10’000 Hours/DigitalVision via Getty Images

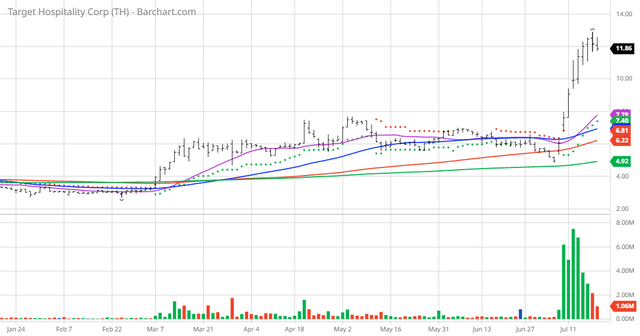

The Chart of the Day belongs to the rental and hospitality company Target Hospitality (TH). I found the stock by sorting Barchart’s Top Stocks to Own list first by the most frequent number of new highs in the last month, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 7/11 the stock gained 31.26%.

TH vs Daily Moving Averages

Target Hospitality Corp. operates as a specialty rental and hospitality services company in North America. The company operates through four segments: Hospitality & Facilities Services – South, Hospitality & Facilities Services – Midwest, Government, and TCPL Keystone. It owns a network of specialty rental accommodation units with approximately 15,528 beds across 27 communities, which include 26 owned and 1 leased; and operates 1 community not owned or leased by the company. Target Hospitality Corp. also provides catering and food, maintenance, housekeeping, grounds-keeping, security, health and recreation, workforce community management, concierge, and laundry services. It serves the U.S. government, government contractors, investment grade natural resource development companies, and energy infrastructure companies. The company was founded in 1978 and is headquartered in The Woodlands, Texas.

Barchart’s Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals but increasing

- 66.80+ Weighted Alpha

- 255.12% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100-day moving averages

- 9 new highs and up 93.60% in the last month

- Relative Strength Index 77.96%

- Technical support level at 11.59

- Recently traded at $11.78 with 50-day moving average of 6.93

Fundamental factors:

- Market Cap $1.21 billion

- P/E 120.00

- Revenue expected to grow 33.80 this year and another 31.70 next year

- Earnings estimated increase 1,060.00% this year, an additional 8.30% next year and continue to compound at an annual rate of 15.00% for the next 5 years

Analysts and Investor Sentiment – I don’t buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it’s hard to make money swimming against the tide:

- Wall Street analysts have 3 strong buy opinions on the stock

- Analysts give an average price target at $18.00

- The individual investors following the stock on Motley Fool have not found this one yet

- 1,130 investors are monitoring the stock on Seeking Alpha

Ratings Summary

Factor Grades

Quant Ranking

Sector

Industry

Hotels, Resorts and Cruise Lines

Ranked Overall

Ranked in Sector

Ranked in Industry

Be the first to comment