Eric Francis

Even in the 21st century, Berkshire Hathaway (NYSE:BRK.B) remains a popular stock for long-term investors. The company remains carefully managed by Warren Buffett and one must give credit to the increasing exposure to the tech sector. The company maintains a fortress balance sheet, though one could make the argument that it is being too conservative given the attractive valuations of the equity markets. BRK.B is a solid investment pick for those looking for an ideal blend of value and risk management.

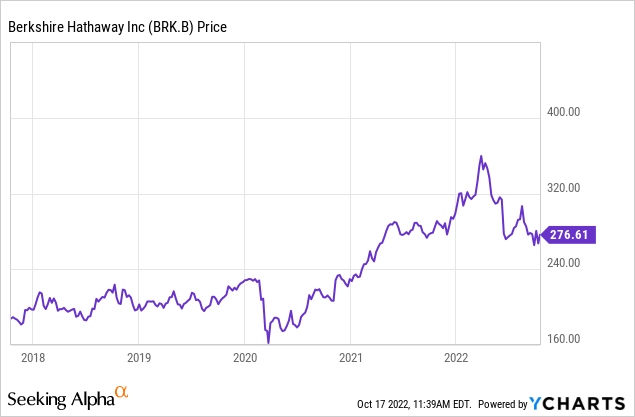

BRK.B Stock Price

After peaking at around $362 per share in March, BRK.B has pulled back nearly 25%.

I last covered the stock in September 2021 where I explained how I valued the stock based on a combination of operating earnings and the equity portfolio. It is time for another look at the valuation and outlook.

Berkshire Hathaway Stock Key Metrics

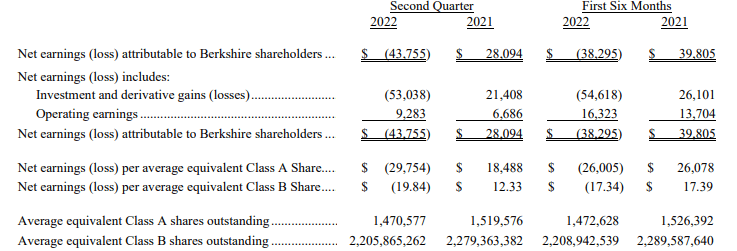

BRK.B’s latest quarter showed a continued recovery from the pandemic, though that may not be immediately obvious looking at just the earnings per share numbers. Due to the market volatility, net earnings per share swung deeply negative.

2022 Q2 Earnings Release

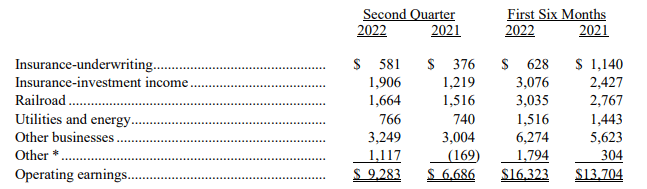

Earnings per share includes non-cash losses from the equity portfolio, which I doubt many investors consider to be representative of ongoing operating earnings. Instead, investors should focus on operating earnings which grew by 38% in the quarter to $9.3 billion. In particular, higher interest rates boosted insurance-investment income.

2022 Q2 Earnings Release

BRK.B ended the quarter with its typical fortress balance sheet, highlighted by $147 billion of insurance float. That was relatively unchanged from the end of 2021. The company repurchased $1 billion of stock in the quarter, bringing its year-to-date total to $4.2 billion. The company used its free cash flow instead to add to its stake in Occidental Petroleum (OXY).

2 Reasons To Buy Berkshire Hathaway Stock

There are two obvious reasons to own BRK.B here, the first being that of the strong balance sheet. This rising interest rate environment can hurt the stocks of over leveraged companies, but BRK.B does not face the same risk. To the contrary, BRK.B can benefit from rising insurance-investment income and its cash-rich balance sheet may enable it to make opportunistic investments as they arise.

The second reason is valuation. I calculate earnings by adding operating earnings and an appropriate contribution from the equity portfolio. To calculate that contribution, I assume 5% average annual returns from capital appreciation. I do not include dividends because that is already included under operating earnings. The portfolio recently stood at $319 billion, leading to a projected $16 billion in profit contribution. Assuming around $32 billion of operating earnings this year, BRK.B is trading at around 13x my calculation of earnings. That valuation does not include the cash hoard. For a company that can probably grow at a 5% to 10% clip over the long term, that multiple is arguably too low. I can see the stock re-rating to 20x earnings over time, implying around 50% potential upside from multiple expansion alone.

1 Reason To Sell Berkshire Hathaway Stock

One potential reason to sell (or avoid) the stock may be surprising: it is too conservative. For investors looking to take advantage of the market volatility in growth stocks, BRK.B might not be the ideal investment.

In 2020 amidst the pandemic crash, BRK.B mainly remained with cash on the sidelines and did not take advantage of the plunge in stock prices. The company has been making some equity investments as of late, but the insurance float remains high at $147 billion. That means that the company could take advantage of low stock valuations if it wanted to, but a reasonable fear is that it won’t.

One must give the company credit for its increasing exposure to tech stocks. Investors likely are already familiar with the $130 billion investment in Apple (AAPL) which has been an absolute home run for the company. But investors may be less familiar with the $5 billion investment in Activision Blizzard (ATVI) which can be viewed as a preliminary investment in Microsoft (MSFT) given the pending acquisition. I would not be surprised to see BRK.B eventually add to that position – perhaps after the acquisition is complete. But the question is: will it be at these discounted prices or after tech stocks recover?

Bottom Line

Whether or not one buys BRK.B may depend on what they are looking for. If they are looking for an undervalued stock that can grow at a respectable pace over the long term, then the stock looks compelling at current levels. If on the other hand they are looking for the best way to take advantage of the crash in tech stocks, then BRK.B might not be the best investment vehicle. I think every portfolio could have an allocation to BRK.B as there is enough to satisfy most investors, though the main catalyst (aggressive deployment of the cash hoard) might not be on the table.

Be the first to comment