piranka

Summary

I still recommend purchasing Cyxtera Tech (NASDAQ:CYXT). My opinion on CYXT has not changed since I first wrote about it; rather, this short post serves as an update in light of the company’s 3Q22 earnings report. I have shortened this post to highlight more of my own thoughts, for more factual information readers can refer to the latest 10-Q. My assessment is that investors can still expect good positive returns from the current valuation.

Earnings overview

CYXT reported an increase in revenue of 5.4 percent, which came in at $186.6 million, and an adjusted EBITDA of 58.5 million (a 0.7 percent increase). The growth rate of recurring revenue was 5.2% higher year over year, while the growth rate of non-recurring revenue was 9.0% higher. The growth in revenue, measured in constant currency, was 8.0% higher than the growth that was reported to be 5.4%.

The primary cause of the decrease in EBITDA margins from 32.8% in the preceding quarter to 31.4% is the increase in the cost of power. MRR per cab reached a new all-time high of $1,456, but the percentage of core churn that occurred each month stayed stable at 0.8%. The good news is that despite the pressures from FX and inflation, CYXT has reaffirmed its sales and adjusted EBITDA projections for 2022. This suggests that the base case outlook is much stronger than the stock price implies, which creates an opportunity in my opinion.

Performance was not as bad as headline suggest

Results weren’t terrible, in my opinion. In fact, it proved that my thesis was correct. However, since August and after 3Q results, the stock price chart has displayed very weak price activity. The share price’s performance so far has been pretty depressing, if I am being completely honest. That said, I am going to evaluate this earnings objectively.

Let’s start with the earnings. Although CYXT’s performance wasn’t spectacular, I don’t think investors need to be too worried about a cash crunch any longer. Firstly, CYXT’s strong customer demand has resulted in $33.9 million in annualized core bookings, the company’s strongest quarter since 2Q19 and an increase of 21% over 2Q22’s $28.2 million. Management also remarked on the generally robust pricing in the industry, which is significant because CYXT normally prices its space at market rates.

That said, although CYXT passes on power costs to consumers, there is normally a 90-day lag which can harm margins due to substantial variations in power prices and FX, and this could continue in 4Q22. Although the quarter’s adjusted EBITDA margins were below my expectations, I believe the contributing factors—power, foreign exchange, and decreased occupancy (a 50bps decline sequentially)—could be overcome in the coming year. Zooming into occupancy rates, occupancy is at 75.5% when accounting for customer deals that completed at the end of 3Q but have yet to begin. In addition, management reported that, on a constant currency basis, CYXT is performing far better than expected.

Next, it is also encouraging to see that CYXT’s plan to convert to a REIT by January 1, 2023, remains on schedule. My expectation is that there will be no purging of earnings as a result of the conversion, that dividends may be paid (though this may not seem likely at first), and that CYXT will need further re-financing due to assets maturing in 2024. Over told, I anticipate CYXT to be an opportunistic real estate investment trust.

Valuation update

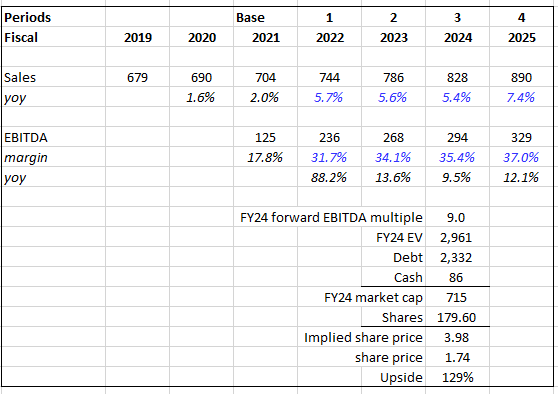

My model has not changed, and the price target for FY24 remains at $4. What I do want to emphasize is that the stock is extremely cheap if one believes CYXT will continue to grow at a mid-single-digit rate and margins will reflect management’s long-term guidance.

Furthermore, based on the share price action and valuation re-rating (downwards), it appears oddly unjustified. If there is any near-term good news, we could see a violent rerating upwards to where it should be trading. As a result, I believe the current market price still represents a good entry point for investors to enjoy very attractive long-term IRRs.

Author’s calculations

Conclusion

The market price of CYXT shares is currently below the company’s fair value. An organization’s long-term prosperity and market dominance are affected by a variety of factors. Surrounding yourself with intelligent, hardworking people is one of the most important things you can do to ensure the success of your business. In that case, CYXT is where you can get it. Additionally, CYXT has top-notch infrastructure and is widely recognized in the global trade community. Assuming CYXT achieves my growth and profitability projections, I think the stock will be profitable for investors who are willing to ride out the short-term share price volatility.

Be the first to comment