DNY59/iStock via Getty Images

Investment Thesis

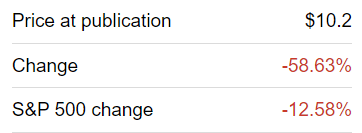

BlackBerry (NYSE:BB) continues to slide lower in the year since I wrote my previous article, where I articulated that it’s difficult to get excited.

BB author’s work

At the time, BlackBerry’s share was $10. And the climb back to there presently feels somewhere between insurmountable and unrealistic. Particularly, as we look ahead to its Q3 2023 results and the near term.

I make the argument that even though the share price is down significantly in the past year, BlackBerry is expensive for what’s on offer.

I maintain that investors would do well to avoid this name as we head into Q3 2023 earnings.

What’s Happening Right Now?

The biggest headwinds companies are facing right now is that the macro environment has become unfavorable.

Given a higher interest rate environment, companies are being forced to reconsider what’s absolutely mandatory for their own survival versus what’s going to potentially deliver improved results down the road. With the latter being given a wide pass.

This is not the time for companies to go out and embrace new technologies. Even if there’s a secular tailwind for IoT, companies are approaching any investment in their own business with heightened caution.

Similarly, there’s been a widely reported elongating sales cycle amongst cybersecurity firms. Incidentally, I’ve reported on this already with CrowdStrike (CRWD) and Fortinet (FTNT).

The problem for BlackBerry is that even as BlackBerry puts a lot of energy into emphasizing its IoT prospects, its IoT business makes up less than a third of its total business.

And even then, it’s not growing that fast, to change the overall direction of BlackBerry’s revenue growth rates.

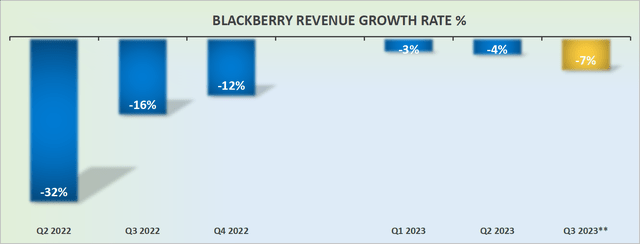

BlackBerry’s Revenue Growth Rates Show No Promise

BlackBerry’s Q3 is expected to come in around negative 7% y/y. It may end up slightly better than this by about 300 basis points, but one thing is clear. BlackBerry’s topline is moving in the wrong direction.

Even though, Q3 2022 was already an easy comparable period. So, not only is BlackBerry’s topline shrinking, but its balance sheet has started to become restrictive.

Balance Starts to Become a Noose

In last year’s Q3, BlackBerry had an ever-so-slightly net cash position. This time around, as we head into Q3 2023, I believe that its balance sheet will be in a worse shape.

After all, recall, that BlackBerry finished its most recently reported Q2 2023 period with an ever-so-slightly net debt position. All the while BlackBerry is unlikely to have been free cash flow positive in the current quarter.

What this means is that with the passage of time, with an ever more restrictive balance sheet, and BlackBerry struggling to be cash flow positive management will be left with few options on the table, asides from one avenue.

BB Stock Valuation – Equity Dilution on Table

I believe that BlackBerry’s run-rate cash burn is about $80 to $100 million. Thus, in practical terms, BlackBerry has less than 24 months left before it must start to think about its available liquidity.

And as a business, you can’t leave it to the last moment to raise funds, BlackBerry must get ahead of crucial liquidity events.

And this brings me to the main critical point facing BlackBerry. BlackBerry carries approximately $500 million face value convertible debentures. These debentures mature in November 2023.

Given that these convertible debentures are trading below the convertible price, I can’t imagine that Fairfax (OTCPK:FRFHF) will be interested in refinancing these convertible notes. And even if they do get refinanced, the coupon will be sure to move closer higher than 5%, rather than the current 1.75% coupon.

The Bottom Line

Last year, I concluded my BlackBerry article by saying:

BlackBerry’s shareholders have shown themselves to be a very resilient and forgiving group of investors. Even if the outlook is less than desirable, investors aren’t likely to turn their backs on BlackBerry after this quarterly performance.

I suspect that in two days’ time after BlackBerry’s Q3 2023 results come out, I could write the same thing again, and it would once again be true. For some reason, BlackBerry’s shareholders are a remarkably united group of investors.

Nevertheless, I maintain that over the next 12 months, if BlackBerry’s prospects don’t dramatically improve, it will be forced to raise funds by diluting shareholders.

Be the first to comment