poba/E+ via Getty Images

A Quick Take On DecisionPoint Systems

DecisionPoint Systems (NYSE:DPSI) reported its Q3 2022 financial results on November 14, 2022, beating expected revenue and EPS estimates.

The company provides a range of mobility-related software and hardware solutions to businesses.

While DPSI has the potential to surprise to the upside, I’m cautious about customer decision-making that may keep a lid on growth, so I’m on Hold for DPSI for now.

DecisionPoint Systems Overview

DecisionPoint integrates enterprise mobility and wireless solutions to improve customer productivity and operational advantages. The company’s services include wireless, mobility, and RFID technologies, as well as lifecycle management, project management and deployment services, and managed services.

The firm also offers MobileConductor, a software platform that provides complete in-vehicle solutions, and ViziTrace, a software platform that manages RFID installations. DPSI provides custom software development services and resells specialized independent software vendors applications.

DecisionPoint is headed by Chief Executive Officer Steve Smith, who was previously Sales Director Global Accounts at Zebra Technologies and Sales Director in the Enterprise Mobility business at Motorola.

The company acquires new customers via its in-house sales and marketing efforts, distributors and through partner referrals.

DecisionPoint’s Market & Competition

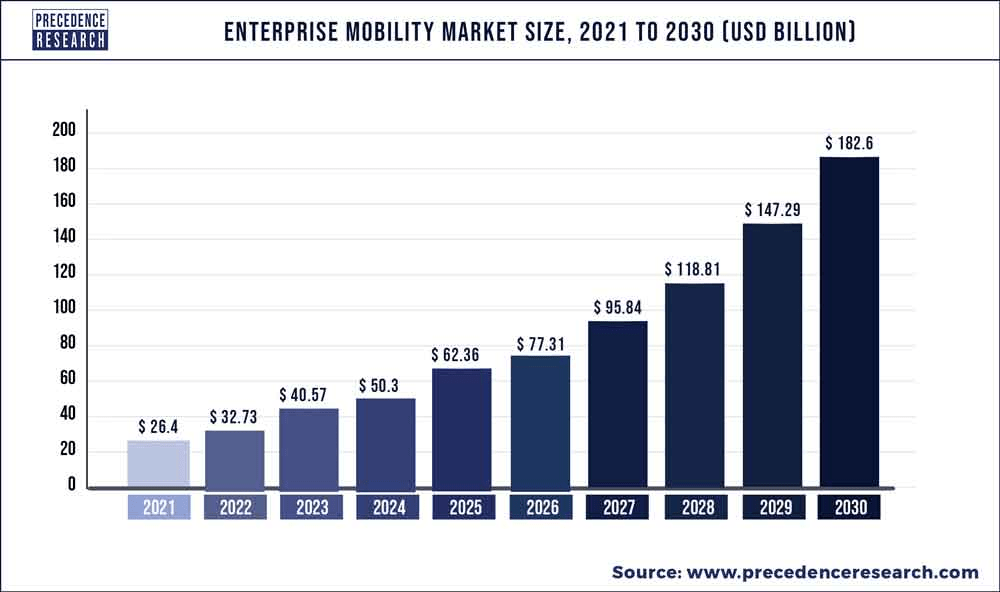

According to a 2022 market research report by Precedence Research, the market for enterprise mobility solutions was an estimated $26.4 billion in 2021 and is forecast to reach $182 billion by 2030.

This represents a forecast CAGR of 23.97% from 2022 to 2030.

The main drivers for this expected growth are a growing workforce that is highly mobile, the adoption of BYOD (Bring Your Own Devices) by companies and the rise of new mobile device categories and capabilities.

Also, the below shows the historical and projected growth trajectory of the global enterprise mobility market through 2030:

Enterprise Mobility Market (Precedence Research)

Major competitive or other industry participants include:

-

Amtel

-

Blackberry Limited

-

Citrix Systems

-

IBM Corporation

-

Infosys Ltd

-

Microsoft

-

SAP SE

-

Sophos Ltd

-

Soti

-

VMware

-

Others

DecisionPoint’s Recent Financial Performance

-

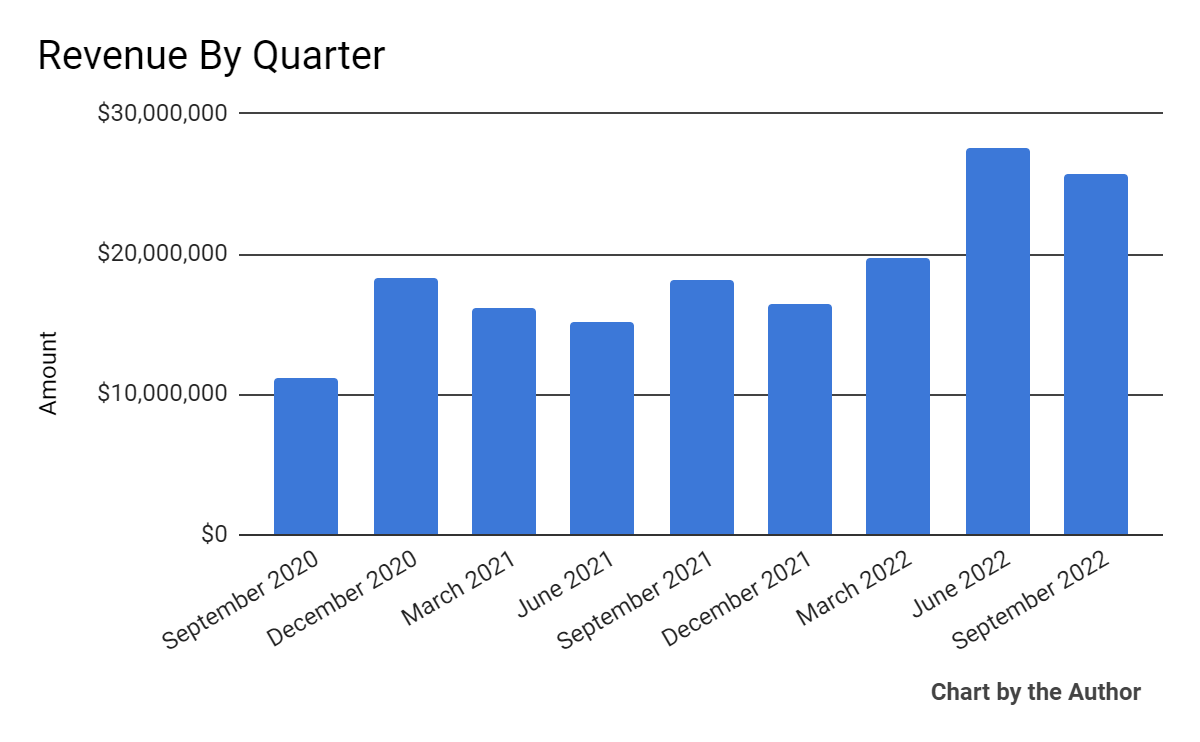

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

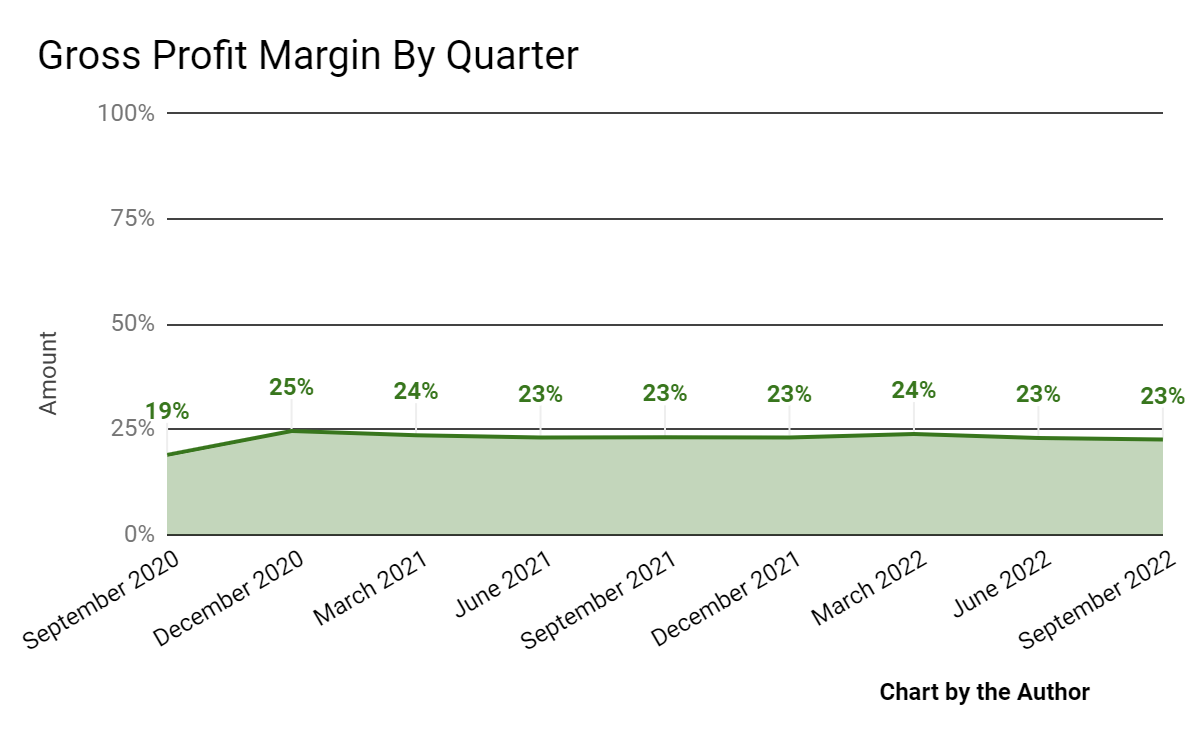

Gross profit margin by quarter has remained relatively flat:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

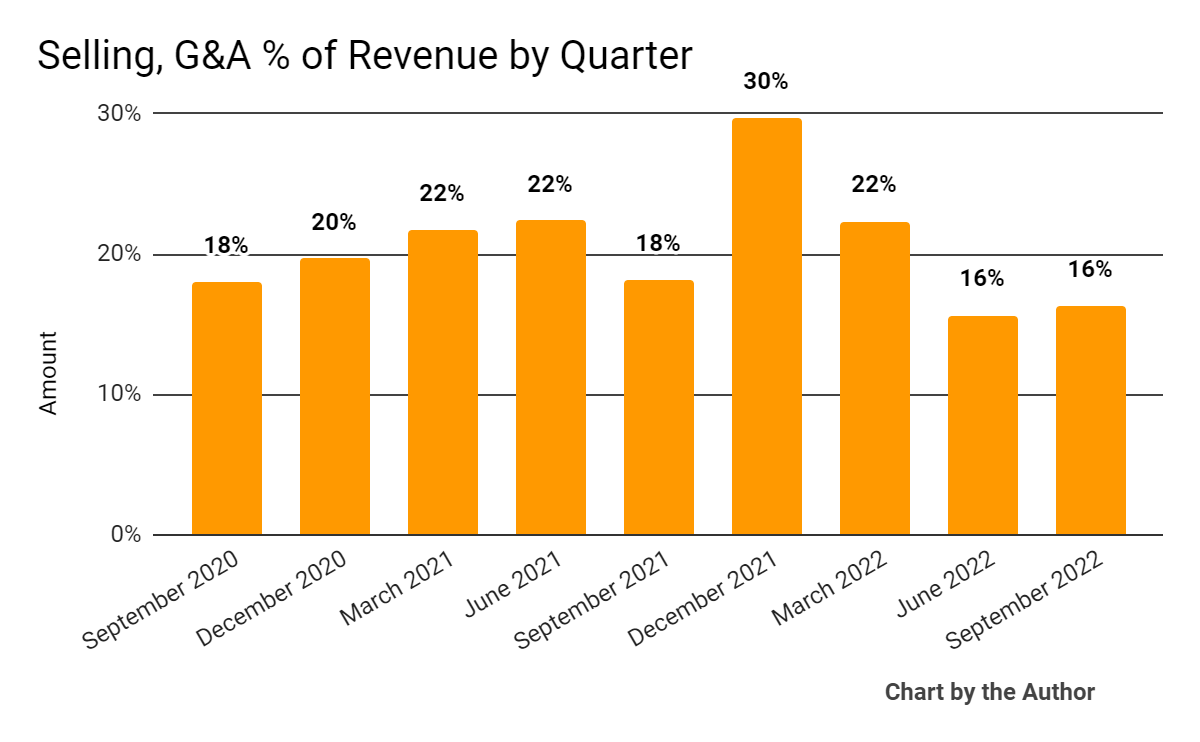

Selling, G&A expenses as a percentage of total revenue by quarter have fallen in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

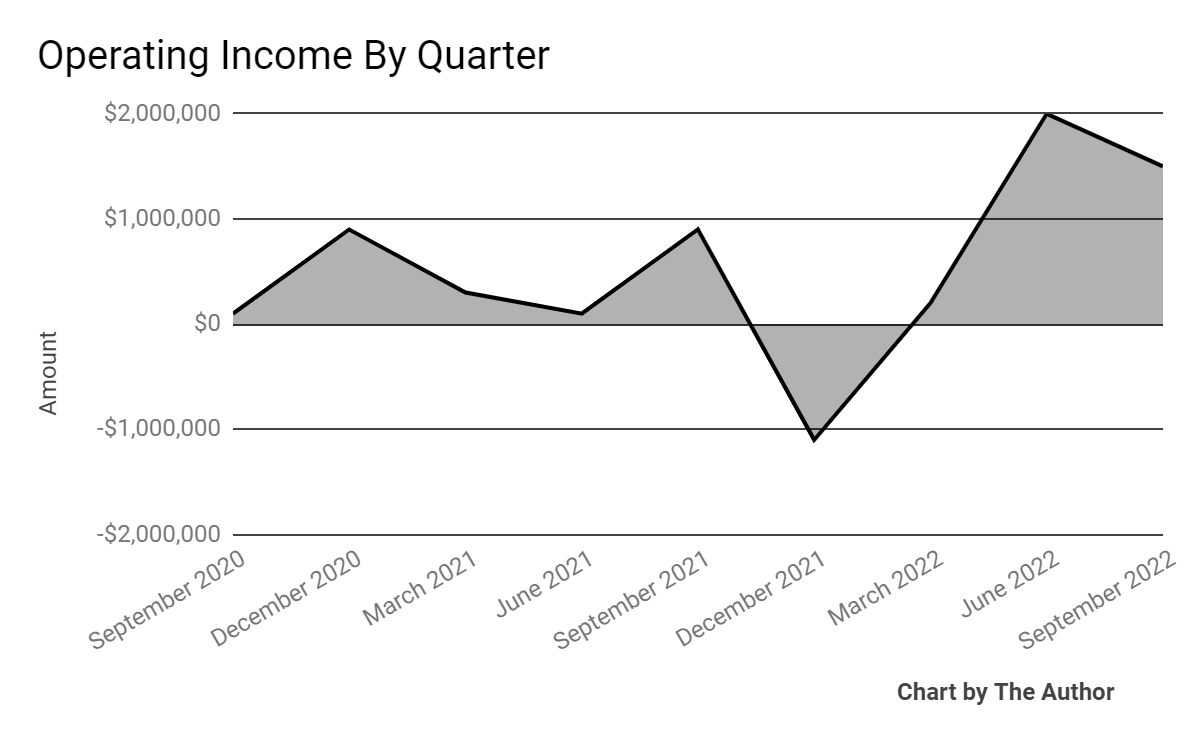

Operating income by quarter has grown in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

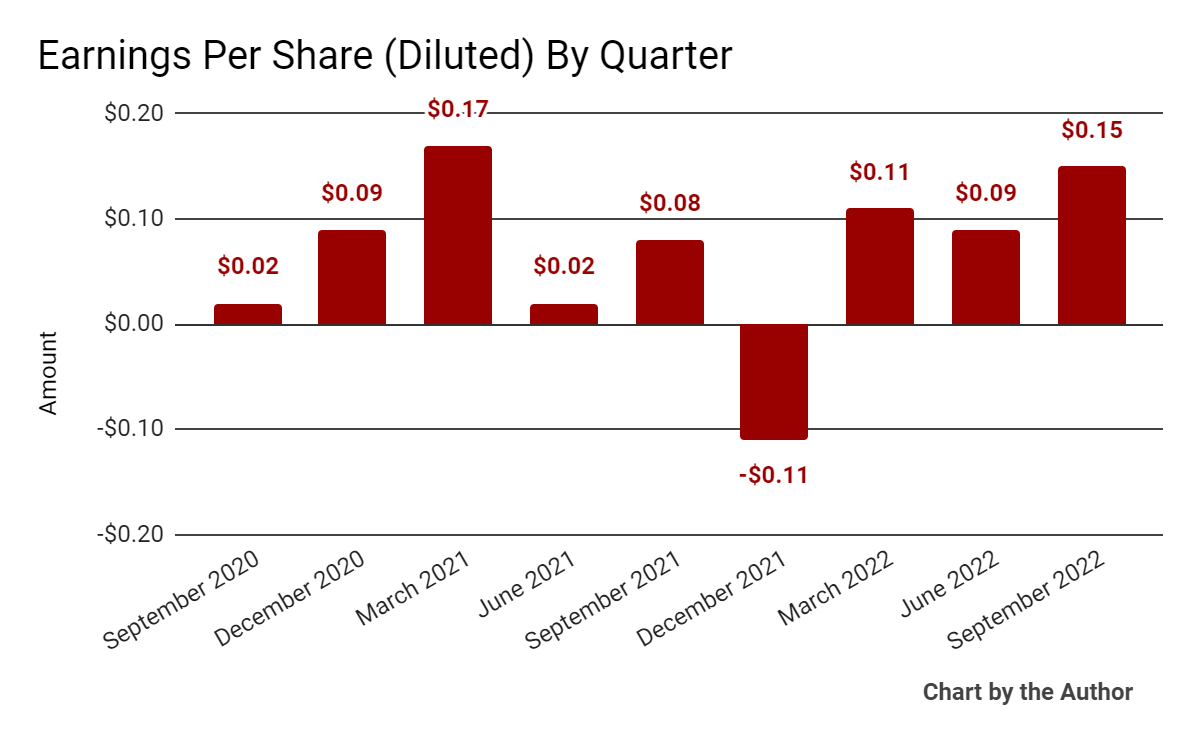

Earnings per share (Diluted) have increased recently, as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

In the past 12 months, DPSI’s stock price has dropped 11.1% vs. the U.S. S&P 500 index’s (SPY) drop of around 18.9%, as the comparison chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For DecisionPoint Systems

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.8 |

|

Enterprise Value / EBITDA |

14.3 |

|

Revenue Growth Rate |

32.0% |

|

Net Income Margin |

2.2% |

|

GAAP EBITDA % |

5.3% |

|

Market Capitalization |

$74,048,912 |

|

Enterprise Value |

$67,807,912 |

|

Operating Cash Flow |

$14,063,000 |

|

Earnings Per Share (Fully Diluted) |

$0.24 |

(Source – Seeking Alpha)

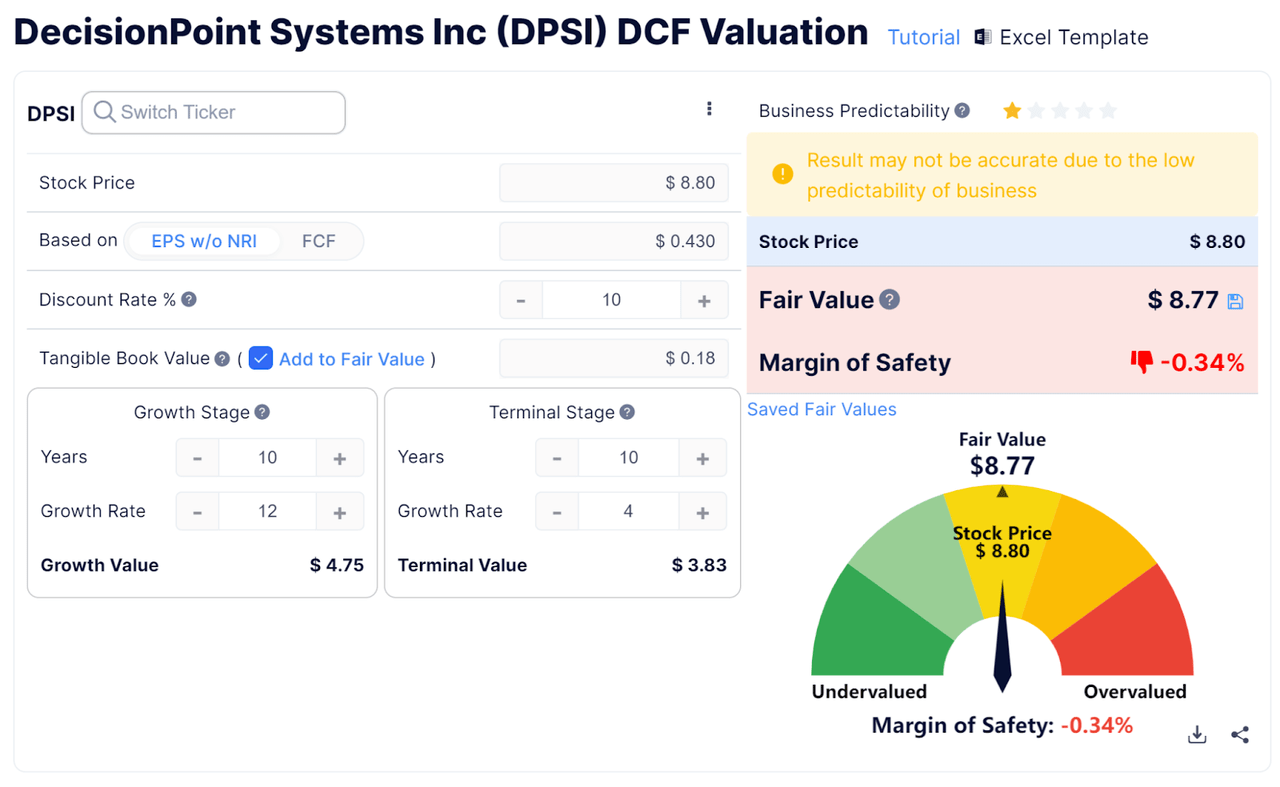

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

DecisionPoint Systems DCF (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $8.77 versus the current price of $8.80, indicating they are potentially currently fully valued, with the given earnings, growth, and discount rate assumptions of the DCF.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

DPSI’s most recent GAAP Rule of 40 calculation was 37.3% as of Q3 2022, so the firm has performed well in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

32.0% |

|

GAAP EBITDA % |

5.3% |

|

Total |

37.3% |

(Source – Seeking Alpha)

Commentary On DecisionPoint Systems

In its last earnings release (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted revenue growth as ‘broad-based across products and services.’

This was despite continued supply chain challenges for its hardware products.

As to its financial results, total revenue rose 41.2% year-over-year, while gross profit margin remained flat.

Even though DPSI isn’t strictly a software company, its Rule of 40 results have been good at just over 37.3%.

SG&A expenses as a percentage of total revenue have dropped and operating income improved year-over-year.

Earnings per share almost doubled year-over-year to $0.15 for the quarter.

For the balance sheet, the firm finished the quarter with $9.4 million in cash and equivalents and $100,000 in total debt.

Over the trailing twelve months, free cash flow was $12.7 million, of which capital expenditures accounted for $1.4 million of cash used.

Looking ahead, management increased full-year 2022 revenue guidance to a growth rate of 38.5% at the midpoint of the range and adjusted EBITDA to around $6.8 million.

Regarding valuation, based on expected 2023 earnings of $0.43 per share, my discounted cash flow calculation estimates that DPSI may be fully valued at its current level.

Potential risks to the company’s outlook include a slowing macroeconomic environment as we head into 2023, possibly reducing its expected growth rate and slowing sales cycles.

While DPSI has the potential to surprise to the upside, I’m cautious about customer decision-making that may keep a lid on growth, so I’m on Hold for DPSI for now.

Be the first to comment