jiefeng jiang

We previously recommended investors buy shares of ON semiconductor (NASDAQ:ON), but we think the trade might have played out in the near term. Hence, we are downgrading ON semiconductor to a hold. Despite ON’s strong position in the analog power market, we do not think it is shielded from weakening consumer demand and a drop in fab utilization. We expect ON will have corrections in its consumer and computing segments. While we like ON’s power exposure to automotive and industrial markets, we believe the sales are elevated from double ordering, which has been a widespread industry phenomenon. We do not expect the stock price to break out in the near term and advise investors to be patient for a better entry point.

Well-positioned in the long-term power industry, not the near term

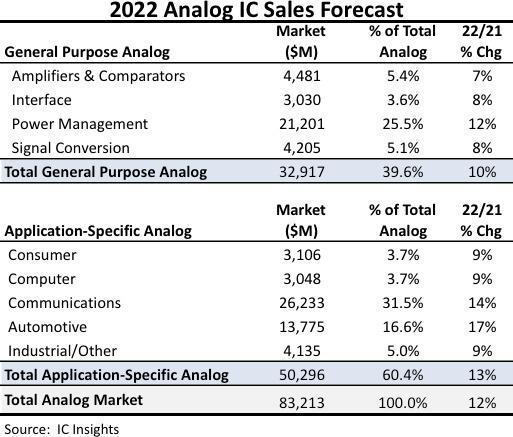

ON operates within the biggest market of the analog industry: power. Power makes up around 26% of analog IC sales. We believe ON is well-positioned in the power IC market to continue outperforming the general analog market in the next 1-3 years. The following image shows the analog IC sale forecasts for 2022.

IC Insights

ON is exposed to significant growth markets within power, namely automotive and industrial. According to 2Q22 earnings, 66% of the company’s revenue is derived from automotive and industrial markets. Automotive and industrial are significant growth drivers. The company forecasted automotive to grow 7-9% between 2021-2025. While we believe ON is well-positioned within these markets for the long term, the company is not safe from industry-wide double ordering. We are bullish on the company’s long-term position within analog but do not believe the stock will grow meaningfully in the near term. We expect better entry points in the near term.

Weakened consumer spending will take its toll

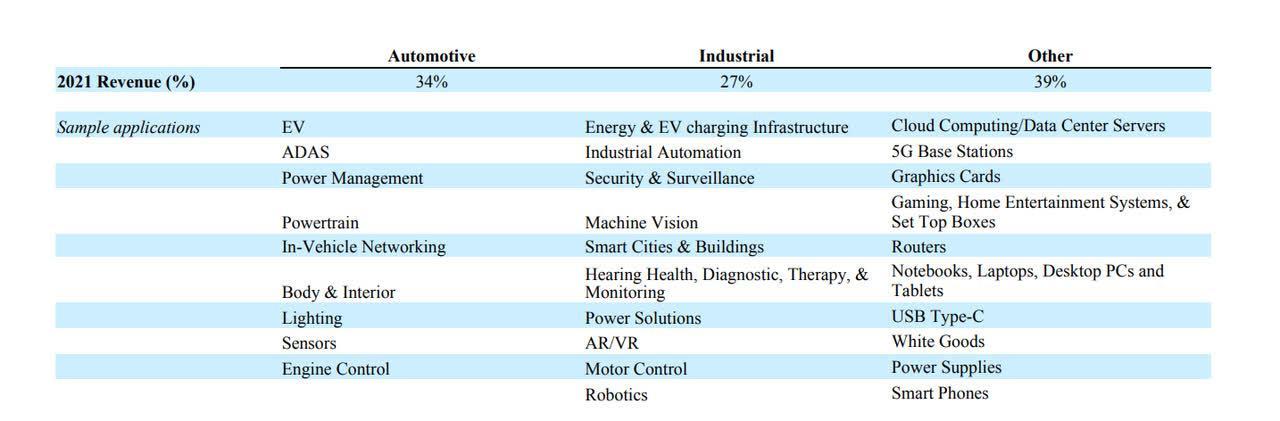

ON is not immune to weakening consumer demand. ON’s business is exposed to cloud computing and data center, 5G, graphic cards, gaming, PCs, and smartphones, among others. Weakened consumer spending has slowed down demand in these end markets and will likely take its toll on ON. The following graph outlines ON’s end markets.

OnSemi 10-K

OnSemi 10-K

According to Gartner, PC shipments are set to decline 13.1% in 2022 after achieving record growth in 2020 and 2021. Smartphone demand is also declining. Global smartphone shipments recorded declines for the fourth consecutive quarter” with an 8.7% drop in 2Q22 shipments,” according to IDC. While ON does not focus specifically on consumer markets, it is still exposed to the weakening consumer demand. We believe ON’s consumer and computing markets will be up for correction. We advise investors to remain on the sidelines until weakening consumer demand eases.

Gross margin headwinds for its fab businesses

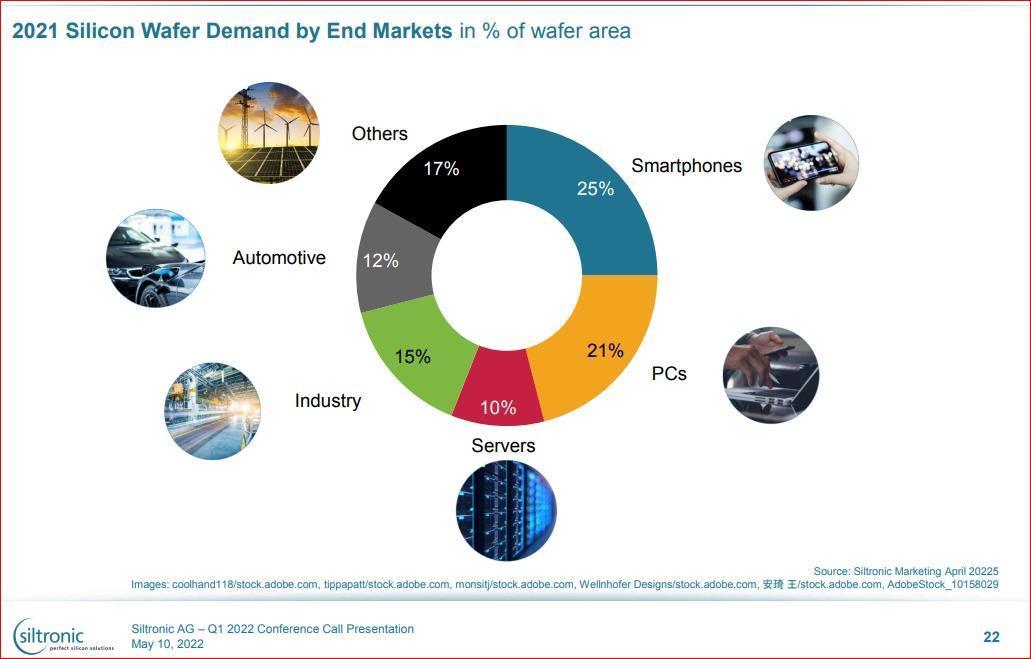

ON is expanding its fabrication plants (the manufacturing facilities where microchips are made) and its silicon carbide (SiC) capacity. In late 2021, the company acquired GT Advanced Technologies, a producer of SiC materials. SiC materials are often used in semiconductors as SiC wafers because their power handling capabilities exceed regular silicon. SiC wafers are a semiconductor material used s because of their excellent electrical and thermal properties. The following image outlines the several end markets SiC wafers touch upon.

Siltronics

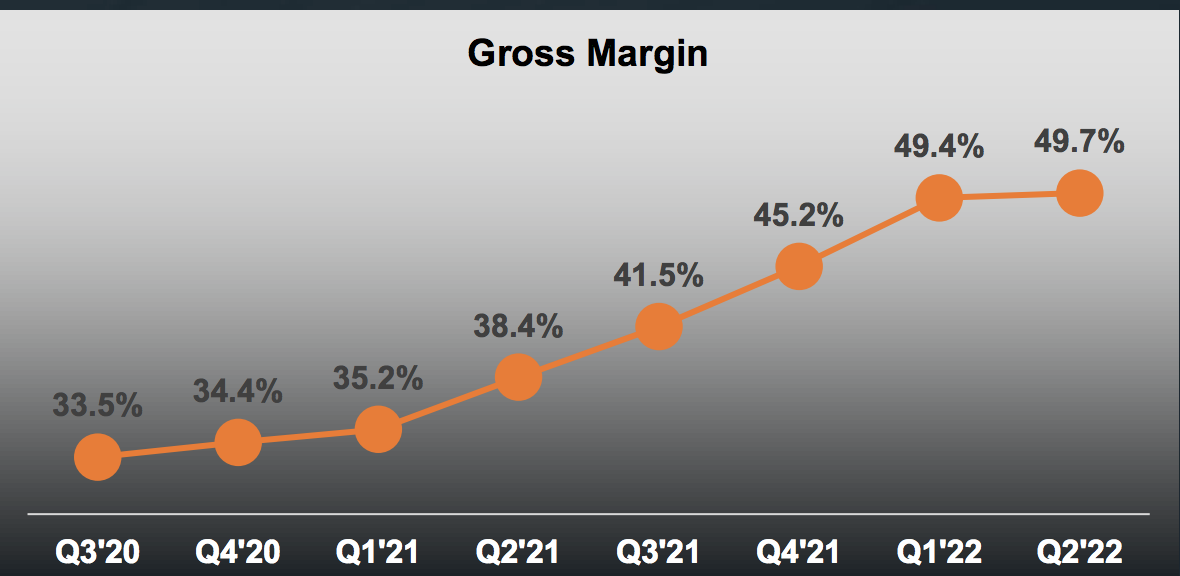

We are not optimistic about the GT Advanced acquisition under current market trends. We expect fab utilization to drop. The demand for fab capacity is slowing down because the demand for the products these fabs create (PCs, smartphones, servers, etc.) is significantly weakened. We believe ON’ s fab and SiC expansion will harm its gross margin. In 1Q22 and 2Q22, ON’ s gross margin growth moderated, and we believe the moderation is the result of dropping fab utilization. Between 1Q22 and 2Q22, the company achieved a .3% gross margin growth compared to 4.2% between 4Q21 and 1Q22. The following graph shows the company’ s gross margin percentages in 2Q22.

ON Semi investor presentation

2Q22 OnSemi earnings

We expect the weakened fab demand will likely cause ON’s chip prices to increase and lower its gross margins.

Valuation

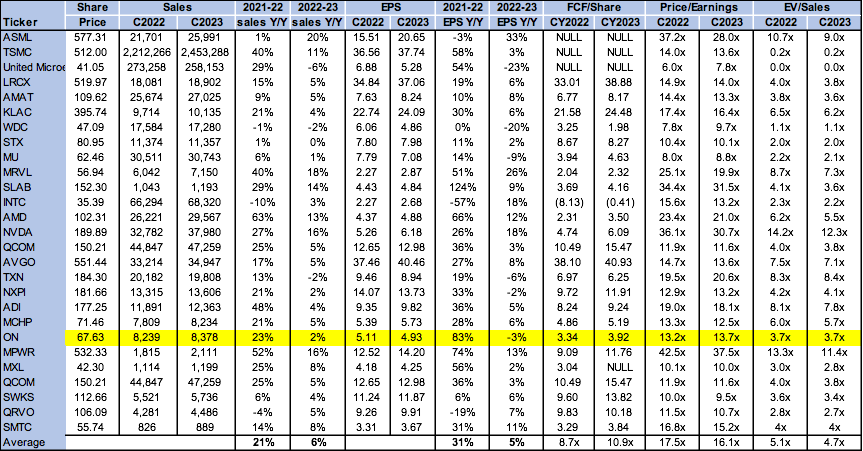

ON stock is cheap relative to the peer group, trading at 13.7x C2023on P/E earnings metric EPS $4.93 compared to the group average of around 16x. The stock is trading at 3.7x EV/2023 sales versus the peer group average of about 5x. We recommend against buying ON at current levels because we believe the stock will still pull back further.

The following chart illustrates the semiconductor peer group valuation table.

Refinitiv & Techstockpros

Word on Wall Street

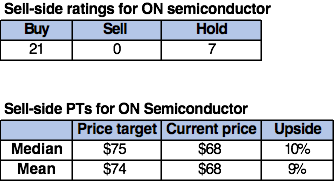

Wall Street is overwhelmingly buy-rated on the stock. Of the 28 analysts, 21 analysts are buy-rated, and the remaining are hold-rated. Despite the buy sentiment, the stock’s sell-side price targets are not too optimistic. ON is currently trading at $69. The sell-side median price target is $75, and the mean is $74 with a 9-10% upside.

The following chart indicates ON stock’s sell-side ratings and price targets:

Refinitiv & Techstockpros

What to do with the stock

We believe ON is a hold by all metrics. ON is well positioned in the power analog market in the long run. However, we do not believe it is shielded from weakening consumer demand. We also believe automotive and industrial orders are potentially inflated and expect to see the effects of double ordering in 2H22. We do not believe the stock will work in the near term and recommend investors wait for a better entry point.

Be the first to comment