dem10

Introduction

Based on our coverages of Soluna Holdings (SLNH) so far, we categorized SLNH under companies with compelling stories but are not compelling investments. SLNH sells investors a means to earn a return by solving curtailed renewable energy. SLNH solves curtailed energy by building facilities around sites with curtailed energy. This is beneficial to both SLNH and the energy provider. SLNH would get energy supply at lower prices while the energy provider can ensure demand at full capacity.

In an early study, our findings suggest that the primary threat to SLNH’s business model is the increasing resources invested to solve curtailed energy in a move away from non-renewable energy. This impact is 2-fold: less curtailment implies less opportunity for SLNH; Less curtailment also implies higher energy prices and lower SLNH profitability. We also argued that SLNH could potentially have a conflict of interest against the general public where energy costs could’ve been lower or that the energy could’ve been used for other productive purposes.

In a recent coverage, we expanded our initial thesis and found several more pieces of evidence suggesting limited upside:

- Over-centralization: 60% of mining operations by Q4 (90% in the longer run) will be centralized in Texas, a state known to suffer from frequent blackouts and near blackouts.

- Mining is not one of the lowest as claimed where the cost of revenue (mining, excluding depreciation) is at the industry-average level while all-in business cost is 2x the industry average.

- Lack of mining capacity and Bitcoin (BTC-USD) reserves to materially take advantage of an upcoming Bitcoin recovery phase and bull market.

- Heavily burdened with 9% preferred dividends at $25 liquidation on 3mil outstanding preferred shares.

In short, we think that the main benefit SLNH investors can derive from a recovering Bitcoin is not the massive upside but only a lower risk of insolvency. That’s why we maintain our verdict that there isn’t sufficient value proposition in investing in SLNH.

Apparently, there is a way to benefit from SLNH’s lower insolvency risk without forgoing very high returns. And that is by investing in SLNH Preferred Shares (NASDAQ:SLNHP).

DeFi-level Yield With Bitcoin-Level Risks

Decentralized Finance is known to provide speculators with extremely high yields from staking where annual yield commonly exceeds 100%. The problem with this staking is that staking yields are usually paid in the form of another token with very little utility. The lack of utility implies less demand for the token and the token price often eventually collapses, tanking the yield with it. In contrast, yields that are paid in well-established coins/tokens have much lesser yield.

On the other hand, SLNHP is a 9% cumulative Series A perpetual preferred shares of $0.001 par value and $25 liquidation price. The 9% dividends are paid on the $25 liquidation price which equates to $0.1875 (= $25 *9% / 12 months). These dividend payouts have continued through 2022 till September with October’s still pending.

At the time of writing, SLNPH is trading at $4.08, implying a monthly yield of 4.6% or 71.5% annual yield compounded monthly. This yield is respectable and even higher than most yields at DeFi’s biggest yield-farming protocols (PancakeSwap (CAKE-USD), Aave (AAVE-USD), Uniswap (UNI-USD) or pure staking at Binance (BNB-USD) and other major exchanges such as Crypto.com (CRO-USD), KuCoin (KCS-USD), and Huobi (HT-USD).

Is this yield too good to be true? No, this high yield is required due to the riskiness involved in investing in SLNH.

From our perspective, SLNH’s primary risk is insolvency. On the basis of per BTC, SLNH’s all-in business expense is equivalent to $74,000 per BTC mined (more than 2x industry average). With Bitcoin trading near $20,000, SLNH is suffering $50,000 per BTC mined. SLNH hasn’t halted operation because Bitcoin is still trading above the cost of revenue (mining, excluding depreciation). As mentioned above, SLNH’s cost of mining (excluding depreciation) is only industry-average at best, which is $13,000 to $14,000 per BTC. Should Bitcoin follow through with its final leg down to $10,000 as depicted by its halving cycle, SLNH will need to halt mining operations, hence the insolvency risks.

Therefore, SLNHP is by no means a safe investment, just Bitcoin-level safe (which is risky by general definition). But in terms of cryptocurrency and DeFi yield farming, Bitcoin is the safest. SLNHP’s dividend yield with Bitcoin-level safety is very respectable. We perceive SLNPH to be the safest because we perceived Bitcoin to be the safest cryptocurrency. Bitcoin is the first and has been around the longest.

Moreover, investors can lock in this level of yield perpetually as long as Bitcoin trades just above SLNH’s breakeven cost per BTC. Bitcoin doesn’t even need to “go to the moon”. Based on our long-standing Bitcoin thesis [1][2], we (base case) expect Bitcoin to hit $10,000 by November before spending the following 2 years (2023-2024) reclaiming its $70,000 all-time highs and eventually $115,000 during the subsequent 1-year bull market (2025). At $115,000 per BTC by 2025, Bitcoin will return 575% in 3 years or 158% annually. During the same period, SLNHP will yield 134% annually compounded monthly (= [1.046^36 -1] / 3 years), very similar to our 3-year Bitcoin base case even without any capital gains. If SLNHP were to reclaim its liquidation price, SLNPH would return an additional 525% (=$25/$4-1) over however long it takes.

There are also other drivers for lowering SLNHP’s risk.

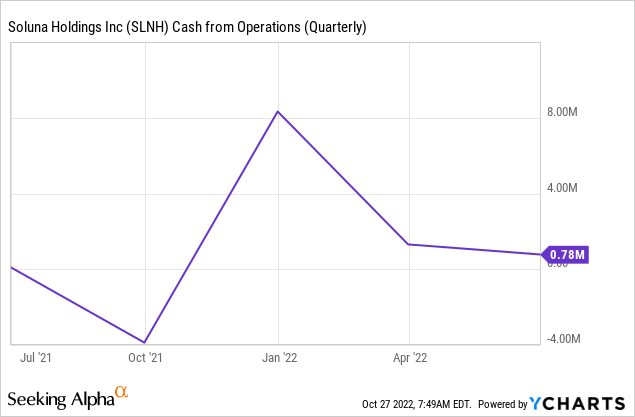

In terms of cash flow, SLNH is still operating cash flow positively despite being unprofitable. In the case of dividend misses, SLNPH is cumulative, meaning all previously unpaid (missed) monthly dividends are accrued and must be paid back in full in the future.

Under the worst-case scenario (bankruptcy), preferred shareholders have priority over common shareholders upon asset liquidations. This is very important because SLNH’s book value may be overestimated (valuation of intangible assets, asset liquidation liquidity, underestimation of asset deprecation, etc.). SLNH is now trading at a 0.15 Price-to-Book (‘PB’) ratio, which provides a good margin of safety under a worst-case scenario. To be even more conservative, we’ll reduce fixed asset values (PP&E and Prepaids) by 50% (to reflect liquidation liquidity challenges and risk of underestimating depreciation) and exclude non-tangible assets (which contributed 28% of total assets and might be realizable as cash). These conservative measures bring up the PB ratio to 1.5 (=$18.32mil Market Cap / [$4.63mil cash + $87mil PP&E * 50% + $10.7mil Prepaid * 50% – $41.4mil Total Liability]). This implies priority over assets during liquidation is very important.

Under the best-case scenario, SLNHP shareholders might be able to convert SLNHP to SLNH shares in the future. We think that this is the best of both worlds.

Fig 1. SLNH is operating cash flow positive (YCharts)

Conclusion: Yield Or Call Options?

Is there a better dividend income opportunity in the crypto space? We echo SLNH’s statement:

To our knowledge, Soluna is the only public company in the sector to have paid its investors dividends as we have done for the preferred stock (SLNHP). Some investors have inquired if they could take all or a portion of their monthly cash dividend in Soluna common stock. If we were to consider this it would be at the investor’s discretion as of the record date

Although we shy away from investing in SLNH, we find SLNPH’s risk level and yield respectable enough to get us invested. Based on the thesis laid out in this article, we’ve converted part of our Bitcoin holdings into SLNHP. The dividend payouts will be used to buy long-dated call options (read here to find out why – hint: 13.6x expected return with limited downside should Bitcoin hit $115,000 in 3 years).

Be the first to comment