imaginima

The case of Enbridge (NYSE:ENB) is quite unique. ENB is a well-run midstream operator with a long track record of strong execution. The company continues to identify numerous project opportunities to reinvest capital. While that does solidify the growth prospects over the near and medium term, this comes at a time when top tier pipeline peers are beginning to prioritize share repurchases. At recent prices, ENB is still yielding nearly 7%. While the prospects for multiple expansion may be more muted as compared to peers, I view the dividend and its future growth as being secured – those looking for a reliable dividend payer without the typical midstream K-1 tax form may find ENB to be a welcome addition to their dividend portfolios.

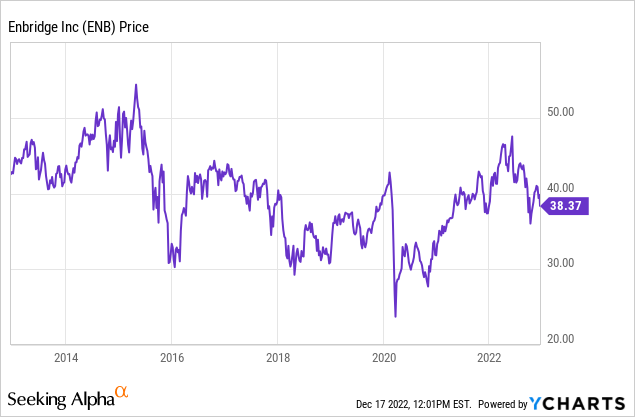

ENB Stock Price

ENB has seen its stock more or less stay in place over the past decade as much of the returns have come from its dividend.

I last covered ENB in April 2021 where I explained why I was not yet buying the 7% yielding stock. The stock has since delivered double-digit total returns and given that I have since changed to view the midstream sector more positively, I am now upgrading ENB to a buy.

ENB Stock Key Metrics

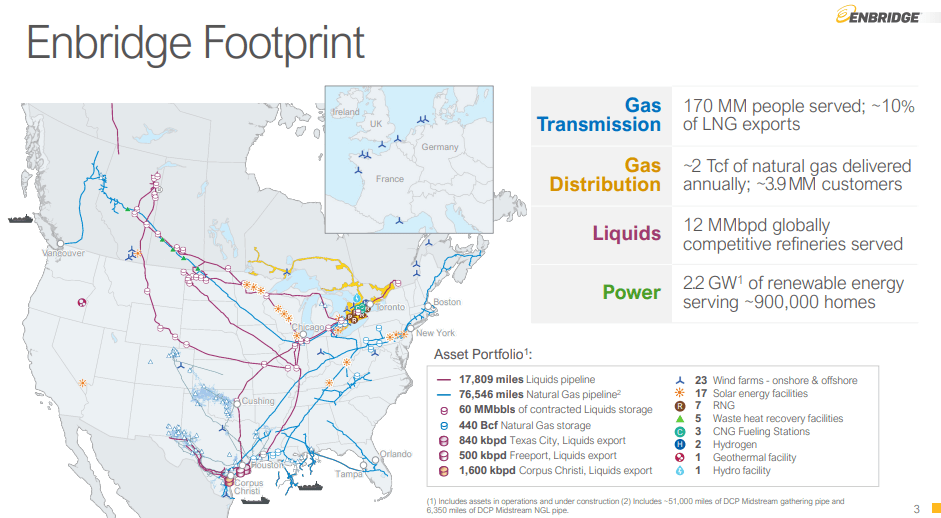

ENB operates one of the largest midstream pipeline footprints in North America.

December Presentation

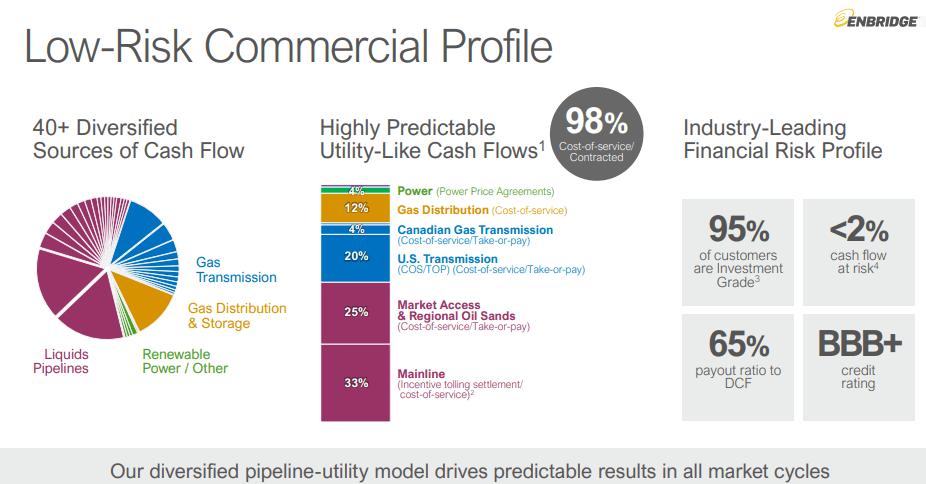

98% of its cash flows come from cost-of-service or contracted sources, making the company very much like a utility business model.

December Presentation

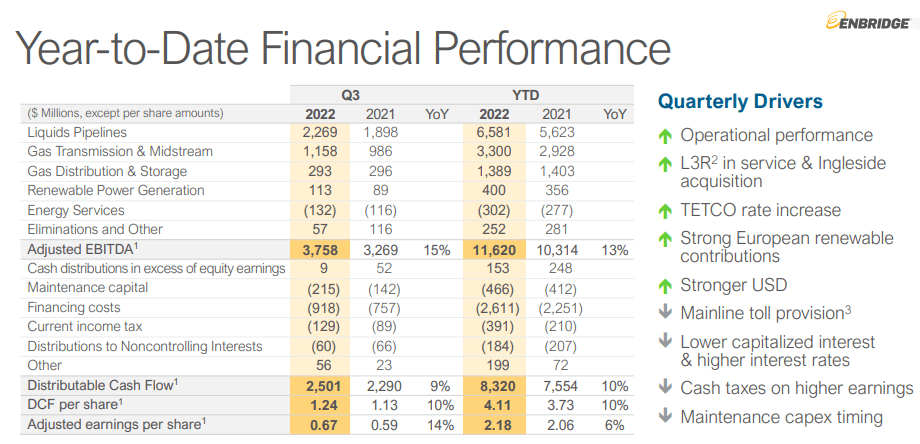

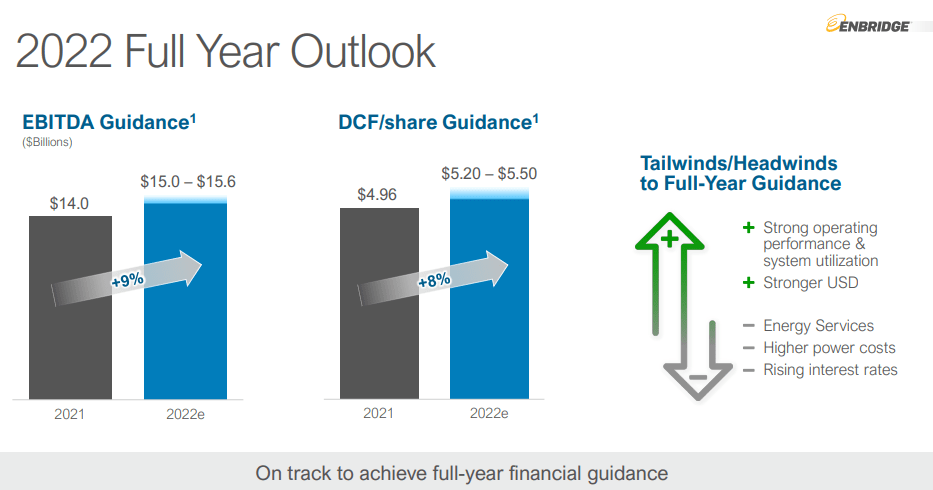

In 2022, ENB has benefitted from solid volume growth as energy prices remained high. ENB was able to grow cash flows by a double-digit rate on a per-share basis this year. The strong operational performance was more than enough to compensate for the higher costs from higher interest rates.

December Presentation

On the conference call, management stated that it expects to come near the top half of their EBITDA guidance range and just above the midpoint of their DCF per share guidance.

December Presentation

Is ENB Stock A Buy, Sell, Or Hold?

Why am I upgrading the stock now? I have already written bullish reports on peers Enterprise Product Partners (EPD) and Magellan Midstream (MMP). The idea is simple: even after the recent plunge, oil prices remain at multi-year highs.

Seeking Alpha

Because energy prices have remained high for a considerable amount of time, I expect that the counterparties have greatly improved their balance sheets and therefore their creditworthiness to pipeline operators like ENB. That helps ease any bearish thesis regarding the ability of counterparties to make payment, helping to support higher valuation multiples.

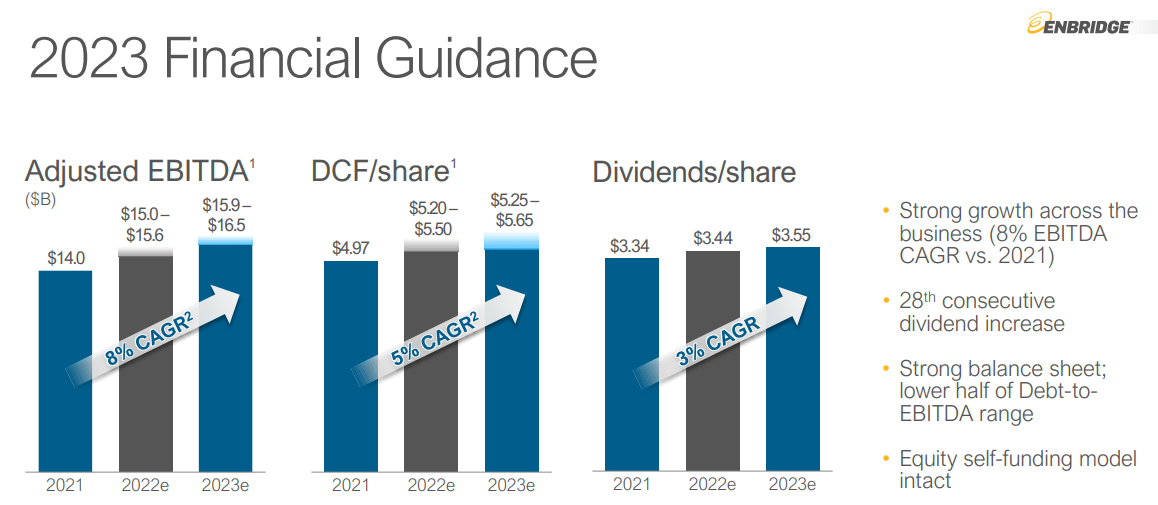

Looking ahead, ENB has already guided for continued growth next year.

December Presentation

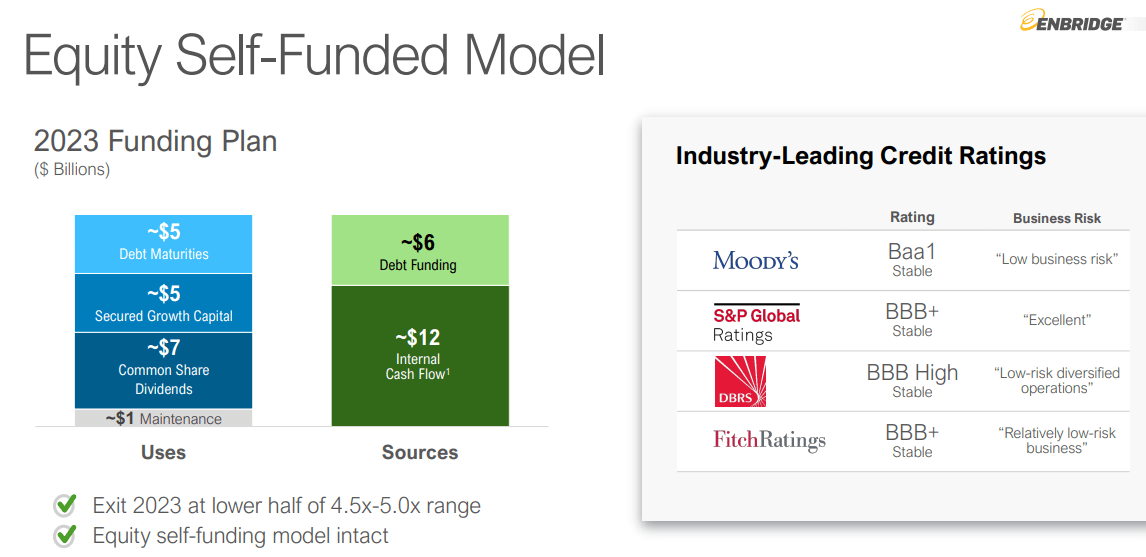

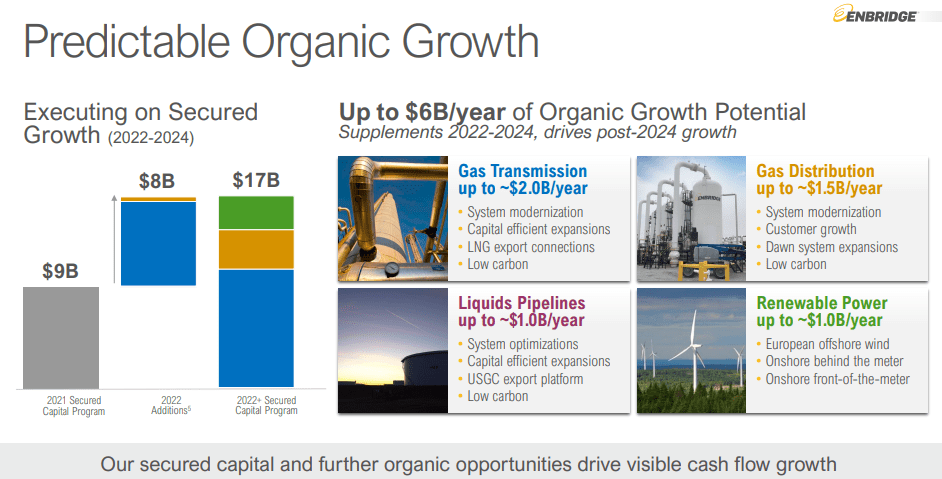

Where will that growth come from? Whereas many peers like EPD and MMP appear to have focused on returning cash to unitholders through unit repurchases, ENB has stuck loyal to the historic strategy of reinvesting in growth projects. ENB has targeted around $5 billion of growth projects in 2023 which it expects to fund primarily with internal cash flow.

December Presentation

The actual number might even come higher, as management has stated that it has identified up to $6 billion of organic growth potential per year through 2024.

December Presentation

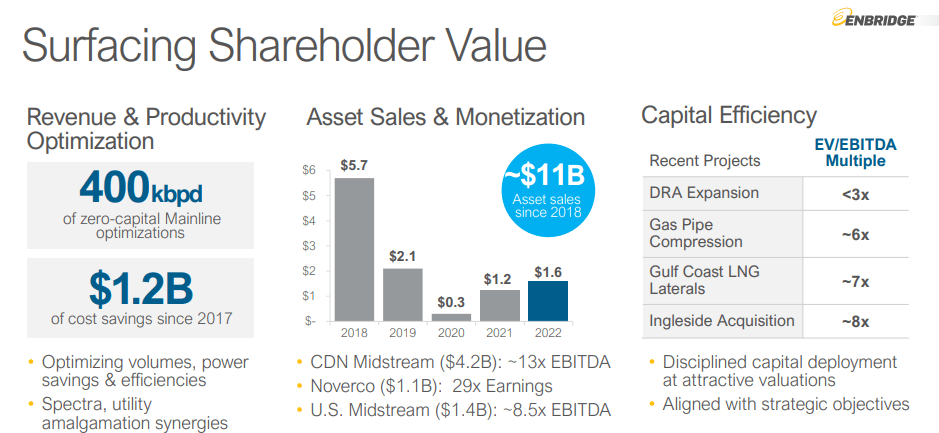

Should investors be happy to see numerous reinvestment opportunities and management’s willingness to invest in such growth projects? The answer is not so simple. I estimate ENB to trade at around 9x EV to EBITDA. It has derived stronger returns than that on recent projects.

December Presentation

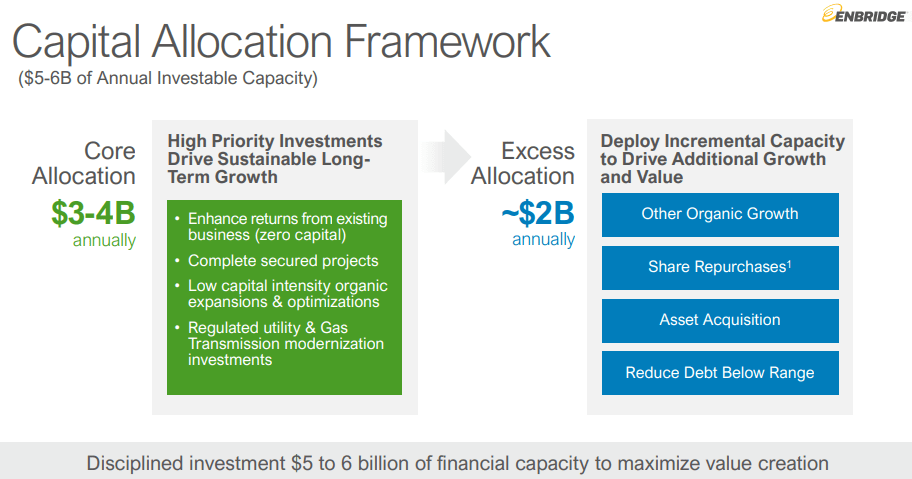

That means that growth projects are likely to deliver higher returns from an accretion perspective than share repurchases, but that may be missing the point. Where share repurchases might lag in terms of accretion, they may compensate from the potential for multiple expansion. In my experience, stocks that consistently repurchase their shares tend to eventually realize considerable multiple expansion at some point or another. That multiple expansion could create far greater value on a per-dollar basis than growth projects could. For example, $4 billion of annual growth projects is expected to lead to around 5% in DCF per share growth. But if ENB can achieve a 5% dividend yield due to share repurchases, then that would instead lead to 40% growth in the stock price. For that matter, debt paydown, even though it would be even less accretive than share repurchases, may arguably be the most attractive use of capital due to it also having a high potential to lead to multiple expansion (lower debt means lower risk which may warrant higher multiples). Management appears to have placed organic growth opportunities at the top of their capital allocation priorities, ahead of both share repurchases and debt paydown.

December Presentation

While ENB has been repurchasing some stock this year, those repurchases have been very modest at just $151 million this year (for reference, this is a $77 billion company). On the conference call, the commentary also seems to support that view, with management saying “under our self-funded model we still have ample investment capacity available for further organic growth, tuck-in M&A, debt repayment or even share buyback.” That phrasing makes clear that their priority is growth projects.

Yet even so, this stock looks cheap. The stock is yielding around 7% and has around 3% projected forward growth. Absent yield compression, the stock is priced for around 9% to 10% annual total returns, but even in today’s market, stocks with 3% reliable growth rates tend to trade around the 5% to 6% yield range, implying some upside. Unsurprisingly, a shift towards greater share repurchases or debt paydown may be an important catalyst for multiple expansion.

What are the risks? Currency risk should be considered. ENB is a Canadian company and thus pays its dividends in Canadian dollars. The strengthening US dollar has led to fluctuations in the dividend payment, even though ENB is consistently growing its dividend. Another risk is that of the sustainable growth rate. Midstream operators have historically sustained growth through reinvesting in their assets. If local governments continue to prioritize renewable energy sources, then ENB may be unable to reinvest in such projects due to regulatory backlash. There is also the risk that energy prices fall from here, which would nullify my aforementioned view that the counterparty risk has been addressed. I view ENB as a buy at today’s prices as this is a market which has emphasized profits and return of cash to shareholders. I would not be surprised if ENB delivers double-digit returns from here as investors welcome the high and growing yield without the K-1 tax form.

Be the first to comment