imagedepotpro/iStock via Getty Images

The housing stock meltdown

Housing-related stocks have been in free-fall this year because of fear that the sharp interest rate rise will kill off home sales and perhaps trigger a recession. Mortgage insurer MGIC (NYSE:MTG) itself is off 21% from its early ’22 peak. But it could be worse. Homebuilders Pulte Homes (PHM) and Hovnanian (HOV) are down 29% and 58% (!) respectively. New Age realtors Zillow (Z) and Redfin (RDFN) have taken hits from peak ’22 prices of 29% and 61% respectively, while traditional realtor Realogy (RLGY) is 30% off its ’22 peak. Finally, mortgage banker and self-styled fintech Rocket Companies (RKT) is down 35%.

P/E ratios for the housing stocks are now at “What? Really?” levels. For comparison purposes, keep in mind that the S&P 500 is currently trading at 18 times ’22 EPS expectations. Pulte? A 4.0 P/E. Hovnanian – ready for it? – is at 1.7. Realogy trades at a heady 4.8 times. Even supposed growth company Zillow is at a mere 27 P/E and Rocket at 9. (’22 EPS estimates courtesy of Seeking Alpha).

MGIC is middle of the pack at a 6.6 P/E, barely a third of the S&P 500. To better see what the Mr. Market is forecasting, flip the P/E ratio around to get an earnings yield of 15%. Would you buy a 15% bond? I bet you’d be all over it, if you thought it had a chance of continuing to make the payments.

Can MGIC maintain the payments. Doing a sum-of-the-parts liquidation value is a good way to address that question.

MGIC’s sum-of-the-parts liquidation value

The three parts are:

- Net cash on the balance sheet

- Insurance in force

- New business creation

The value of: Net cash on the balance sheet

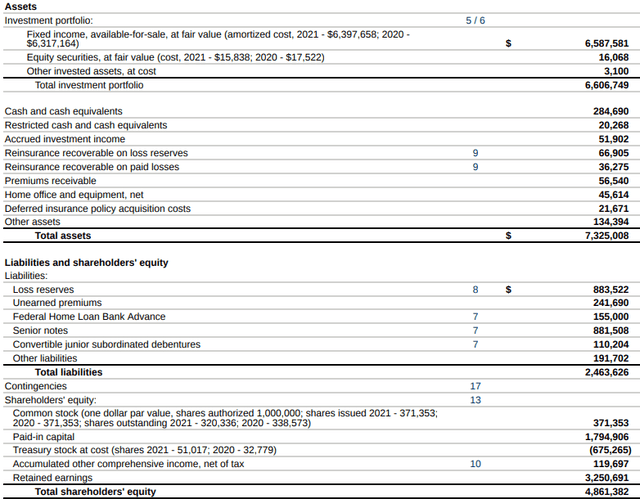

Here is MGIC’s balance sheet at the end of last year:

To calculate net cash per share, we subtract off accruals (management’s estimates of future cash to be received or owed) from shareholders’ equity. The accruals include accrued investment income, reinsurance recoverables, loss reserves and unearned premiums. MGIC’s net cash comes to $5.8 billion, $1.0 billion higher than reported equity largely because MGIC has reserved an accrual of $0.9 billion against future home mortgage default claims. With 339 million of shares outstanding, MGIC’s net cash per share on its balance sheet is $17.20.

MGIC’s stock price at last week’s close was $13.03. That’s 24% below MGIC’s cash already on hand! Which implies that investors expect MGIC’s other parts to lose money.

While this valuation measure certainly makes my point that MGIC’s stock is cheap, I don’t put much credence into it. The fact is that MGIC’s regulators require it to hold cash in case needed to pay future insurance claims. Investors therefore only have access today to the cash that MGIC holds in excess of its regulatory capital requirement, plus a cushion. MGIC says that it has $2.1 billion of excess capital at present; after assuming a conservative 35% cushion above required capital, the excess is $1.0 billion.

The value of: Insurance in force

Being in the mortgage insurance business, MGIC has insurance in force (IIF), whose value is not on its balance sheet. $274 billion of IIF at the end of ’21, to be exact. How much is this asset worth?

To best estimate this value, let’s assume that MGIC wakes up tomorrow morning and says, “Enough. We’re done. Let’s shut this baby down.” MGIC’s value then would be the present value of cash distributed to shareholders as the insurance pays down, cash that includes both insurance earnings and the $5.8 billion of cash supporting the IIF.

To estimate the present value, we need to make some critical assumptions. Here are mine:

Persistency. How fast will MGIC’s $274 billion of IIF pay down over time? The higher the persistency, the greater the value of the IIF.

The persistency rate is driven by policyholders’ mortgage refinancing and relocation activity. Until recently, the persistency rate was very low because falling mortgage rates drove record refinancing activity. But of course, that story has now reversed. Over 70% of MGIC’s IIF was originated over the past two years, when mortgage rates were well below where they are today. Mortgage rates would have to at least fall to 3.5% from 4.75% today to set off active refinancing again. I therefore assume persistency of a historically high 85% a year.

Average insurance premium. MGIC is currently earning an average 37 bp insurance premium on its IIF. The rate has been falling as older, higher priced business pays down. I therefore assume an average 35 bp premium going forward.

Investment income. MGIC earns interest income on bonds it invests its cash in, and pays interest on some borrowed funds. The current net interest income yield is about 1.5%. But MGIC is reinvesting at higher yields and paying down more costly debt, so I’ll assume 1.8% going forward.

Operating expenses. A liquidation scenario allows MGIC to shut down its sales and marketing efforts and shrink staff as IIF shrinks. I therefore assume that MGIC cuts its current $220 million of operating business by 30% day 1, then by 15% a year.

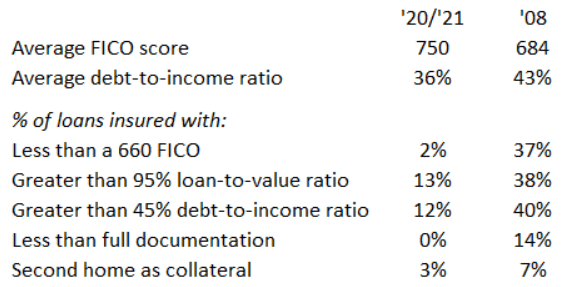

Claims payments. This is the big assumption. What will mortgage defaults look like going forward? There is plenty of reason for optimism, even with weak economic forecasts. The key reason is the high underwriting quality of MGIC’s IIF. Take a look at this comparison of MGIC’s current underwriting standards to those that preceded the ’08 financial crisis and housing meltdown:

MGIC financial report

Look at the very high FICO scores, no subprime loans, low debt levels, etc.

MGIC’s credit risk also has two important external protections. One is a serious housing shortage. The current single-family housing vacancy rate is 0.9%, tied for the lowest rate in the 57-year history of the data and last seen in 1978. It’s hard to see how home prices drop sharply with such built-up demand.

The other is the labor shortage caused by declining population growth. The current number of unfilled job offerings is 11 million, more than twice the level of the boom year of 2006. It therefore seems less likely that a recession will cause a large increase in the unemployment rate, thereby limiting the risk of large numbers of households defaulting on their mortgages.

Use of cash. As MGIC liquidates in our experiment, does it use its cash flow to pay dividend or buy back stock? I assume that MGIC uses 75% of its free cash flow for buybacks for the first three years, and thereafter pay cash only.

Discount rate. What minimum rate of return do I expect over the period of MGIC’s liquidation? I assume fairly low, because I don’t have to forecast growth or worry about future management mistakes if the company is liquidating. I therefore assume an 8% discount rate.

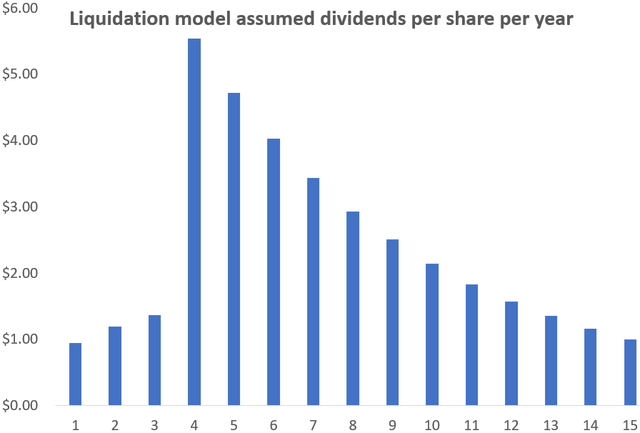

Summing up – a liquidation value of $26, calculated as the present value of these dividends per year:

Note that the first three years of dividends are low because of the share buybacks, but the buybacks pay off by sharply increasing dividends per share after that.

The value of: New business

Writing new insurance should add additional value to MGIC over time. Private mortgage insurance is a needed product for lenders who want to reduce the risk of mortgages with below-20% downpayments. Depending upon your assumptions, $5-10 a share in added value is reasonable.

The bottom line: This $13 stock has a $30+ fair value

Let’s check my liquidation valuation with a cash flow valuation. MGIC earned $1.95 in cash earnings last year. My $30 fair value is 15 times cash earnings, which is below the market multiple. Cash earnings per share should rise sharply over the next few years, in large part because MGIC is using its large pool of excess capital to buy back stock at cheap prices. As a result, MGIC’s shares outstanding could decline by 25% or more over the next four years. Therefore, reaching $3.00 per share of cash flow by 2025 is not that difficult.

Afraid of a depression? Don’t buy MGIC, focus on canned goods. Other than that, seriously consider this stock. Stare fear in the face. Make your parents proud.

Be the first to comment