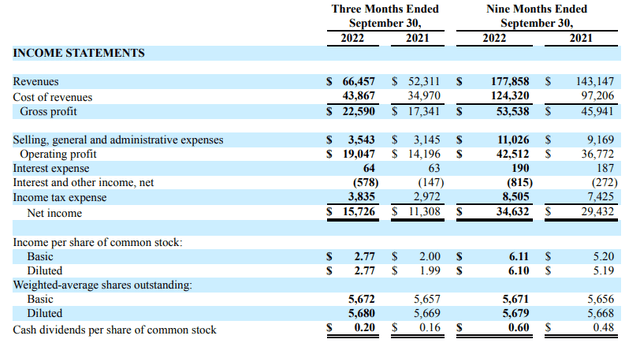

USLM reported total revenue of $66.5M in the third quarter, and was able to record a $22.5M gross profit on those sales. Thanks to its low overhead expenses (the SG&A expenses tend to be less than $15M per year), the pre-tax income was just over $19M resulting in a net income of $15.7M.

Based on the current share count of just under 5.7 million shares, the EPS was roughly $2.77 which is almost 40% higher than in the third quarter of last year. Additionally, the total EPS in the first nine months of the year came in at $34.6M for an EPS of $6.11. And while there’s a certain degree of seasonality, let’s not forget USLM was able to report an EPS of $1.35 in the final quarter of 2021. While it’s not easy to extrapolate this number and while that would still represent a QoQ EPS decrease of more than 50%, I think it’s fair to assume the full-year EPS will likely come in around $7.50.

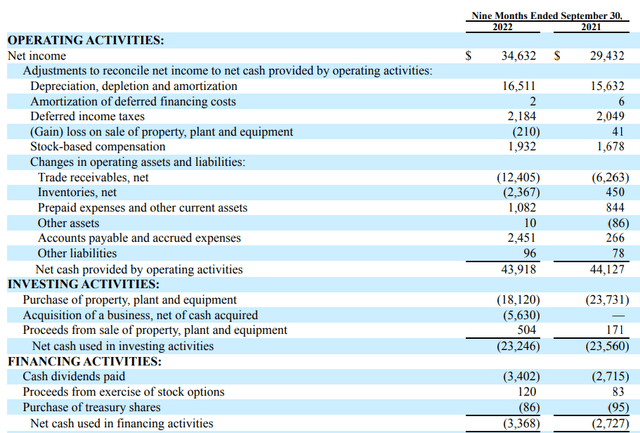

One of the more important elements at USLM is its strong free cash flow conversion rate. Looking at the cash flow statement below, you see there’s an operating cash flow result of $44M, but this includes a net investment in the working capital position to the tune of $11.1M. So on an adjusted basis, the operating cash flow is actually $55M. And even if you would deduct the $2.2M in deferred taxes, the operating cash flow would still be just under $53M.

With a total capex of $18.1M (excluding acquisitions), the underlying free cash flow result was $35M. Slightly higher than the reported net income, the FCF per share was approximately $6.20.

This will likely substantially increase in the final quarter as the capex during Q4 tends to be pretty low. Just for comparison sake, the Q4 2021 capex was just over $6M, which is about one-third of the capex incurred in the third quarter of this year. On top of that, USLM generated a positive operating cash flow of $12.9M which means the Q4 free cash flow was just over $6M or $1.1/share. This means we should aim for a $7.5 FCF and EPS performance for the entire financial year.

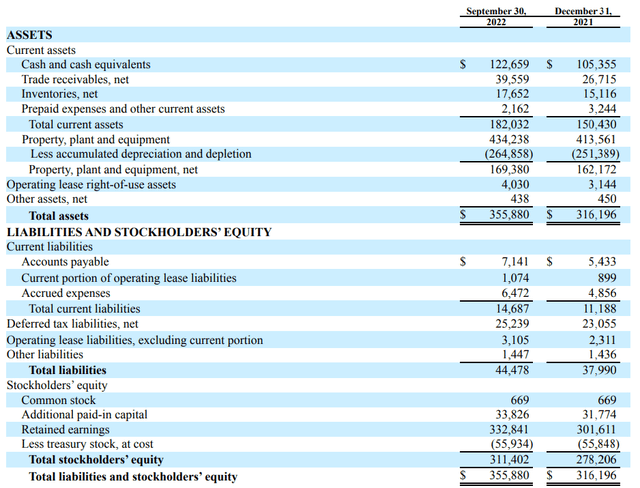

While this makes the current share price of almost $150 appear quite rich, let’s not forget USLM retains the vast majority of the free cash flow it generates. The company currently pays a quarterly dividend of just $0.20 for a dividend yield of just over 0.5%. Barring some smaller bolt-on acquisitions, USLM adds the free cash flow it generates to its balance sheet, and as you can see below, the cash position increased to in excess of $122M as of the end of September.

As there’s no financial debt (other than some lease liabilities), this also is the net cash position of the company and based on the current share count, the cash pile represents a value of in excess of $21 per share. That made the stock quite cheap at $110-120 but also helps to put the current share price into perspective. On an enterprise value basis, USLM is currently trading at a free cash flow yield of approximately 6%. That’s still not cheap but perhaps an acceptable valuation for a company with a large cash pile as it reduces the financial risk and allows it to move fast should (M&A) opportunities arise.

Investment thesis

Unfortunately I didn’t secure a long position during the share price weakness just a few months ago. I was keeping track of the stock but never pulled the trigger and I’m afraid I missed an excellent entry point. Now I know to be more decisive and just hit the buy button when the share price dips again. An additional bonus is USLM’s large (and growing) cash pile: Now interest rates are increasing, the company may actually enjoy from an interest income tailwind. In the third quarter, USLM reported a $0.6M interest income and I expect this to increase due to higher interest rates and a continuously increasing cash position. On top of that, seeing how the cash isn’t burning in the company’s pockets is a positive feature as well. Rather than just spending the cash, USLM is managing its treasury quite conservatively.

Be the first to comment