atosan

Business Overview: Caesars Entertainment’s history and operations

Caesars Entertainment (NASDAQ:CZR) is one of the biggest Casino operations in the US, controlling 46 casinos (20 of which are owned and 26 leased), mainly in Nevada. In 2020, they merged with “Former Caesars”, in a transaction valued at around $17 billion. As a result, the new CZR saw net long-term debt rise from $2 billion to $10 billion (2019 v. 2020), new financing obligations related to the leases in the amount of $12 billion, and goodwill of $9 billion. The result of the merger is a behemoth that now controls 47,700 hotel rooms and 2,900 table gas across the US.

While EBITDA passed from $700 million in 2019 to more than $2.9 billion in 2021 (post-covid), net leverage increased from 2.85x to 4.0x, leaving on the ground a much riskier company with a lower margin of error. Cash flows did not have a good time as well, with FCF being consistently negative post-merger as the company expenditure for M&A well surpasses the CFO.

And what is the shareholders’ position after the merger? Well, around $3 billion of the acquisition cost was sustained by the equity holders through a capital raise in 2020.

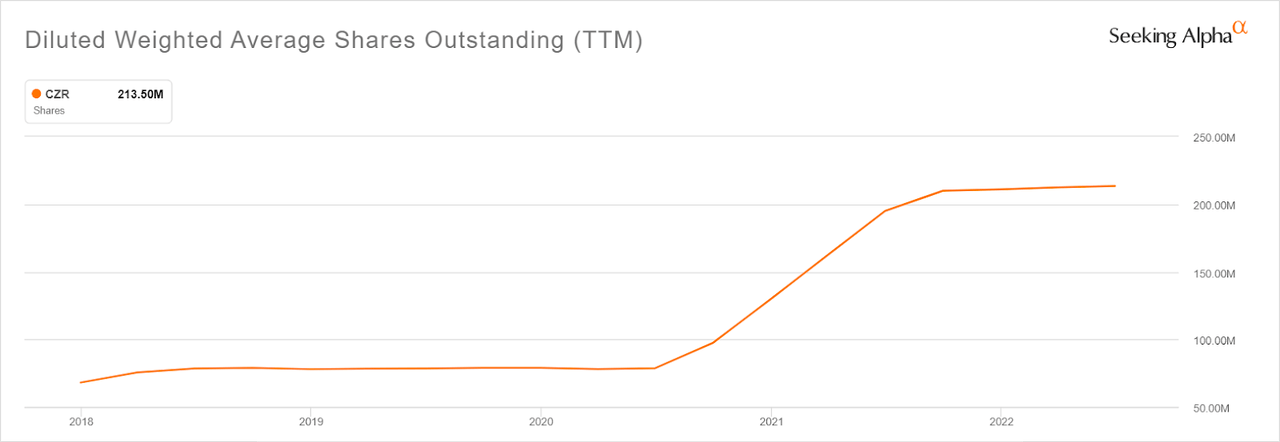

Number of shares outstanding (Seeking Alpha Charting)

The shares outstanding passed from 68 million at the end of 2017 to 213 million today, marking a substantial dilution of existing equity holders, who saw their weight (and voting rights) declining by some 70%. A 10% owner in 2017 would now be left with only a 3% stake.

Caesar’s real issue: a huge balance sheet full of variable interest debt

Like many other businesses that require big PP&E assets and Capex expenditures, Caesars has a ton of long-term debt on its balance sheet. This debt, mainly in the form of term loans and credit facilities, is the result of the merger completed in 2020.

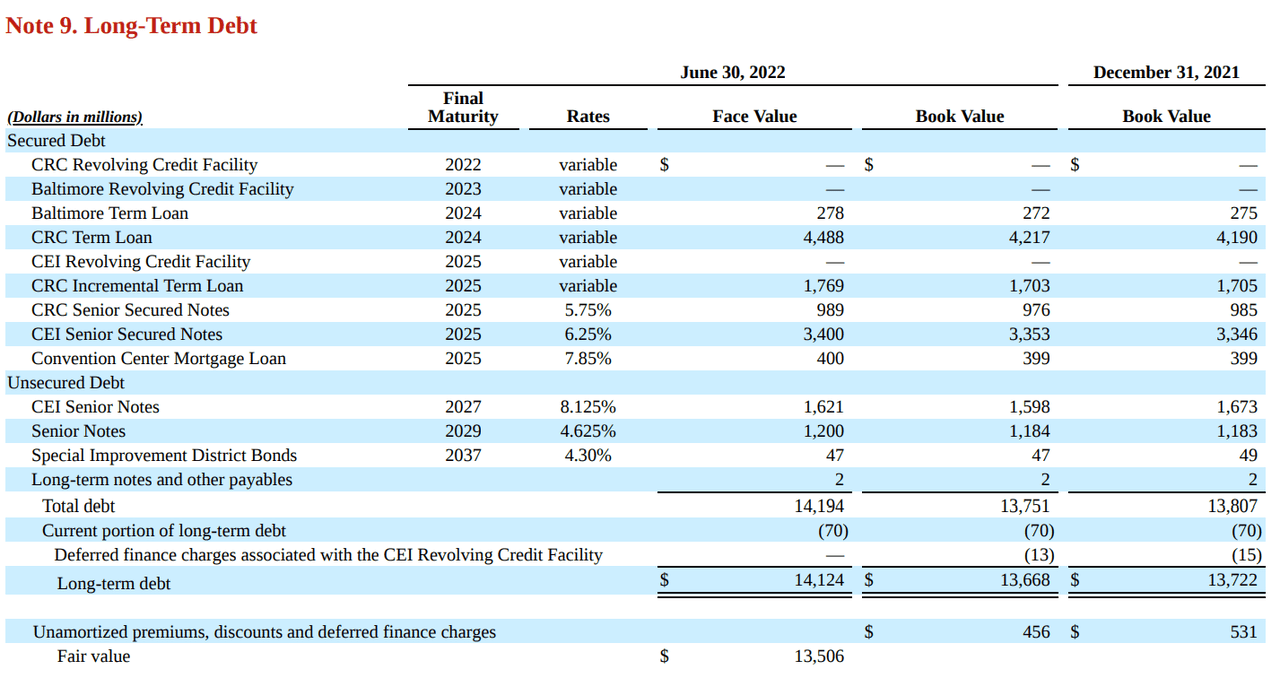

Long-Term Debt (CZR Latest 10-Q )

This is what the facilities look like in their filings. It’s very clear that the main issue there is the variable rates, which are applied to 6 different facilities for a total amount of around $6.6 billion in book value. Usually, companies prefer to cover themselves by entering into interest swap agreements, in order to be hedged in case the FED decided to raise rates by 3% in 9 months. Well, CZR is pretty much fully exposed instead, with the swap covering only $1.2 billion of variable interest debt, and expiring on December 2022.

This means that starting January 2023, the company will be 100% exposed to $6.6 billion in variable debt, which will be subject to rates between 3-4% higher than in January 2022 (depending on how much the FED will continue to raise). By computing the additional expense using a 350bps average increase, CZR is expected to pay around $210-230 million of additional interest. It may seem reasonable for more than $13 billion of debt outstanding, but actually, it’s around 10% of 2021 Adj. EBITDA, and 17% of cash from operations.

For a company with an already deeply negative FCF, it’s definitely not a good addition to expenses, which will only squeeze the shareholders’ value even more, as it’s clearly already compressed by the huge importance of creditors.

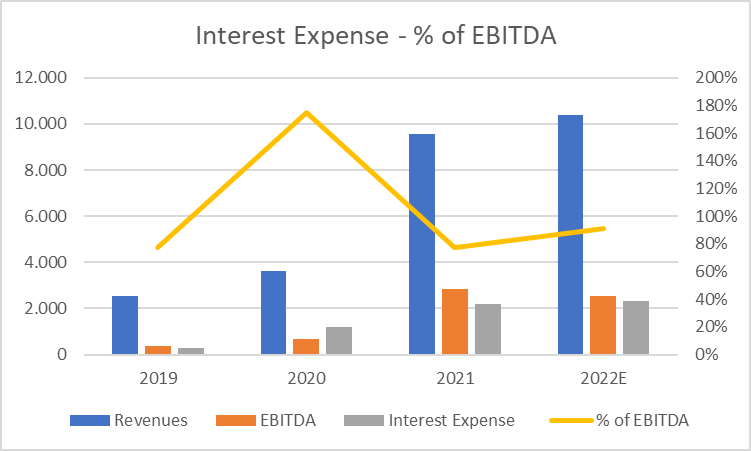

Interest expense (Own-made chart)

This chart shows how much interest expense accounts for, as % of EBITDA, and it is clear that even after a return to normal after Covid, the company still struggles to keep interest expense contained. Indeed, it’s expected to increase from around 80% of EBITDA to more than 90% in 2022, due to both higher rates and lower EBITDA.

Inflation: expect higher rent expenses and lower revenues

As I anticipated before, the company is currently operating 26 of its 48 casinos under leasing agreements, which were incurred after the merger closed. In particular, VICI Properties is the main lessor with 18 properties under their agreement, so basically they are the company’s landlord. Under their lease agreement, there is a dangerous (for CZR) clause that consists of a rent increase based on the CPI (i.e., inflation) increase during the last fiscal year.

This means that starting January 2023, they will be subject to an 8-10% increase in their $1.1 billion rent expense, which means an additional $90-110 million in rent expense (which is actually expensed as interest).

And then there is the other significant issue: how will demand be impacted by inflation hitting consumers? I see two main issues: a direct effect due to lower purchase power, and an indirect effect due to increased interest expense on mortgages (caused by rising rates). These two factors could lead to a decrease in travel to Vegas and thus spending in Caesars’ locations. This could happen during a very delicate and fragile trend of returning to pre-covid levels, as many stats suggest that still much need to be recovered.

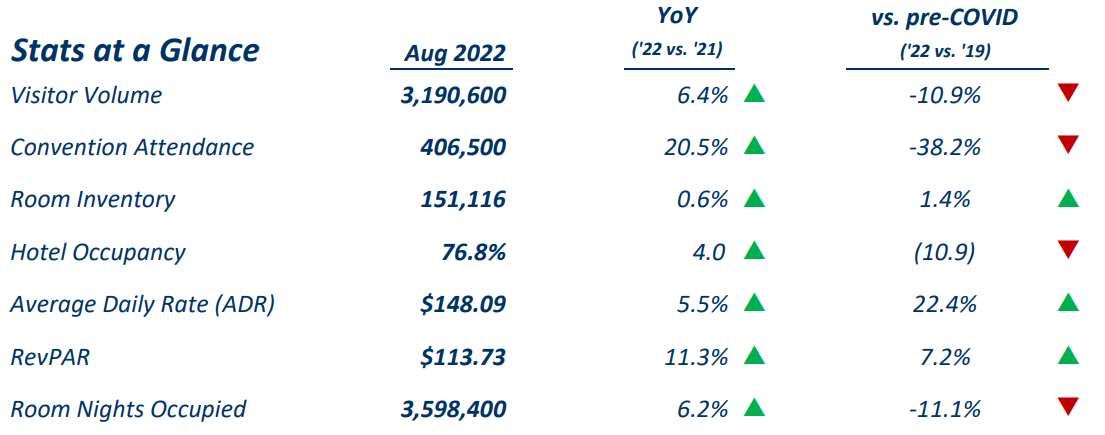

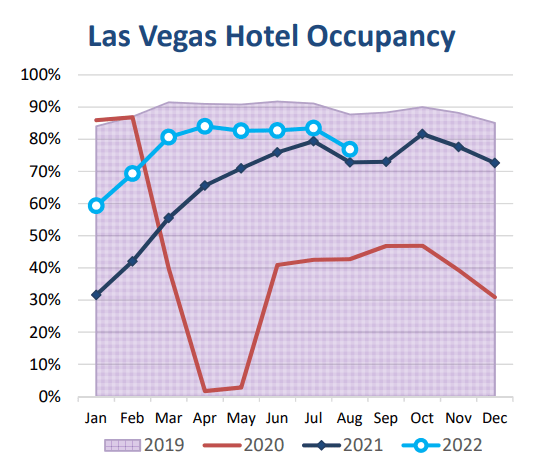

Las Vegas Tourism Stats (LVCVA )

This official report issued by the LVCVA authority shows that visitors are still 11% lower than in 2019, and hotel occupancy (crucial for CZR) is down about the same.

Las Vegas Tourism Stats (LVCVA)

Inflation hitting the positive trend taking place so far in 2022 could be deadly for many casinos and hotels.

Modeling scenarios: assessing CZR’s fair value

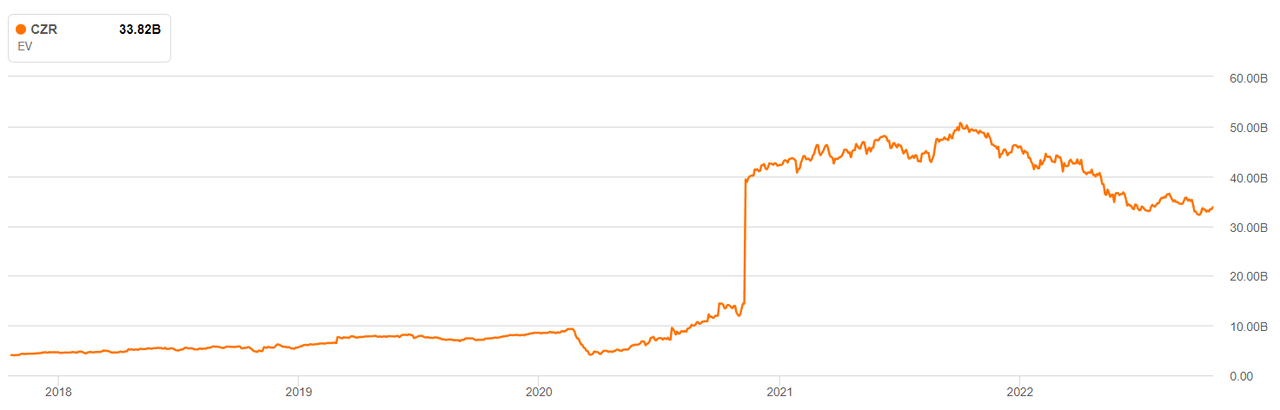

In recent years EV of Caesars exploded following the merger completed in 2020.

CZR EV (Seeking Alpha Charting)

Right now it stands at $33 billion, with $8.5 billion in equity value and $24.5 billion in debt. If we exclude liabilities derived from financial lease obligations, we can reduce this last figure to $14.5 billion (total EV of $23 billion).

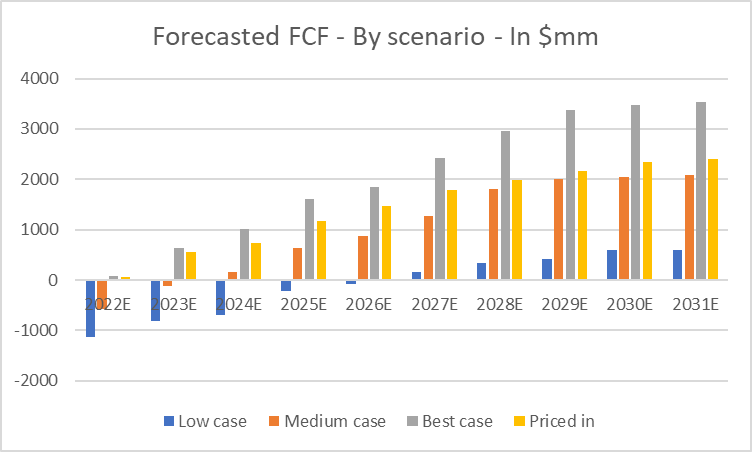

To properly value CZR, I will use a DCF model with different scenarios: low, medium, and best case, along with a priced-in scenario, which derives from reverse engineering of the current market value of CZR equity (i.e. market cap). This priced-in scenario will help us understand the assumptions the market is making (approximately) on CZR future growth, margins, and Capex requirements; and eventually expected Free Cash Flow available for distribution. To end up with an $8.5 billion valuation, the market is expecting the following from CZR (according to my model):

-

Growth rate between 14% (2022) and 3% (from 2026).

-

EBITDA margin rising from 26% (2022) to 28% (2024 and beyond).

-

FCF between $57 million (2022) to $2.5 billion (end of period, 2030).

To compute FCF I’m using net income, and not NOPAT, to properly include interest expense derived from leases and LT debt, which is a proper cost weighting on equity holders. All the assumptions above, when computed for in the model, result in a fair equity value of $35 per share, near the $39 it’s currently trading at. To give some perspective, their current non-adjusted EBITDA margin stands at 23-24% for the last 6 months, and 27% for 2021, while FCF was negative by $300 million and $6 billion in 2021 and 2020 respectively, due to expensive acquisitions.

Let’s see the other scenarios’ assumptions:

-

Worst case: Revenue growth rate of 3%, EBITDA margin at 12% (2022) to 14% (2024 and beyond), FCF between -1.1 billion (2022) and $700 million (2030), mainly due to margins not capable of covering interest expenses.

-

Medium case: Revenue growth rate between 10% (2022) and 2% (2026 and beyond), EBITDA margin growing from 21% in 2022 to 25% from 2026 and beyond, FCF between -500 million (2022) to $2.1 billion in 2030.

-

Best case: Revenue growth rate between 14% (2022), 5% (2024), and 3% after 2024, EBITDA margin starting at 27% growing to 29% after 2026, FCF between $86 million (2022) and $3.5 billion (2030).

CZR Forecasted FCF (Own-made DCF model)

The results with the probabilities I assigned for each scenario are the following:

-

Low case: EV of $3 billion, resulting in $0 equity value. The probability for this scenario is 10%.

-

Medium case: EV of $16 billion, resulting in $2.2 billion equity value ($11.5 per share). The probability for this scenario is 70%.

-

Best case: EV of $30 billion, resulting in a $16 billion equity value ($80 per share). The probability for this scenario is 20%.

This distribution is clearly distributed in favor of the best scenario, relative to the worst one, but the result is still quite bearish, suggesting an overall fair value per share (weighted average) of $24. Compared to the current share price of $39, it represents a downside of around 40%.

Conclusion

Caesars Entertainment is not in a great position to face the current environment of rising rates, inflation, and rent expenses. In my opinion, their reliance on expensive, variable-interest debt, to finance their expensive acquisitions could soon turn out negatively in the form of lower CFO and FCF, effectively harming shareholders. After computing their fair value, and considering all the factors that could pressure the company in the following months, I conclude that CZR is a sell with a target price of $24.

Be the first to comment