400tmax/iStock Unreleased via Getty Images

Currently, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is one of the most resilient businesses in the world. Despite the macroeconomic uncertainty, the company has all the chances to continue to have a dominant position in the digital ads market, it has more than enough resources to weather a major crisis, and its latest initiatives could help it to continue to expand its business more even in the current turbulent environment.

While there’s a high chance that the regulators from both sides of the Atlantic would be looking for ways to break the company’s digital monopoly, there’s a small possibility that major regulatory risks will materialize in the short to near-term. As a result, it’s safe to assume that the market underestimates Google’s ability to create shareholder value in the foreseeable future, since at the current levels the company’s shares trade at a discount to fair value of as much as ~40% in the base-case scenario, creating an opportunity to profit from for investors.

Cyclical Decline Creates New Opportunities

It’s safe to say that the digital advertising industry is currently in a cyclical decline due to the turbulent macroeconomic environment. After relatively weak performances in recent quarters, digital advertisers such as Meta Platforms (META) and Snap (SNAP) already publicly announced that they’ll start laying off their people. At the same time, there’s a risk that the current cyclical decline in the industry would be prolonged into 2023 due to geopolitical uncertainty and a more hawkish Fed policy, which in the end will likely result in a global recession. The latest forecasts already show that while digital advertising spending would continue to increase, the overall spending growth rate in the U.S. would decelerate in the second half of 2022 and 2023.

However, the good news is that despite all of this, it’s safe to say that Google would be able to navigate through this turbulent period with relative ease thanks to its significant war chest and greater competitive advantages against others. The company wasn’t affected as much by Apple’s (AAPL) privacy policy change that is forecasted to cost Meta alone ~$10 billion in lost revenues, and in Q2 it performed mostly better against its peers as it only barely missed its expectations. On top of that, the company’s search and video business continue to grow at an impressive rate, as the revenues for Google Search and YouTube in Q2 were up 13.5% Y/Y and 7.34% Y/Y to $40.7 billion and $7.34 billion, respectively.

As the company is about to report its Q3 earnings results later this month, there’s an indication that despite all the troubles that the industry is currently experiencing, Google would be able to continue to expand its competitive edge along with its market share in the foreseeable future. In addition to the pledge to invest $690 billion in Japan by 2024 to improve its products and services, Google is also about to begin monetizing YouTube Shorts in order to gain additional market share in the short video format field.

As a digital advertiser myself, I believe that it makes sense for the company to explore new opportunities in the short video format for several reasons. First of all, thanks to the rise in popularity of ByteDance’s (BDNCE) TikTok app in recent years, we know that a short video format is an engaging way for users to interact with each other. According to different reports, TikTok’s revenue is about to surpass the revenues of Twitter (TWTR) and Snapchat combined later this year, which is a sign that there’s an opportunity for monetization in the short video format, especially for a company like Google that already has a significant presence in video thanks to YouTube.

What’s also important to mention is that despite significant growth in recent years, TikTok has a major problem that makes it exposed to competition. That problem is the lack of incentives for content creators to continue to create short-form videos, as they don’t generate a lot of revenue from ads and instead rely almost entirely on sponsorship deals from which the app doesn’t make any profits. While earlier this year TikTok announced a 50% ad revenue share program, that program is covering only a small portion of content creators.

Considering this, there’s a high probability that the short format video creators at the very least would be interested in exploring what Google has them to offer with YouTube Shorts. From what we already know, Google plans to pay 45% of the ad revenue to those YouTube Shorts creators, who have over 1000 subscribers and 4000 watched hours, which could be considered a relatively low entry requirement. At the same time, the company’s management in the latest Q2 earnings call said that the initial results of the YouTube Shorts monetization program were encouraging and that the program itself will be launched at the beginning of 2023. If Google manages to successfully launch the program and lure in a large portion of TikTok content creators, then the company would have new opportunities to accelerate the growth of its video advertising business, which should result in the creation of additional shareholder value in years to come.

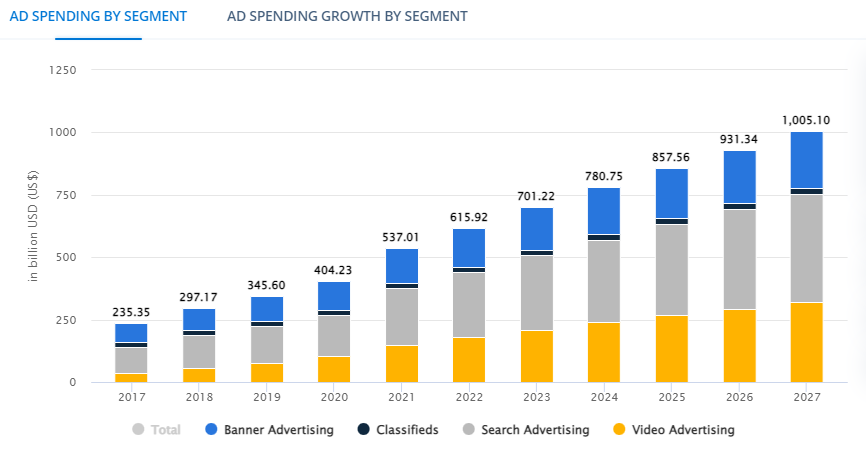

In addition to all of this, while the advertising spending growth rate in comparison to the growth rate of recent years is expected to depreciate in the following quarters, there will come a time when this cyclical decline will reverse, and by that time, Google would have additional tools that should help it to benefit the most from this change. Some reports suggest that by 2027 the ad spending in the digital advertising market would reach over $1 trillion, with search and video advertising leading in the amount of spending in comparison to other segments.

Considering that it’s unlikely that Google would lose its dominant position in the search segment due to the competitive edge that it built over the last couple of decades, it makes sense for the company to focus on the video segment, which has the potential to continue to grow at an aggressive rate in the following decade. If the company manages to successfully launch the YouTube Shorts monetization program and actively attract major content creators, then it’ll likely be able to capture a significant portion of the video segment in years to come.

Ad Spending by Segment Forecast (Statista)

Considering all of this, it appears that the latest depreciation of Google’s shares is nothing more than a market overreaction due to the worsening macroeconomic environment. Even when it becomes obvious that it’s likely that we’ll enter a global recession in the following quarters, the latest estimates still suggest that Google would be able to continue to grow its top-line at a double-digit growth rate, which is a sign that its business is as resilient as ever.

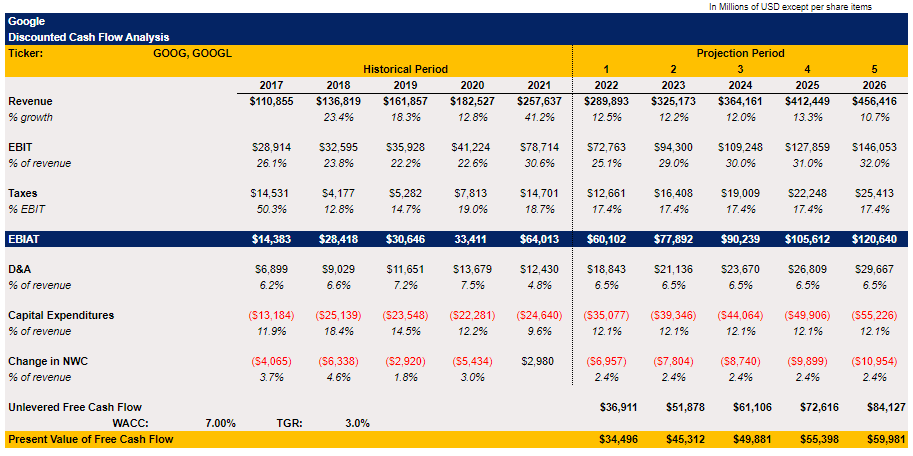

To figure out how much upside Google’s shares offer at the current levels, I have recently updated my DCF model where the top-line growth is almost in-line with the street forecast, while all the other major metrics are either averages of recent years or close to the latest reported period. The WACC in the model is 7% while the terminal growth rate is 3%.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

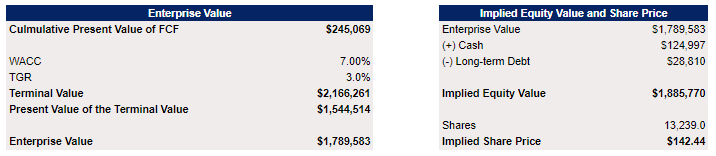

My model shows that Google’s fair value is $142.44 per share, which implies an upside of as much as 40% from the current levels. My price target is also close to the street consensus price target of $139.42 per share.

Google’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

Considering all of this, it makes sense to say that the market lost its mind when it punished Google’s shares to the levels at which it trades today. However, the good news is that thanks to such an irrational depreciation, investors now have an opportunity to profit, as there’s every reason to believe that the company would be able to successfully navigate through the current turbulent environment and even increase its presence in the video segment at the same time.

Risks

In the short to near-term, the only major risk to the company is a prolonged global recession. The latest decision of OPEC to cut its oil production along with the Fed’s decision to continue to execute its hawkish policy and engage in quantitative tightening to tame inflation have already severely rocked the markets and there’s a risk that most stocks will continue to depreciate in the foreseeable future. As a result, there’s a possibility that Google’s stock would continue to decline and trade at even more irrational levels until the macroeconomic situation, over which the company has no control, improves over time.

As for the long-term risks, I believe that a change in the regulatory environment and the constant prosecution from the antitrust watchdogs is the only major thing that can disrupt Google’s business model in the following years. Back in June, I already wrote an article that explained how the regulators from both sides of the Atlantic are looking for ways to level the playing field, which includes stripping Google and its peers their monopoly status in the digital advertising space. In recent months, several major developments have occurred, which could potentially force Google to make some unpleasant changes to its business and lead to lower returns in years to come. However, those developments don’t pose a major threat to the company in the short to the near term, as they’re unlikely to materialize anytime soon, but I plan to write a separate article about this and highlight what Google investors should expect from the upcoming changes on the regulatory front.

The Bottom Line

While there are certain regulatory risks regarding Google, those risks are unlikely to severely affect the company’s position in the digital ads market anytime soon. At the same time, with a nearly 40% upside, it appears that the company’s stock is oversold and could be considered a bargain at the current levels.

Let’s not forget that Google has more than enough resources to weather turbulent times, and at the same time, it has more than enough capabilities to continue to launch new products and services, which are able to create new monetization opportunities for the business and help it to further expand.

Considering this and the fact that there’s an indication that the company will continue to generate double-digit returns despite the macroeconomic concerns, it appears that Google continues to be a solid stock to own for investors, especially at the current levels.

Be the first to comment