Jemal Countess/Getty Images Entertainment

Since the November 2021 all-time high, Salesforce’s (NYSE:NYSE:CRM) collapse seems to have no brake. From $311 per share, a few days ago it reached $150 per share. Fear of a recession looms over the markets, and it is exactly in these phases that bargains can be made. Obviously, I am not talking about buying junk companies with no operating cash flows coming in, but I am talking about buying companies with a significant competitive advantage and excellent prospects like Salesforce.

Significant competitive advantage

If you want to invest for the long term, it is necessary for the company to possess some competitive advantage, otherwise the risk is that it may lose market share over time. Currently, Salesforce’s competitive advantage is impressive, in fact for the ninth year in a row it was named #1 CRM provider in the world. Its leadership includes several areas, here are the main ones.

www.salesforce.com

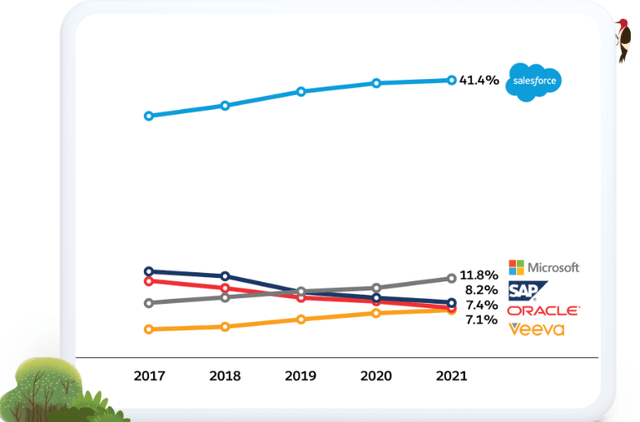

Ranked #1 for productivity and sales force management applications.

In this area Salesforce present a dominant market share over its competitors, evidence that sales representatives prefer to use Salesforce software to improve the efficiency and productivity of their sales.

www.salesforce.com

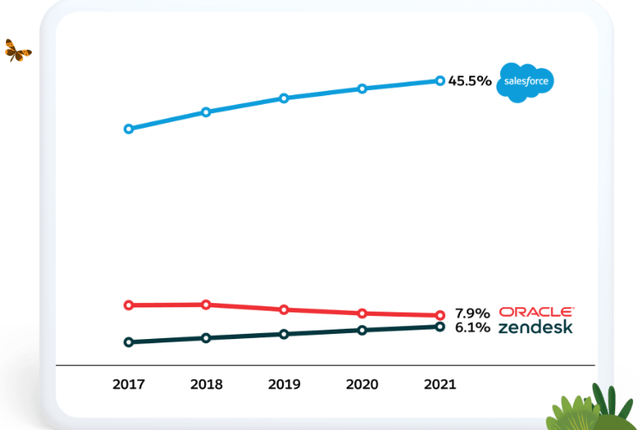

Ranked #1 for customer service applications.

Salesforce also has an undisputed market share in this area, where by the way competitors are fewer. What this data signals to us is that Salesforce customers are fully satisfied with the service they get and experience a satisfactory experience. Such overwhelming dominance is an indicator of customer satisfaction well above the norm. Once you have become part of the Salesforce ecosystem, it is unlikely to leave. On this aspect I note a certain similarity with Apple’s business model, with due differences of course.

www.salesforce.com

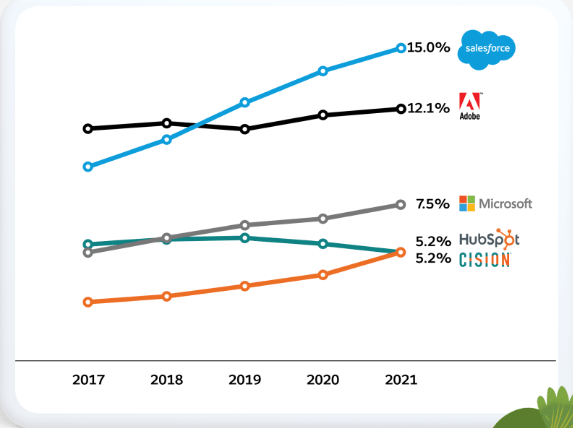

Ranked #1 for marketing campaign management applications.

This is the area where Salesforce’s market share is not as dominant compared to its competitors. In any case, this trend seems to be growing strongly, so I expect the difference to become more pronounced in the future. More and more customers are relying on Salesforce to manage their advertising campaigns, which are critical for business growth.

www.salesforce.com

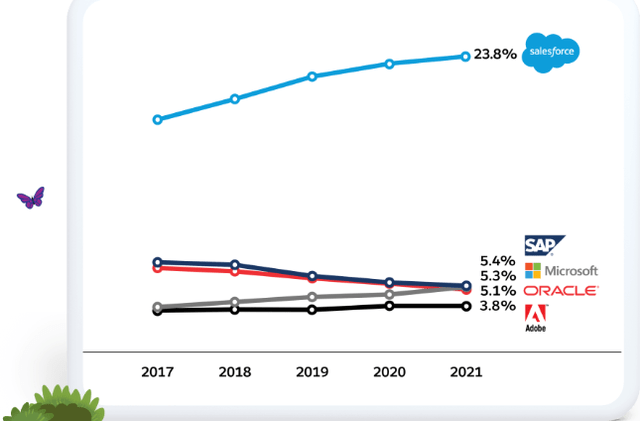

Ranked #1 for CRM applications.

In this last chart we can see how once again it is evident which CRM is the most important in the world. Using Salesforce any business owner will best manage interactions with existing and potential customers.

Stable and growing revenues

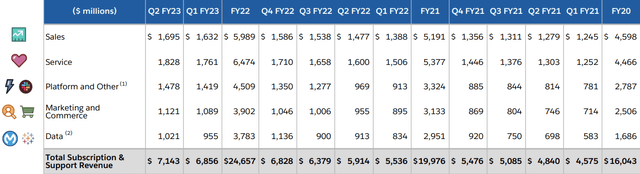

Salesforce Q2 FY23

In FY20 Salesforce’s revenues were $16 billion, in FY23 the company expects instead to earn $31 billion. In just 3 years this company has almost doubled its revenues, which were already not low at all in FY20. The reason for such high growth can be attributed to 3 reasons mainly:

- More and more companies are realizing that they need an efficient CRM to better organize their business. Salesforce’s CRM is currently the best in the world and more and more companies are making use of it, which is why its market share continues to rise. The global CRM market is currently worth $63.91 billion and is expected to grow to $145.79 billion by 2029 (12.5% CAGR).

- Salesforce tends to use much of its revenue to expand marketing and R&D spending. The goal is to grow as much as possible and neglect profit for the time being (which is why the P/E is so high). This is a strategy designed for long-term benefits but sacrifices profitability in the short term. In 2020 research and development expenses were $2.76 billion, in the last 12 months $5.14 billion. As for marketing expenses, on the other hand, in 2020 they were $9.63 billion, while in the last 12 months they reached $16 billion. The goal is to make Salesforce known to as many companies as possible.

- Salesforce is a company that pushes hard on acquisitions. To expand its field of operation and offer a better and better service, the company tends to make expensive acquisitions. In 2018 MuleSoft was acquired for $6.5 billion, in 2019 Tableau was acquired for $15.7 billion, and in 2020 Slack was acquired for $27.70 billion. Interestingly, despite these huge investments Salesforce’s net debt is only $786 million. This is because Salesforce in order to make its acquisitions tends to dilute its shareholders by raising the funds needed for acquisitions. There were 731.50 million shares outstanding at the beginning of 2018, while currently there are 1 billion. Although dilution hurts shareholder ownership, I favor it when used discreetly as Salesforce is doing. In any case, in the latest quarterly report the company announced that it will begin its first buyback program (up to $10 billion), so this trend will be reversed.

Salesforce’s revenues are not only growing, however, but are also very solid: about 90% of revenues come from annual subscriptions. It is worth noting that the moment a company decides to use a particular CRM it is unlikely that it will change it, especially if it is the best in the world. Changing the CRM is laborious and also economically expensive; therefore, companies do what they can to avoid this drastic choice. Moreover, since Salesforce’s subscription provides a payment calculated based on the users who use the software, the more companies that use the software grow, the more money Salesforce makes. At first glance this business model seems pro-cyclical, however, in the current recession Salesforce’s revenues continue to grow in double-digits. This is impressive.

Geographic and sectoral diversification

To ensure that a company’s revenues are solid, it is necessary that they are not too dependent on a particular geographic area or sector.

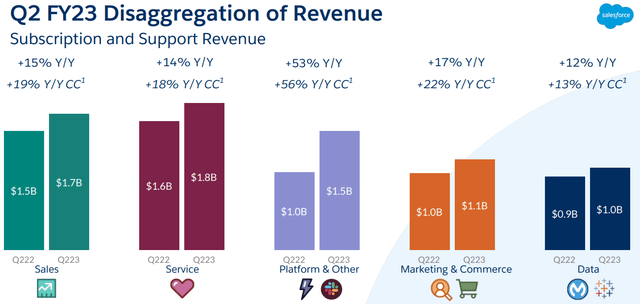

Salesforce Q2 FY23

From a segment perspective, Salesforce’s revenues in addition to being diversified are also growing strongly. In particular, the Platform & Other achieved a marked growth, in fact Q222 revenues were only $1 billion versus the current $1.5 billion. The performance of the other segments was also significant, showing double-digit growth. The impact of the strengthening dollar was certainly negative, but it did not hinder Salesforce’s growth too much.

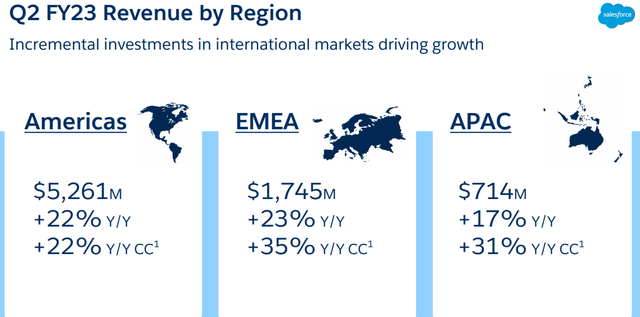

Salesforce Q2 FY23

On the other hand, considering geographical diversification, revenue growth was strong in every area of the world. In EMEA and APAC there has even been more than 30% growth if we do not count the effects of the strengthening of the dollar. To date certainly Americas has a predominant weight, but at the same time I expect that in the future it will also be the area that grows more slowly.

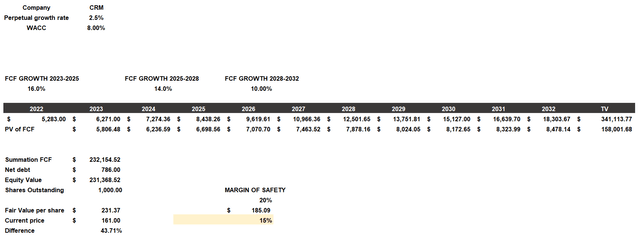

How much is Salesforce worth?

The fair value of Salesforce will be made using a discounted cash flow; however, it is worth noting an important aspect first. Assessing what the appropriate growth rate is for Salesforce is quite complex being a high-growth company. A change of a few percentage points on the growth rate can result in a large difference on the fair value. To try to be as conservative as possible I will base the future growth rate on that of the past, and reduce it more and more as the company gets larger. That being said, the DCF will be constructed as follows:

- The FCF entered in FY22 will be the one already accounted for, the one in FY23 was calculated based on the revenue guidance on which I applied the average FCF margin of the last 3 years.

- The growth rate between FY23 and FY25 is equivalent to the average growth rate of the last 3 years (19%) minus 3%.

- The growth rate between FY25 and FY28 equals the previous growth rate minus 2%.

- The growth rate between FY25 and FY28 equals the previous growth rate minus 4%.

- The cost of equity will be 8.25% and considers a beta of 1.08, country market risk premium of 4.20%, risk-free rate 3.50% and additional risks of 0.25%. The after-tax cost of debt will be 5.40%.

- The capital structure will be 90% equity and 10% debt, with a resulting WACC of 8%.

- Shares outstanding and net debt are taken from TIKR Terminal.

Free cash flow

According to my assumptions, Salesforce’s fair value is $231 per share; therefore, the company is undervalued by 43.71%. Moreover, as I am doing this analysis the price has already risen to $161 per share, but a few days ago it was even at $150. For a company with such a competitive advantage and such a growth prospect, I believe that Salesforce is currently a rare diamond within the stock market. I cannot have the presumption to say that at $150 the bottom has been reached, with such volatility in the markets Salesforce could collapse even further. In any case, at least in my opinion, a further collapse would mean an opportunity to buy at a lower price. As long as the leadership does not change and the company continues to generate growing free cash flow, I am not concerned about the price drop. My perspective on this company is on a 10-year basis not a monthly basis.

Be the first to comment