weerapatkiatdumrong/iStock via Getty Images

Investment Thesis

The Mosaic Company (NYSE:MOS) may prove to be a leading supplier of the new “liquid gold” for the next decade, given the global push for battery-operated electric vehicles. MOS is currently at the interesting inflection point of its growth story, since the company offers the crucial Phosphate needed for Lithium Iron Phosphate (LFP) batteries.

Many automakers, such as Tesla (TSLA) and Ford (F), have embraced the cobalt-free LFP batteries due to the lower cost and improved technology – allowing for a 267-mile EPA range. With CATL’s speculative presence in Mexico by 2023 or 2024, we might see an increased localized demand for Phosphate in North America then – as observed in China. Since battery technologies will also continue to improve, we expect LFP batteries to match nickel-cobalt-aluminum-based batteries in terms of range – thereby, increasing the demand for Phosphate as a cheaper and more environmentally friendly alternative over time.

As a result of the immense demand for Phosphate in the agricultural, energy storage, and EV sectors ahead, we expect MOS to perform very well indeed, with up to 40 years of reserve left – based on its FQ1’22 earnings call. Jenny Wang, MOS Senior Vice President, said:

And second thing we are seeing more than doubled adoption of LFP battery in the EV adoption. Therefore the total LFP production in the first quarter this year has been more than doubled than the same time of last year. And it is reaching to the half of the total production in 2021. So we are seeing significant increases of LFP production, which are taking away of P205 from the fertilizer MAP, DAP production. (Seeking Alpha)

Mosaic Has Benefitted From the Tight Fertilizer Supply Thus Far

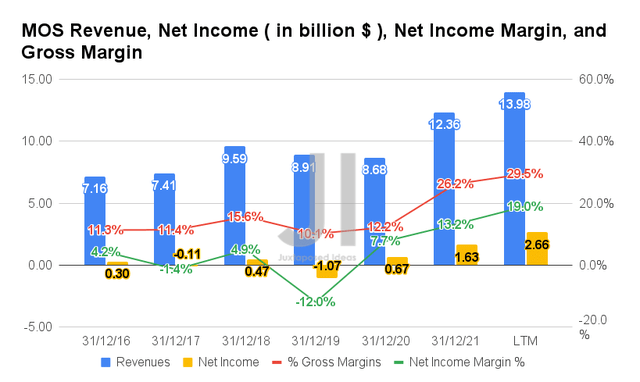

MOS grew its revenues at an impressive rate in FY2021, given the supply chain issues then. By the LTM, the company reported revenues of $13.98B and gross margins of 29.5%, representing an increase of 61% and 17.3 percentage points from FY2020 levels, respectively. In addition, MOS reported net incomes of $2.66B and net income margins of 19% in the LTM, representing an increase of 397% and 11.3 percentage points from FY2020 levels, respectively.

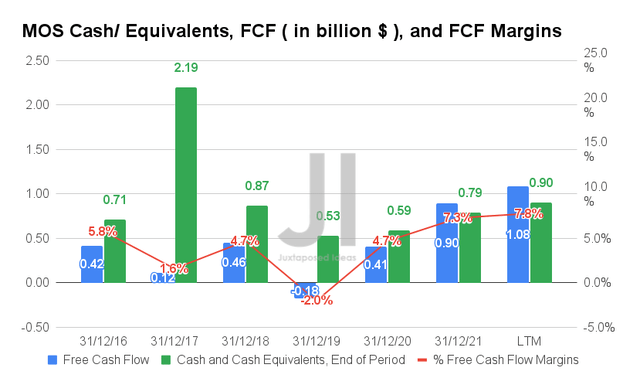

As a result of its increased profitability, MOS also grew its FCF generation excellently in the past two years to $1.08B in the LTM, representing an increase of almost 7 fold from FY2019 levels of -$0.18B. Thereby, growing its cash and equivalents on its balance sheet to $0.9B by the LTM, an impressive increase of 69.8% from FY2019 levels.

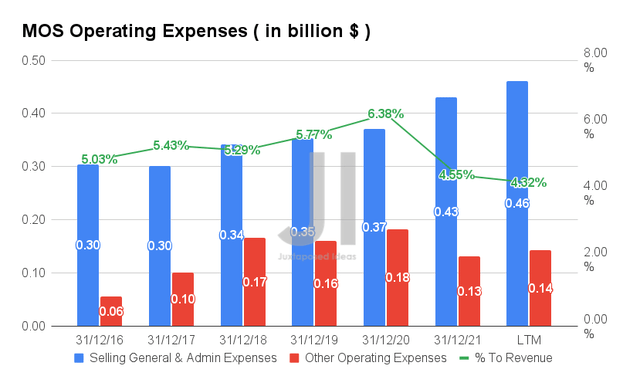

To meet the additional demand, MOS continues to grow its operating expenses to $0.6B by the LTM, representing an increase of 17.6% from FY2020 levels. However, it is also essential to point out that the ratio to its growing revenues has been relatively controlled at 4.32% in the LTM, compared to 5.77% in FY2019 and 6.38% in FY2020. Therefore, we are not concerned yet for now.

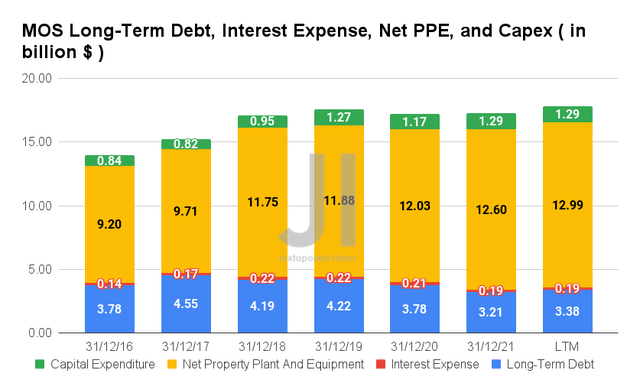

It is evident that MOS has been putting its robust FCF to excellent use, with a continued deleveraging to $3.38B by the LTM, representing a notable decrease of 20% since FY2019 levels. Thereby, helping the company reduce its interest expenses by 13.6% to $0.19B by the LTM, compared to $0.22B in FY2020. In contrast, MOS has also been growing its net PPE assets to $12.99B in the LTM with FY2022 guidance of capital expenditure at $1.3B, indicating continued investment in its capacity and output moving forward. Thereby, top and bottom lines accretive eventually.

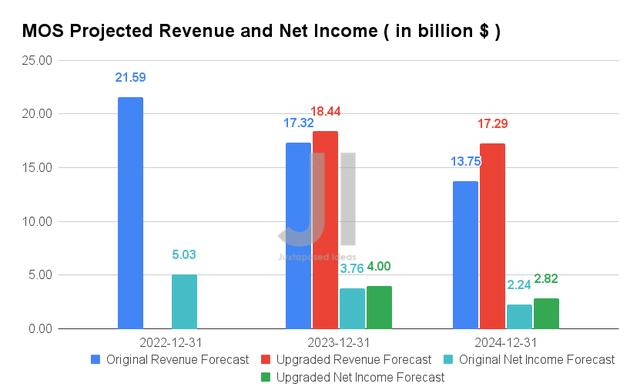

An Upwards Re-Rating To Mosaic’s Revenue and Net Income From FY2023 Onwards

For the next three years, MOS is expected to report an apparent deceleration of revenue and net income growth, since the start of the COVID-19 pandemic. Nonetheless, it is also apparent that its normalized revenue and net income would still represent an excellent CAGR of 12.19% and 35.73% by 2024, respectively. For FY2022, consensus estimates that MOS will report revenues of $21.59B and net incomes of $5.03B, representing an impressive increase of 74.8% and 308.5%, respectively.

Nonetheless, we are more bullish about MOS’ long-term prospects, since Phosphate remains an essential raw material for this and the coming decade, due to the massive demand for LFP batteries. The global lithium iron phosphate battery market is projected to grow from $10.12B in 2021 to $49.96B by 2028 at a CAGR of 25.6%. Thereby, potentially upgrading MOS’ revenue growth to a bullish CAGR of 18.8% from FY2023 onwards, assuming the speculative partnership with CATL then. That will bring its projected revenue to $17.29B and net incomes to $2.82B in FY2024, indicating a potential 25.7% upside then.

In the meantime, analysts will be closely watching MOS’ FQ2’22 performance, with consensus revenue estimates of $5.61B and EPS of $3.97, representing YoY growth of 100.47% and 238.98%, respectively. We expect the company to deliver excellent results then, given the massive YoY growth in the sales price for its products at 248% in the Potash segment, 186% in Phosphates, and 238% in Mosaic Fertilizantes per tonnage volume for May 2022. This is on top of a 370% increase in sales price in the Potash segment, 194% in Phosphates, and 223% in Mosaic Fertilizantes per tonnage volume for April 2022.

So, Is MOS Stock A Buy, Sell, or Hold?

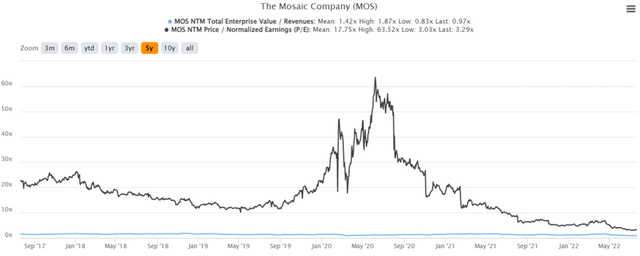

MOS 5Y EV/Revenue and P/E Valuations

MOS is currently trading at an EV/NTM Revenue of 0.97x and NTM P/E of 3.29x, lower than its 5Y mean of 1.42x and 17.75x, respectively. The stock is also trading at $47.64 now, down 39.9% from its 52 weeks high of $79.28, though at a premium of 63.4% from its 52 weeks low of $29.14. It is evident that MOS’ recent rally has also been digested by now, with the stock plunging back to its normalized levels since the start of the Ukraine war in February 2022. Thereby, leading to the consensus estimate’s attractive buy rating with a price target of $71.60, with an upside of 50.29%.

MOS 5Y Stock Price

However, since we are nearing MOS’ FQ2’22 earnings call, we prefer to wait a little longer before recommending anyone to add at this level. Though we are reasonably confident of its stellar performance for the quarter, we do not expect it to be translated to the stock prices then. This is due to the farmers’ continued refusal to purchase fertilizers at currently elevated prices – leading to further downward pressure on MOS stock prices in the short term.

Nonetheless, the eventual downside post-earnings call would provide any interested investors with highly attractive entry points to this interesting stock. There will be a continued fertilizer shortage due to the ongoing Ukraine war, which is unlikely to end any time soon. In addition, we expect CATL to proceed with its Mexico and/or US factory plans, given Tesla’s massive demand for LFP batteries in the Texas Gigafactory due to the soaring prices for Nickel and Cobalt.

Therefore, MOS is highly suitable for those with a higher tolerance for volatility and speculation, since we expect the company to continue growing its revenue and profitability in this current agricultural crisis and EV boom. Nonetheless, it is also advisable to size the portfolio accordingly, given the potential disconnect between MOS’ fundamental performance and stock prices then.

Therefore, we rate MOS stock as a Buy for speculative investors only.

Be the first to comment