Thomas Lohnes/Getty Images News

Markets got a mega dose of reality this week, and it shouldn’t have been a surprise had investors listened to Fed officials over the past six weeks. It was crystal clear that the Fed intended to raise its projections for the overnight rate higher than it had projected at the September FOMC meeting. Based on several Fed officials’ commentary, it was also clear that those projections on the dot plot would be 5% or higher.

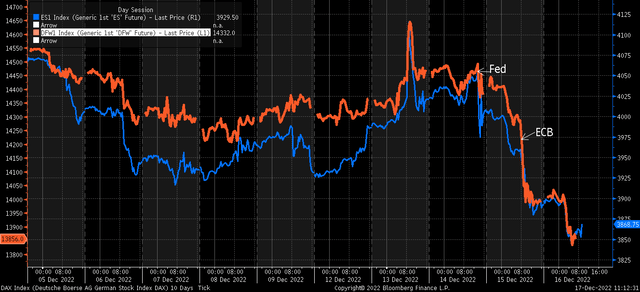

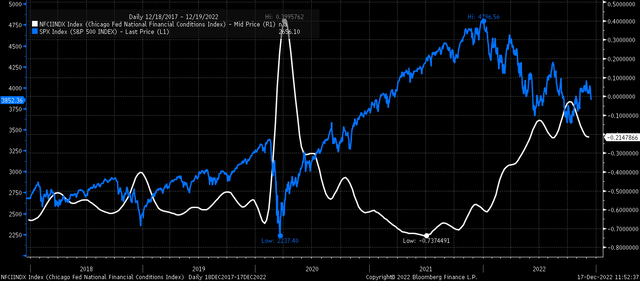

However, the market blew off the message, with the S&P 500 rising as rates and the dollar fell, easing financial conditions since the middle of October. But that came crashing to a halt this week when the Fed’s dot plot projected rates at 5.1% by December 2023. On top of that, the ECB provided another gut punch to markets the following day, which sent rates in Europe soaring and stock indexes plunging.

Cumulative Effects

The cumulative effect of tightening financial conditions and the unwillingness to take these two central banks seriously will likely result in the entire rally since the middle of October melting away.

The rally was built on the notion that slowing the pace of rate hikes indicated that the Fed, the ECB, and nearly every central bank around the globe were signaling the end of the rate hiking cycle was near. Instead, Christine Lagarde, the President of the ECB, was asked in the press conference about slowing the pace of rate hikes; she said:

Thank you for your question, because it helps me to clarify one thing. Anybody who thinks that this is a pivot for the ECB is wrong. We’re not pivoting, we’re not wavering.

The message was stern and direct, and in case there was any confusion, she also noted:

So I know that it is tempting to assume that, oh, well, all central banks are doing the same thing at the same time. Not quite. The ECB is not pivoting.

She even threatened multiple 50 bps rate hikes saying:

Based on the information that we have available today, that predicates another 50-basis-point rate hike at our next meeting, and possibly at the one after that, and possibly thereafter, but everything will also be determined by the review of data. So don’t assume that it’s a one-shot 50; it’s more than that.

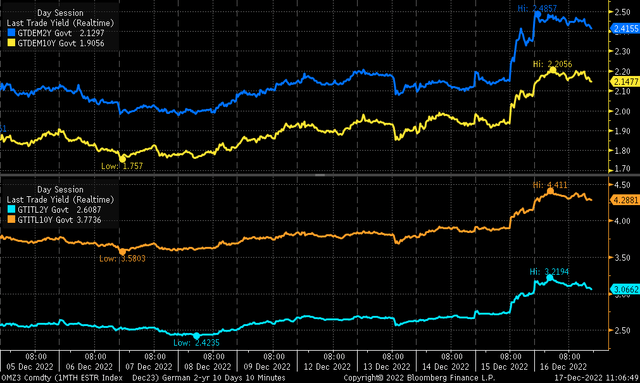

Of course, markets were not expecting this type of hawkish commentary from the ECB, especially Lagarde, who tends to lean on the dovish side, with rates in Germany and Italy exploding to the upside.

It sent the German DAX sharply lower; around the same time, US S&P 500 futures also made another sharp move down on December 15. The combination of the Fed and ECB’s message appears to have just been too much for the equity markets to handle. It was a clear message that the fundamental assumption made back in the middle of October that central banks were going to “pivot” had been entirely wrong.

It leaves the Fed on a clear path to an overnight rate higher than 5% and an ECB that appears nowhere near finished. Therefore, equity markets are too expensive for the amount of financial condition tightening likely to come their way in the weeks ahead. When financial conditions tighten, they result in stock prices and valuations falling.

Too Optimistic On Inflation

Unfortunately, this is the reality of where markets are and have been through 2022, and likely to be through the better part of 2023 until central banks signal that they are willing to let financial conditions ease. Should financial conditions ease through market forces before central banks are ready, it seems likely that they will ramp the hawkish commentary up, threatening more rate hikes and possibly accelerating balance sheet run-offs.

Not only that, but it may take only one lousy inflation report to screw everything up for the market. Mary Daly of the San Francisco Fed said on December 16 that she wasn’t sure why the market was so optimistic about inflation and seemed to be pricing in perfection.

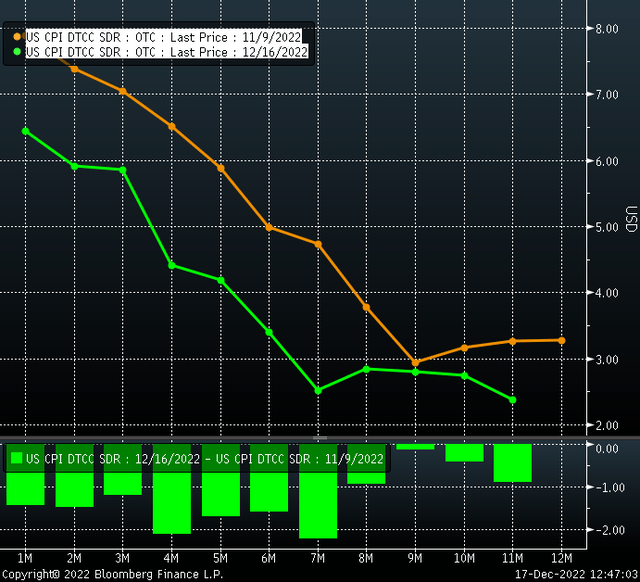

Indeed, it appears that the market is pricing in perfection. Inflation swaps are pricing for inflation to make a perfect landing and fall to 2.55%. Even more astounding is how quickly. The market sees inflation falling to 2.55% in just seven months. That 7-month swap on November 9, the day before the October “surprise” CPI print, was pricing inflation at 4.7%, more than two percentage points higher. One bad CPI print will be all it takes to push these expectations higher again.

Until the Fed and the ECB loosen their grip on financial conditions, it will be challenging for equity markets to see a sustainable rally. There may never have been a better time to not fight the Fed than right now.

Be the first to comment