DarrelCamden-Smith

Just over two months ago, I wrote on Torex Gold (OTCPK:TORXF), noting that while it was not without risk given its single-asset producer status and transitioning to a new mine, the stock looked like a Speculative Buy under US$6.45. Since then, Torex has seen significant outperformance, up more than 80% in a span of just over six weeks. While this is great news from a momentum standpoint, with Torex back above its key moving averages, a large portion of the valuation gap between it and its peers is now closed. Hence, I don’t see any way to justify chasing the stock above US$11.80. Let’s take a closer look at recent developments below:

RopeCon – ELG Operations (Company Website)

Q3 Results

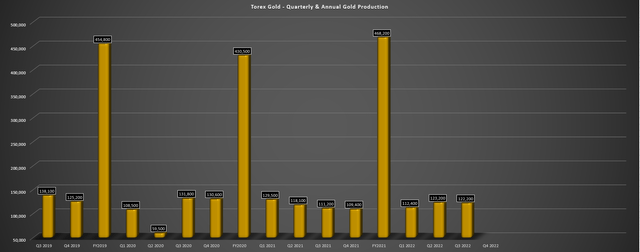

Torex Gold released its Q3 results last month, reporting quarterly production of ~122,200 ounces and sales of ~119,000 ounces at all-in-sustaining costs of $1,059/oz. This impressive performance was driven by higher tonnes mined from El-Limon Guajes [ELG] Underground, elevated processing rates, and another quarter of very strong recoveries. The result is that Torex is in a position to easily deliver into its FY2022 guidance of 430,000 to 470,000 ounces, and might be able to beat the top end of this guidance with a strong finish to the year (~357,800 ounces produced year-to-date). Of note is the fact that this will be Torex’s fourth consecutive year delivering on guidance, which has not been an easy feat given two years of headwinds from a global pandemic.

Torex Gold – Quarterly & Annual Production (Company Filings, Author’s Chart)

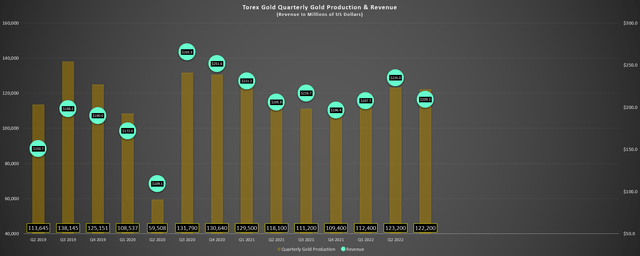

Digging into the quarter a little closer, Torex mined 143,000 tonnes from ELG Underground in the quarter at 6.06 grams per tonne gold, a significant improvement from 113,000 tonnes in the year-ago period. When combined with higher tonnes processed (~1.2 million tonnes) and higher grades from its open pits, the company enjoyed higher production year-over-year despite lapping tough comps due to elevated underground grades mined in Q3 2021 (6.68 grams per tonne gold). Given the increase in gold ounces sold offset by a weaker average realized gold price in the period, revenue came in at $209.3 million, only down slightly on a year-over-year basis, a positive result relative to most of its peers.

Torex Gold – Quarterly Production & Revenue (Company Filings, Author’s Chart)

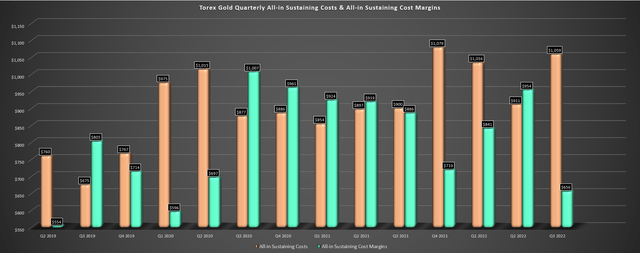

From a cost and margin standpoint, Torex was not immune from inflationary pressures sector-wide, with cash costs up nearly 5% to $760/oz (Q3 2021: $727/oz), and all-in-sustaining costs [AISC] soaring to $1,059/oz. However, it’s worth noting that even if AISC margins dipped to $656/oz from $886/oz in the year-ago period, these margins are still ahead of its peer group and the increase in costs was largely due to the much higher sustaining capital in the period ($29.4 million vs. $13.7 million). The elevated sustaining capital was related to increased capitalized stripping at ELG in relation to the pushback which will provide flexibility and an increased buffer in case Media Luna tracks a little bit behind schedule. The ELG Pushback is expected to extend open-pit production to the end of 2024 to smooth out production until Media Luna ramps up.

Torex Gold – Costs & Margins (Company Filings, Author’s Chart)

While some investors might be disappointed by the increase in costs and Torex has guided for further cost increases in 2023 with pressure on cyanide and reagents, the team has done a very solid job reducing cyanide consumption vs. 2021 levels which have helped to mitigate costs as part of its metallurgical control program. In fact, one reason for the higher costs in Q3 2022 was the combination of higher cyanide costs and slightly higher consumption due to increased levels of copper and iron sulfides in ELG ore. That said, this is largely out of Torex’s control, and the company is doing an excellent job in areas it can control, such as near flawless safety performance and strong delivery against output/cost guidance.

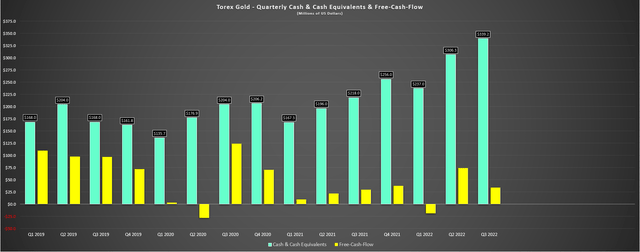

Torex Gold – Free Cash Flow & Cash Position (Company Filings, Author’s Chart)

Finally, when it comes to Torex’s financial results, free cash flow was up slightly from the year-ago period to $33.5 million, helping Torex to add to its already strong balance sheet which consists of ~$340 million in cash and no debt. The company also has $150 million available on its credit facility which gives it total liquidity of $590 million. When combined with over $400 million in operating cash flow over the next two years combined gives the company lots of flexibility to fund its Media Luna construction based on remaining capital spending of ~$800 million. That said, while free cash flow generation in Q3 was strong, this trend will reverse sharply as spending picks up on Media Luna where capex was below schedule.

Recent Developments

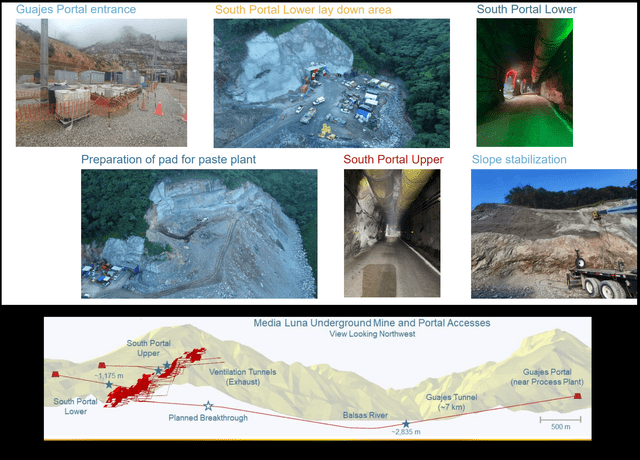

Moving over to recent developments, Torex continues to make solid progress at Media Luna, with total project, engineering, and procurement at 9%, 22%, and 14%, respectively. The company noted that the main Guajes Tunnel (7 kilometers) has advanced over 2,800 meters as of the end of October even though advance rates are tracking a little behind schedule. Meanwhile, the South Portal Lower has advanced 1,175 meters and advance rates are improving, but are still slightly below planned levels. Some images of progress to date are shown below, and a look at the construction plans which are to tunnel under the Balsas River to the Media Luna deposit and complete underground development on the south side of the river.

For those unfamiliar, Torex’s updated Technical Report with Media Luna envisions annual gold-equivalent production of ~375,000 ounces per annum at sub $1,000/oz AISC, or closer to 450,000 GEOs per annum when the mill is full (23% reduction in mill feed post-2024).

Media Luna Progress (Company Presentation)

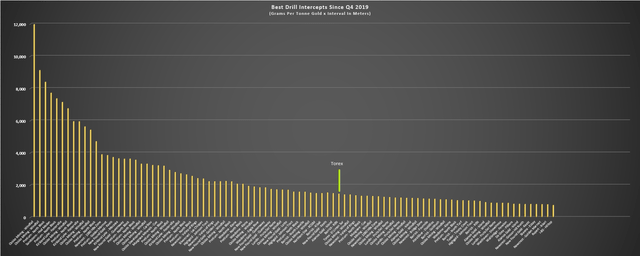

In terms of other developments, Torex has continued to release phenomenal exploration results from El-Limon Guajes which are extremely encouraging given that they suggest growth in resources and reserves is likely. A couple of highlight holes from drilling below the El Limon Sur open pit (named El Limon Sur Deep) included 16.0 meters of 87.6 grams per tonne gold, as well as 22.8 meters of 25.3 grams per tonne gold or ~32.0 grams per tonne gold-equivalent when factoring in silver and copper credits. These intercepts are world-class and even more valuable to Torex given that they’re at an operating asset. As we can see below, the best hole gave Torex a top-80 intercept on a gram-meters basis when compared to the best gold drill intercepts since Q4 2019 sector-wide.

Best Gold Drill Intercepts Since Q4 2019 (Majority Owned Assets) (Company Filings, Author’s Chart)

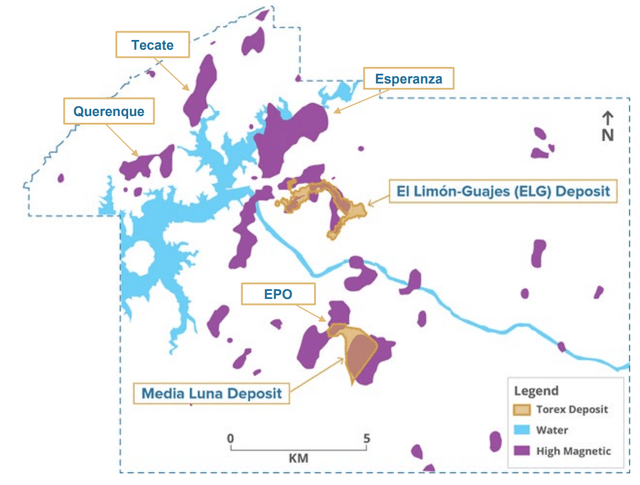

While it’s early to try and figure out how many ounces Torex could add from its drill programs at ELG, it’s very encouraging to see the incredible grades we are out of Sub-Sill, Sub-Sill South, El Limon Sur Deep, and EPO this year. This is because the company will have ~2,400 tonnes of excess mill capacity post-2024 after reducing mill throughput to 10,600 tonnes per day, and a longer reserve life + increased mining rates at ELG Underground would certainly augment its planned production profile, especially if we see a lift in grades as well. A development decision at EPO (south side of Balsas River) would further complement this production profile, where Torex currently has an inferred resource of ~1.0 million GEOs at 4.0 grams per tonne gold-equivalent.

Torex Gold – Current Deposits & Future Targets + Mag Signature (Company Presentation)

To summarize, Torex isn’t just firing on all cylinders operationally, but its exploration success this year is very positive and suggests that the average life-of-mine production profile for Media Luna at sub 375,000 GEOs could end up being conservative with opportunities to top up mill feed. Hence, while Media Luna previously looked like a minor downgrade from ELG due to the lower production profile at similar costs, this may not be the case, and the returns here could be better than planned as Torex appears to have no shortage of high-grade material across its large and most importantly unexplored land package along the Guerrero Gold Belt.

Valuation & Technical Picture

Based on ~87 million fully-diluted shares and a share price of US$11.75, Torex is trading at a market cap of ~$1.02 billion. This valuation continues to compare favorably to other producers of its size and relative to its estimated net asset value of ~$1.22 billion. However, the sharp rally in the stock has significantly reduced the valuation disparity with its peers, with Torex now trading at ~0.84x P/NAV and closer to 4.4x FY2023 cash flow estimates ($2.68) vs. ~0.50x P/NAV and less than 3x forward cash flow when I highlighted the stock as a Speculative Buy at US$6.45 – US$6.65. The filling in of this valuation doesn’t mean the stock can’t rally further, but the massive discount to fair value relative to peers is no longer present.

TORXF:SAND Relative Performance (StockCharts.com)

At the same time as Torex has appreciated further, some names have continued to get cheaper, with Sandstorm Gold Royalties (SAND) being one example. In fact, Sandstorm is currently trading at a similar P/NAV multiple to Torex despite having significantly higher margins and superior diversification (over two dozen paying assets). So, while I continue to be bullish long-term on Torex and believe the acquisition of a second asset could help re-rate the stock considerably, I see some better opportunities elsewhere in the sector currently from a valuation standpoint. Hence, if I were looking to put new capital to work, I see SAND as the more attractive option here near US$5.00 per share.

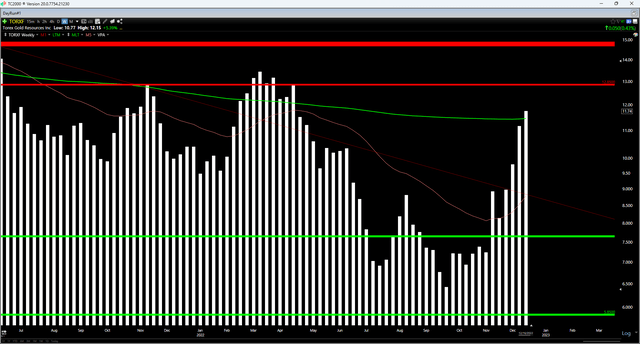

TORXF Weekly Chart (TC2000.com)

Meanwhile, if we look at Torex from a technical picture, we can see that while the stock has momentum on its side, this near-parabolic rally has left the stock extended above its support zones and within 10% of a potential strong resistance level. When it comes to small-cap stocks, I prefer a minimum 5.0 to 1.0 reward/risk ratio to justify entering new positions, and with $2.90 in potential downside to support and $1.10 in potential upside to resistance, this reward/risk ratio has contracted to 0.38 to 1.0, nowhere near the ratio required to justify entering a new position in the stock. In fact, if Torex were to rally above US$12.00, I would view this as an opportunity to book some profits.

Summary

In what’s been a rough year across the sector for most single-asset producers and developers, Torex has continued to be a shining star with near flawless execution from a safety and operational standpoint under Judy Kuzenko and the all-star team here. This phenomenal execution during a very difficult period (global pandemic, inflationary period) with Torex on track for its fourth consecutive year delivering into guidance is commendable and should help to alleviate any doubts about this team’s ability to successfully transition from one mine to another, which makes Torex riskier than peers given that this transition is occurring with Torex being a single-asset producer.

That said, and as Joel Greenblatt famously says, there’s no investing without valuation and while Torex was a steal below US$6.65 when it traded at depressed levels, the stock has since re-priced considerably with the market finally recognizing the value here. So, with Torex trading at just a ~20% discount to a fair value of US$13.40 [5.0x FY2023 cash flow per share estimates], I think there are more attractive bets elsewhere in the sector. For this reason, I would view any further strength in the stock as an opportunity to book some profits.

Be the first to comment