Luis Alvarez/DigitalVision via Getty Images

A Quick Take On The Glimpse Group

The Glimpse Group, Inc. (NASDAQ:VRAR) went public in June 2021, raising approximately $12.3 million in gross proceeds from an IPO that priced at $7.00 per share.

The firm provides enterprise software and services for virtual reality and augmented reality applications.

Given VRAR’s worsening operating losses, poor Rule of 40 result and continued investment in growing the company’s expense structure despite a looming economic slowdown, I’m on Hold for VRAR over the near term.

The Glimpse Group Overview

New York, NY-based Glimpse was founded to create a VR and AR platform to deliver software and services to the enterprise market.

Management is headed by co-founder, president and CEO Lyron Bentovim, who was previously COO and CFO of Top Image Systems and of NIT Health and Cabrillo Advisors.

The company’s offering categories include:

-

Training & Education

-

Healthcare

-

Branding & Marketing

-

Retail

-

Financial Services

-

Food & Hospitality

-

Media & Entertainment

-

Social VR meetings

The company uses a “hybrid approach” to its sales and distribution efforts, with each subsidiary having its own business development and sales team while the holding company management remains actively involved in business processes and fostering collaboration between subsidiaries.

Glimpse does not develop hardware and management says that most of its software and services are compatible with all major hardware platforms.

The Glimpse Group’s Market & Competition

According to a 2021 market research report by Grand View Research, the global market for virtual reality was valued at an estimated $15.8 billion in 2020 and is expected to grow to $59 billion by 2028.

This represents a forecast CAGR of 18.0% from 2021 to 2028.

The main drivers for this expected growth are improved hardware devices and related software and services offerings by industry participants as well as a growing usage of VR technologies in training across various industry verticals.

Also, other industries are beginning to adopt these technologies, including CAD or computer aided design, healthcare services and tourism applications.

Management says major competitive or other industry participants include:

-

Spatial

-

Striver

-

EonReality

-

IrisVR

-

Mursion

-

OssoVR

Glimpse’s Recent Financial Performance

-

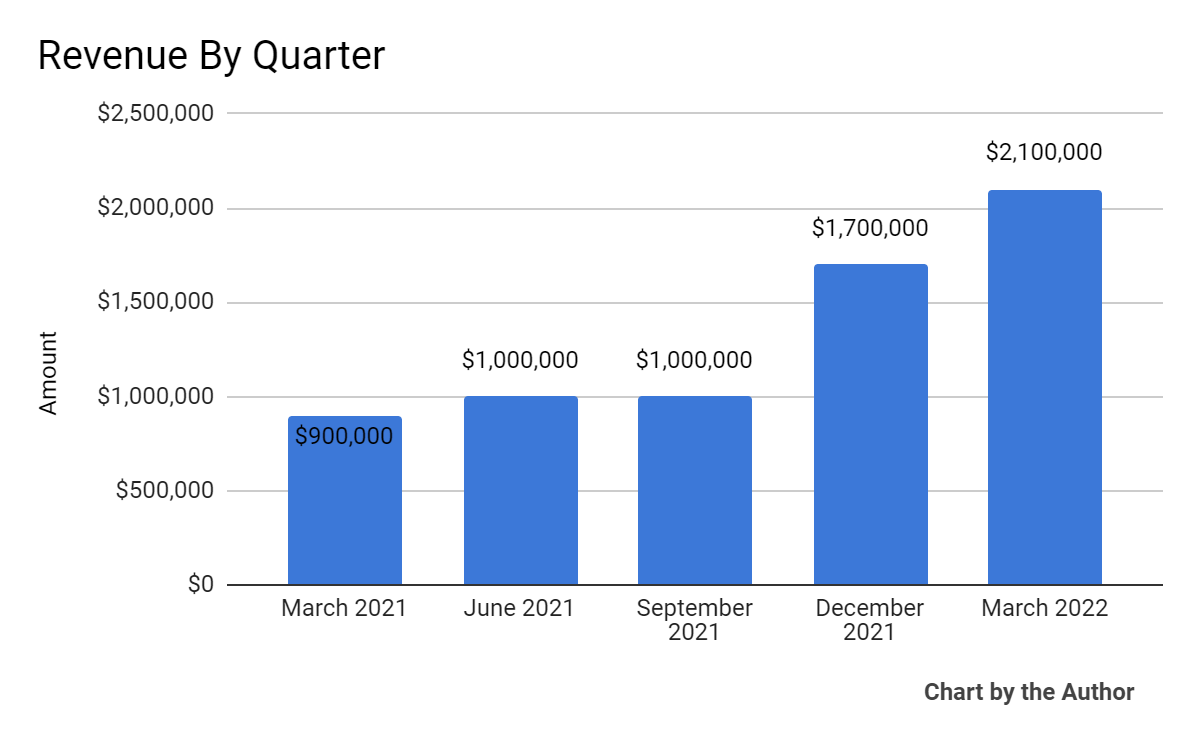

Total revenue by quarter has grown in recent quarters, but remains tiny for a public company:

5 Quarter Total Revenue (Seeking Alpha)

-

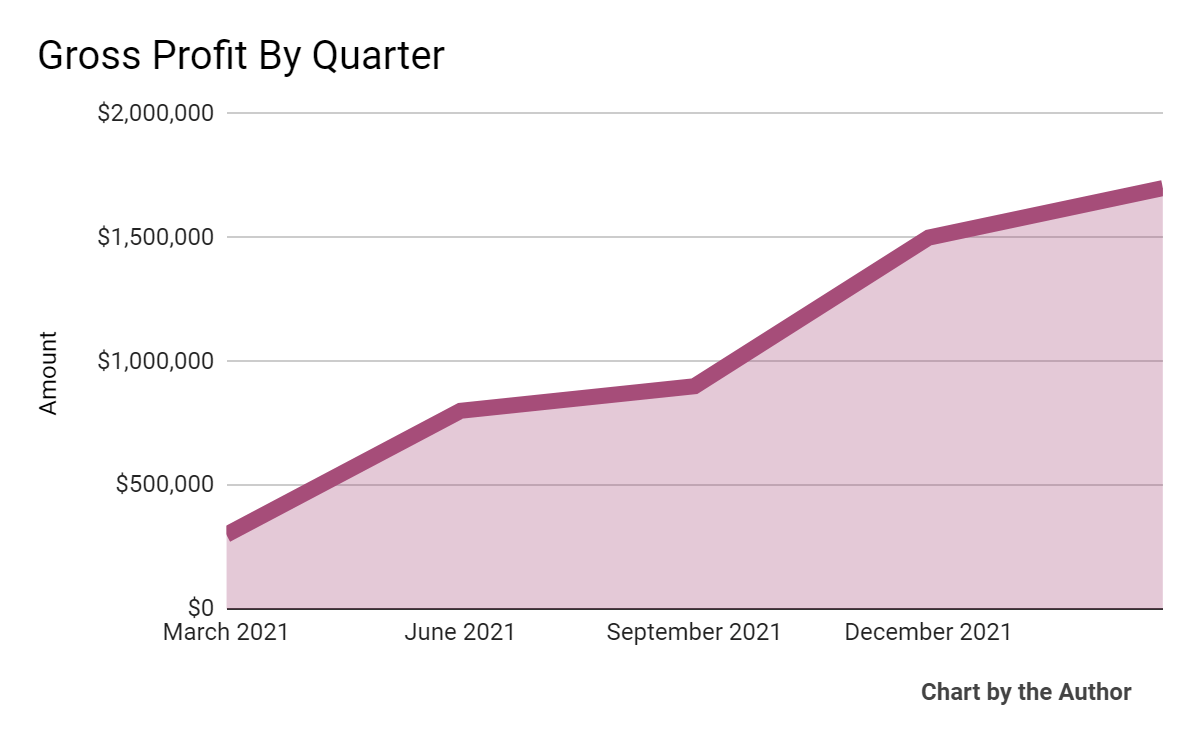

Gross profit by quarter has also risen significantly on a percentage basis:

5 Quarter Gross Profit (Seeking Alpha)

-

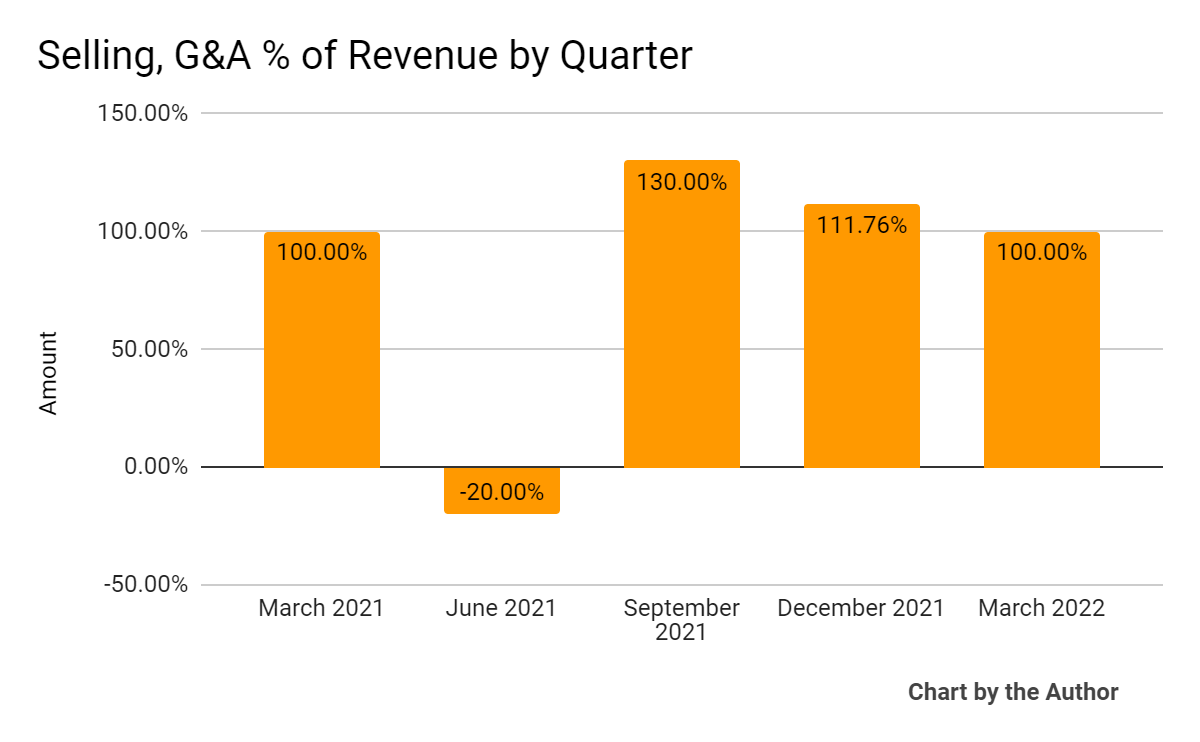

Selling, G&A expenses as a percentage of total revenue by quarter have varied materially in recent quarters:

5 Quarter SG&A % Of Revenue (Seeking Alpha)

-

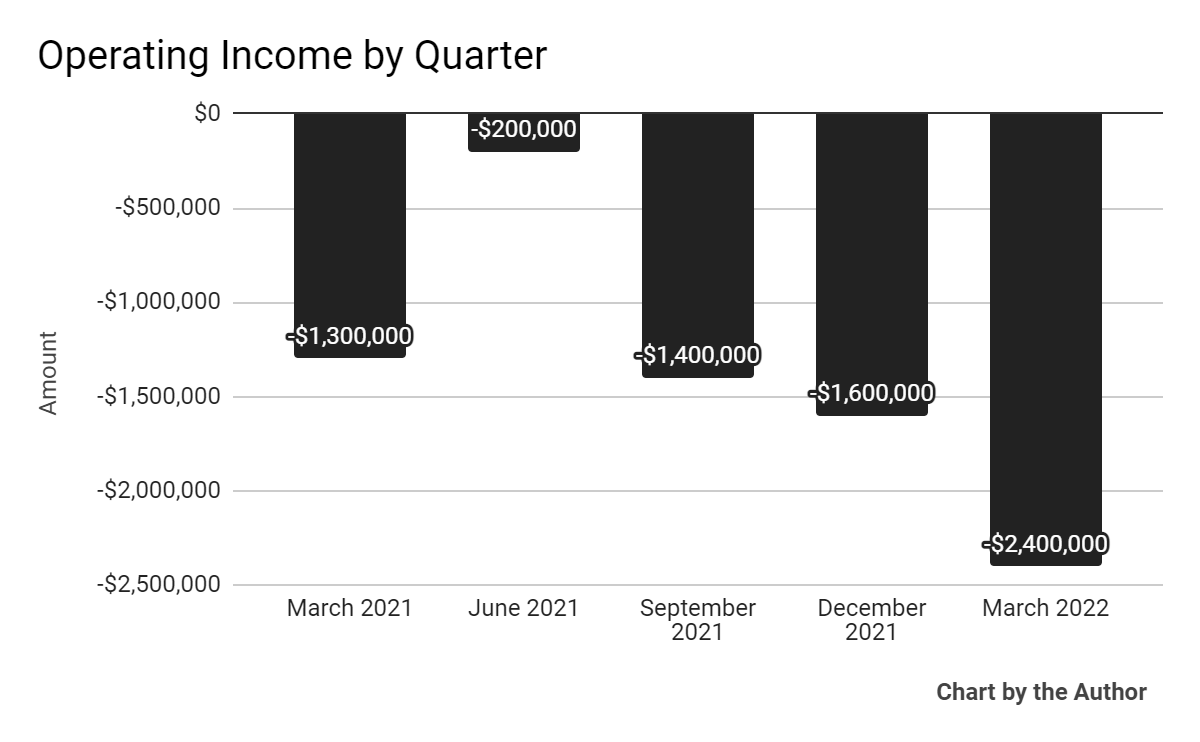

Operating losses by quarter have increased substantially, as the chart shows below:

5 Quarter Operating Income (Seeking Alpha)

-

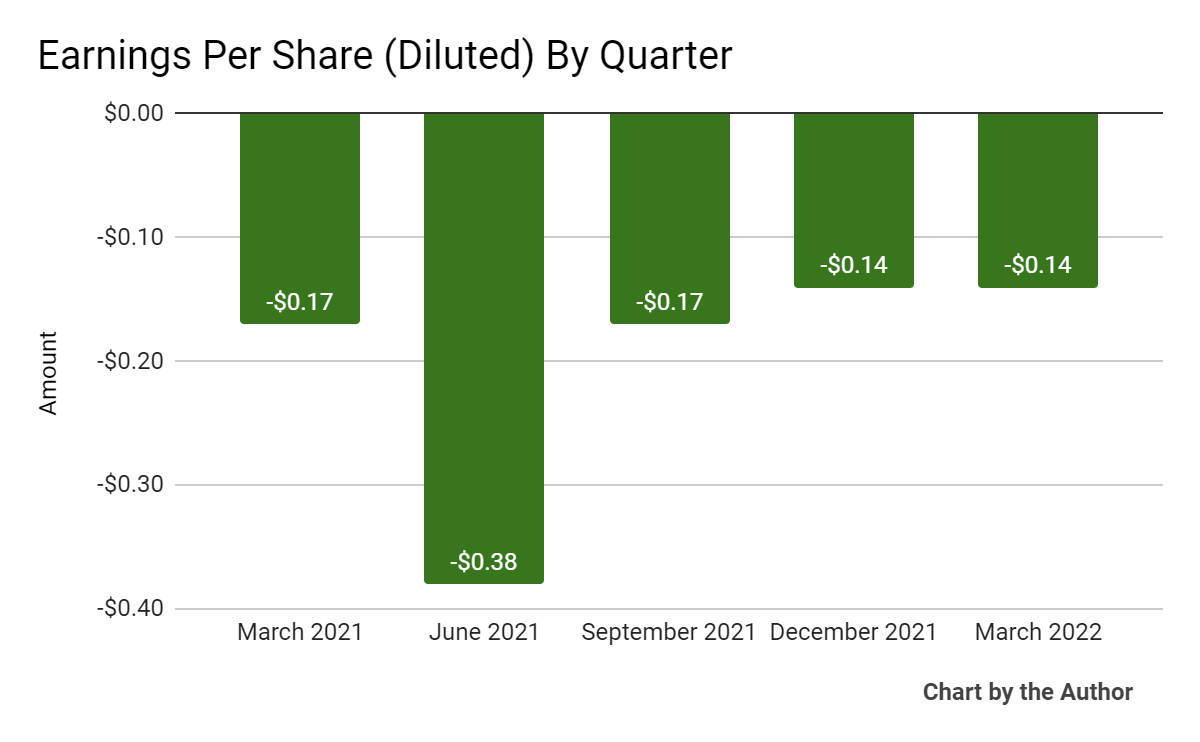

Earnings per share (Diluted) have remained negative over the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

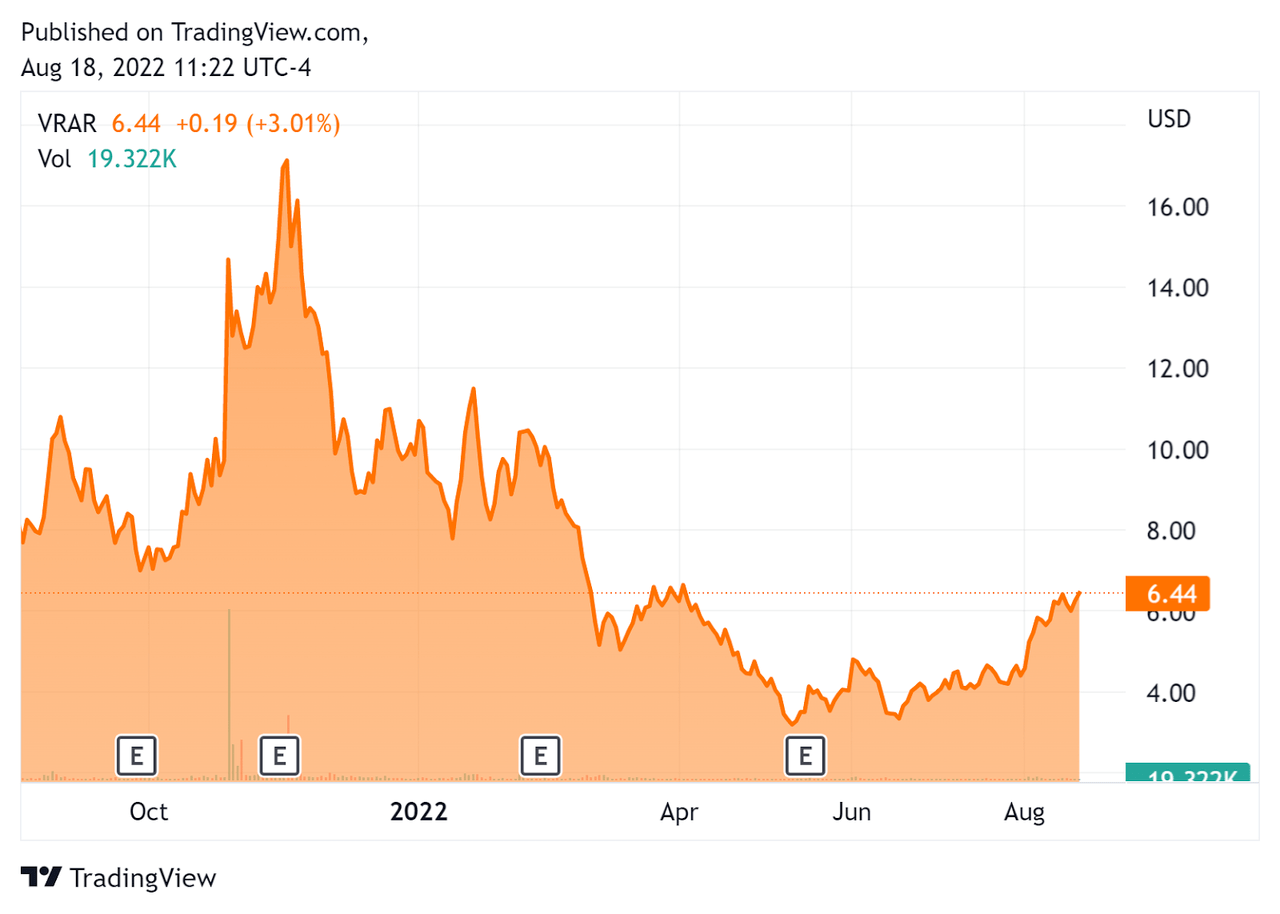

In the past 12 months, VRAR’s stock price has fallen 20% vs. the U.S. S&P 500 index’ drop of around 2.8%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Glimpse

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value |

$61,380,000 |

|

Market Capitalization |

$79,660,000 |

|

Enterprise Value / Sales |

10.67 |

|

Revenue Growth Rate |

93.3% |

|

Operating Cash Flow |

-$3,850,000 |

|

Earnings Per Share (Fully Diluted) |

-$0.83 |

|

Net Income Margin |

-136.1% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

VRAR’s most recent GAAP Rule of 40 calculation was only 2% as of FQ3 2022, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

93% |

|

GAAP EBITDA % |

-91% |

|

Total |

2% |

(Source – Seeking Alpha)

Commentary On The Glimpse Group

In its last earnings call (Source – Seeking Alpha), covering FQ3 2022’s results, management highlighted the ‘highly variable’ nature of its expense structure, where 85% of its expenses are labor-related.

The firm inked some initial contracts with several unnamed Fortune 500 companies during the quarter.

CEO Lyron Bentovim also indicated the company will continue to invest in blockchain and NFT capabilities as it believes these will be important building blocks within the metaverse.

Also, during the quarter, the company closed its Sector 5 Digital acquisition, which is forecast to double the firm’s revenue base.

The deal includes primarily equity-based earnouts payable upon a floor issuance price of $7.00 per share, so the share price may have a difficult time getting much above that price for the near term.

As to its financial results, topline revenue rose 123% year-over-year, helped by the partial inorganic revenue from the S5D acquisition.

Gross profit rose sharply due mostly to “non project” revenue growth.

Operating expenses rose sharply due to headcount growth and the “addition of three new subsidiary companies.”

As a result, operating losses worsened significantly, exceeding total revenue.

For the balance sheet, the firm finished the quarter with cash, equivalents, short term investments and escrowed cash of $20 million and no long-term debt. VRAR used $1.4 million in free cash flow during the quarter.

Looking ahead, management estimates that it will conclude fiscal 2022 with a “net cash burn rate” of $3.5 million at the midpoint of the estimate.

Regarding valuation, the market is valuing VRAR at an EV/Sales multiple of around 10.7x, well above a current benchmark for subscription-based companies which have more predictable revenue than VRAR’s software and services mix.

The primary risk to the company’s outlook is a potential macroeconomic slowdown or recession, which may slow sales cycles and reduce its revenue growth trajectory.

A potential upside catalyst to the stock could include a general market “melt-up” which reduces downward pressure on valuation multiples, especially for technology oriented stocks which have been beaten down in recent quarters.

However, given the firm’s worsening operating losses, poor Rule of 40 result and continued investment in growing the company’s expense structure despite a looming economic slowdown, I’m on Hold for VRAR over the near term.

Be the first to comment