Justin Sullivan

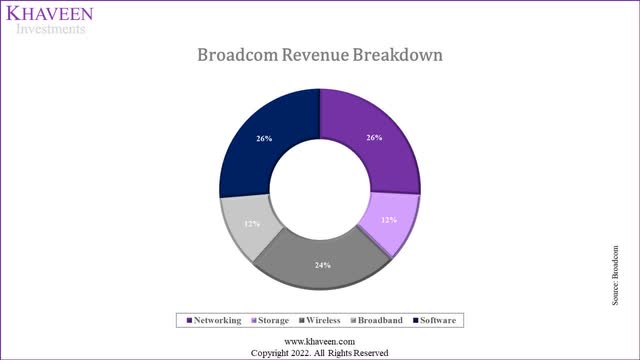

Following the recent announcement of Broadcom Inc’s (NASDAQ:NASDAQ:AVGO) first shipments of its next-gen Tomahawk 5 switch chips, we analyzed Broadcom’s networking segment which represented 26% of its total revenue. According to Broadcom, the company claims that its new Ethernet switch chip has double the bandwidth capability of its competitors. We looked into Broadcom’s Ethernet switch chip portfolio which includes its Tomahawk, Trident, and Jericho lineup and determine whether it has a performance advantage against competitors including Nvidia (NVDA) and Marvell (MRVL). Moreover, we examined the pricing differences between Broadcom’s different product generations of its Ethernet switch chips and projected its revenue growth based on pricing growth and unit shipments growth.

Furthermore, we looked into Broadcom’s new Ethernet chips which are co-packaged with its silicon photonics and their benefits to customers. We also compared its silicon photonics capabilities with competitors and projected its revenue growth.

Finally, we broke down the company’s Networking business segment into its main product groups besides Ethernet switch and optic products including ASICs and embedded processors and identified its common customer base of enterprise and data center customers. Based on an estimated revenue breakdown of the company’s networking segment, we projected its revenue growth by each product group to forecast its total Networking semiconductor business growth.

|

Semicon Breakdown % |

2020 |

2021 |

|

Networking |

6,044 |

6,930 |

|

Growth % |

14.7% |

|

|

Storage |

2,418 |

3,057 |

|

Growth % |

26.5% |

|

|

Wireless |

5,353 |

6,523 |

|

Growth % |

21.8% |

|

|

Broadband |

2,418 |

3,261 |

|

Growth % |

34.9% |

|

|

Total |

16,232 |

19,772 |

|

Growth % |

21.8% |

Source: Broadcom, Khaveen Investments

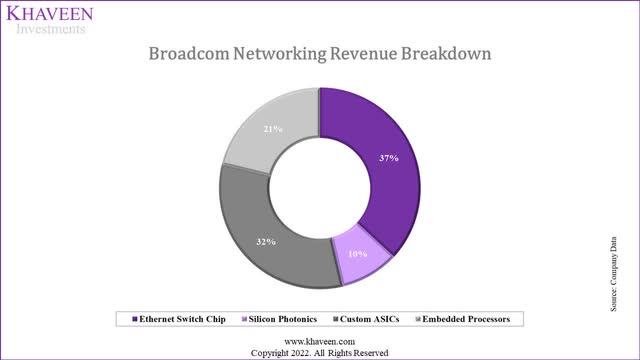

Based on the company’s Networking segment revenue in 2021, we broke down its segment by its main product groups which are Ethernet switches, optics, ASICs and embedded processors. For its Ethernet switch revenue, we estimated this based on its market share of 70% of the Ethernet switch chip market estimated to be valued at $3.65 bln in 2021 based on the market CAGR of 10.3% by Market Research Future. Whereas we estimated its optics revenue based on the market size of $10.94 bln and the company’s share of 14% by Yole Development. Moreover, for its ASICs revenue, we based it on the midpoint of JPMorgan (JPM) estimates of the company’s ASICs revenue of between $2 bln to $2.5 bln with the market forecasted to grow between 12% to 15%. Lastly, for its embedded processors revenue, we calculated it as the remainder of its total networking revenue less Ethernet switch, optics and ASICs revenue.

Company Data, JP Morgan, Yole Development, Khaveen Investments

Superior Ethernet Switch Product Performance Advantage

Recently, Broadcom announced that it had recently shipped its first Tomahawk 5 switch series. According to the company, it claims that its products offer double the bandwidth of its competitors and has doubled its product bandwidth every two years with each new product launch.

Providing 51.2 Terabits/sec of Ethernet switching capacity in a single, monolithic device, double the bandwidth of any other switch silicon available on the market today. – Broadcom

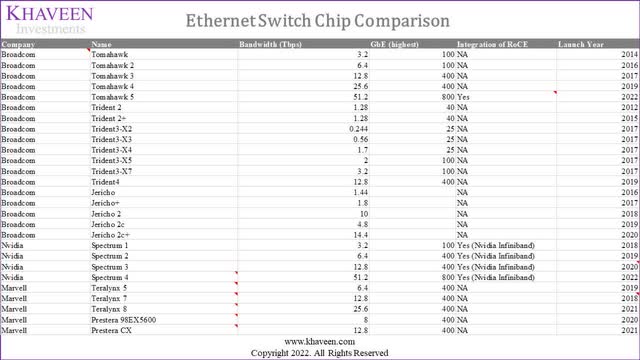

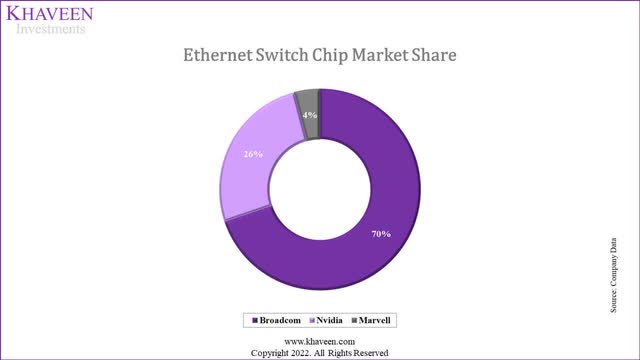

Broadcom had dominated with a market share of 80% of the $3 bln Ethernet switch chip market according to Linley but its market share had eroded from 94.5% in 2015 and is believed to have further declined to 70%. Whereas newer entrants such as Innovium and Mellanox (acquired by Nvidia) are its competitors with Nvidia accounting for 26% of the market based on our estimates derived from the revenue breakdown of its Ethernet segment. To determine Broadcom’s claim, we looked at a total of 27 product models from Broadcom, Nvidia and Marvell across 10 years and compared Broadcom’s Ethernet switch chips with its competitors including Marvell, which acquired Innovium and Nvidia through its Mellanox acquisition, based on their product bandwidth and Gigabit Ethernet speed.

Company Data, Khaveen Investments

Broadcom offers 3 main switch chip product families including Tomahawk for hyperscale data centers, Trident for enterprise and Jericho for carriers/service provider networks. Based on the table above, Broadcom’s Tomahawk bandwidth had been doubling with every new product launch since 2014. Its latest Tomahawk series offer 51.2Tbps of bandwidth capability with 800 GbE. Though, Nvidia’s Spectrum 4 also has 51.2 Tbps of bandwidth capability and 800 GbE, which is in contrast with Broadcom’s claim as the only product with 51.2 Tbps bandwidth. However, Nvidia’s 51.2 Tbps product is only expected to start shipping in 2023 according to the company. In comparison, Marvell’s Teralynx 8 product only has 25.6 Tbps bandwidth as it was launched in 2021. Thus, we believe that while Broadcom has a wider portfolio and is the first to launch its 51.2 Tbps Ethernet switch chip, we expect it to face competition from Nvidia which is expected to start shipping its new chip in 2023.

One aspect of the new Tomahawk 5 chip is the integration with RDMA over Converged Ethernet ((RoCE)) technology. According to Mellanox, RoCE is

a network protocol that leverages Remote Direct Memory Access (RDMA) capabilities to dramatically accelerate communications between applications hosted on clusters of servers and storage arrays.

The incorporation of RoCE is claimed to result in lower latency, higher throughput, and better performance. Nvidia had leverage on RoCE from Mellanox which is called Nvidia Infiniband. Thus, we believe that the incorporation of RoCE for Broadcom could provide it an opportunity to close the advantage gap that Nvidia has had.

Moreover, we compared Broadcom’s Ethernet switch chips product pricing across different product generations to calculate its pricing difference. According to Broadcom, for its Tomahawk 4 chips, 6 12.8Tbps chips are needed to create the bandwidth of the Tomahawk 4 (25.6Tbps).

Another way of saying that is that the Tomahawk 4 can cost six times much as the Tomahawk 3 and still have space, thermal, resiliency, and huge latency advantages to deliver the same raw bandwidth that is carved up into ports. – The Next Platform

Broadcom is not providing specific pricing for its chips, and it is an incorrect assumption that Broadcom will charge the same price for the Tomahawk 4 as it did for the Tomahawk 3. On the contrary, with these improvements, we expect that Broadcom will be able to charge more for the ASIC (but far less than 2X of course) – probably on the order of 25 percent to 30 percent more for that 2X increase in throughput and reduction in latency. – The Next Platform

|

Broadcom Ethernet Chip |

BCM56960 |

BCM56970 |

BCM56980 |

Average |

|

Price ($) |

4,128 |

4,308 |

6,384 |

|

|

Growth % |

4.4% |

48.2% |

26.3% |

Source: Avnet, Khaveen Investments

We obtained the price of Broadcom’s past 3 Tomahawk chip models from Tomahawk 1 to 3 from Avnet due to limited information provided from the company’s websites which shows an average price increase of 26.3%.

|

Broadcom Ethernet Switch Revenue ($ mln) |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Unit Shipment Growth % |

8% |

8% |

8% |

8% |

8% |

|

ASP Growth % |

13.1% |

13.1% |

13.1% |

13.1% |

13.1% |

|

Revenue Growth % |

22.2% |

22.2% |

22.2% |

22.2% |

22.2% |

|

Broadcom Ethernet Switch Revenue |

3,057 |

3,735 |

4,564 |

5,576 |

6,813 |

Source: Omdia, Khaveen Investments

Thus, we that while the company had launched the industry’s first 51.2 Tbps switch product, we expect it to face competition from Nvidia in the future but could close its technological gap with Nvidia’s Infiniband with the integration of its RoCE technology. We projected the company’s Ethernet switch chip revenue growth based on the market forecast switch silicon units CAGR of 8% by IHS and ASP growth based on our derived average of Broadcom’s past products generations but divided by 2 to account for its product launch which is every 2 years. In total, we projected its Ethernet switch chip revenue to grow at an average of 22.2% through 2026.

New Ethernet Chips Leverage on its Silicon Photonics

According to Broadcom,

Co-Packaged Optics (CPO) is an advanced heterogeneous integration of optics and silicon on a single packaged substrate aimed at addressing next-generation bandwidth and power challenges. CPO brings together a wide range of expertise in fiber optics, digital signal processing (DSP), switch ASICs, and state-of-the-art packaging & test to provide disruptive system value for the data center and cloud infrastructure.

Whereas according to GazetteByte, co-packaged optics brings together optics and the chip in one package.

Broadcom highlights several performance advantages of using co-packaged optics. According to Broadcom, it reduces power consumption by 30% and the cost-per-bit by 40% compared to using pluggable optics. Further, Co-packaged optics also double rack density bandwidth.

Additionally, leveraging Broadcom’s leading-edge silicon photonics and packaging technologies, Tomahawk 5 will be made available with co-packaged optics using Broadcom’s Silicon Photonics Chiplets in Package (SCIP) platform, providing a more than 50 percent decrease in the power needed for optical connectivity. Since the same switch silicon provides all these options, customers can choose the optimal I/O for each part of their intra-cluster, inter-cluster, and inter-DC networks with no software porting required. – Broadcom

Furthermore, Broadcom and Tencent (OTCPK:TCEHY, OTCPK:TCTZF) announced a strategic partnership to “accelerate the adoption of high bandwidth co-packaged optics (CPO) network switches for cloud infrastructure”. Under this partnership, Broadcom will

provide the 25.6-Tbps Humboldt CPO switch device that features Broadcom’s Tomahawk 4 switch chip directly coupled and co-packaged with four 3.2-Tbps Silicon Photonics Chiplets In Package (SCIP) optical engines.

|

Co-Packaged Optics Platform |

Broadcom |

Marvell |

Nvidia |

|

Throughput |

800 Gb/s |

800 Gb/s |

N/A |

|

Ethernet Switch |

25.6 Tb/s & 51.2 Tb/s |

51.2 Tb/s |

N/A |

|

Expected Launch |

2022 |

2024 |

N/A |

Source: The Register, Company Data, Khaveen Investments

We compared the co-packaged optics products from Broadcom with Marvell and Nvidia. According to Broadcom, the company plans to launch its 25.6 Tbps Humboldt product in 2022 followed by its 51.2 Tbps Bailly product in 2023 with a max throughput of 800 Gbps. Compared to Broadcom, Marvell also plans to launch its co-packaged optics but only in 2024 which similar specs to Broadcom’s Bailly product. On the other hand, Nvidia had yet to announce its co-packaged optics but had previously hinted that it was developing co-packaged optics for its NVLink.

|

Broadcom Networking Segment |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Optics |

656.64 |

826.05 |

1,039 |

1,307 |

1,645 |

2,069 |

|

Growth % |

25.80% |

25.80% |

25.80% |

25.80% |

25.80% |

Source: Yole Development, Khaveen Investments

Overall, we believe that Broadcom’s integration of its silicon photonics solutions with its Ethernet chips to create its co-packaged optics product which it claimed to enable benefits such as lower power consumption and cost per bit could provide growth opportunities for its optics business. We projected the company’s optics revenue based on the silicon photonics market CAGR of 25.8%. Though, we expect the company to face competition from Marvell and Nvidia in the future as they develop their co-packaged optics.

Broad Networking Portfolio Targeting Data Center and Enterprise Customers

Besides Ethernet switch and optics products, Broadcom’s Networking segment also includes other products such as embedded processors and ASICs. According to its annual report, Broadcom’s processors leverage its ARM CPU and Ethernet switching technology for applications in

communication products such as voice-over-internet-protocol, telephony, point-of-sale devices and enterprise and retail access points and gateways in a variety of advanced devices in the enterprise, metro, access, edge and core networking spaces.

Moreover, in terms of the company’s ASICs business, the company integrates SerDes technology into its ASICs built on leading-edge processes and custom-built to individual customer specifications. According to Broadcom, its ASICs are targeted toward data center and enterprise networking as well as HPC applications.

Similar to the company’s Ethernet switch and optics products, these products cater to the company’s data center and hyperscale customers. For example, according to JPMorgan, the company had co-designed Google’s (GOOG, GOOGL) TPU4 chip for its data centers and has engaged with other customers through its ASIC business such as “Facebook (META), Microsoft (MSFT), AT&T (T), ByteDance, Nokia (NOK), Ericsson (ERIC), ZTE.” Recently, Broadcom was reported to have secured additional design wins for custom ASICs from Meta as the company focuses on its metaverse hardware infrastructure architecture which requires significant capabilities for “AI/ML, video processing, and high-speed networking.”

|

Broadcom Networking Segment |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Ethernet Switch Chip |

2,502 |

3,122 |

3,814 |

4,661 |

5,695 |

6,959 |

|

Growth % |

22.2% |

22.2% |

22.2% |

22.2% |

22.2% |

|

|

Optics (Silicon Photonics) |

656.64 |

826.05 |

1,039 |

1,307 |

1,645 |

2,069 |

|

Growth % |

25.80% |

25.80% |

25.80% |

25.80% |

25.80% |

|

|

Custom ASICs |

2,250 |

2,554 |

2,899 |

3,290 |

3,734 |

4,238 |

|

Growth % |

13.50% |

13.50% |

13.50% |

13.50% |

13.50% |

|

|

Embedded Processors |

1,522 |

1,589 |

1,719 |

1,860 |

2,013 |

2,178 |

|

Growth % |

8.20% |

8.20% |

8.20% |

8.20% |

8.20% |

|

|

Total Broadcom Networking |

6,930 |

8,091 |

9,472 |

11,118 |

13,086 |

15,444 |

|

Growth % |

16.7% |

17.1% |

17.4% |

17.7% |

18.0% |

Source: Company Data, JP Morgan, Yole Development, Khaveen Investments

From the table, we estimated its Ethernet switch chip to represent 37% of its Networking segment revenues, making it its largest in the segment followed by ASICs at 32% of revenue. We forecasted its Ethernet switch chip revenue to grow at an average of 22.2% based on ASP and unit shipment growth as discussed above, which is the second highest to optics at 25.8% based on the silicon photonics market CAGR. For its embedded processors, we based its growth on the market forecast CAGR of 8.2% and the ASIC market on the midpoint of the market forecast CAGR of 13.5% by JPMorgan. All in all, we projected its Networking business segment to grow at an average of 17.4% through 2026.

Risk: Competition with Nvidia and Marvell

For Broadcom’s Ethernet switch chips, we highlighted the company’s declining market share from above 90% in 2015 to 70% with competitive pressure from Nvidia and Marvell. Despite the launch of its Tomahawk 5 chip which makes the company the industry first for a 51.2 Tbps product, we expect Nvidia to pose a competitive threat to Broadcom when its ships its next-gen Spectrum 4 chips in 2023. Moreover, we believe Marvell and Nvidia’s development in silicon photonics with the acquisition of Inphi for Marvell and Nvidia’s investment in Ayar Labs could heat up competitive pressures in the future for Broadcom and affect its revenue growth outlook for its Networking segment. Nonetheless, we projected Broadcom’s Networking revenue growth to increase in the next 5 years compared to its historical growth of 14.7% in 2021. Though, as we projected the company’s Networking revenue growth based on market forecast CAGR, we believe a contraction in the market could affect the company’s growth outlook.

Company Data, Khaveen Investments

Valuation

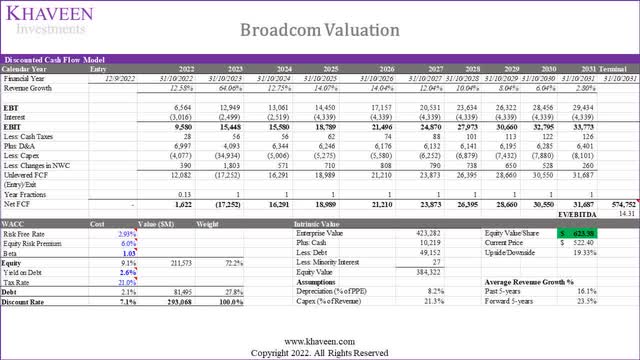

We updated our revenue projections from our previous analysis of the company with its Semiconductor Solutions segment. We projected its Networking revenue growth based on its Ethernet switch, optics, ASICs and embedded processors growth. Whereas for its other segments, we based its growth on the market forecast CAGR for its Storage (9.7% CAGR), Wireless (8.5% CAGR) and Broadband (5.3% CAGR) segments.

|

Broadcom Revenue Projections ($ mln) |

2021 |

2022F |

2023F |

2024F |

2025F |

2026F |

|

Semiconductor Solutions |

20,383 |

21,956 |

24,446 |

27,294 |

30,563 |

34,331 |

|

Semiconductor Solutions Growth % |

18.05% |

7.72% |

11.34% |

11.65% |

11.98% |

12.33% |

|

Infrastructure Software |

7,067 |

7,622 |

8,221 |

8,869 |

9,570 |

10,329 |

|

Infrastructure Software Growth % |

6.74% |

7.85% |

7.87% |

7.88% |

7.90% |

7.92% |

|

Total |

27,450 |

29,578 |

32,667 |

36,163 |

40,134 |

44,659 |

|

Growth % |

14.9% |

7.8% |

10.4% |

10.7% |

11.0% |

11.3% |

|

M&A Related Revenue Growth % |

1,327 |

1,327 |

1,327 |

1,327 |

1,327 |

|

|

Total |

27,450 |

30,904 |

33,993 |

37,490 |

41,460 |

45,986 |

|

Total Growth % |

14.9% |

12.6% |

10.0% |

10.3% |

10.6% |

10.9% |

|

VMWare Revenue |

16,148 |

19,116 |

23,186 |

28,372 |

||

|

VMWare Revenue Synergies |

559 |

559 |

559 |

|||

|

Total Revenue (Post-Acquisition) |

27,450 |

30,904 |

50,701 |

57,165 |

65,205 |

74,358 |

|

Growth % |

14.9% |

12.6% |

64.1% |

12.7% |

14.1% |

14.0% |

Source: Broadcom, Khaveen Investments

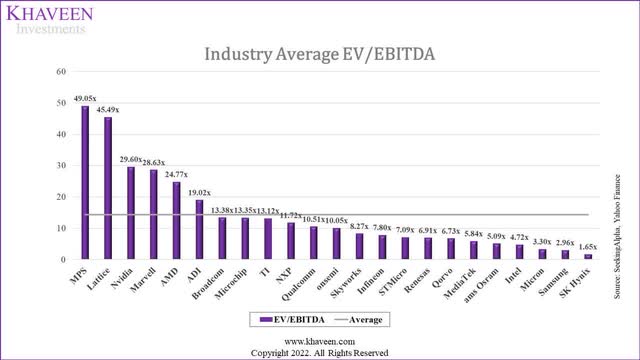

We continue to value the company with a DCF valuation as we expect the company to continue generating positive FCFs. We updated the industry average EV/EBITDA to 14.31x based on the semiconductor chipmaker average.

SeekingAlpha, Khaveen Investments

Based on a discount rate of 7.1%, our model shows Broadcom shares are undervalued by 19.33%.

Verdict

To conclude, we analyzed Broadcom’s Networking segment following the launch of its new Tomahawk 5 chips and determined its advantage over Nvidia and Marvell for the time being as it is the industry’s first 51.2 Tbps switch chip. Based on ASP and unit shipment growth, we projected its Ethernet switch revenue growth at 22.2% through 2026. Moreover, with the integration of optics and its Ethernet switch chips, we expect the company to benefit from growth opportunities for its optics portfolio and projected its revenue growth based on the market CAGR of 25.8%. Finally, we broke down its Networking segment into Ethernet switches, optics, AISCs and embedded processors which target common customers such as enterprise and data center customers and projected total networking growth at an average of 17.4% through 2026.

Overall, we projected Broadcom’s Networking segment’s growth to fare better than its historical growth at a 5-year forward average growth rate of 17.4% compared to 14.7% in 2021. We expect its growth to be driven by Ethernet switch chips and optics revenue growth at 22.2% and 25.8% respectively with the launch of the company’s next-gen chips and co-packaged optics. Though, we projected it based on market forecast CAGR, thus indicating the acceleration of the market growth rather than due to the company’s competitive advantage which could pose a risk to Broadcom’s growth if the market contracts. Whereas for the company’s other semiconductor segments including Storage (9.7% CAGR), Wireless (8.5% CAGR) and Broadband (5.3% CAGR), we forecasted their growth rate to be lower than their historical growth in 2021.

We believe this highlights the importance of the Networking segment for Broadcom as it is its largest semiconductor segment representing 26% of revenue, thus we expect its higher networking revenue growth to contribute to higher total revenue growth for Broadcom at a 5-year forward total revenue growth of 23.5% compared to 22% in our previous analysis.

We updated our valuation which shows a lower price target of $623.38 as the average EV/EBITDA had declined from 18x to 14.31x despite a higher 5-year forward revenue projection of 23.5%. Thus, we rate the company as a Buy as the company’s stock had declined by 25% YTD.

Be the first to comment