Justin Sullivan

Walgreens Boots Alliance (NASDAQ:WBA) is one of the longer-running pharmacy companies in the United States. Walgreens has been in business since the early 1900s and thrived during a period of rapid change and consolidation in the industry where local mom and pops were largely replaced with national chains.

Walgreens played its cards well and ended up being one of the big winners to emerge within the industry. That also has generated fantastic returns for shareholders. An investment in WBA stock 40 years ago today would be up 4,500%, with that return nearly doubling again if you include dividends.

Speaking of dividends, Walgreens is a long-running Dividend Aristocrat that has increased its dividend for 47 consecutive years. However, recently, the company’s dividend increases have petered out, with the latest one being a mere 0.5% bump. That’s in-line with the company’s weakening profit picture, and a stock chart that looks downright sickly.

What’s gone wrong for Walgreens Boots Alliance, and can this once great retail enterprise get back on its feet again?

Walgreens’ Fundamental Problem: Falling Margins

Oftentimes, it takes a fair bit of digging around to figure out what has gone wrong with a company’s business.

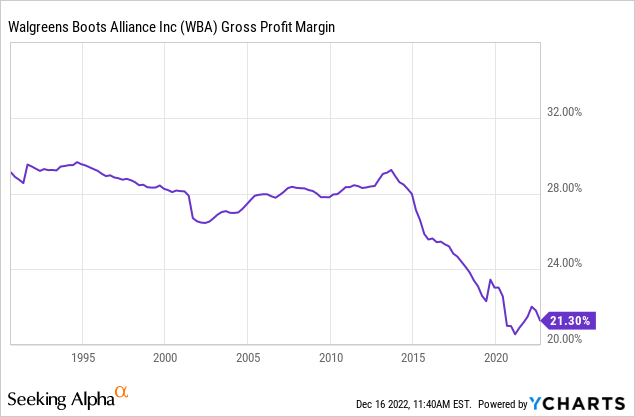

In Walgreens case, however, we can get to the root of the problem with just one chart. Here is 30 years of Walgreens’ gross profit margin:

From the 1990s on through around 2014, Walgreens earned a consistent 28% gross margin, give or take a couple of points. There was a bit of erosion in the late 1990s, but Walgreens was able to turn things around in the 2000s and get margins back up to the high end of their range by 2013.

And then things just fell apart. From 2014 onward, Walgreens’ gross margin has collapsed in virtually a straight line. Even during the pandemic when Walgreens stores were delivering essential health services in the crisis, it failed to move the needle for the company’s profitability.

More Than Just A Retail Problem

At first glance, Walgreens’ problem might seem fairly simple. It’s getting harder to maintain profits on the front part of the store. Walgreens sells a lot of chips, soda, and other convenience goods to customers who are in the store anyway for other reasons. Convenience stores are historically a good business as there are plenty of people willing to pay a premium to get a product quickly and/or who make impulse purchases.

However, this business has come under some pressure. For one thing, the rise on online commerce has reduced the number of trips people may make to their nearest corner store. If nothing else, the availability of the online option limits the extent to which Walgreens and other convenience stores can mark up their products.

Home delivery options provide an additional concern. Before, the worry was online ordering, but that was often still a 2-day delivery. Now, however, the delivery services make it easy to carry out impulse purchases from the couch and have it arrive in minutes. This further diminishes the potential market that Walgreens can go after with the front of its stores.

To be clear, the convenience business isn’t going away. A lot of people will still be walking into Walgreens stores to get access to the company’s assortment of health care products and services. While there, they might as well pick up some retail goods too. However, the size and margins on this business will likely continue to be challenged compared to where they were a decade ago.

If that were the whole story, Walgreens’ problems would be more readily solvable. However, my understanding is that the back half of the store — the pharmacy — is actually facing worse profit margin pressures. This comes about because the pharmacy benefit managers (PBMs) have increasingly gained clout within the drug delivery supply change and have now wrestled a significant amount of pricing away from the pharmacies.

This is a particular problem for Walgreens since it doesn’t own its own PBM. That’s unlike key rival CVS (CVS) which bought Caremark many years ago and has overseen its rise to being the largest PBM in the country. That, in turn, is part of CVS’ broader strategy of buying up or partnering with major companies across virtually all of the pharmaceutical drug and insurance pipeline. In doing so, CVS has diversified its business and thus reduced the impact from weakening pharmacy results on its overall business.

Walgreens’ efforts to diversify its own operations, such as going into the UK market with the Boots deal, have proven less successful. However, Walgreens is now moving to adapt to changing conditions.

Strategic Repositioning

Walgreens’ management appears to be aware of the issues with the company’s existing business strategy.

To that point, it is shifting its strategic investments around. Walgreens attempted to sell its Boots business earlier this year, with reports suggesting a possible valuation north of $10 billion. The deal was scuttled, at least for the time being, due to the poor conditions in equity markets which worried potential buyers. That said, Walgreens seemingly had the right idea in mind trying to sell that business, and I wouldn’t be surprised if it goes back on the block once financial market conditions improve.

On the other side of the ledger, Walgreens has been making various investments in other health care businesses including home care and primary care providers. Walgreens has announced subsequent deals in this space recently.

Analysts have started to notice. Cowen upgraded the stock in November, for example. It offered the insight that by fiscal year 2025, U.S. retail will make up just 66% of Walgreen’s operating income, down sharply from around 80% today. Cowen is hardly alone in that improving view, either, as that was the third upgrade Walgreens stock has received recently.

Smart Capital Allocation

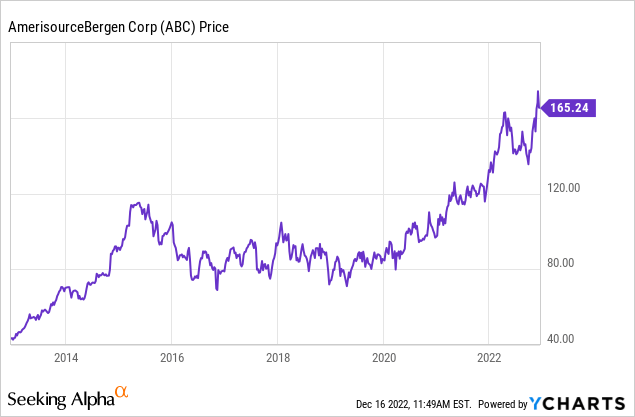

One clear positive for Walgreens is that it sold $1.0 billion of AmerisourceBergen (ABC) in recent weeks. I’d note that Walgreens managed to sell near ABC stock’s all-time highs, and it has been a surprising source of strength despite the bear market this year:

Walgreens will be using the cash raised from this sale to pay down debt and fund recent acquisitions.

This is not a huge amount of cash compared to Walgreens’ $34 billion market cap. However, it is incrementally positive to take some cash off the table off in this holding at its highs and plow it into retiring debt given the weakening conditions in the bond market.

Adding to that, Walgreens merely trimmed its holding in AmerisourceBergen from 20% to 17% of the whole outstanding company. The firms’ strategic relationship will remain as is. From the press release announcing the stock sale:

“The sale has no impact to the long-term partnership between the two companies. Walgreens Boots Alliance remains fully committed to the strategic, mutually beneficial relationship with AmerisourceBergen, which has been a strong and trusted partner since 2013. Chief Operating Officer, International of Walgreens Boots Alliance, Ornella Barra, will continue to serve on AmerisourceBergen’s Board of Directors.”

Rounding things out, Walgreens’ remaining stake in AmerisourceBergen is worth almost $6 billion. With Walgreens’ whole market cap being $34 billion, the value of ABC stock makes up a substantial piece of its valuation. And, notably, as long as AmerisourceBergen continues to gain momentum, it offsets a significant piece of the weakness in Walgreens’ core business.

WBA Stock Verdict

Walgreens has its fundamental problems, namely falling profit margins and an unclear longer-term business outlook. The company needs to pivot and reinvent itself to a degree.

The good news is that this is fully reflected in the valuation. Shares have traded at between a 6x and 8x P/E ratio for the year. That’s not just a post-Covid anomaly either. WBA stock had already fallen to below 10x earnings prior to the onset of the pandemic.

The company’s current 4.9% dividend yield is also close to the highest that it has offered. For a Dividend Aristocrat, a starting 4.9% dividend yield is quite a feat.

This makes Walgreens a classic value stock. Any sort of good news on the strategic front, such as a sale of Boots, could lead to a significant appreciation in the share price. Management is aware of the problems with the business and is actively trying to turn things around.

There’s no guarantee that they’ll be successful. Oftentimes, turnarounds fail to turn. However, at this valuation, things are priced well for prospective shareholders, and the yield is certainly rewarding enough for investors patient to hold shares during this down period. Walgreens is a mess, but it’s a slow-moving one that still throws off a ton of cash flow. That offers multiple ways to win from a starting 8x P/E ratio.

Be the first to comment