Bet_Noire/iStock via Getty Images

The BlackRock Energy & Resources Trust (NYSE:BGR) is a closed-end fund that invests in energy sector stocks through an unleveraged long-only portfolio across global oil & gas majors. The fund also incorporates the use of a buy-write options strategy in support of the fund’s monthly distribution which currently yields 4.4%. This is a fund that we previously covered back in 2020 at the depths of the pandemic crash in energy, with an impressive rally as BGR has more than doubled over the period.

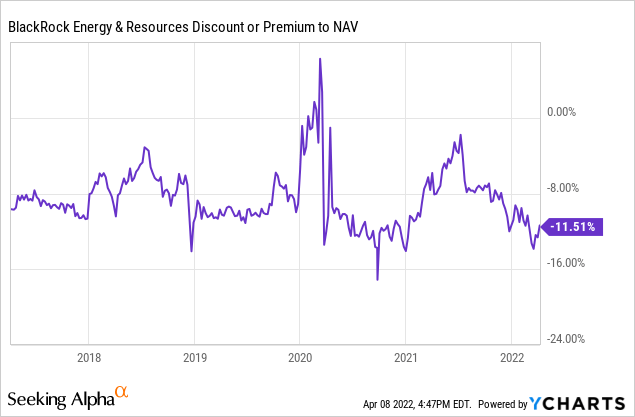

Taking a second look, despite the upside, we’ve been overall disappointed considering BGR has simply underperformed other energy sector benchmarks. Separately, BGR’s yield doesn’t stand out as exceptional among other high-yield opportunities. We believe these factors explain the fund’s widening discount to NAV. In other words, we no longer recommend the fund considering what may be some better alternatives for similar exposure.

What is the BGR Fund?

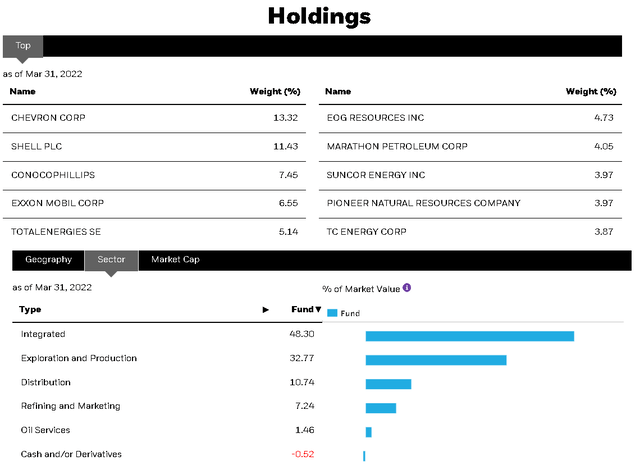

With a current portfolio of 29 equity holdings, keep in mind that BGR is actively managed, meaning every position is at the discretion of the portfolio manager and not meant to track any particular benchmark. The focus here is on exploration and production companies which are in contrast to other energy sector CEFs that typically target master limited partnerships (MLPs) given their high-yield profile. In this regard, BGR is relatively unique by not utilizing leverage and not investing in MLPs.

Chevron Corp (CVX) is the fund’s largest position with a 13% weighting, followed by Shell plc (SHEL) at 11%, while ConocoPhillips (COP) and Exxon Mobil Corp (XOM) both have a 7% weighting. Overall, the takeaway here is the fund’s global profile including U.S. and international names targeting integrated producers.

We mentioned the options buy-write or “covered calls” strategy. The idea here is that fund sells calls on individual stock holdings to enhance income by collecting the premium. Currently, 36% of the fund is “overwritten” which in theory represents a partial hedge and can help reduce downside volatility but also ends up limiting the upside potential.

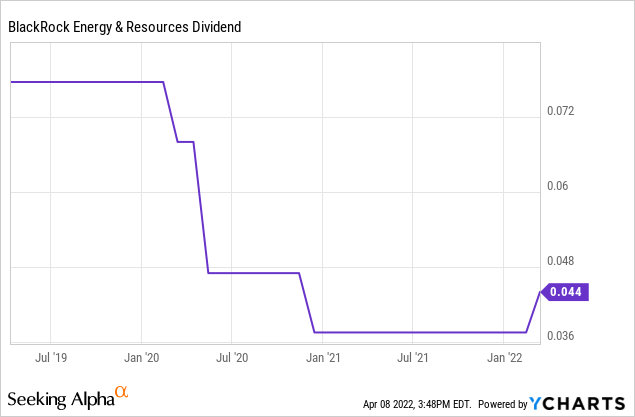

Favorably, considering the fund’s strong performance over the past year, BGR was able to increase its monthly distribution amount in March to $0.044 per share, up 17% compared to the old $0.0375 rate. On the other hand, it’s worth noting that the fund has had an inconsistent distribution history considering a series of cuts in 2020 compared to a peak level of $0.075 per share in 2019. In 2021, approximately 38% of the total distribution was classified as a return of capital (ROC), while the measure has averaged closer to 66% over the past 5-years.

BGR Disappointing Performance

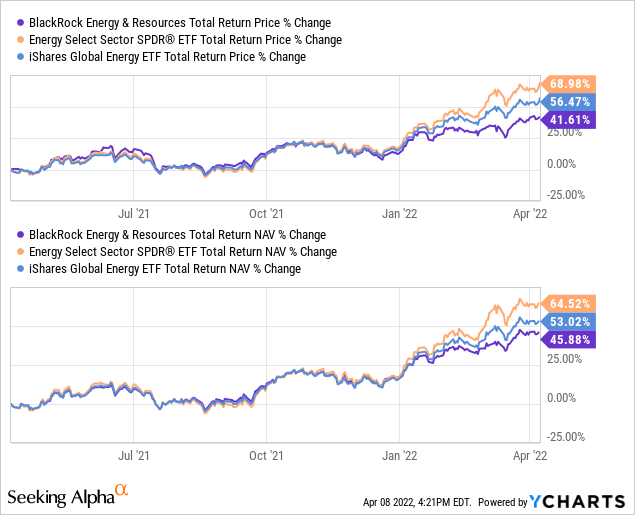

The good news is that BGR has returned 46% on a total return basis at its market price or 42% at the NAV over the past year. This considers what has been particularly strong momentum in the energy sector and oil & gas stocks over the period.

Still, the trend looks less exceptional when we consider the performance of benchmark ETFs like the Energy Select Sector SPDR ETF (XLE) which tracks the energy stocks within the S&P 500 Index (SPY) and has returned 56% over the same period, a spread to BGR of nearly 15 percentage points. We also view the iShares Global Energy ETF (IXC) as a good comparable to BGR considering it has a broader exposure to include large-cap international energy stocks, like the BlackRock fund. Here IXC has captured an even stronger return of 69% over the past year.

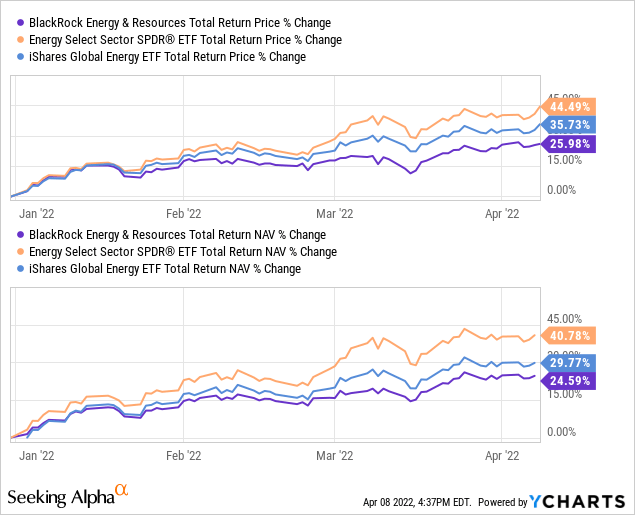

The performance spread has widened year-to-date with BGR returning 26% at the market price compared to 36% for XLE and 44% for IXC. Our take is that the underperformance simply reflects poor security selection on the part of BGR’s portfolio management team that has been unable to deliver excess returns.

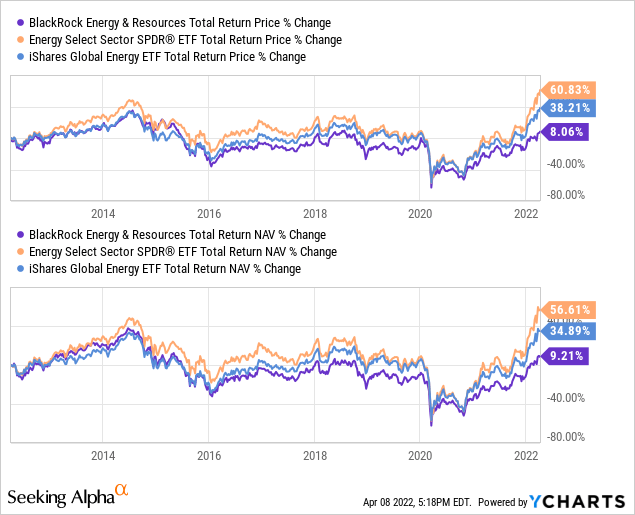

To round out our discussion and nail the point home, we also note that BGR has also underperformed XLE and IXC over the past decade. The takeaway is that long-term shareholders could have done a bit better.

In the world of CEFs, a lagging return by a fund relative to a similar ETF can sometimes be justified by the fund’s income-focused strategy or differentiation through the use of credit securities or complex derivatives. In this case, BGR’s relatively vanilla equity portfolio and a distribution yield of 4.4% hardly stand out compared to XLE which offers a 3.5% dividend yield. On this point, the attraction of XLE is going to be its 0.10% expense ratio compared to BGR which charges 1.33%, expensive for what you get in our opinion.

So putting it all together, we believe the soft returns of BGR, high expense ratio, and modest yield explain its persistent discount to NAV which has reached -11.5%. While there are many reasons a CEF can trade at a spread to its net asset value, the market here appears to be less enthusiastic toward BGR limiting the demand for shares. If the fund was able to consistently beat XLE, we would expect a narrower discount or even a premium which has not been the case.

Final Thoughts

With a bullish outlook on energy and a view that the price of oil can climb higher amid the geopolitical environment and the recovery of post-pandemic demand, we expect oil & gas stocks to have more upside. By this measure, we believe BGR should rally alongside the sector and continue to deliver positive returns. On the other hand, we haven’t seen a good reason to choose this fund over a low-cost ETF and expect it to continue underperforming on a relative basis.

CEF investors that are looking for a high-yield option can consider the First Trust Energy Income & Growth Fund (FEN) or Kayne Anderson Energy Infrastructure Fund Inc. (KYN) which have exposure to the energy sector through a portfolio of MLPs but offer a higher yield closer to 8%. For everyone else, it’s going to be hard to beat XLE for its simplicity and exposure to high-quality mega caps.

Be the first to comment