Pavel Muravev

All values are in CAD unless noted otherwise.

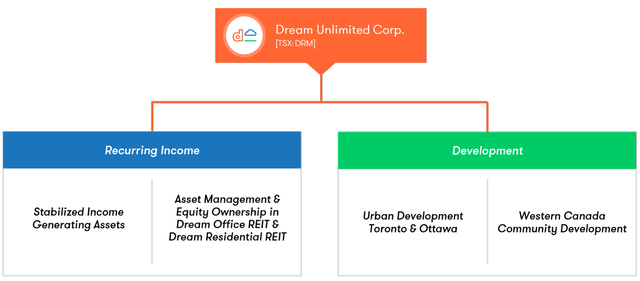

Dream Unlimited Corp. (OTCPK:DRUNF) (TSX:DRM:CA) wears several hats. The Canadian entity is an asset manager, owner and operator, and developer of properties across North America and Europe. It has two business segments, recurring income and development.

1) Recurring Income: This segment comprises income from:

- Property management and development services to publicly traded REITs within the Dream Group, namely Dream Industrial REIT (OTC:DREUF) (DIR.UN:CA), Dream Residential REIT (DRR.U:CA) and Dream Office REIT (OTC:DRETF) (D.UN:CA), which we have covered in the past,

- Asset management services to private clients and the Dream Impact Trust (OTC:DDHRF),

- Ownership interests in a few of the Dream entities noted above, which generate monthly distributions, and

- Ownership of income-generating recreational, retail, residential and mix-use properties.

2) Development: This segment comprises income from the development of condominiums, rentals and mix-use properties across Toronto and Ottawa in the east. In the west, this includes the development of land, multi-family, retail and commercial properties in the provinces of Alberta and Saskatchewan. The work in the Virgin Hotels in Las Vegas is also included in this segment. Dream Unlimited has exposure to this via their ownership interest in the Dream Impact Trust.

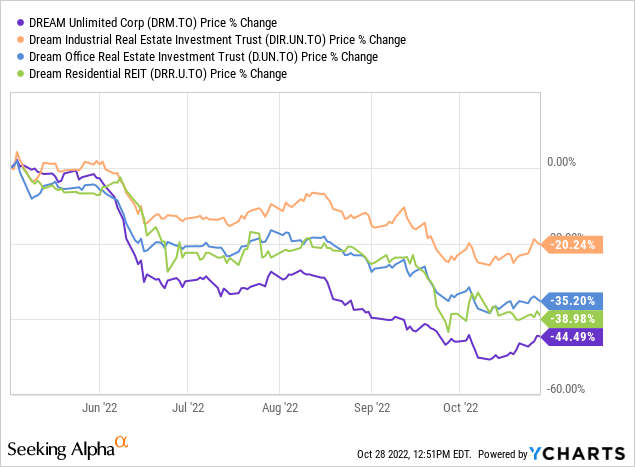

The market has not been kind to the Dream Group in recent times. Dream Unlimited, more so, with the inception of the Residential REIT.

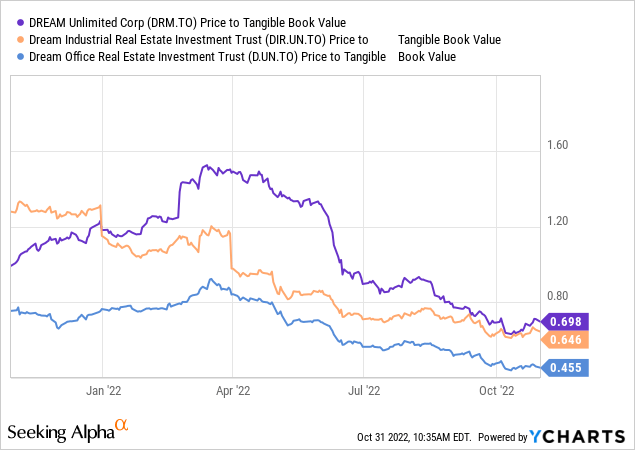

We can see that in the case of Dream Unlimited and Industrial, some of this was just removing the premium it enjoyed prior to real estate (and their managers) being put into the doghouse due to increasing interest rates.

Let’s look at Dream Unlimited in more detail today and see if now is a good time to buy.

Debt and Liquidity

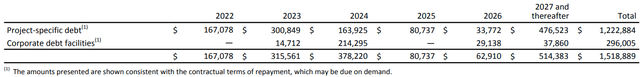

Speaking of high interest rates playing spoilsport in the real estate party, let’s take a look at the upcoming debt maturities for this corporation. As of June 30, around 31% of the total debt was due by the end of 2023. Most of this debt is project-specific and Dream Unlimited is expected to pay this from the closings of the related real estate, with cash from their recurring income filling in the gap as needed.

Close to 70% of the project-related debt is geared towards recurring income-generating properties. The interest rate on about half of the total loans is fixed, with a weighted average rate of 3.03%. The balance has a weighted average variable rate of 4.66% (vs. 3.30% on December 31, 2021). A portion of the variable rate loans is hedged via fixed interest rate swaps. Their debt-to-asset ratio while higher than 2021 (37.1%), still comes to a fairly respectable 40.1%. Keep in mind that the debt-to-asset ratio is overstated as a lot of assets are not fully reflecting their value on the balance sheet. In other words, debt to NAV is lower than debt to assets.

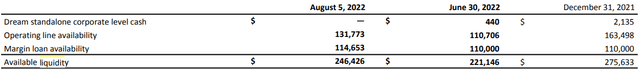

As of June 30, the corporation had $97 million in cash and cash equivalents on a consolidated basis and an additional $221 million available to draw upon as needed. As we can see below, that increased by the date of the financial report.

We don’t see any major concerns for the company, but real estate closings for the residential side could slow down substantially in the next two years versus what the company had envisioned. We might see a similar slowdown on the commercial side as well as the weaker economy bites. This might make the debt levels slightly more problematic than current ratios imply.

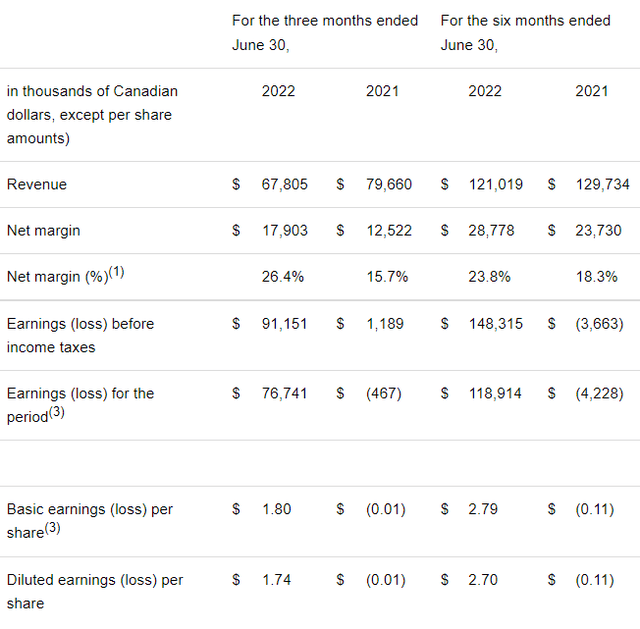

Q2 Results

Earnings before interest or EBIT below includes the fair value adjustment for Dream Impact Trust. Excluding the adjustment, this number increased by $3.1 million and $35.5 million in comparison to the three and six months ended June 30 of the prior year.

The year-to-date performance came from the underlying Dream entities, high margins on the sale of the Canary Commons units and increases in the earnings from their skiing destination, Arapahoe Basin. The great performance was offset partially by the higher interest costs due to additional debt and higher rates, but overall, it still came out impressively ahead.

Verdict

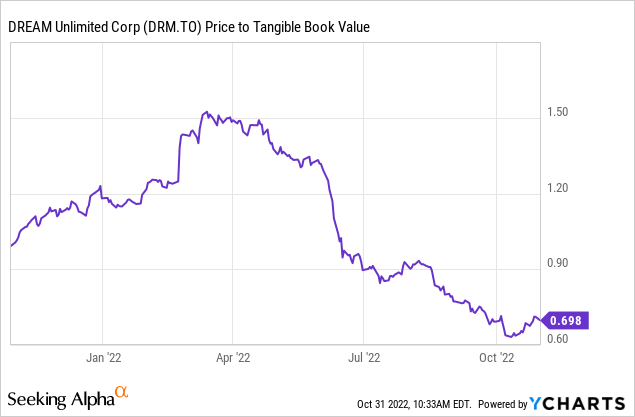

We have been an admirer of this management team for some time now. We were an investor in Dream Global, when they negotiated the accretive sale of the company. With our protagonist trading at a considerable discount to book value, we are confident that they will make the right moves.

While the book is around $36, the estimated NAV by analysts is closer to $60. The bulk of this difference comes by applying a 12-15X multiple on the asset management business and by lifting land values to actual numbers. IFRS requires land to be marked at cost. NAV is of course an estimate, and we think $50 is probably a reasonably good guess in today’s market. Dream agrees with this assessment, and that is why the company has been buying back shares.

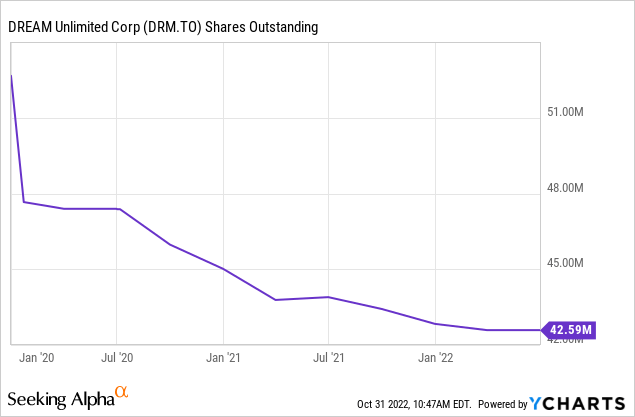

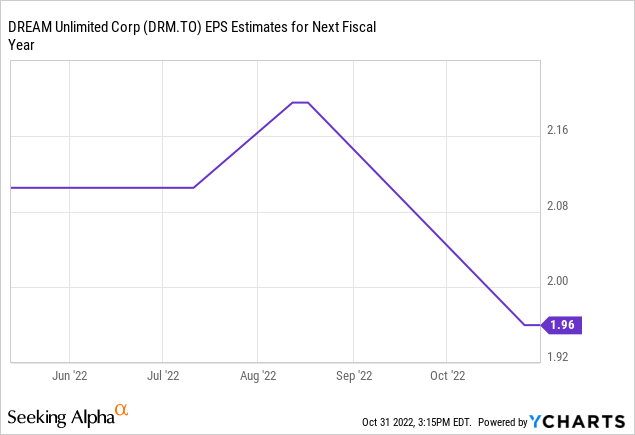

However, since the share-based compensation has offset most of the 2.8 million share repurchases the company has made since 2021, we have not seen this pay dividends. The next 12 months will be challenging for the company as it fights multiple battles from closing residential sales to stabilizing occupancy levels in Dream Office. The earnings estimate for the next fiscal year is likely optimistic, and we could easily do half as much.

The small dividend though is very safe, and we think there is room to grow it over time. The asset base underlying the stock is pretty good, but considering a lot of real estate is very cheap today, we are not too crazy about chasing an asset manager. We are rating the stock a hold for now. We might buy it, if it drops below $20.00.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment