B4LLS

There are two ways to be fooled. One is to believe what isn’t true; the other is to refuse to believe what is true.”― Soren Kierkegaard

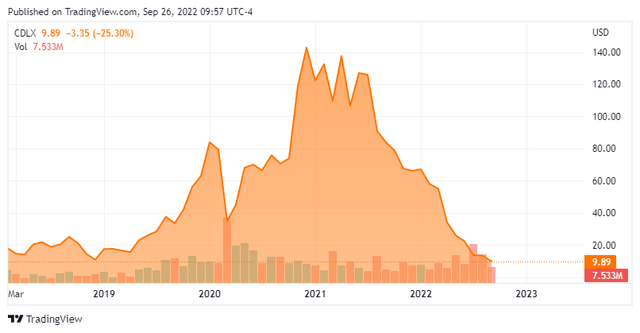

Today, we shine the spotlight on Cardlytics, Inc. (NASDAQ:CDLX) for the first time. As can be seen below, the stock has been crushed on a poorly timed acquisition as well as a more challenging environment for both digital advertising spend and consumer spending. The company recently brought in a new CEO, lowered guidance, and implemented some cost-cutting measures. Will it be enough to stop the bleeding? An analysis follows below.

Company Overview:

Cardlytics, Inc. is headquartered in Atlanta, GA. The company operates an advertising platform in the United States and the United Kingdom. The firm offers Cardlytics platform to its clients. This is a proprietary native bank advertising channel that enables marketers to reach customers through their network of financial institution partners through various digital channels (EX, mobile apps, email, etc.). Cardlytics also provides its Bridg platform. This is a customer data platform which utilizes point-of-sale data and enables marketers to perform analytics and targeted loyalty marketing, as well as measure the impact of their marketing. The stock currently trades around ten bucks a share and sports an approximate $320 million market capitalization.

August Company Presentation

Cardlytics works with banks and financial institutions to run their banking rewards programs that promote customer loyalty and deepen banking relationships. For which, Cardlytics has a secure view into where and when consumers are spending their money. In turn, these insights can help marketers identify, reach, and influence likely buyers at scale.

Second Quarter Results:

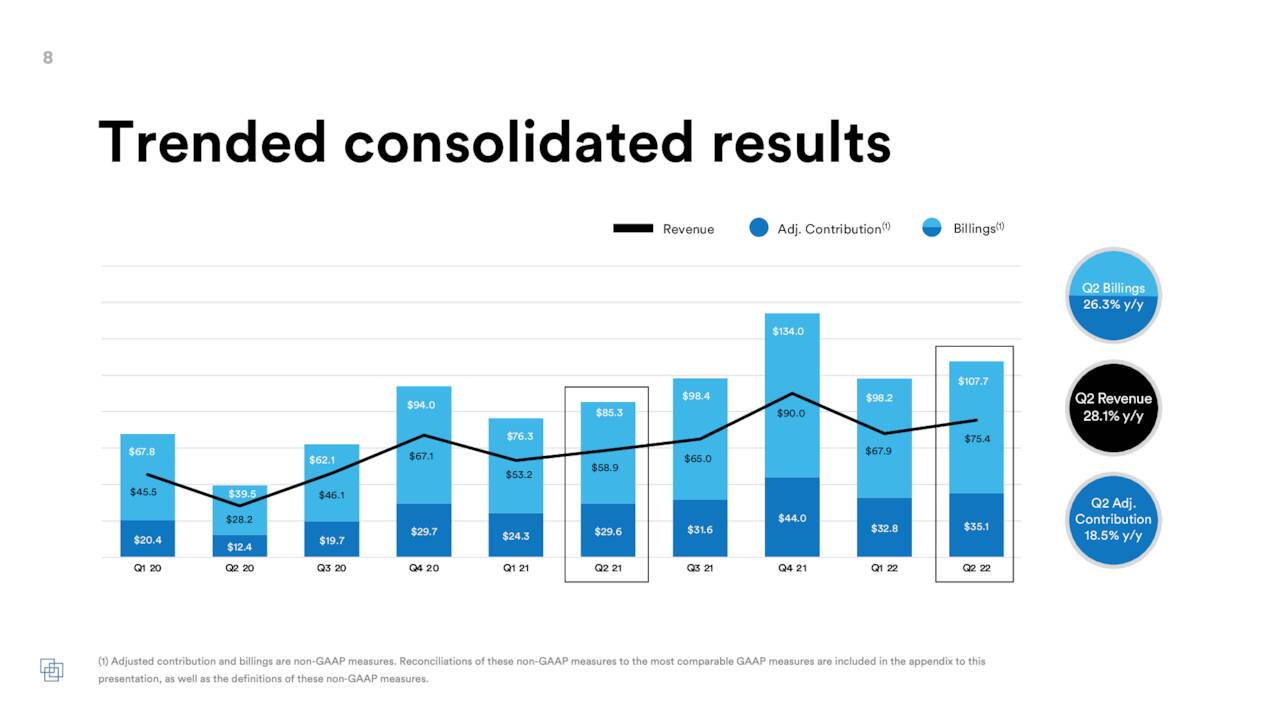

On August 2nd, Cardlytics posted its second quarter numbers. The company lost $3.75 a share on a GAAP basis, missing expectations by over $2.80 a share. Revenues rose 28% from the same period a year to $75.4 million, just slightly missing the consensus. The company took an $83 million goodwill impairment cost in relation to the acquisition of Bridg (discussed later in this section) which accounts for the majority of the headline bottom line ‘miss’.

August Company Presentation

Management provided some other key metrics for the second quarter:

- Billings, a non-GAAP metric, was $107.7 million, an increase of 26% year-over-year, compared to $85.3 million in the second quarter of 2021.

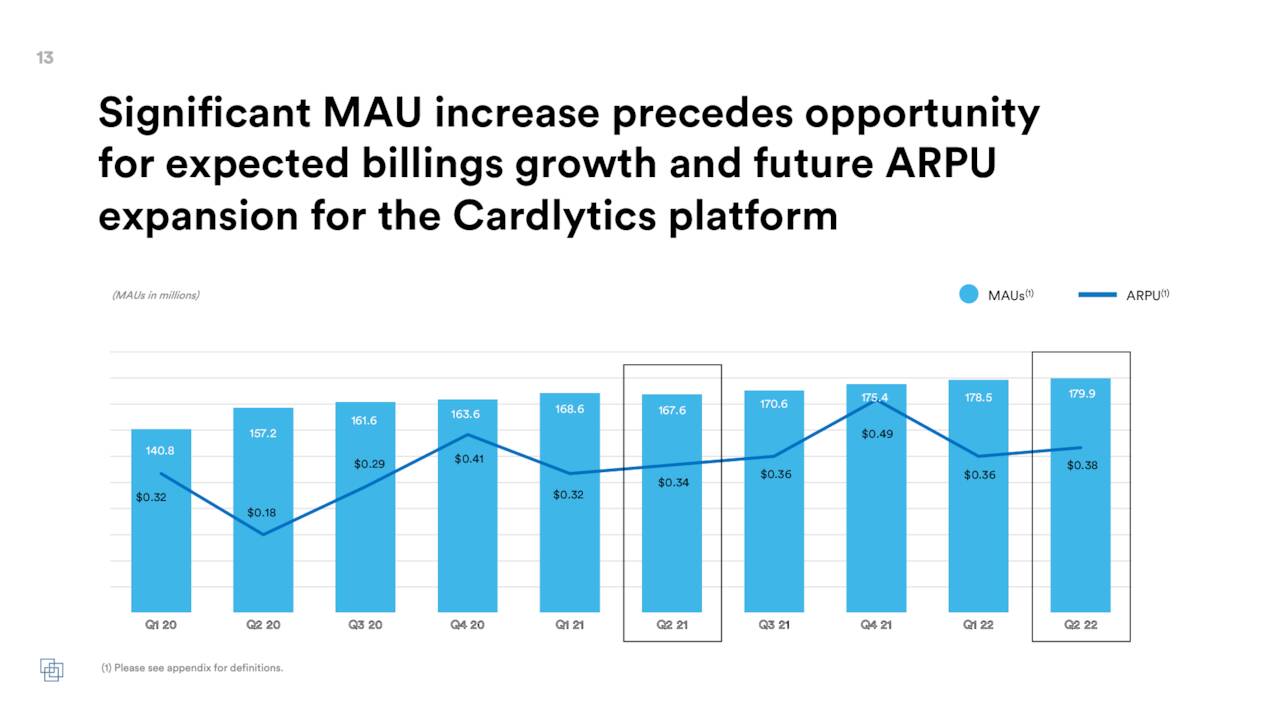

- Cardlytics MAUs (Monthly Active Users) were 179.9 million, an increase of 7%, compared to 167.6 million in the second quarter of 2021.

- Cardlytics ARPU (Average Revenue Per User) was $0.38, an increase of 12%, compared to $0.34 in the second quarter of 2021.

August Company Presentation

Back in April of last year, Cardlytics purchased Bridg, a customer data platform for $350 million in cash. Bridg has a cloud-based platform that retailers and CPG marketers use for a wide range of applications, including analyzing customer behavior, marketing on digital platforms, and measuring the effectiveness of their business strategies, while following consumer privacy best practices. Bridg ARR was $21.8 million in the second quarter, which was up 35% sequentially from the first quarter of this year. As part of this acquisition, Cardlytics also agreed to make two potential earnout payments in cash and stock on the first and second anniversary of the closing. This will be based on Bridg’s U.S. annualized revenue run rate. Cardlytics expects these payments could equal approximately $100 million to $300 million in total.

Management lowered its guidance and now believes revenues will grow just 10% to 15% in the second half of 2022 on a year-over-year basis.

Analyst Commentary & Balance Sheet:

Since Q2 results came out, the analyst community has been quite negative on Cardlytics’ prospects. JPMorgan ($17 price target), Craig-Hallum ($15 price target), and Wells Fargo ($13 price target) have all maintained or downgraded to Hold ratings. Needham ($19 price target) reissued its Buy rating and appears to be the lone optimist on CDLX at the moment.

Just over 20% of the outstanding float in the shares are currently held short. Several insiders step up their purchases in both May and August, buying approximately $600,000 worth of shares in aggregate during those two months. The company ended the second quarter with just over $155 million of cash and marketable securities on its balance sheet against approximately $225 million of long-term debt. The company also has access to a $60 million credit facility if needed.

Verdict:

The current analyst firm consensus has the company losing just over $1.50 a share in FY2022 as revenues rise some 18% to $317 million. In FY2023, the project sales will rise 15% and losses will be cut to just over $1.10 a share.

The company named its new CEO in July and he will have plenty of challenges going forward in the coming months and quarters. Digital advertising spend growth is falling and will continue to do so as the country heads into recession. Consumer spending is also dropping. Management stated on its second quarter earnings call that average restaurant spending it monitors was up 12% at the beginning of the second quarter, but had fallen to just 2% by the end of the quarter as but one example of this consumer spending slowdown.

In addition, in hindsight, it appears the company clearly overpaid for the Bridg acquisition given its current revenue run rate and recent goodwill write-down. Cardlytics also used $40 million of cash in the second quarter to buy back stock at the average price of $28 a share. Hardly, the best use for its cash in retrospect. That stock buyback authorization has now been used up it should be noted.

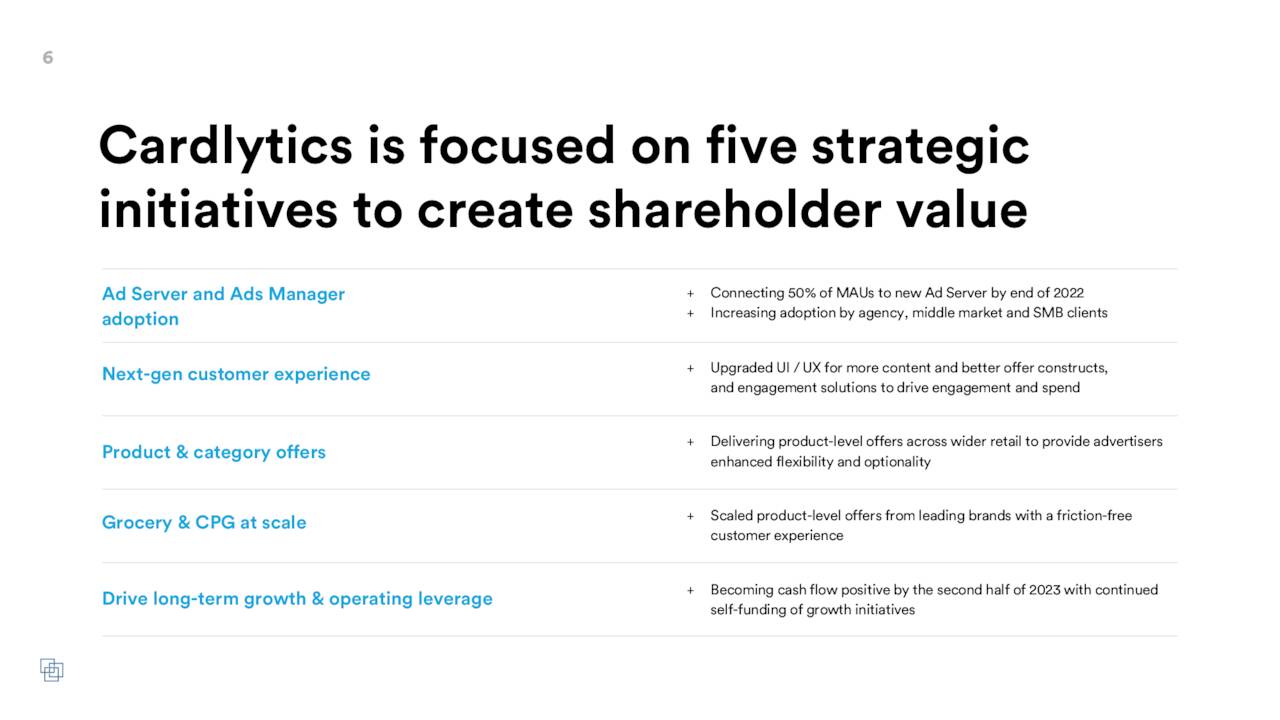

August Company Presentation

The company is implementing a plan to cut $15 million in annual costs out of operations and hopes to achieve positive free cash flow by the third quarter of 2023. Given the declining economy, it is hard to say whether these measures will be enough to stem losses in the coming quarters and years. Shorts seem to believe the stock has further to fall based on the high short percentage in the shares. Therefore, until more progress is seen on multiple fronts, CDLX seems to be an avoid right now for investors.

The person who writes for fools is always sure of a large audience.”― Arthur Schopenhauer

Be the first to comment