IPGGutenbergUKLtd/iStock via Getty Images

This article was coproduced with Wolf Report.

The initial set-up for Orion Office REIT (NYSE:ONL) can only be said to be “spectacular”. We covered the company, considering it a “Strong Buy”.

Why did we believe this?

Because when this REIT debuted through its spin-off, coming from the merger of VEREIT and Realty Income (O), it held 92 mission-critical office assets with headquarter-like quality scores.

It can even be said to be “unique”, and we equated its quality being like that of Realty Income, which of course is known as the “Monthly Dividend Company”.

Aside from the company’s asset quality, the company’s management team was, and is, extremely well-versed in the market. The CEO, Paul McDowell, comes from an executive V.P. and COO of Vereit and was for 7 years. He was also the founder of a former net-lease REIT that was covered by iREIT until it was M&A’d by American Realty in 2014.

(Here’s our last interview with the CEO, Paul McDowell)

ONL’s CFO was the chief accounting officer at Vereit, the CIO was in senior industrial asset management at Vereit, and the COO came from a senior VP position. So, all in all, the C-suite was essentially all from Vereit, all with plenty of expertise.

All good, right?

ONL carries a portfolio of no less than 10.5M rentable square feet, that’s around 94% leased, with over 70% of investment-grade tenancy and an average ABR of $16.7 per square foot.

So, Orion is essentially the office version of Realty Income and Vereit. The company has a 100% office exposure, primarily found in the single-tenant suburban net lease sector.

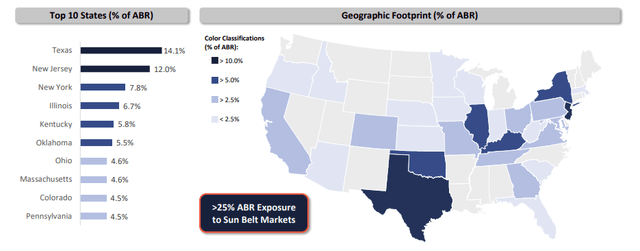

Its mission is focusing on single-tenant net-lease properties in attractive suburban markets, with a Sunbelt focus due to pop growth and economic growth.

All good thoughts here, as I see it.

There is also no external management to this REIT, which is sometimes the case. No, ONL is entirely internally managed by the aforementioned team with over a quarter of a decade of combined experience in the net lease space.

ONL Investor Presentation

So, on the surface, this sounds like a splendid deal.

A great mission.

Experienced management, great properties, only moderate leverage, plenty of liquidity available, and with a robust platform.

Why is there supposedly such an upside in this space, then?

Well, the continued de-urbanization in areas in the U.S. is enhanced by the COVID-19 pandemic – previous and ongoing.

82% of urban centers saw net move-outs during COVIDs, and 91% of suburban counties saw net move-ins, clearly outlining this trend. This was especially noticeable in New York, San Francisco, and Los Angeles, with the highest net move-outs and population losses that continue.

What’s more important, this trend is being driven by the future workforce – young, affluent, and highly educated urban dwellers.

Sunbelt markets are in special demand, with Texas, Florida, North Carolina, Arizona, and Georgia being primary targets. 75% of the last 10-year population growth has been sunbelt – and these states combine low-cost tax-friendly sunbelt market with now-attractive demographics.

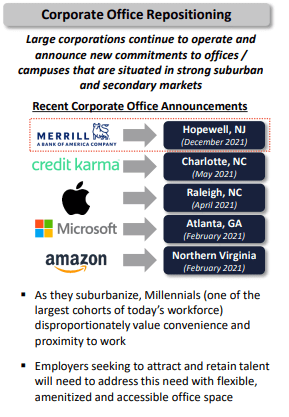

The corporate office space is repositioning.

ONL Investor Presentation

We combine this with the trends of:

- Good school systems

- Limited new office supplies

- Access to communications

- Supply of affordable houses

Pretty much the exact opposite of geographies like Cali or NYC – and we can start to understand what ONL Bulls are starting to see here.

Investment-grade average tenant quality with lease terms of between 8-12 years on average, annual escalators in the rents, and with only triple-net, double net or modified gross leases, we have some very attractive fundamentals.

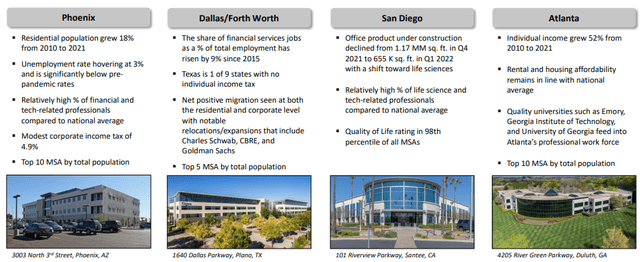

Some examples of attractive markets here.

ONL Investor Presentation

So, what of the portfolio?

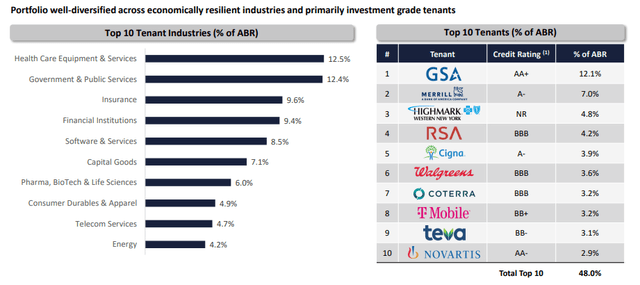

Well, it has good diversification.

12.5% is government and public services – which is great. That’s the sort of quality I’m looking for when delving into these things because these tenants usually or very rarely ever go anywhere.

Aside from that, large tenants are health care equipment and services, insurance clients, and financial institutions. Those clients are in line with the future few decades in the US, with the biggest risk from the financial space.

But it’s a good mix.

You can argue about the quality of some of them, but over 45% of the mix is in the top 10, and those companies are well-worth considering “safe”.

ONL Investor Presentation

The pure-play office REIT already has the diversification we want to be looking at, with perhaps a slight over-emphasis on the New Jersey and NYC area.

ONL Investor Presentation

ONL has a current leverage target of around 5.5-6.5X net debt/adj. EBITDA. Its current debt has an average outstanding maturity of 3.5 years, with an average interest of 4.07%. The company has south of half a billion available in its revolver, and some millions in cash.

Now we start slowly seeing some of the weaknesses of ONL – but one more moment of bullishness here.

Since the company began less than a year ago, the company has managed:

- A JV with a 127,000 sqft. property in St. Louis leased to an investment-grade energy tenant.

- Sold off three assets of around 185,000 sqft, with another $13M in additional potential divestments.

- Signed early lease extensions in late 2021 (11 years), with the largest property the company owns. 2022 extensions are signed with tenants in key properties in Texas and Georgia.

So, lease extensions, and divestments, things are going quite well for the business – at least from that perspective.

So what exactly is the issue?

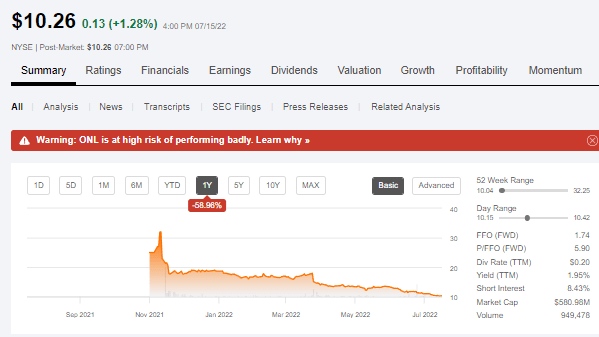

Seeking Alpha (Warning)

Wolf Report sold close to all of his ONL when he received it – and he received quite a bit, thanks to his large stake in Realty Income. His reason at the time was that he didn’t like the risk/reward ratio, the dividend, and the potential downside.

He sold before the slight “pop” as well and now holds only a very marginal position.

(I still own shares from the O spin – Brad Thomas)

We’ve gone through bull – let’s move to bear.

Bearish view on Orion Office REIT

The market is expecting that tenants, not landlords, are going to be holding the chips in the office space when it comes to negotiating extensions.

Why?

Because as we start seeing lease extensions, we’re going to see significant rising costs in CapEx due to inflation, overall price increases and related pressures. This muddies the waters around Orion Office, and that’s part of the reason we’re seeing issues here.

Another one is the dividend.

ONL was expected, even by iREIT, to provide a dividend at a very high yield and were expecting a 65%+ payout ratio on FFO, compared to around 77.5% for the sector in the iREIT coverage spectrum.

Enter our disappointment when the company went to a 24% FFO payout ratio at $0.4/share.

That makes the yield at the current price 3.9%.

Not exactly sub-par low, but less than half of what we actually expected the company would go for. The company sees its re-leasing and other challenges and seeks to prepare its balance sheet and its operations for the challenges.

The latest report in May was a beat on the expectations for FFO, and a miss by revenues. ONL hasn’t disappointed the market, in our view, in a way that justifies a 50%+ 1-year drop since late last year.

The company wants to spin the massive amounts (over half of the portfolio until 2024) of re-leases in the next few years as an opportunity. Indeed, it might be – but this puts immense pressure on management and its ability to execute under difficult conditions.

Can you fault anyone, really, for being careful in this market?

The company’s CFO was very clear in the earnings call regarding the dividend.

The dividend was sized to permit future growth while preserving meaningful cash flow for reinvestment into the current portfolio and for accretive investments.

So, we need to basically be buckling up for the “long game” when it comes to Orion. They’re asking for your trust, as well as your money, with a low rate of dividend in an environment that’s high-inflation, and simply as a product of the company’s size, a higher risk.

The office space isn’t an easy one. (We only recommended two office REITs in our “Anchor & Buoy” portfolio and ONL was not one of them).

It’s not a growth story for Orion Office – this is a deep value play that requires patience.

(Bears will argue ONL is a value trap)

The company expects an FFO just above $1.6/share. Current analyst expectations are for around $1.75/share, followed by an actual decline in 2023E, to around $1.6/share. We expect that the company will increase its payout ratio on a year-by-year basis.

There are risks – deep risks to this investment. However, there is a bright spot when we look at what can be called “capitulation”.

There’s an end to it.

Have you seen ONL going bankrupt?

Of course not. Is it in danger of doing so? We would argue that there is absolutely no such danger.

There are risks – the company’s single-tenant focus can be viewed as a volatile negative as opposed to an asset, and investment-grade ratings don’t necessarily make things better when we’re talking about re-leasing negotiations.

Tenants are being targeted by plenty of office lessors, which means that they can go anywhere (or at least, into other areas than Orion properties).

Occupancy is down to just south of 88.1% as opposed to above 94% a few months back. And 4 years average remaining lease term is not very long, compared to what some other companies have.

The argument that single-lease tenant properties in the office space are perhaps one of the riskiest plays out there is certainly one that deserves weighting because if a company decides they want to go back to WFH or some sort of hybrid solution towards which the space is no longer suitable, there are plenty of options out on the market which wouldn’t hurt the company but would hurt Orion.

Also, Orion management itself is expecting significant cost increases.

Why do we say this?

Because of their own guidance of maintaining the 4.7X to 5.5X to December 2022 was said in the last earnings call.

Because of their very conservative P/O ratio, that FFO net of dividends should be combined with share price pressure, driving the comparative net debt/EBITDA down towards just north of 4X.

The fact that management hasn’t noted this in guidance, but instead mentions a number as high as 5.5X suggests to us that the company expects significant EBITDA pressure as well as CapEx increases.

If this negative scenario turns out to be true, ONL hasn’t just right sized, it has forecasted pressures that many investors might not have noted.

That’s the bearish view.

ONL Stock – The appealing valuation

However, we’re not going anywhere without putting these things together.

Because even the realistic and problematic expectations for this company don’t completely take away what we view as being a very compelling potential upside.

Why is that?

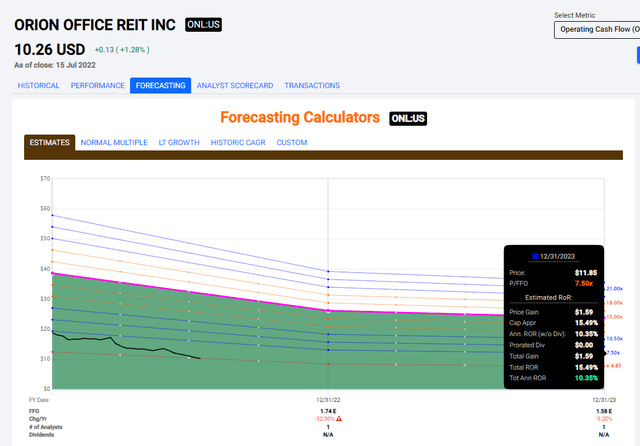

Because at below $11/share, this company’s assets trade at cents on the dollar. At current pricing, it’s expected to move at a negative 19.6% annual FFO growth rate, meaning it’s moving down to a $1.6 2023E FFO/share.

However, any sort of reversal towards anything above a 5X P/FFO would result in positive returns. At a forward 7.5X P/FFO, that return could be 15.5% in less than 2 years.

FAST Graphs

That’s the conservative base case, if you’re a risk-tolerant investor. The positive is, of course, far higher coming in at well over 100% ROR in less than 2 years. Do we consider this likely?

No, not in this market. This market is like as not to keep delivering challenges as opposed to favorable solutions for the foreseeable future. This makes investing in an Office REIT with a single-tenant focus a venture that should be made only by the more risk-tolerant of investors.

However, the fact remains that this company’s assets are being severely undervalued in the case that the base assumption of the volatile nature or their appeal is even slightly wrong.

Given how many companies have recently pushed their employees that the WFH culture is over, this isn’t as clear-cut a case as some investors would like to make it seem.

That is why we maintain a conservative price target of $17.1 for Orion Office, at around 11X P/FFO. We give this a margin of safety of around 40% here – but the word “safety” should be qualified as still meaning some risk here, given how the company is currently being treated.

In terms of quality, Orion doesn’t score all that high at this time. They began their REIT in perhaps one of the worst times to do so in the last 10 years or so. it’s up to management to now manage this.

In valuation, however, only one single company scores higher than does Orion Office REIT. The company is being so vastly undervalued that you would expect to see half of their properties on fire or about to collapse, as opposed to the quality structures they actually are.

For that reason, we cannot do anything but give this company a “BUY” here – because it’s being undervalued.

That being said, we would only buy this in the more speculative and risk-tolerant of approaches, which is why we ourselves are very careful with the holding.

Questions?

As always, thank you for the opportunity to be of service.

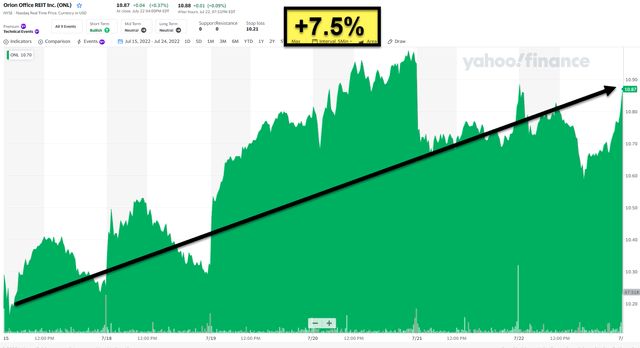

PS: This article was published a week ago at iREIT on Alpha and since that time shares have moved +7.5%. ONL will release financial results for the Q2-22 after market close on Wednesday, August 3, 2022.

Be the first to comment