Kwarkot/iStock via Getty Images

In a lot of ways, I have warmed up to W. P. Carey (NYSE:WPC) over the past couple of years. Even so, my view of the massive bullish coverage found on SA remains skeptical.

Since January 1, 2020, one finds 64 bullish articles. Leaving aside my own few articles, one sees those 64 articles offset by seven now labeled “Hold” and zero bearish takes. WPC pretty much qualifies as a cult stock, at least in the SA context.

My inclination is to be suspicious of cult stocks. But having warmed up to WPC in some ways, the question for me is when I might decide to buy.

Feel free to join me if you want a quantitative analysis that goes beyond what I’ve noticed in any prior article on W. P. Carey.

Here is some brief context about W. P. Carey:

- Rock solid balance sheet not discussed here.

- Emphasizes properties that are essential to the operations of firms such as manufacturing or food processing.

- This flavor of “industrial” is quite different from logistics warehouses.

- Very active in both the USA and Europe.

- Generally does sale/leasebacks on a triple net basis.

Challenged Past and Present

I spent a lot of time working through WPC earnings calls last year, seeking to better understand their history. That was discussed at more length in this article. Here is a very brief summary, including a bit of the future to be discussed below.

|

Dates |

Theme |

|

1973 to 2012 |

Assets Under Management (“AUM”) via a sequence of funds |

|

2012 |

REIT Transition with a large dividend increase (too large) |

|

2012 to 2015 |

Split focus on AUM and owned properties; hated by investors |

|

2015 to 2017 |

Searching for identity; many discussions with investors |

|

2017 |

Forward focus to be on owned net lease properties; Jason Fox appointed CEO |

|

2017 to 2022 |

Exiting AUM business ASAP; which turned out to take 6 years. |

|

2024 |

End of U-Haul lease |

|

After 2024 |

Growth as a typical REIT with sector-leading escalators |

For REITs, the rubber meets the road for shareholders in dividend payouts. There has been little potential in recent decades for increases in REIT asset values that are not reflected in dividends.

This may change with sustained inflation, as I discussed here. But we are not there quite yet.

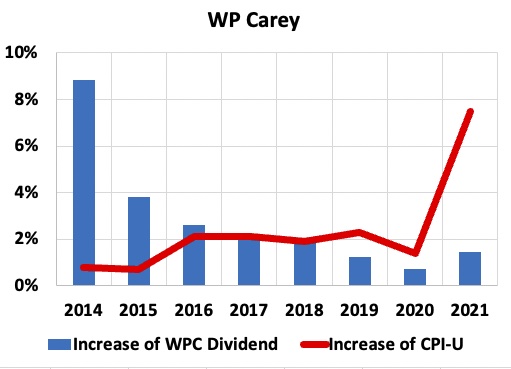

The dividend history of WPC has been challenged. Before the REIT conversion, the dividend increase was less than 2% per year. Here is the history since.

RP Drake

The average increase from 2015 through today is 2% per annum. Those who bought WPC for income in 2015 have already seen their earnings lose ground to inflation by 7%, with more to come.

In the midst of grappling with their internal challenges, WPC managed to grow AFFO (Adjusted Funds From Operations) per share from their owned properties at only a 3.8% compounded rate from 2017 through 2021. And that did not all show up in the dividend.

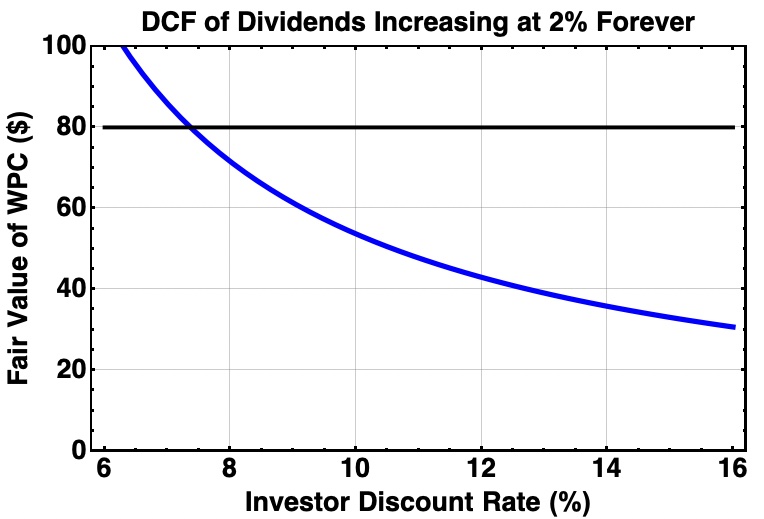

I find myself endlessly perplexed by the enthusiasm shown by some investors for dividends that grow at a 2% rate. If one takes the current WPC dividend, and has it increase indefinitely at 2% a year, one gets this plot for the Discounted Cash Flows:

RP Drake

One way to look at this plot is that WPC is fully priced today for an investor who will be satisfied with a 7.3% total return. It seems that a lot of investors will accept this prospect just to get a 5% dividend. Or perhaps they believe the qualitative platitudes from the WPC cult and don’t think about it.

My own personal minimum total return is 10% and I prefer more. In that context and based on the history alone, WPC is overpriced today by more than 50%.

By now bullish readers are grinding their teeth and saying: “So what! The future will be different!” True enough, but how different?

Things Are Better, Soon

Until recently, shareholder communications by WPC were also a disappointment to me. Nothing seemed unethical, just poorly focused and lacking in some ways.

Here is how one on our members at High Yield Landlord reacted to the WPC earnings call from Q4 2020:

Wow, those WPC guys are unimpressive. They are focused like a laser beam on increasing gross assets—do their comp packages depend on assets? Growing FFO/shr, AFFO/shr, NAV/shr? What’s that? FFO/shr has been at about 4.50-4.80 for a decade, and that’s where they like it. They don’t do accretive stuff because that’s not their style. Why do they bother to present if they are going to talk like that?

My own reaction was similar.

But that was so last year. Here is the lead on the recent 2022 CEO Letter from Jason Fox:

W. P. Carey 2022 CEO Letter

This change in the focus they present has also been seen in more recent earnings calls. My own current estimate is that what we had there was a failure to communicate, and that WPC has been headed the right direction all along. But it was difficult to tell.

That said, WPC is not yet achieving the goals for shareholder disclosure laid out in Warren Buffett’s most recent CEO Letter. While the word “inflation” is mentioned 8 times in the WPC letter, and no false promises were made, what has been said is too easily misinterpreted.

WPC does not seem to have hidden anything. When Fox was asked about the future of the dividend, he was straightforward and explicit. (This was in an exclusive interview by Samuel Smith of High Yield Investor, which our members at High Yield Landlord had access to.)

Fox acknowledged that recent increases had been insignificant and mainly kept the streak going. He spoke of the need to get the payout ratio (fraction of AFFO paid as dividends) down to a level that enables some retained cash flows. He emphasized the long-term intention to see AFFO/share grow and to see dividends grow in proportion to that.

This is all perfectly sensible, and positive in the long run. I just think Warren Buffett would have mentioned the first two items in the Letter.

Quantifying Inflation Impacts

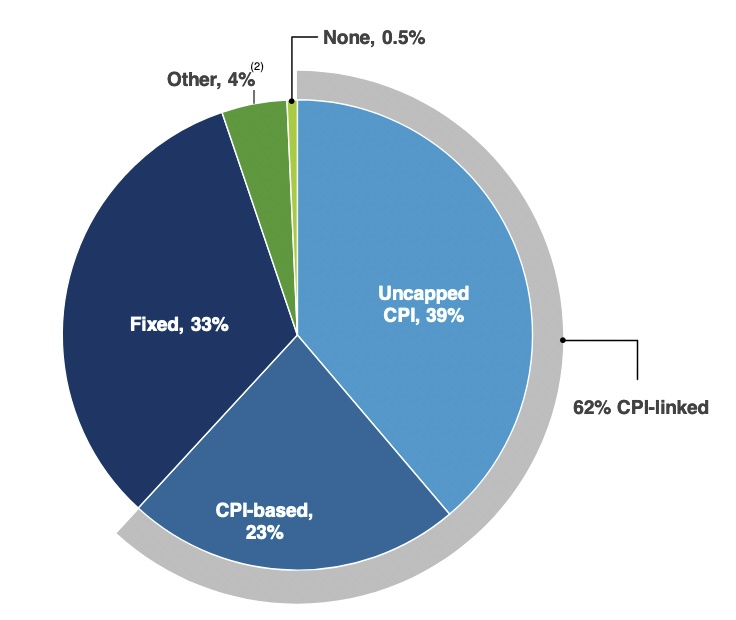

Many of the articles on WPC show this display of their rent escalators:

WPC Corporate Presentation

This graphic did not leave me as excited as others seem to be. Less than 50% of the leases have uncapped escalators.

As to the other CPI-based escalators, both STORE Capital (STOR) and National Retail (NNN) have some or many such escalators. But they are capped at some value like 2.5% or 3%. This sort of cap has been pretty common; it is likely that WPC is similar.

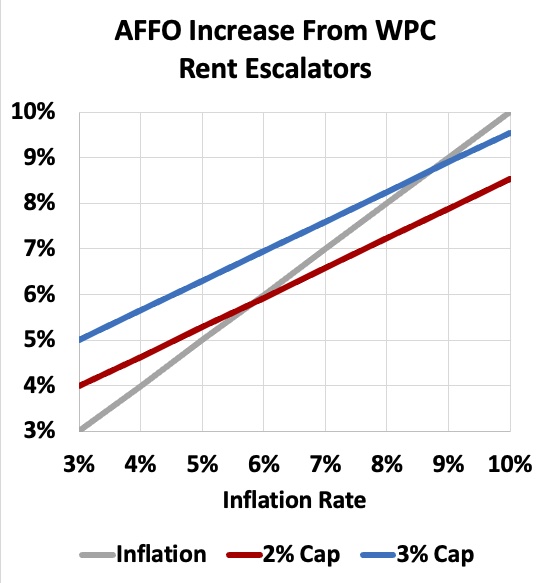

The mix of escalators is pretty easy to model, if one assumes some value for the caps that exist and that interest expenses remain the same fraction of NOI, or Net Operating Income. This last will not be precise, but will matter little since such expenses are less than 20% of NOI.

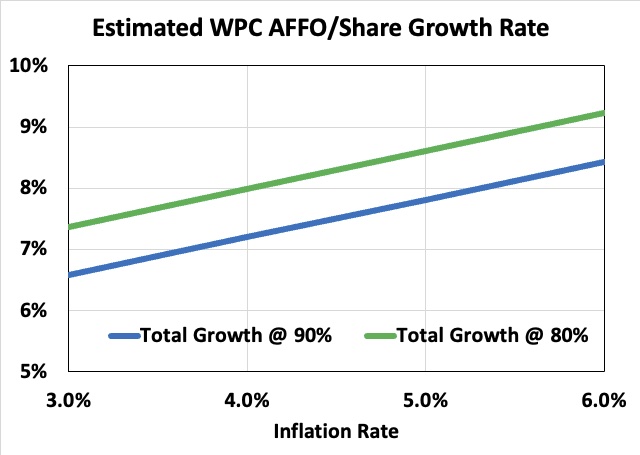

Then the fractional increase of AFFO can be evaluated as the leveraged fractional increase in NOI due to the escalators. WPC reports using a leverage to gross assets of 40% or a bit more, so the model used 40%. One gets this:

RP Drake

We see that the escalators will increase the AFFO ahead of inflation when inflation is low. They will increase the AFFO at nearly the rate of inflation for higher inflation.

This is a lot better impact of rent growth than any of the traditional net-lease sector will manage. It will take only modest growth from retained earnings to keep AFFO/share growing ahead of the inflation rate.

The Capacity for Growth

My two recent articles addressing cap rate compression also included the theory and applications for the three main categories of growth. These are the growth from rent increases just discussed, growth from retained earnings, and growth from capital raised by issuing stock.

WPC paid out 90% of (REIT/base) AFFO in 2020. Quality REITs generally pay out 80% or less. The annual growth of AFFO from this source for WPC will increase from the 1% ballpark for 90% to the 2% ballpark for 80%.

Share issuance in the 5% range will add another 1.6% to AFFO/share growth on net (for the current Market Cap) but will also dilute the internal growth by 5%. Putting it all together gets us this for the two payout ratios mentioned:

RP Drake

The modeled growth rate increases as inflation does. But the spread of that growth rate over inflation decreases.

In the following, I will use a 7% growth rate once WPC gets past some hurdles to be discussed. If inflation stays hot, the nominal growth rate will increase but the real rate will drop.

The Saga Ends With U-Haul

We saw above how WPC has been pushing through the headwinds produced by their decision to exit the AUM business. They are not done yet, with the forthcoming merger with their final fund, CPA/Global:18, expected to close this year.

This will increase AFFO but also will impose some costs. Perhaps this is why WPC has guided to only 4% growth of AFFO per share, rather than the larger number one might expect from the above.

One can expect that the added costs will continue into 2023, as some reworking of the property portfolio will be needed after the merger. So the following uses 4% again for the AFFO/share growth in 2023.

Then, in 2024, just as WPC is about clear of the AUM mess, the lease with U-Haul ends. Here is some discussion of that, between analyst Elvis Rodriguez and WPC, from the Q2 2021 earnings call:

Elvis Rodriguez

Great. And then just a question. So at the end of 4Q ’20, you got about 9.5% of your leases of ABR rolling in 2024 and now you only have about 8%. Is that a function of bringing leases up, selling assets? How should we think about the role that’s occurring in the portfolio over the next few years? And what retention can look like?

Jason Fox

Brooks, you want to take that one?

Brooks Gordon

Sure. So with respect to 2024, it’s really just ongoing leasing activity that has occurred. So that’s not really disposition activity. So we are very focused always on reducing that next 5-year lease roll percentage, and we’re making good progress on that. In the next 3 years, we have a very manageable lease expiration outlook, less than, say, 8% through 2023. 2024 and 2025, certainly larger years, but that’s pretty typical at this point in time. And so we’re focused on all of those years right now, and that’s really our approach is kind of 5 years out, really taking a proactive approach to those. On note, in 2024, the biggest piece of that is the U-Haul lease expiration, and that’s one where they have a purchase option in 2024. So when you back that out, it’s really only about 5% of ABR expiring in 2024.

Elvis Rodriguez

At this point, to your best of your knowledge, do you expect them to exercise that option?

Brooks Gordon

We do.

While WPC will get some funds from the repurchase of the properties by U-Haul. But this is part of their capital transactions and does not contribute to AFFO.

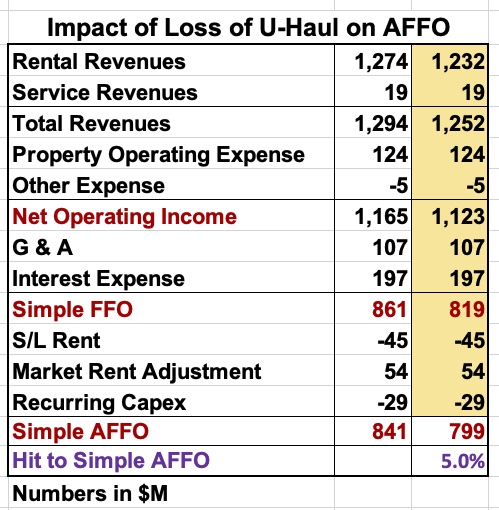

The hit to revenues, based on current numbers, will be 3.3% of current revenues. I modeled the impact based on a comparison with 2021 revenues, to estimate how large it will be. Here is a summary table:

RP Drake

The impact may be less as revenues will have increased and debt might get paid down. For modeling purposes, we will assume that AFFO/share grows by only 2% in 2024.

Then after 2024 the job will be done, finally. U-Haul will be gone and the simplification of the business will be complete. The model below uses an AFFO/share growth rate of 7% for the years after that.

Back to the Dividend and Valuation

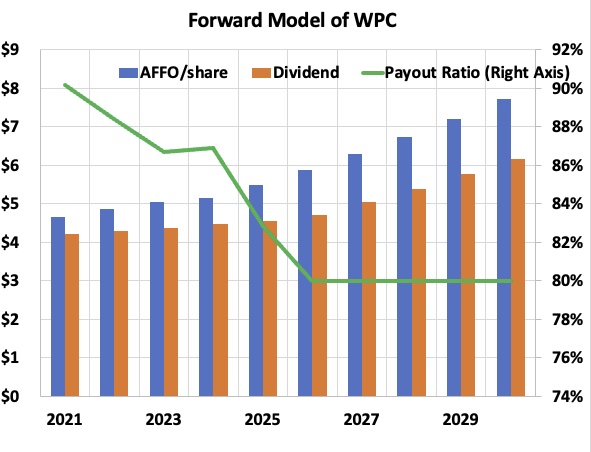

As to the dividend, the model assumes that dividend increases stay at 2% until the AFFO payout ratio is down to 80%. After that, dividends will finally increase with AFFO/share as long anticipated.

Here is how this plays out. The dividend finally begins to soar in 2026.

RP Drake

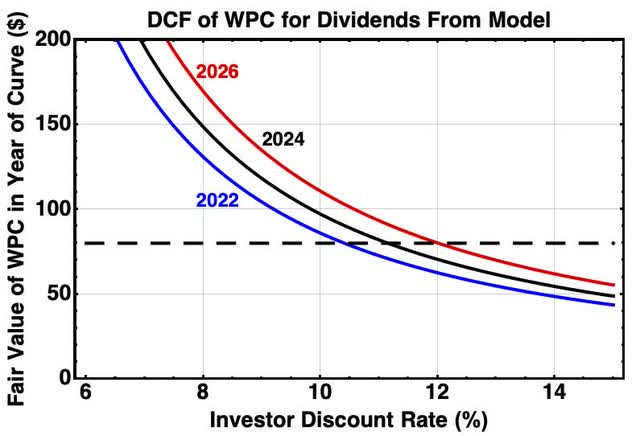

I ran these results through a discounted-cash-flow model as follows. The goal was to see what the value of WPC would be if bought in future years.

For a specific year, this calculation started with the dividend shown on the above plot. That dividend was incremented by the amount discussed above for 25 years. After that, additional value was based on a 3% terminal growth rate.

Doing this generated the following plot. The years shown are 2022, 2024, and 2026, indicated by color. The dashed line indicates the current price.

In this model WPC is now priced for roughly a 10% total return. That’s not bad.

WPC is a very solid company. If your total return expectations are 8%, then the above suggests that they are substantially undervalued. This will be adequate for some investors but not for others.

The future increase of the cash flows boosts the calculated returns. What happens is that there is much higher value in the rapidly growing dividend after 2026. This drives a more rapid fair value increase from year to year than one would see if the dividend growth were constant.

Going forward, the model would see the fair value increase about 7% per year. As you can buy the stock at a yield above 5% today, one can anticipate an intermediate-term total return above 12% starting from today.

For young investors pursuing Dividend Growth Investing, WPC at this point looks to me like an excellent stock. The next few years don’t matter to them.

Retiree Perspective on WPC

Retirees, in contrast, need a more nuanced view. WPC bought today does not get you inflation protected income. It bothers me a lot that so many article titles seem to promise this.

Inflation protection seems likely to become true eventually, but it is false today. The real value of the dividend has fallen several percent over the past year. Over the next 5 years, the value of the annual dividend seems likely to fall another 10% to 20% in constant dollars.

The scary thing would be a retiree who puts their net worth into WPC and who needs to live on the income. They could easily see their real income drop by more than 30% across this next decade.

As an income source, WPC will be a bit better than bonds paying the same rate, and to my mind will also be safer. My view is that the speculative-grade bonds paying 5% are more risky than the WPC dividend. So using WPC as a bond proxy for near-term income does not bother me.

Of course, you should be aware that adverse markets could prevent you from getting your principal out for a year or three. But if you just want the income, and realize it will decay in real value, fine. Presumably other parts of your portfolio are intended to handle inflation.

Personal Takeaways

In my own context, my retirement income includes plenty of cash flows that will lose ground to inflation at some rate. It would make little sense for me to add more.

I like getting dividends of 5% or more, but only from fundamentally sound firms that are in my view significantly underpriced. In that group today are Simon Property Group (SPG), STORE Capital, National Retail, and some midstream energy stocks.

Investing in such firms gives me a nice cashflow and an expectation of gains that will keep me well ahead of inflation. Everything in the portfolio I actively manage is likely, in my view, to get me better total returns than would be expected from WPC at today’s price.

That said, at the right price I would eagerly establish a significant position in WPC. For me that would be $56 today, increasing to $77 in 2026.

Such an opportunity could come. The market may panic over interest rates or inflation or the next recession. In addition, the logistics part of the industrial sector could crash hard whenever the “more e-commerce forever” narrative implodes. The market is very likely to take WPC down with the rest of the sector, even though that will make little sense.

Beyond all that, and at the end of the day, perhaps I am wrong about how the market will value WPC stock in the long run. At High Yield Landlord, Jussi Askola has been very enthusiastic about them and has WPC as a large position and a strong buy in his Retirement Portfolio.

My own view is that WPC will become more attractive over time, but I’m still not yet seeing comparatively strong value. Time will tell; disagreements make markets.

Be the first to comment