sanfel/iStock via Getty Images

(This article was co-produced with Hoya Capital Real Estate)

Introduction

Seeking Alpha requires each article to contain an image to help “market” the article in search engines. We have free access to millions of Getty Images. Usually, I find one directly related to option trading but I went in another direction this time; one that is vital to keep in mind.

With so many option strategies to pick from, option traders need to “choose their path wisely!”. By that, I mean know what your goal or goals are before placing any trade. Consider what your “exit strategy” will be if your, the stock’s, or market situation drastically changes after you initiated any trade.

I designed this article’s flow based on the trading strategies I use most, which are two or three depending how you want to look at what actually happens. First, I will review which of my Put writing trades resulted in taking ownership via assignment. Second, I will give updates on those assigned I then started writing Covered Calls against and how that is working. Third, I will review the Puts I wrote that expired without assignment or I closed out before expiration. Lastly, I list all the option activity that were open at the end of the quarter.

Author’s reminder: All the ROIs shown have been annualized to allow comparison between trades. Achieving any of those ROIs over an entire year of course is dependent on several variables. An important one is length of time the position was open. The shorter that time, the harder to achieve.

Reviewing The 1st Quarter

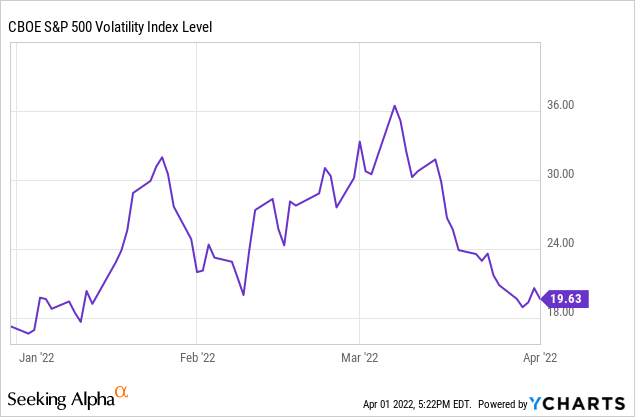

Before getting into the reviews, a brief look back at the last quarter. As a famous novel opened: “It was the best of times, and the worst of times”.

Some of the events that drove volatility over the last three months we’re:

- Russia/Ukraine: By the end of the March, the supposed blitzkrieg appears to coming to a stalemate. Peace talks and missile attacks occurring: sanctions in place, probably some even after the war ends if Putin still Russia’s leader.

- Inflation: It seems every month reports numbers not seen the late 70s or early 80s. Higher rates effect sectors differently so stock selection to execute option trades gain an extra level of complexity.

- Interest rates: Inflation will help drive these up regardless of any actions taxed by the Fed. How much the March Fed Funds rate was going to be raised added uncertainty as odds increased it could be 50bps.

Assigned Put Activity

There are four assets I have been writing Puts against that are high on my “to own” list. Three were to lower the cash and raise the equity allocation in our Joint taxable account and one to increase an existing position. I will cover this activity first.

Vanguard Extended Market Index ETF (VXF): Regular readers of my option review articles will recognize this ETF as one I was trying to own via Put writing since the summer. Well both JAN’22 Puts were indeed assigned as the VXF ETF dropped from over $200 to under $160. I acquired 200 shares @$180 and 100 shares @$175. These are all the Put trades used in this strategy.

Author’s XLS

If I had bought at the start, my cost would have been $183. My weighted Assigned price was only $178.33, with an actual “cost” of only $172.60 after adjusting for the premiums earned. I did miss out on $1.02 in dividends so overall, I was about $9.50 to the good on VXF.

I did write another conservative Put that expired in March ($145). This one contract expired OTM and earned 10.86% due volatility spike when written.

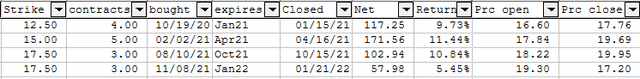

PennyMac Mortgage Investment Trust (PMT): I owned some shares in PMT and was using Puts to pick up some more. The January dip caused my $17.50 Puts to be assigned as PMT closed at $17.20 that day, down almost a down a dollar on the week. The option ROIs about equaled the dividends PMT paid over the time since the first Puts were executed back in April, and the assigned price was only slightly lower, but overall, the strategy worked. It looks even better if I include 2019-20 Puts as the “cost” would be $2 lower still.

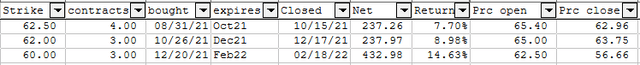

iShares U.S. Medical Devices ETF (IHI): Our Joint taxable account started to accumulate cash and the IHI ETF was one I decided to try owning via Put writing as our medical exposure was low. With the concerns in Ukraine and higher interest rates at home, many ETFs started selling off in February. Such was the case for IHI and that resulted in the FEB $60 Puts (3 contracts) getting assigned as IHI closed at $56.66 at expiration. These were my third set of Puts in this strategy.

If bought at the start, my cost would have been $65.40 and I would have collected $.11 in dividends. Adjusting the last $60 strike used, my “net” cost is only $56.97 after accounting for all the premiums received. While that is above the price when assigned, what’s the odds I would have executed that trade?

Covered Call Activity

When I get assigned and the stock is one I would rather earn income via Put writing, I will turn around and start writing Calls against my position. The desire is to exit at a profit but, as you will see, that becomes difficult if the price took a big hit; then I need to decide to keep or cover.

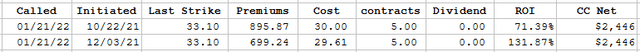

Schlumberger Limited (SLB): My second Covered Call position in SLB closed ITM in January as oil climbed above $80/barrel. My last strikes missed the final price rally to $36.36 but overall the position was very profitable, earning ROIs of 71.4% or 131.9%, based on the two ways I measure it. First uses starting date of the Put option, the second the date of assignment. Unlike the LUV trades covered next, here not taking assignments would have resulted in a $190 loss versus the $2446 I made covering.

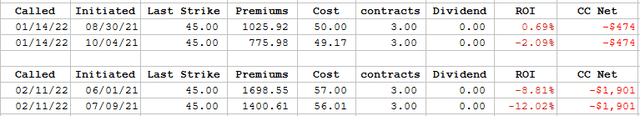

Southwest Airlines (LUV): Via two separate Calls, I have completely exited my Southwest Airlines covered position. The first 300 share set was called via the 1/14/22 $45 Calls as LUV closed at $45.82. I lost $474 on these 300 shares. The rally into mid-February caused the second part of my LUV shares to be called away. The Final contract was the 2/11/22 $45 strikes written for $.50. The stock closed at $45.53, so in one sense the last trade lost only 3 cents. Overall, due to the high initial cost near $57/share, the position was exited at an overall loss of $1901.

My combined loss was $2375 from taking assignment to getting both sets called. This is about $1200 more than I would have lost if I had closed out the Put options instead of getting assigned. I did consider rolling out and up my expiring options, known as a Net Credit trade (see article link below), but decided getting Called and writing a new set of Puts provided a better ROI trade as the premium on the 3/11/22 $47 Call was the same as the $42 Puts.

SPDR S&P Biotech ETF (XBI): Regular readers again know I picked up 300 shares of XBI via Put writing recently. The last 100 were from a FEB $105 Put. Since I am more okay only holding 200 shares, I decided to write a MAR $105 against that last 100 shares. XBI bounced around the opening price and closed there ($92), resulting in the option earning a 6.25% ROI. While low, the ROI was in line with most of my ETF trades. Other attempts of writing $105 Calls have failed to execute. I did finally write a May $106 Call. Since I plan on holding XBI long-term, I no longer will report this as Covered Call activity.

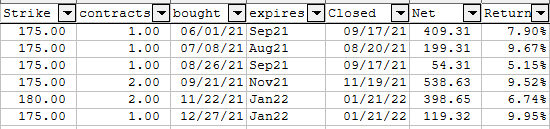

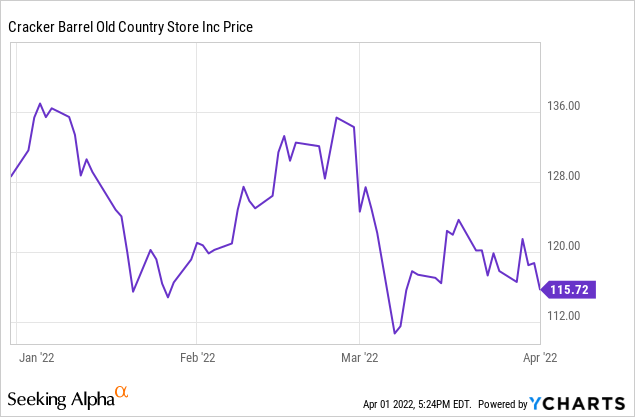

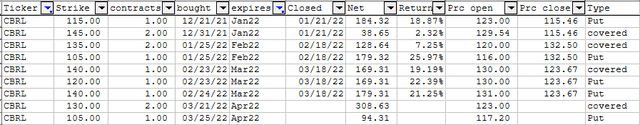

Cracker Barrel Old Country Store (CBRL): This is the one Covered Call I still have open. CBRL was a real roller coaster in price this quarter, making trade timing critical.

Each month I write 2 Call contracts and if attractive, 1 Put contract. Since picking up my 200 shares last year, my option premiums and dividends have dropped my breakeven price over $20. This allows me to write Puts at a lower strike price and, if called, exit at a profit. Currently I have APR $130 Calls and a $105 Put.

All but one trade had a ROI more than the yield provided by CBRL’s dividend. Notice the Put ROIs are much better than the Calls as the economic conditions for dining out, especially for a chain more tied to travelers, has writers demanding more compensation for the risk they perceive. If the April options expire OTM, the expected ROI on both is over 16%.

Expired/Closed Put Activity

iShares MSCI Frontier and Select EM ETF (FM): This is an ETF I am using Put trades to expand what I already own. Frontier Market countries are the smallest, newest, and thus supposedly the riskiest markets for equity investors, thus potentially the most rewarding. Since the spring of 2021, Frontier stocks have vastly outperformed EM stocks. One advantage adding FM stocks is their .6 correlation to US stocks, which are probably the largest equity allocation for most investors.

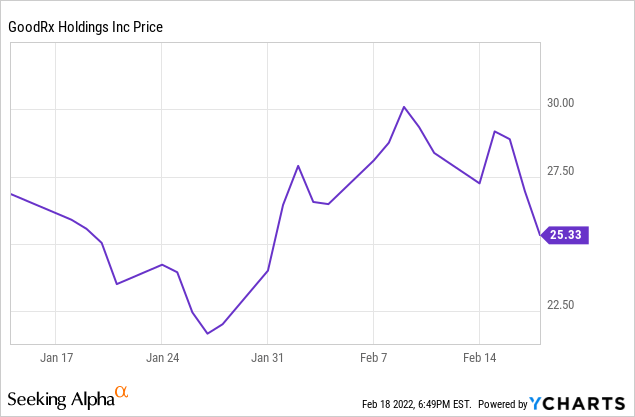

GoodRx Holdings (GDRX): If things worked as planned, my 2 FEB $27.50 Puts would have earned 22%, but that wasn’t the case. GDRX was at $33 when I opened my position just before Christmas.

With GDRX having dropped to $22, if that happened again, my loss would be near $900 so when GDRX started showing weakness with under two weeks remaining, and the stock at $27.75, I closed out at a $68 loss. Of course, it rallied the days several days to the point I could have exited at a profit, but at that point I probably would have hung on until the 18th, when they expired. If I had, and closed out at the close, my loss would have been about $200. So, by closing out when I did wasn’t the optimal play, it was better than waiting to expiration day, which has its own fun as the next trade shows.

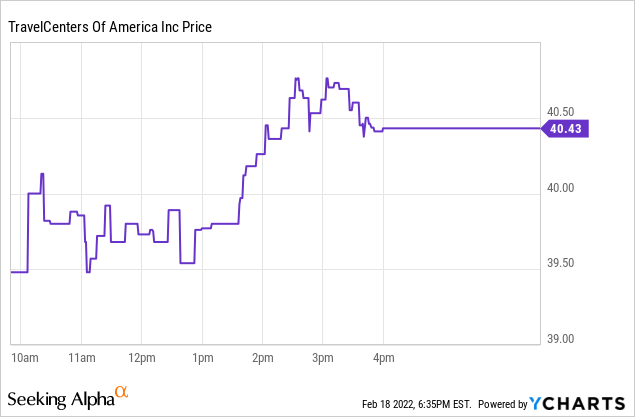

TravelCenters of America (TA): This is a tough stock to write options against: monthly, $5 strike spreads, minimal volume. Despite that, I try as the ROIs are excellent! I owned 7 FEB $40 Puts I acquired at different times when TA was selling for $49 and $52, respectfully. I spent expiration day watching it move from above, to below, and back above that strike price. Twice, I tried entering “Fill or Kill” closing trades but they were not executed as the time premium was still over $.25 most of the day.

While I don’t mind trying to write Puts against a stock like TA, having to do Covered Calls isn’t worth the effort so I was planning on taking what the market offered to close out. Anything over $38.95 would have resulted in a profit. As it was, I earned 18.91% on 3 contracts and 11.29% on the other four. To show how low the volume is, my contracts were 40% of the open interest at expiration.

There was a second reason I would have preferred not taking ownership on this date. One, the Olympics ended on Sunday and as expected, Russia invaded the Ukraine on Tuesday. Add in TA was announcing earnings before the market open Wednesday, that was a lot of risk to avoid. TA jumped as earnings beat expectations.

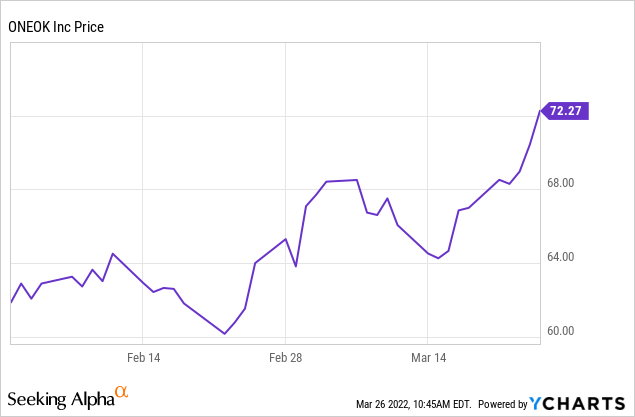

ONEOK (OKE): I started writing against OKE as it had weekly options and decent ROIs. Sometime late in 2021, the weekly ones stopped. The options I wrote in late December (FEB $52.50) expired and then the war broke out. I tried writing a March set, but the trade was not executed and then the price kept climbing. Now the high price and lower ROIs do not look attractive.

As I wrote on separate days, my February Puts had different ROIs: 13.33% and 11.73%, respectively.

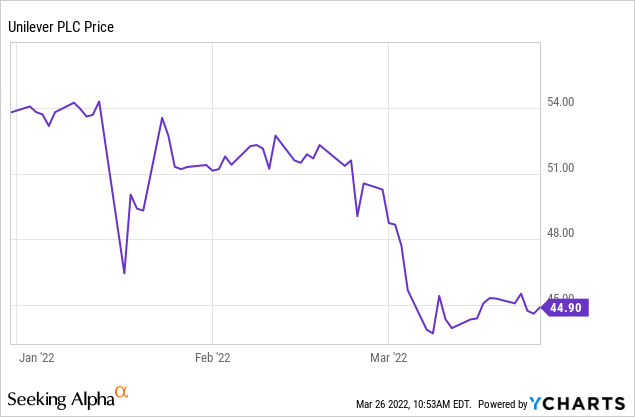

Unilever PLC (UL): This was a “story play”. Unilever made a bid for the consumer unit of GlaxoSmithKline, which the market had concerns about. I didn’t and took advantage of what I saw was a temporary price drop/partial recovery, to write 3 FEB $47.50 Puts when UL traded at $50.50. The price bounced back but has since has taken a hit, which I took advantage of to write APR $40 Puts. The February trade earned a 13.91% ROI.

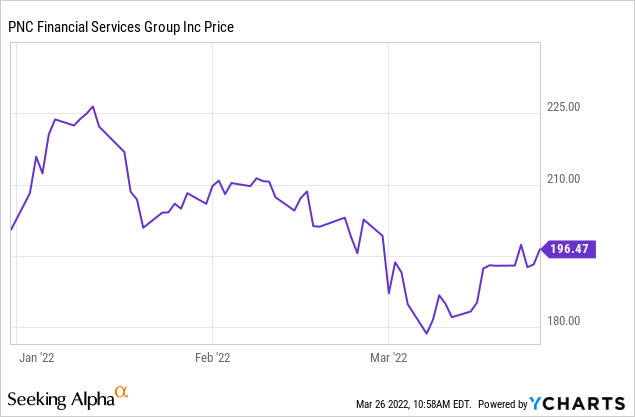

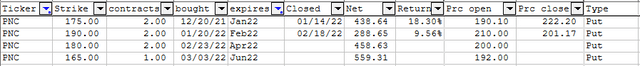

PNC Financial Services Group (PNC): This bank continues to offer high ROIs because of its wide price movements. Opinions seem to shift as fast as the yield curve does.

Author’s XLS

For the expired trades, the ROIs reflect the difference in how much the selected strike was OTM at the time. With the price at $210, I was more cautious. I added a JUN $165 Put when the stock dropped to $180 in early March to capture the higher volatility available for an extended time period. Even using a price PNC hasn’t traded at in over a year, the ROI will be near 12%.

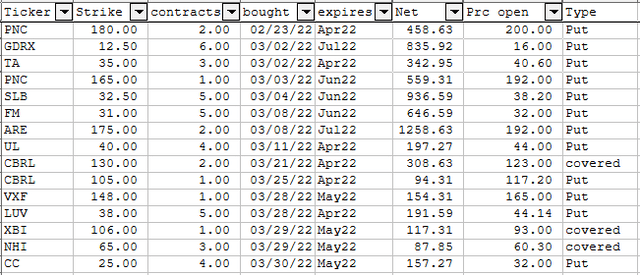

Open Option Positions

Quarter’s Results

- 5 Put options were assigned ($1205 net premiums)

- 4 Call options were assigned ($512)

- 6 Covered Calls expired OTM ($609)

- 17 Puts expired OTM ($3460)

- Quarterly ROI: 9.3%

- Recaptured ROI: 4.6%

- Paper loss ROI: -3.2%

ROI is calculated by dividing the total premiums written by the $250,000 backing the Put trades and annualizing. Writing Covered Calls adding 1.8% to the ROI. The Recaptured ROI represents the market-value improvement on the assigned Calls from their 12/31/21 value. This amount was reported as “paper loss” last quarter. The Paper loss listed represents how much the one open Covered Call (on CBRL) dropped in value over the quarter.

The 9.3% is above my 6-8% ROI target; including the recapture/paper loss puts the ROI for the quarter close to 11%.

Going with longer-date trades

Close eyes will notice a difference in the list of open option positions from past reports. There are six securities with 19 Put contracts that expire in June and July. Normally my longest would have been May contracts. With the second spike in volatility caused by oil trading over $120/brl. Expected ROIs average near 20%, much higher than my targeted ROI of 6-9%. It has restricted my ability to write May contracts as funds are already committed, but both of those months could net over $2000 each.

Portfolio Strategy

For readers new to options, I suggest you read this: 10 Rules For Option Traders. From reading comments to my series of option articles and what other Seeking Alpha Contributors have written, it is obvious that many strategies are undertaken by writing options; buy strategies are rarely discussed.

My main strategy is income generation as explained here: Adding Income Using Cash-Covered Puts And Covered Calls. Since restarting my option trading in mid-2019, I have explored how changing selected variables will effect my ability to achieve my 6-9% ROI on the cash backing these trades. Some of these included:

The “perfect trade” is one that expires “worthless” and you, as the writer, pocket the premium. While there are strategies one can employ (Rolling Your ITM Put Option Before Getting Assigned: The Net Credit Strategy), another outlined what to do when your Put is assigned: I Was Just Put To – What To Do Now. Having an “exit strategy” as each expiration-date approaches is wise.

Final Thoughts

While I suspect most readers are experienced option traders; for the others: remember option trading is not for everyone. There are risks I haven’t covered here which can results in large, even unlimited losses. Be sure you have educated yourself before you place that first trade!

Be the first to comment