Boarding1Now/iStock Editorial via Getty Images

Upsides are Blatant, Downsides are Underemphasized

Airlines have had it rough since the start of the pandemic, but key indicators and projections signal towards a turn of tides for the aviation industry. LTM total revenue growth for American Airlines (NASDAQ:AAL) and its comparables have a mean increase of 78.5%, with a projected further 60% revenue increase in FY2022 for the broader industry. This is in line with Moody’s predicted revenue increase to US 275 billion in 2022, 60% YoY increase from US 165 billion in 2021. Lower CAPEX costs for FY2022 and FY2023 and permanent operational cost efficiencies, could help AAL to achieve profitability, while enabling accelerated debt balance reductions. Key risk factors are still largely systematic. This includes volatility of oil prices, and the impact on demand due to costs passed to consumers, as well as, the threat of rising interest rates, and its potential contractionary effect on the overall economy. Relating to the previous point, an idiosyncratic risk could arise from high income elasticities, and subsequent more than proportionate decrease in demand could stem from decrease in income levels.

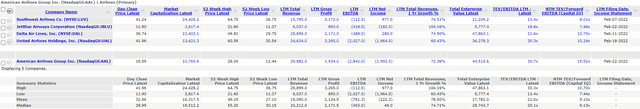

Comparables Company Analysis

American Airlines has a 52 week high of $26.04 back in early February 2021, and a corresponding 52 week low of $12.44 in March this year. Current prices are at $17.38 as of 7th April’s close. Operating revenue was $29.9 billion in FY2021, a 72.4% increase from FY2020.

Latest total enterprise value (TEV) for AAL was $45 billion, with a subsequent TEV/LTM EBITDA 30.7x, relatively higher than its comparables. NTM TEV/Forward EBITDA estimates are 15.52x, which still stands at a premium valuation compared to its peers with a median of 9.13x.

American Airline Comps Overview (Capital IQ)

Margin Risk due to Raging Fuel Prices

Near-term rise in fuel, a key COGS, would inevitably affect margins, with the assumption that fuel-associated costs are not passed down to consumers (which they undoubtedly will be). American Airlines is anticipating positive net income in FY2022. Notwithstanding, the level of profitability would be highly dependent on the proportion of cost-shifting to consumers, with the subsequent demand changes by its consumers.

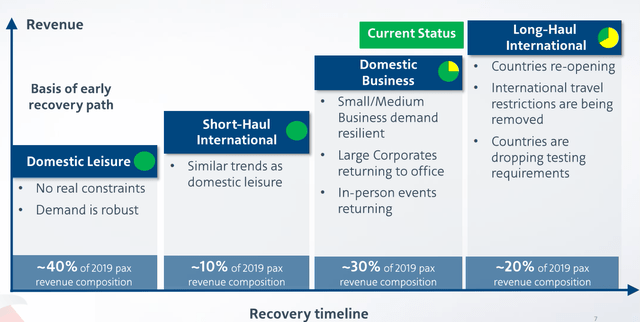

Traditionally, price elasticity of demand for small and medium business travel would be lower than that of leisure travels. Furthermore, a meta-analysis done has shown that flight distance is negatively correlated to price sensitivity, probably due to the lack of substitutes available for such types of travel. The aforementioned supports high revenue group compositions, including long-haul international and domestic business which is set to take off in 2022.

Q4 2021 AAL Earnings Conference Call (AAL Investor Relations)

With the global easing of restrictions, consumers are jittery to spend, and would more likely be undeterred by higher flight-related costs.

WTI Crude has also fallen almost 5%, upon International Energy Agency’s (IEA) announcement to release 120 million barrels of crude oil. On American Airlines side of things, management is confident that oil prices at its current level of around $100 a barrel would not hinder AAL’s road to profitability.

We can make money at oil prices of $100 a barrel or higher, and we will,” said Chief Executive of American Airlines Doug Parker.

However, this does not take away the fact that elevated oil prices will inevitably play a controlling part in reducing bottom line and profitability margins. This is especially true due to the fact that major US airlines do not hedge against oil prices unlike European ones.

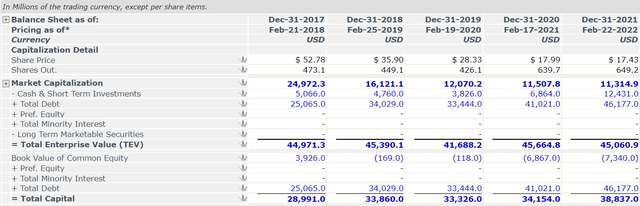

Unsustainable Balance sheet

Balance sheet wise, American Airlines is relatively over-levered, mainly attributed to the lack of demand and need for debt raising during the COVID-19 pandemic. Total debt balance stood at $46.18 billion as of Dec-31-2021, with LTM Total Debt/Capital of 118.9% (median comparables value of 72.3%).

American Airlines ended Q4 2021 with $15.8 billion total available liquidity, enabled through greater debt funding. Last quarter’s total debt are 184% that of end 2017 levels. The current debt interest funding should only be maintained in the short term, due to the long term unsustainability of over-leveraged balance sheets and correspondingly high interest payments.

Management will be focused on accelerated deleveraging- target reduce overall debt by 15 billion by end 2025 with projected $5.4 billion debt reduction in 2022 relative to its peak in 2021.

AAL Capitalization Overview (Capital IQ)

Potential Demand Waiver Arising from Economic Contraction

Current high inflation numbers are unsustainable, and the Feds are addressing this by raising interest rates, which could display peak aggressiveness towards July/August (statistically speaking, Fed tightens the most 5 months after initial rate hikes). This inevitable cycle of rapid inflation coupled with raising interest rates are a all-too-well-known phenomenon, which has a secondary effect of decreasing incomes.

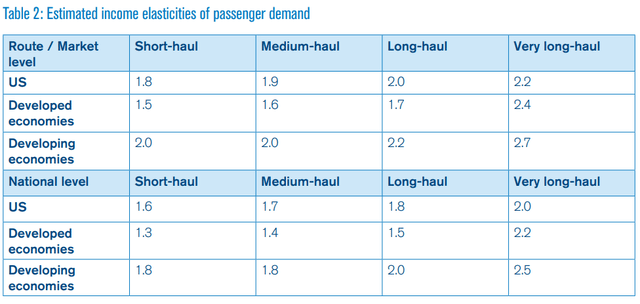

Income elasticities for the aviation industry could be argued rather both-ways. American Airlines, operating in the US would be more highly susceptible to decrease in incomes led by the potential recession. This is further supported by US markets short-haul income elasticities of 1.8, and long haul of 2.0. As such, a decrease in income levels will result in a more than proportionate decrease in demand for both short-haul and long-haul flights. I believe with unrelenting inflation levels, the Feds would need to take drastic steps in order to push back on inflation.

According to management conference, there is current straight-lining of trends, with the exception of short-haul business which has almost made a 100% recovery. This means that projections are based on demand increasing 60%, as per revenue consensus estimates. This poses a key risk for investors, due to the potential overlooking of the decrease in income and subsequent demand for air travel.

Income Elasticity Breakdown by Segment (IATA)

Cautious Optimism, Awaiting Entry

Overall, the risk of crude oil prices affecting profit margins is blatant, but unless oil prices rise disproportionately and continuously, AAL would be able to pass costs to consumers, without significantly compromising demand and bottom line revenues. Effects of high income elasticity on a potential recession, could serve as an underemphasized risk, which might not have been sufficiently priced into the market. Currently, AAL’s valuation might be higher than that of its comparable companies in the aviation industry, but potential permanent cost savings could help boost profitability for the company in the upcoming years. Investors should be eyeing the efficacy of accelerated debt reductions by American Airlines as justification for an over-leveraged balance sheet dwindles due to the opening up of major economies and travel routes. The Fed’s ability to engineer a soft landing for the broader economy is crucial in order for American Airlines to outperform, and will act as a significant headwind for the aviation industry. Valuations have come down, but I would be rating American Airlines a hold while eyeing for an entry of around $14 for a buy entry, which could be possible in the near term.

Be the first to comment