Khanchit Khirisutchalual/iStock via Getty Images

Looking to protect your capital from the effects of rising inflation while mitigating the effects of an economic downturn? W. P. Carey Inc. (NYSE:WPC) provides both of these services, as well as others: The REIT allows dividend investors to participate in the trust’s growth while also limiting the risks associated with a potential recession. The trust’s dividend is intended to grow over time, and rent escalators help protect investors from inflation.

Widely Diversified: W.P. Carey Is A Rock Solid Choice In The REIT Market

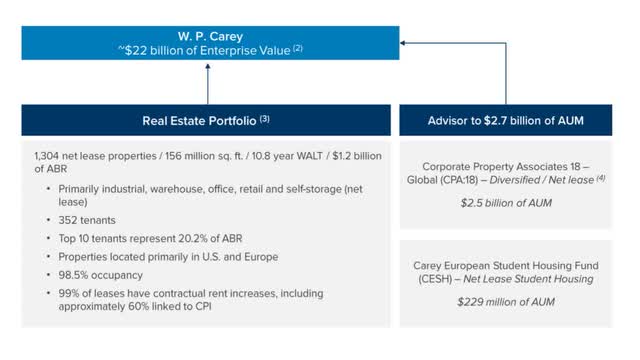

W.P. Carey is a real estate investment trust with a market capitalization of approximately $22 billion. The trust, which operates as a net-lease REIT, primarily invests in industrial properties, warehouses, self-storage facilities, and office buildings.

Net-lease real estate investment trusts shift the burden of paying maintenance, taxes, and insurance costs to the tenant, significantly simplifying W.P. Carey’s business. The trust’s real estate portfolio consists of 1.3K properties totaling 156 million square feet.

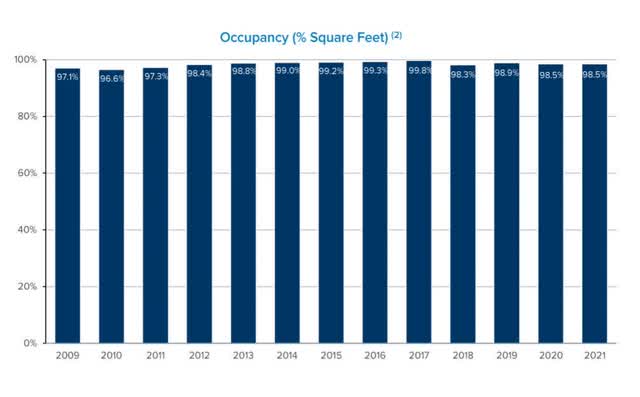

W.P. Carey’s portfolio also generates approximately $1.2 billion in annualized rental income and currently has a 98.5% occupancy rate. Furthermore, W.P. Carey manages approximately $2.7 billion in investor assets.

Portfolio Summary (W.P. Carey)

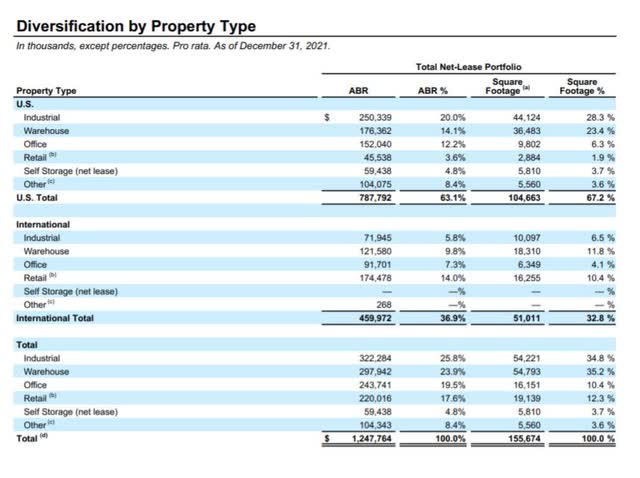

W.P. Carey is expanding, and the trust is adding real estate not only in the United States, where the trust’s primary focus is, but also internationally. The U.S. market, particularly industrial properties, accounts for approximately 63% of the trust’s annualized rental income.

International markets, which account for 37% of W.P. Carey’s annualized rental income, rely more heavily on retail properties, which generate the majority of the real estate investment trust’s rental income outside of the United States.

Diversification By Property Type (W.P. Carey)

Portfolio Strength = Downside Protection

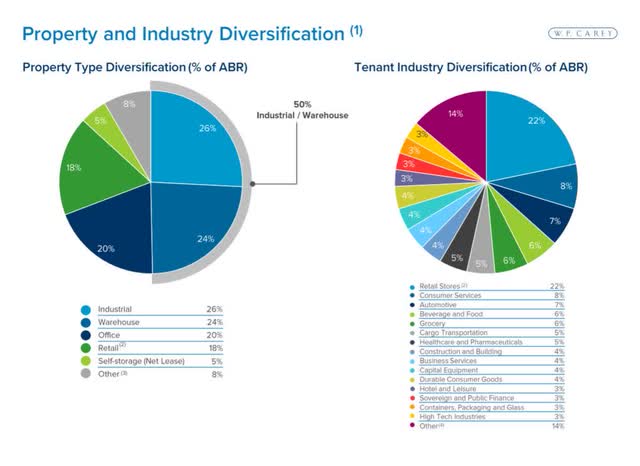

To account for the possibility of a recession, it is critical to invest only in the highest quality, most diverse real estate investment trusts. W.P. Carey’s investments outside of the United States, as well as the presence of multiple property types in its portfolio, provide diversification. The trust’s asset mix is dominated by industrial properties and warehouses (50%), but the REIT is still sufficiently diversified to withstand a recession.

In terms of industries, retail stores account for 22% of W.P. Carey’s annualized rental income, and it is an industry that is less affected by a recession than other industries. W.P. Carey’s real estate portfolio, when combined with a high historical occupancy rate, protects investors from downside risk.

Property And Industry Diversification (W.P. Carey)

W.P. Carey has consistently seen exceptional lease rates, implying that the trust has kept high occupancy rates even during recessions.

Inflation Protection

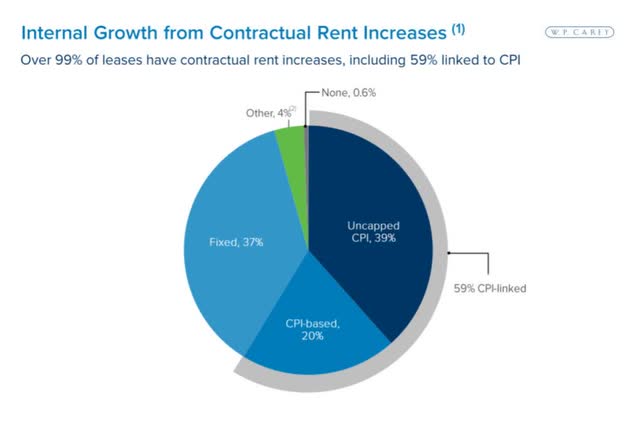

Inflation has become a major concern for investors beginning in 2021. Inflation soared to 40-year highs in February, and the March inflation report will almost certainly show a new high. Having said that, real estate is a good asset class to invest in when consumer prices rise because real estate asset values and rental payments tend to rise during periods of high inflation. W.P. Carey also heavily relies on rent escalators, with 59% of contracts tied to the CPI, which helps to mitigate the effects of inflation.

Internal Growth From Contractual Rent Increases (W.P. Carey)

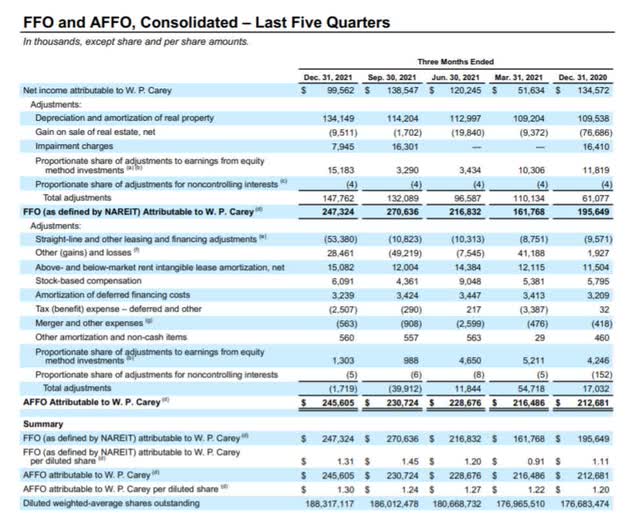

FFO Discussion And Dividend Upside

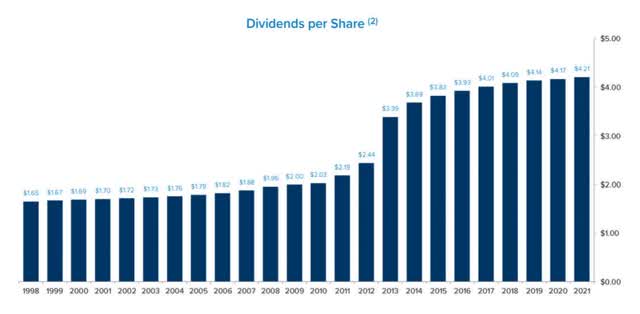

In 2021, the real estate investment trust earned $896.6 million in funds from operations, a 3.5% increase YoY. On a per-share basis, funds from operations were $4.90 and have gradually improved throughout the year. W.P. Carey’s total dividend pay-out in 2021 was $4.21 per share, implying an 86% funds from operations pay-out ratio.

To add to my previous point about inflation protection, W.P. Carey raises its dividends marginally every quarter, but these small increases add up to a significant amount over time. W.P. Carey’s stock currently yields 5.1%, with more dividend increases on the way.

Dividends Per Share (W.P. Carey)

FFO Multiple

W.P. Carey anticipates a 5.4% increase in funds from operations in 2022. Management has suggested a range of $5.18 to $5.30 per share in (adjusted) funds from operations this year, based on an investment volume of $1.5 billion to $2.0 billion.

W.P. Carey’s funds from operations are valued at 15.8x based on the trust’s guidance. This means that investors place a 16x multiple on W.P. Carey’s real estate portfolio’s potential. This is not an irrational FFO multiple for high-quality REITs like W.P. Carey, which have enterprise values in the billions. Because of the trust’s strong asset base, inflation protection, and prospects for a growing dividend, I believe the valuation is very appealing here.

What Could Drive W.P. Carey Lower

W.P. Carey and other real estate investment trusts are not immune to a recession, and recession risks have arguably increased in light of rising inflation rates. During the last decade, W.P. Carey maintained high occupancy rates, but a decline in the trust’s portfolio health would raise concerns about funds from operations.

My Conclusion

W.P. Carey is a buy, and both the REIT’s valuation and dividend yield are appealing. The trust can help you protect against the downside of a recession as well as inflation risks, while W.P. Carey’s international expansion, FFO growth, and the possibility of a higher dividend cover the upside.

Be the first to comment