-Oxford-

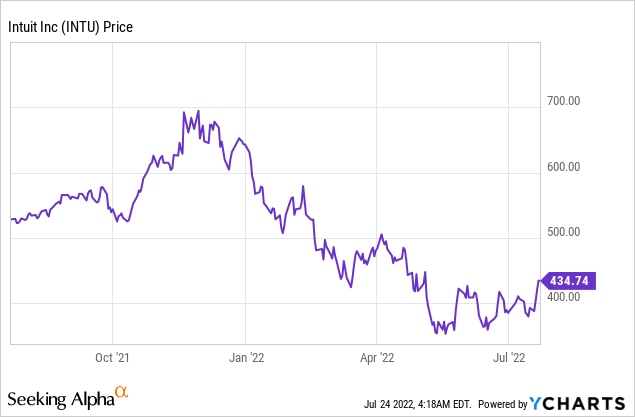

Intuit (NASDAQ:INTU) is a leading financial software provider, which focuses on helping small businesses. The company was founded in 1983 in Mountain View, California and rode the wave in digital accounting. By the 1990s, the company had 1.3 million customers and today they have over 100 million customers. Intuit’s share price went on a tremendous bull in 2020 and increased by over 200% from the March lows till the December highs. The high inflation numbers released in the fourth quarter of 2021 and the subsequent interest hikes, acted as one catalyst for the stock price to plummet by ~47%.Since then the stock has made gains of ~20% (since my last post), but is still down substantially from its highs. Intuit stock is still undervalued intrinsically and relative to historic multiples, despite the gap between price and value closing slightly. Thus, let’s dive into the Business Model, Financials and Valuation for the juicy details.

SaaS Business Model

Intuit offers a suite of financial software products which include: QuickBooks, TurboTax, Credit Karma, Mint and now Mailchimp which was recently acquired. Managements mission is to help solve its small business customer problems, which include everything from “Getting Customers” to tracking accounting and filing tax returns.

Intuit Software Products (Official Website)

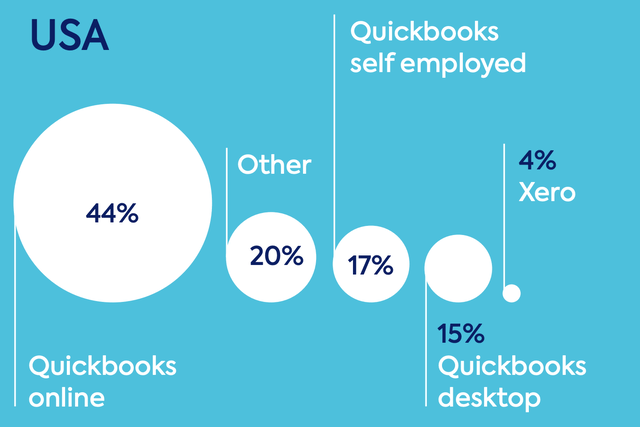

QuickBooks is Intuits flagship digital accounting product. This is the market leading Digital Accounting Software in the US and Canada, with a 76% market share in the USA, split across the multiple versions of the software suite. The different QuickBooks versions include: QuickBooks Online (44% market share), QuickBooks Desktop (15%), and QuickBooks Self Employed (17%). Management’s strategy is to gradually convert its desktop users to the cloud offering, but usually it’s the larger customers which are slower to switch.

QuickBooks Market share (Codat Study)

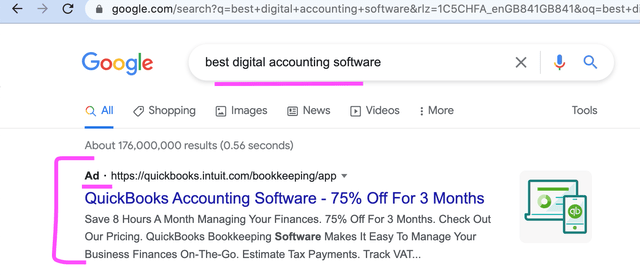

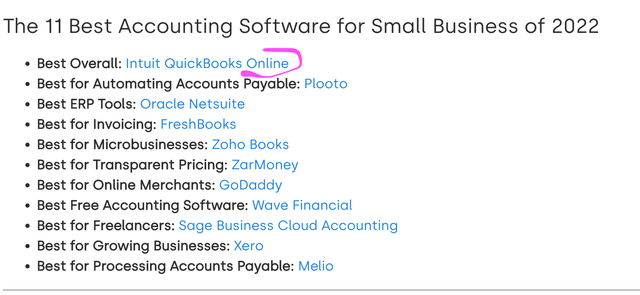

As an extra data point, I did a search on Google for “Best Digital Accounting Software” and saw QuickBooks has paid for the top search result. In addition, they are ranked number one on multiple review websites.

Note: I completed my google search in “Incognito mode” to avoid any bias, as I had visited Intuits website previously.

Best Digital Accounting Software (Author Google Search) Best Digital Accounting Software (Review Website)

TurboTax is Intuit’s easy tax filing solution which complements QuickBooks.

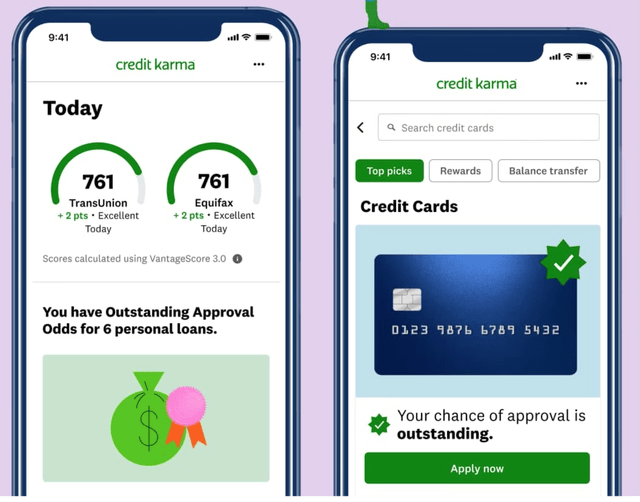

In 2020, Intuit acquired Credit Karma for $3.4 billion in cash and 13.3 million shares of stock. Credit Karma is a financial application which provides free credit scores and reports, with data derived from Equifax (EFX) and TransUnion (TRU) . The company then uses this credit information to tailor financial offers direct to consumers from credit cards to loans. The platform has over 110 million members across the US, Canada, and the UK.

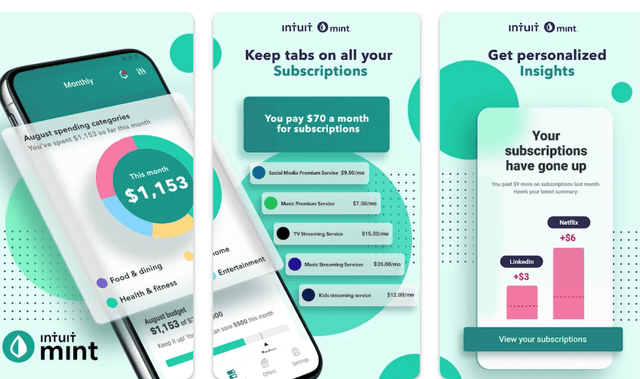

Intuit also acquired personal finance App, Mint.com in 2020, for $170 million. Mint helps people to track their budget and expenses in order to be more financially aware. A unique part of the platform is its ability to connect All bank accounts and investment accounts in one place. In addition, it’s “Bill Negotiation Service” powered by “Bill Shark” contacts your phone, internet or cable provider and “negotiates” your bills down. Bill Shark then takes a 40% cut on the savings for the service and gives Mint a nice kickback.

According to a study by LendingClub, 64% of the US population were living “Paycheck to Paycheck” in the January 2022, up 12% year over year. This has been driven by the high inflation rates in Food, transport and utility bills, which impacts the cost of living, while wage growth hasn’t kept up. According to Intuit, 75% of Americans have concerns about their ability to pay bills and loans. Europeans are also feeling the pressure as they have seen energy and food price inflation. In addition, to concerns Russia will cut off the gas supply to Europe. Thus, personal finance apps such as Mint are actually poised to do quite well given the psychological anxiety of the everyday consumer.

Mailchimp Acquisition

The most recent acquisition by Intuit has been Mailchimp which was acquired in Q421 for a staggering $5.7 billion in cash and 10.1 million shares of stock, with a value of $6.3 billion. Mailchimp is an email marketing platform which has a small business customer base of over 2.4 million active users. This customer base aligns perfectly with Intuits small business demographic and thus the potential for cross selling between platforms is strong.

Mailchimp QuickBooks (Investor presentation)

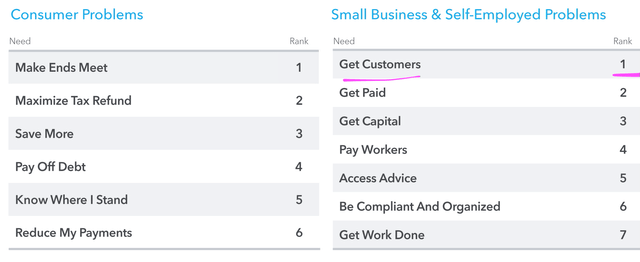

In a presentation by Intuit, they discovered that the biggest pain point for small business owners is “getting” and retaining customers, thus Mailchimp can assist in solving this through its Website Building, Ad platform connections and email automation software.

Intuit Customer Problems (Investor presentation)

Growth Strategy and AI

Intuit’s growth strategy has been driven by combination of in-house innovation and strategic acquisitions such as those mentioned prior. Management laid out it’s “Bold Goals for 2025” which includes growing the platform from 102 million customers to 200 million by 2025. Intuit also has plans to continually improve “AI-Driven expert platform. This includes the use of AI (Artificial Intelligence) to offer personalised and predictive offers and experiences. In addition, to connecting customers directly with experts such as Accountants to help them file their tax returns.

Growing Financials

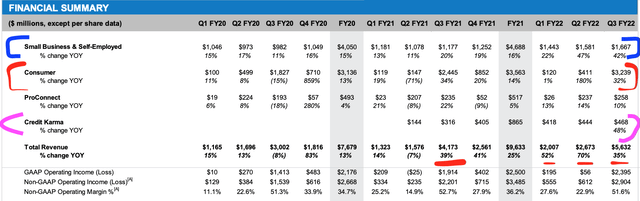

Intuit generated strong financials for the third quarter of 2022. Revenue grew to $5.6 billion, up a rapid 35% year over year, including the acquisition of Mailchimp. However, even without this acquisition total revenue increased by a strong 29%.

This growth was driven by strong Consumer Group Revenue of $3.2 billion, up 32% year over year. In addition, to a rapid 42% growth in the Small Business and Self Employed group, which generated $1.7 billion. Again, if we exclude the acquisition of Mailchimp the group still grew by a respectable 20%. Its Online Ecosystem grew revenue to $1.2 billion, up 67% or 31% excluding Mailchimp. Credit Karma hit record revenue of $468 million, up a blistering 48% year over year.

Financial Summary (Earnings Q322)

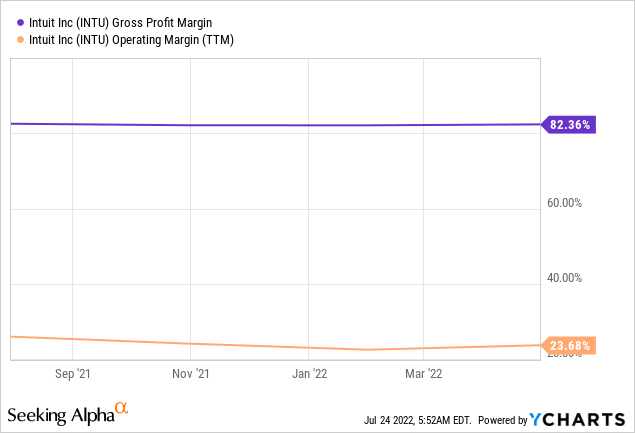

Intuits revenue is well diversified with no customer making up 10% or more of the total. As a Software company, Intuit has a tremendous gross margin of 82% and a high operation margin of ~24%.

Levered Free Cash Flow, popped from $1.9 billion in Q321 to $2.7 billion in Q322 up a blistering 42% year over year. Management increased guidance for FY2022 to ~$12.6 billion, up 32% year over year, which is higher than the 26% to 28% range guided for previously. However, due to an earlier tax filing date in 2022, expect revenue to decline in Q422 by 8% to 9% due to business seasonality.

Despite all the acquisitions, Intuit has a strong cash position with $3.9 billion in cash and short-term investments. However, be aware they do have a substantial $6.8 billion in long term debt, but I believe this is manageable due to the strong cash flow and earnings of the company. Management showed confidence and repurchased 2.4 billion worth of shares in the 9 months prior April 30th 2022, and got authorization to repurchase up to $2 billion worth of stock.

Advanced Valuation

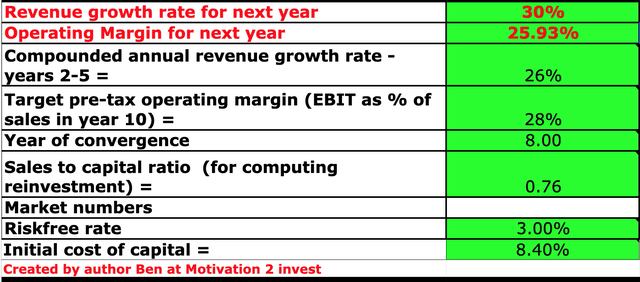

In order to value Intuit, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 30% revenue growth for next year and 26% for the next 2 to 5 years. This is aligned with managements guidance and the top end of analyst estimates.

Intuit stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted the operating margin to expand to 28% over the next 8 years as the company benefits from cross selling synergies in its acquisitions and moves “upmarket” with larger SMB customers. To increase the accuracy of the valuation, I have capitalized R&D expenses.

Intuit Stock Valuation 1 (created by author Ben at Motivation 2 Invest)

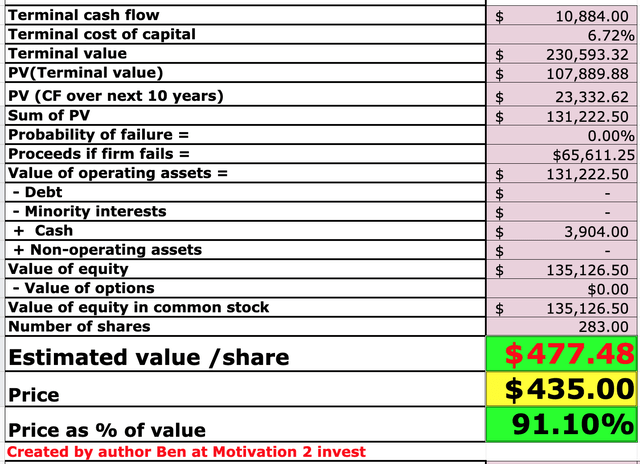

Given these factors I get a fair value of $477/share, the stock is trading at ~$435/share at the time of writing and thus is ~9% undervalued. This discount was much greater when I first covered the stock last month, which gives me faith in my valuation model and strategy.

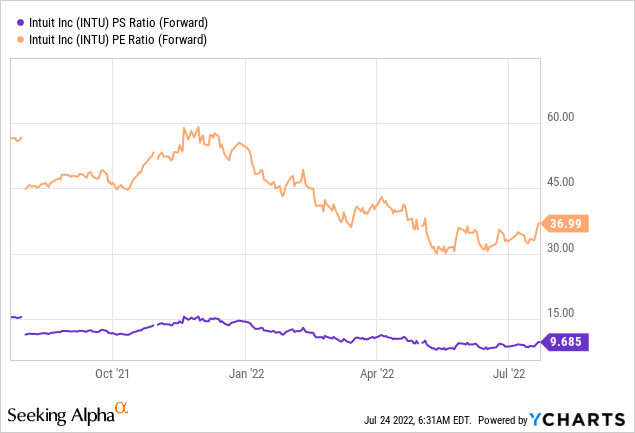

As an extra datapoint, Intuit trades at a P/E Ratio (FWD) of 37, which may seem high but is 5% cheaper than its five-year average. Also, it should be noted that the company is investing over $1 billion per year into R&D. Thus, they could be more “profitable” and thus have a lower P/E ratio without this investment. Thus, the Price to Sales ratio is also interesting to analyse. Intuit has a PS (forward) Ratio = 9.76, which is ~3% cheaper than its five-year average.

Risks

Recession

Analysts are forecasting a “shallow but long” recession which is expected to start in the fourth quarter of 2022. Small Businesses are often less protected from the volatilities of an economic downturn and tend to “feel” rising input costs much more. Now although, I don’t believe small businesses will end accounting software subscriptions, they may be less inclined to transition over to digital accounting or start new subscriptions for marketing platforms given the uncertainty of the environment.

Final Thoughts

Intuit is a tremendous company which truly dominates the market for Digital Accounting Software. Its management has been on a shopping spree recently snapping up everything from personal finance apps to email marketing platforms. Overall, the true value of these acquisitions is still coming to light, however strong synergies are expected due to the common small business audience. Given high inflation, rising interest rate environment and economic uncertainty the stock price has slid down which now offers a “Fair valuation” and buying opportunity for long term investors. But again, due to the recent “recession” fears I would expect short term volatility.

Be the first to comment